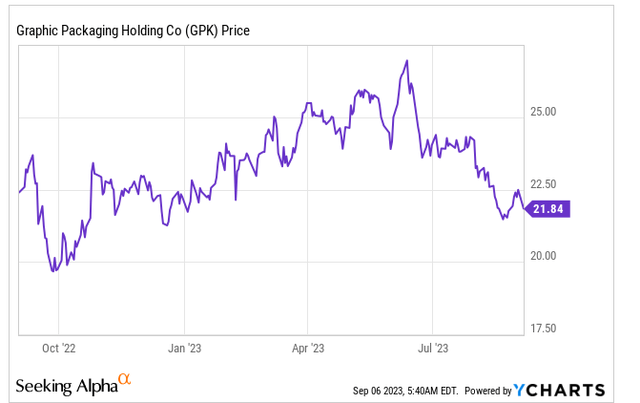

Graphic Packaging: On Its Way To A 15% Free Cash Flow Yield In 2025

Summary

- Graphic Packaging's cash flow remains strong despite a slowdown in demand for packaging products.

- The company's operating income and adjusted EBITDA have increased in Q2 2023 compared to Q2 2022.

- Graphic Packaging is expected to generate a total revenue of $10B and an adjusted cash flow of $600-800M in 2023, with a mid-term guidance for 2025 showing further growth potential.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

AdShooter/E+ via Getty Images

Introduction

I like packaging companies. And although they are surfing on the waves of the world economy and there has been some pain in the past few quarters as they all had to deal with destocking, they remain attractively valued. I have a long position in WestRock (WRK) but as it has been over a year since I last had a look at Graphic Packaging (NYSE:GPK), I felt an update was warranted.

It’s all about the cash flow

In the article that was published a year ago, I zoomed in on Graphic’s cash flow performance. I expected the company to report an underlying free cash flow result of $2.40 in 2022 (the company narrowly missed that expectation but the underlying free cash flow exceeded $2.25/share) but I was also hopeful for 2023 as the company’s expansion efforts should not go unnoticed. But as mentioned in the introduction, most packaging companies have experienced a substantial slowdown in the demand for their products. This is per definition a temporary thing (destocking can only continue until a certain level), so I wanted to make sure I have all the details handy to act fast when the situation turns around.

Graphic Packaging Investor Relations

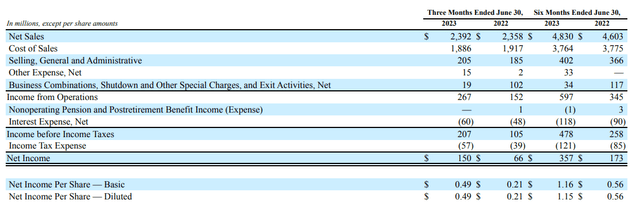

And Graphic Packaging is just continuing along with the momentum that started a few years ago subsequent to some big M&A action. During the second quarter, the company’s revenue increased by 1% to $2.4B while the adjusted EBITDA jumped by 14% to $453M. And as you can see below, the operating income of $267M was substantially higher than the $152M in Q2 of last year, mainly due to the non-recurring items that had a negative impact on last year’s second quarter. Adjusted for those items, the operating income would have been $254M in Q2 2022 and $286M in Q2 2023.

Graphic Packaging Investor Relations

The increasing interest rates on the financial markets are also having a negative impact on Graphic Packaging: despite reducing its gross debt and net debt (the gross debt slightly increased during H1 due to working capital changes), the interest expenses increased. Not by a lot, but definitely by a noticeable amount. And when the dust has settled, the net income came in at $150M or $0.49 per share, resulting in an H1 net profit of $357M for an EPS of $1.16. That is more than twice the EPS generated in the first semester of last year, but keep in mind those non-recurring restructuring items weighed on the H1 2022 result.

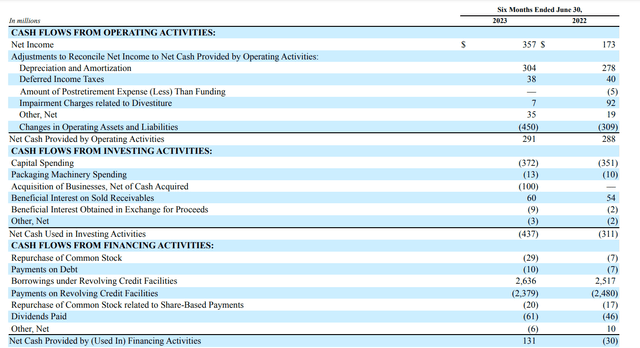

But to make sure I am comparing apples to apples, I need to have a closer look at the cash flow statement to make sure Graphic Packaging still is the cash cow I thought it was.

As you can see below, the total operating cash flow was $291M, but we still need to add back the $450M in working capital investments. This means the underlying operating cash flow was $741M.

Graphic Packaging Investor Relations

The total capex was $372M with an additional $13M spent on machinery for a total of $385M. This means the underlying free cash flow in the first half of the year was approximately $356M, or $1.16 per share.

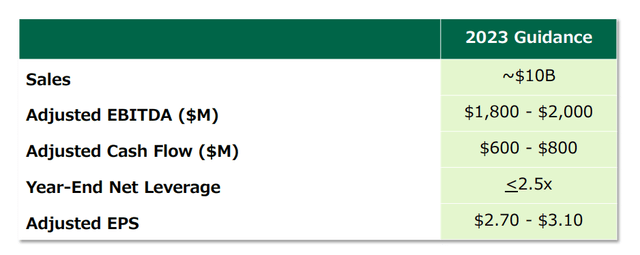

This also matches up with the company’s own guidance for 2023. As you can see below, Graphic Packaging is expecting to generate a total revenue of $10B and an adjusted EBITDA of $1.8-2B. The total capex should be around 7-8% of the revenue, and GPK’s anticipated adjusted cash flow is $600-800M for the year. Annualizing the $356M free cash flow result from the first half of the year indicates a full-year free cash flow of around $700M, which is right in the middle of the guidance.

Graphic Packaging Investor Relations

And considering the company expects an EPS of $2.7-3.1, even achieving just the lower end of that guidance means Graphic Packaging is trading at just 8 times earnings.

More importantly, the company also confirmed its midterm guidance for 2025. The revenue will increase by a mid-single digit per year, while the EBITDA should come in firmly above $2B. As you can see below, the midpoint of both guidances calls for a $11B revenue and a $2.2B EBITDA.

Graphic Packaging Investor Relations

In that case, the EPS should exceed $3.25, and I think that is a rather conservative assumption. Assuming a $300M EBITDA increase and a $50M increase in interest expenses and an average tax rate of 25%, the net income would increase by $0.55-0.60 per share versus the 2023 result. This means the $3.25 appears to be the worst case scenario, and it is as likely the EPS may actually exceed $3.50 per share.

Investment thesis

Just to err on the side of caution, I will use Graphic Packaging’s own EPS guidance of $3.25 for 2025. The free cash flow result should be pretty similar to the reported earnings. This means the stock is now trading at less than 7 times the anticipated 2025 earnings and at a free cash flow yield of close to 15% based on the company’s own guidance for 2025. The current EV/EBITDA is around 6.3 and if I would assume a $1B net debt reduction by the end of 2025 and a $2.2B EBITDA in 2025, the forward EV/EBITDA is just around 5. If you’d apply a required free cash flow yield of 7.5%, the fair value of the stock based on a FCF result of $3.25 in 2025 would be around $43 (95% above the current share price). Discounting this back to today at a 10% annual discount rate results in a current fair value of $35, for an upside potential of 60% from today’s share price.

And that makes Graphic Packaging appealing by any metric. I’m not too worried about the increasing interest rates as the gross debt will decrease while I have allocated an additional $50M in interest expenses in my scenario in this article. As a substantial portion of the debt consists of bonds with maturity dates well after 2025, the total interest expenses will only increase at a moderate pace.

I currently have a small long position in Graphic Packaging, but I will likely add to this position in the near term. I have also written put options on Graphic Packaging and will continue to do so.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GPK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a small long position in GPK and will add to this position shortly. I have also written put options on GPK.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

I discussed PKG at around $100 in 2020 seekingalpha.com/...Feels like an eternity ago, pfew!