Insurer American Financial Group Is A Buy Opportunity Despite Elevated Valuation

Summary

- American Financial Group (AFG) got a Buy Rating today, in line with Wall Street consensus.

- Positives: special dividends paid out, share price is low vs. 200-day moving average, overall financial health, earnings positive growth.

- Headwinds: valuations (P/e and P/b) are modestly overvalued vs. sector.

- Risk of exposure to unrealized losses on fixed-income securities has been addressed, and deemed a manageable risk right now.

Wasan Tita

Research Summary

Today I'll be rating American Financial Group (AFG), in the financials sector, insurance subsector.

For readers less familiar with this company, here are relevant points from their website: headquartered in Cincinnati Ohio, roots go back to 1872, focused on the property & casualty (P&C) insurance segment. Also oversees an investment portfolio worth about $15B. In 2022, announced acquisition of crop risk services from insurance giant American International Group (AIG).

Its most recent fiscal Q2 results were announced on Aug. 2nd, and we will be using some of that data in today's analysis.

Two key peers of this company are Fidelity National Financial (FNF), and First American Financial (FAF).

Rating Methodology

Using a process similar to 5 project phases in project management, I break down my overall holistic rating of this stock into 5 categories I rank individually and of equal weight: dividends, valuation, share price, earnings growth, financial health.

If I recommend this stock on at least 3 of 5 categories, it gets a hold rating. 4 of 5 gets a buy, and less than 3 gets a sell rating. Then I compare my rating to the consensus from analysts, Wall Street, and the quant system.

Dividends

In this category, I will analyze the dividends of this stock and whether I think they present an opportunity for dividend-income investors. The data comes from official Seeking Alpha dividend info.

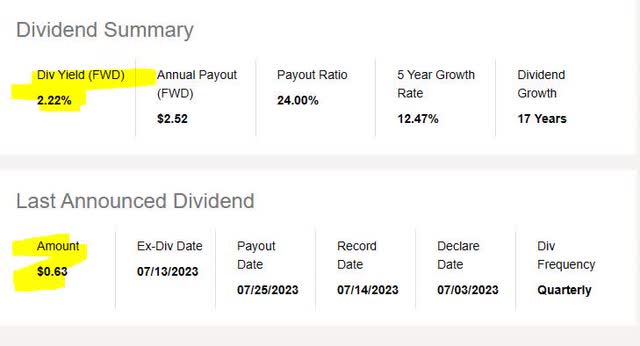

As of the writing of this analysis, the forward dividend yield is 2.22%, with a payout of $0.63 per share on a quarterly basis, with the most recent ex date being July 13th. I think this is a dividend yield that is neither paltry nor attention-grabbing, but just modest enough.

American Financial Group - dividend yield (Seeking Alpha)

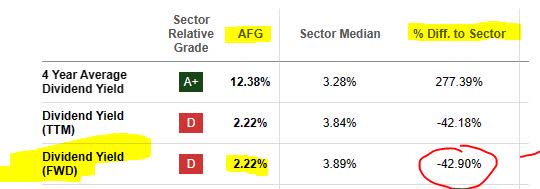

When comparing to its sector average, this dividend yield is 43% below its sector average. I believe this is a negative point to consider for dividend investors who are comparing multiple stocks in which to invest, as I would expect a yield somewhere between 3% - 4%.

AFG - dividend yield vs sector average (Seeking Alpha)

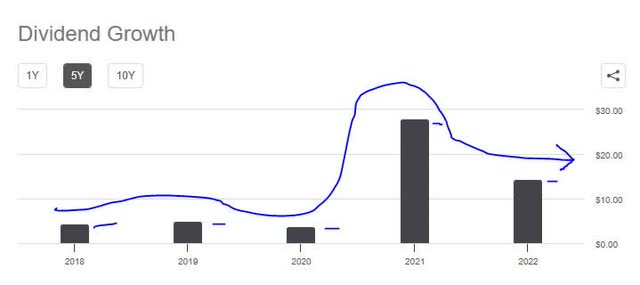

In looking at the 5 year dividend growth for this stock, it has shown a lopsided growth trend. This is, in my opinion, neither a positive nor negative point for dividend investors since it will require more analysis as to the why behind this trend, since what I like to see is a steady upward trend over 5 years.

AFG - dividend 5 year growth (Seeking Alpha)

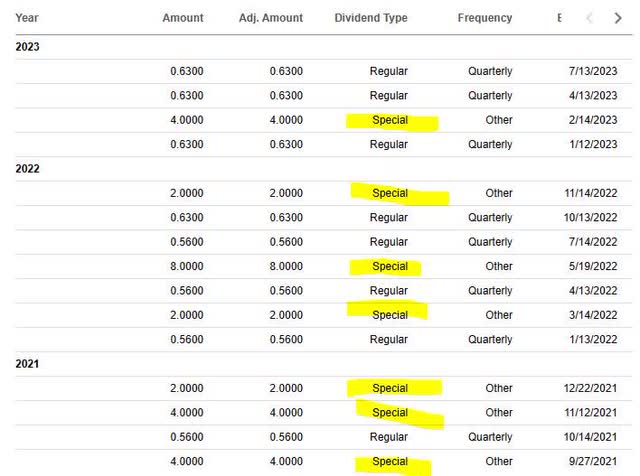

Additionally, I am looking for stability with dividend payouts, and this stock has shown regular dividend payment history lately, which is a positive point to think about.

More importantly, what sets this firm apart is its payout of "special" dividends in addition to its quarterly ones, something not that many firms do, but when I do find them I certainly like to feature them here.

AFG - dividend history (Seeking Alpha)

On the whole, I would recommend this company on the category of dividends, mostly because I believe their payout of special dividends offsets other weaknesses like having a yield lower than the sector average. Later in the section on share price, I will show how this quarterly dividend can be used in an investment idea for this stock.

Valuation

In this category, I will analyze the valuation of this stock. The data comes from official valuation info on Seeking Alpha, specifically the forward P/E ratio and forward P/B ratio, the key metrics I look at.

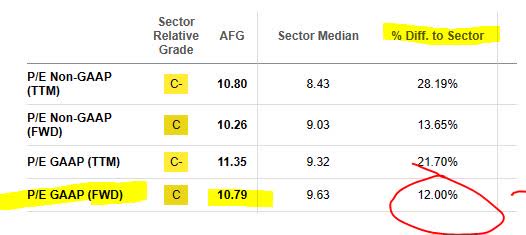

This stock has a forward P/E ratio of 10.79, which is 12% above its sector average. I think that a reasonable price to earnings for this stock would be between 8.5x earnings and 11.5x earnings, to stay within a reasonable 2 point range of the average. In this case, on this metric the stock appears only slightly overvalued vs its overall sector, so not a major concern by itself.

AFG - P/E ratio (Seeking Alpha)

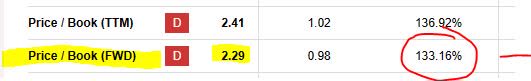

This stock has a forward P/B ratio of 2.29, which is 133% above its sector average. I think that a reasonable price-to-book value for this stock would be between 0.50x book value and 1.50x book value, to stay within a 1/2 point range of the average. In this situation, this stock appears somewhat overvalued vs its sector.

AFG - P/B ratio (Seeking Alpha)

Let's take a look at one of its peers mentioned earlier: Fidelity National Financial. If comparing the two, Fidelity has a price-to-earnings that is 70% above the sector average and a price-to-book 67% above the average. So, it seems more overvalued on price to earnings than AFG but less overvalued on price to book than AFG.

Based on the examples I gave, I would not recommend this stock on the basis of valuation, since it could use some improvement in both metrics I highlighted, when looking at both of them together and also in relation to its sector and peers.

Share Price

In this category, I will use a very simplistic investment idea to determine if the current share price presents a value buying opportunity right now or not, and try to explain the idea in the easiest & shortest way possible!

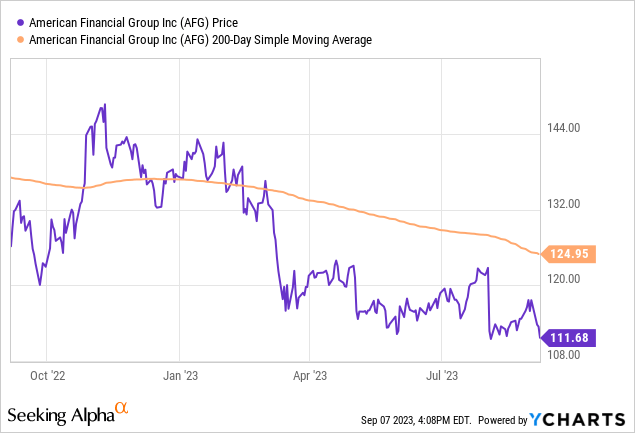

First, I pulled the chart (as of the writing of this article, so the price shown is not real time!) which shows a share price of $111.68, compared to its 200-day simple moving average "SMA" of $124.95, over the last 1 year period.

The 200-day SMA was chosen because it smooths out the longer-term trend for this stock, and to establish a target buy/sell price in relation to the moving average.

Now, at first glance some may think "wow" it's a great buy if the share price is that far below the moving average, right?

Not so fast.. let's first determine what is my goal is for return on capital and what my risk tolerance is for capital loss, if I buy 10 shares at the current share price and hold for 1 year to also earn a full year of dividend income.

My goal is positive +10% return on capital, and my risk tolerance is a -10% negative return on capital, after 1 year, with a goal of exiting the position in Aug. 2024.

After holding for 1 year, I plan to sell the 10 shares. The following simulation tests what happens if the share price I sell at in Aug. 2024 is +10% above the current 200 day SMA, and what happens if it has dropped to -10% below the current 200 day SMA:

AFG - investing idea (author analysis)

In the above example, I exceeded my profit goal by 15.33% and also stayed within my risk tolerance since the bottom sell scenario actually leads to a positive return as well.

With that said, the current share price presents a buy opportunity and in my opinion I would recommend it.

However, readers should still run their own simulations based on their individual portfolio goals which I cannot advise on here, as their risk tolerance and profit goals my differ from this idea above. It is simply a framework with which to think about potential gains & losses if buying at the current price.

Also, note that the above idea can create two potential tax events: dividend income and capital gains. This ought to be discussed further with your tax pro for consultation on this topic.

Earnings Growth

In this category, I examine the earnings trends comparing the most recent quarterly results to the same quarter a year ago, including both top-line and bottom-line income, and other relevant topics to earnings I think should be discussed for my readers.

On a YoY basis, this firm showed positive growth in interest/dividend income, which I wanted to call out since it appears the interest rate environment is favorable to this firm.

AFG - interest/dividend YoY growth (Seeking Alpha)

Also important to mention, since investors & analysts like to keep an eye on top-line revenue growth, is the fact that total revenue YoY growth was positive, but also on a general uptrend over the last year, despite a dip or two.

AFG - revenue YoY growth (Seeking Alpha)

To get some better insight into these positive results, I turned to commentary from Carl & Craig Lindner, the co-CEOs:

The higher interest rate environment contributed to meaningfully higher year-over-year investment income, and we continue to be pleased with the performance of our alternative investment portfolio, where returns exceeded our expectations during the quarter.

On a YoY basis, the firm also showed positive growth in net income, showing its strength on the bottom line as well.

AFG - net income YoY (Seeking Alpha)

A relevant item from its Q2 earnings release relates to its core business, which is not interest income on investments but earnings premiums on insurance policies, which is the proverbial bread & butter of an insurance firm.

Consider the following that points to continued strength in this space:

Second quarter 2023 gross and net written premiums were up 12% and 10%, respectively, when compared to the second quarter of 2022. Year-over-year premium growth was reported within each of the Specialty P&C groups as a result of a combination of new business opportunities, increased exposures, and a good renewal rate environment.

If this positive trend continues for Q3 and Q4, my forward-looking sentiment is a positive one.

Based on this evidence, I would recommend in this category.

Financial Health

In this category, I will discuss whether this company shows strong financial fundamentals in the realm of capital, liquidity, and overall balance sheet & cashflow topics.

To keep things moving, I will mostly just highlight the following critical statement in the company's Q2 earnings, showing that they are a capital-rich company committed to returning excess capital back to stockholders, a positive sign in my opinion:

AFG had approximately $700MM of excess capital at June 30, 2023, which is net of the $235MM in cash deployed to fund the CRS acquisition on July 3, 2023, and includes parent company cash and investments of approximately $550MM. Returning capital to shareholders in the form of regular and special cash dividends and through opportunistic share repurchases is an important and effective component of our capital management strategy.

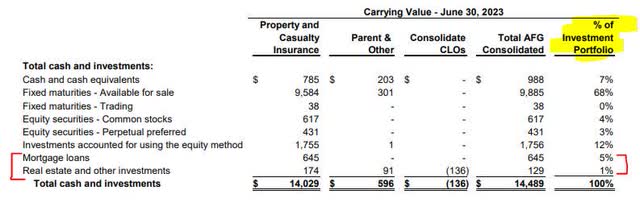

Further, I find it relevant to point out that the breakdown of exposure this company on its books to what I consider higher risk items like mortgage loans and real estate-related items is in total no more than 6% of what sits on their books as shown below. Fact is, the largest exposure (68%) is tied to fixed-maturity available-for-sale securities.

AFG - investment portfolio breakdown (company Q2 earnings)

I think such data is relevant because it can address potential questions of financial health if the firm has heavy exposure to bad mortgages and problematic real estate assets. At the same time, all of the above capital assets on their books are income-producing. Even cash.. it is earning interest income. I like to say the best assets are those that produce recurring income, which leads to more cash coming in each month or quarter, and more capital to work with.

I would recommend in this category, based on the evidence found.

Rating Score

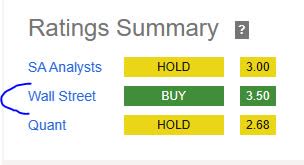

Today, this stock was recommended in 4 of my rating categories, earning a buy rating from me today. This is in line with the consensus from Wall Street and more bullish than the consensus from the quant system and SA analysts.

AFG - rating consensus (Seeking Alpha)

My Rating vs Downside Risk

My bullish rating can face a downside risk from something very obvious from an earlier paragraph.. the firm's heavy exposure to fixed-income available-for-sale "AFS" securities. Although, as mentioned earlier, these are income-generating assets for the firm, they also have a certain market value that has to be accounted for, and even "paper losses" have to be accounted for and revealed publicly.

For example, many investors and analysts I think could be bearish on this stock due to the following.. considerable unrealized losses to the tune of $587MM on this firm's fixed-income portfolio, and one of the biggest drivers of this loss being residential MBS, as the table below shows.

AFG - unrealized losses on AFS securities (company quarterly supplement)

However, I would argue that the market has mostly already priced in this risk as it has been aware to most market participants since last year as it has been well publicized as a potential systemic risk. In fact, the following was from a June 2022 study by the Federal Reserve Bank of Kansas City which found a similar risk exposure in banking, not just insurance companies:

As a result of recent interest rate increases and the lengthening of maturities in securities portfolios during the pandemic, unrealized positions in available-for-sale (AFS) securities have dropped to record lows.

However, insurance firms are not exactly the same as banks. A bank must give a depositor their money if that depositor closes their account suddenly. If a few hundred thousand do, they too are entitled to their funds up to the FDIC-insured limit. This can be a liquidity issue some banks could find themselves in, being forced to sell off AFS securities at a realized loss to raise money.

With an insurance company, it is not paying out money to depositors but rather it only pays out money to valid policy claims such as catastrophe & damage claims when such events occur. Such claims have to be verified and examined first, of course.

So, my sentiment is the exposure to these AFS securities will continue to be a short-term stain on their books until interest rates normalize and the value of those securities go up again since the two act conversely. However, I don't see why they would be forced to sell off a large majority of those at a realized loss in order to fund liquidity needs. Hence, they remain "unrealized" losses, or paper losses, although certainly not worth ignoring either.

Analysis Wrapup

To wrap up today's discussion, here are the key points we went over:

This stock got a buy rating today.

Its positive points are: dividends, share price, earnings YoY growth, financial health.

The headwinds it faces are: valuation.

The downside risk to my outlook has been addressed.

In closing, I recommend adding this stock to a watchlist of financial sector stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

Business Wire

CINCINNATI -- August 23, 2023

American Financial Group, Inc. (NYSE: AFG) announced that its Board of Directors has approved an increase in the Company’s regular annual dividend to $2.84 from $2.52 per share of common stock. The increased dividend, when declared, will be paid on a quarterly basis of $0.71 per share of common stock beginning in October 2023. The new dividend rate is a 12.7% increase over the declared rate. The Company has increased its dividend in each of the last eighteen years. The ten-year compound annual growth rate in AFG’s regular annual dividends paid is 12.4%.