CrowdStrike: Massive Opportunities For The Brave

Summary

- CRWD still has massive tailwinds ahead, thanks to the increased transition toward centralized cloud-native applications and robust generative AI demand.

- With consumers remaining highly sticky, it is also unsurprising that the non-cancellable remaining performance obligation has further expanded to $3.6B, with stellar net retention rate of 125.3%.

- The CRWD management has strategically taken advantage of the elevated interest rate environment and growing cash hoard, by generating $30.19M of net interest income in the latest quarter.

- The company is likely to achieve economy of operating scale as new consumers onboard and more cross sales occur, attributed to the growing consumers with multiple Cloud Module Subscriptions.

- CRWD remains an excellent buy with a great upside potential to our long-term price target of $218.57, as the global cybersecurity TAM expands at a CAGR of 12.3% through 2030.

chaofann

The CRWD Investment Thesis Is Even More Attractive Here

We previously covered CrowdStrike Holdings, Inc. (NASDAQ:CRWD) in June 2023, discussing its expanding contracts, despite the elongated sales cycle during the tightened corporate spending.

Combined with the increased transition toward centralized cloud-native applications, thanks to the robust demand for generative AI, we had been highly optimistic about its near and long-term prospects.

For now, it appears that our optimism has been affirmed, with CRWD reporting an excellent FQ2'24 earnings and Annual Recurring Revenues of $2.93B (+7.3% QoQ/ +36.9% YoY).

Consumer demand appears to be more than healthy as well, triggering its expanding GAAP gross margins of 75% (-0.6 points QoQ/ +1.3 YoY) and growing consumers with multiple Cloud Module Subscriptions.

For example, CRWD now reports 63% of consumers with 5 or more modules (+3 points QoQ/ +4 YoY), 41% with 6 or more (+1 points QoQ/ +5 YoY), and 24% with 7 or more (+1 points QoQ/ +4 YoY) in the latest quarter.

With consumers remaining highly sticky, it is also unsurprising that the non-cancellable remaining performance obligation has further expanded to $3.6B (+9% QoQ/ +44% YoY), explaining the stellar net retention rate of 125.3% in the latest quarter.

Therefore, while CRWD has yet to report positive GAAP profitability with operating margins of -2.1% (+0.7 points QoQ/ +6.9 YoY) in FQ2'24, we are not overly concerned for now.

This is because the company has recorded positive cash flow from operations at $245M (-18.5% QoQ/ +16.6% YoY), with it likely to achieve economy of operating scale as new consumers onboard and more cross sales occur.

Thanks to the Fed's sustained hike and its excellent net cash of $2.42B (+11% QoQ/ +54.1% YoY), the CRWD management has also been able to take advantage of the elevated interest rate environment by generating $30.19M of net interest income in the latest quarter (+25% QoQ/ +2,071.9% YoY).

Thanks to the excellent profitability and improving balance sheet, the cybersecurity company is more than well equipped to weather the uncertain macroeconomic outlook, before eventually generating positive operating margins over the next few quarters.

For now, keen investors may want to pay attention to CRWD's accelerating Stock Based Compensation of $164.78M (+25.9% QoQ/ +25.2% YoY). This has naturally triggered the sustained dilution of its long-term shareholders with 242.14M of shares reported in FQ2'24 (+1.54M shares QoQ/ +9.59M YoY).

Depending on when the management decides to use its cash hoard to repurchase shares, investors may have to momentarily contend with the growing share count and GAAP EPS headwinds in the intermediate term.

So, Is CRWD Stock A Buy, Sell, or Hold?

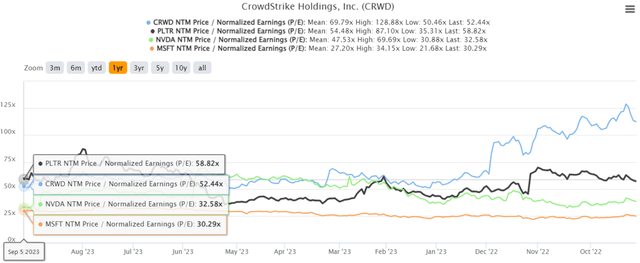

CRWD 1Y P/E Valuations Compared to Its AI Peers

S&P Capital IQ

For now, CRWD trades at NTM EV/ Revenues of 10.77x and NTM P/E of 52.44x, moderated compared to its 1Y mean of 10.54x/ 69.79x, respectively. The same has been observed with its AI peers, such as Palantir (PLTR), Nvidia (NVDA), and MSFT.

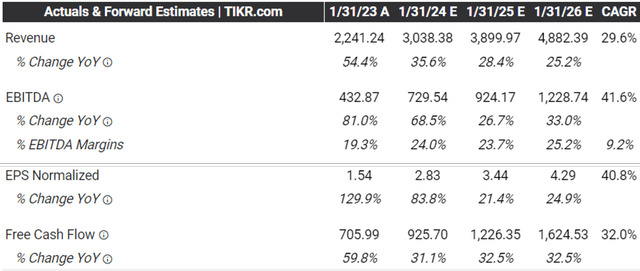

Consensus FY2026 Estimates

Tikr Terminal

This moderation is likely attributed to the impressive long-term estimates through FY2026, with CRWD expected to generate an excellent top and bottom line expansion at a CAGR of +29.6% and +40.8%, respectively.

It is also important to note that its FY2024 EPS estimates have been raised by approximately +40.55% compared to the previous numbers, and FY2025 EPS estimates by +20.72%, thanks to the robust consumer demand for generative AI products in an increasingly connected world.

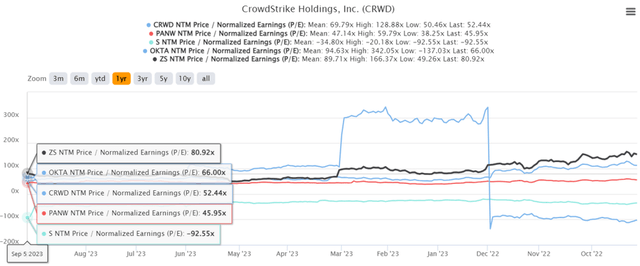

CRWD 1Y P/E Valuations Compared to Its Cybersecurity Peers

Trading View

Most importantly, CRWD's premium valuation is also shared by its cybersecurity peers, such as Zscaler (ZS) at NTM P/E of 80.92x, Okta (OKTA) at 66.00x, and Palo Alto Networks (PANW) at 45.95x, with SentinelOne (S) yet to report profitability.

As a result, investors may be rest assured of CRWD's prospects, due to its highly strategic cybersecurity AI integrated offerings since 2011.

With the company already capturing the Endpoint Security market share of 17.7% as of June 2022 and up to 21.69% as of 2023, we believe its forward tailwinds as the undisputed leader remain excellent indeed. This is especially due to the nascency of generative AI market and the unknown cybersecurity threats ahead.

The same misuse of AI has also been highlighted by Peter Klimek, the director of technology in Imperva, a cybersecurity company:

One way attackers are already doing this is by using AI to develop webshell variants, malicious code used to maintain persistence on compromised servers. Attackers can input the existing webshell into a generative AI tool and ask it to create iterations of the malicious code. These variants can then be used, often in conjunction with a remote code execution vulnerability (RCE), on a compromised server to evade detection.

The result will be an explosion in the number of zero-day hacks and other dangerous exploits, similar to the MOVEit and Log4Shell vulnerabilities that enabled attackers to exfiltrate data from vulnerable organizations. (Ventura Beat)

Therefore, it is unsurprising that Grand View Research has already projected an outsized growth in the global cybersecurity market size from $202.72B in 2022 to $515B in 2030, expanding at a CAGR of +12.3%.

The same has been highlighted by CRWD in the recent earnings call, with the management expecting its TAM to drastically expand from $58B in 2022 to $158B by 2026 at a CAGR of +28.47%, compared to the previous April 2022 Investor Day projection of $126B BY 2025.

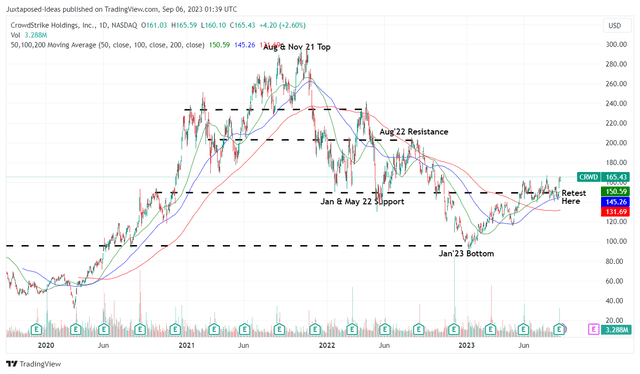

CRWD 5Y Stock Price

Trading View

For now, despite the excellent FQ2'24 double beat and raised FY2024 guidance, the CRWD stock appears to have met immense resistance at current levels of $160s.

However, here is where we believe there is massive opportunities for the brave. Based on the consensus FY2026 adj EPS estimates of $4.29 and NTM P/E valuations, we are looking at a long-term price target of $224.96, implying an excellent upside potential of +35.9% from these depressed levels.

As a result of the attractive risk reward ratio, we continue to rate the CRWD stock as a Buy here.

Naturally, since high expectations come with premium valuations, the management needs to continually generate growth in order to achieve our ambitious price target, especially buoyed by the management's highly optimistic commentary in the recent earnings call:

Heading into the second half of the year, we see increased momentum in the business, driven by record levels of new logo and upsell pipeline, record deal registrations from our market-leading partner ecosystem and record levels of customers proudly trusting CrowdStrike to be their long-term security platform consolidator of choice. (Seeking Alpha)

For example, S had previously experienced a drastic plunge of over -30% in its stock prices after an underwhelming FQ1'24 earnings call in June 2023, worsened by the lowered FY2024 guidance and headcount reduction.

While the cybersecurity company has recently reported a double beat FQ2'24 performance while guiding excellent growth for FQ3'24, the stock has also underperformed since then, implying a baked-in pessimism about its forward execution.

As a result, while CRWD may have generated excellent growth thus far while raising its FY2024 guidance, investors may want to closely monitor its execution over the next few quarters of market consolidation.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CRWD, NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.