Pinterest: Cost Cuts Are Bearing Fruit (Ratings Upgrade)

Summary

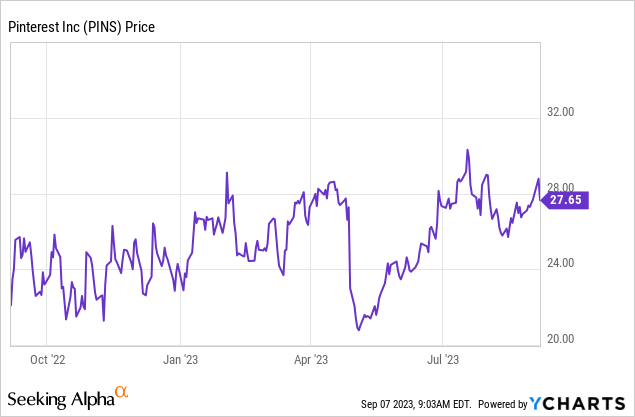

- Pinterest's stock is up over 20% this year, with gains accelerating after its recent earnings release.

- The company has shown prudence in building up its bottom line during the recession, leading to increased investor confidence.

- Positive drivers include a purpose-driven user base and high gross margins, while red flags include stagnant user growth and challenges in increasing ad revenue.

- The company trades at a ~24x P/E multiple against FY24 earnings and a ~5x multiple of FY24 revenue.

5./15 WEST

Amid a market that continues to be skittish over interest rates and the probability of the current recession extending throughout 2024 and beyond, it has been increasingly difficult to justify investing in stocks, particularly growth stocks with no profits, when risk-free cash is yielding such a generous amount. Part of remaining invested, however, is continually monitoring single-stock positions as valuations and quarterly earnings change.

Pinterest (NYSE:PINS) is a company that has utilized the recession to build up its bottom line, and the market has rewarded that prudence. Year-to-date, the stock is up more than 20% (slightly edging out over the S&P 500), with gains picking up steam in August after the company's recent earnings release.

To level set here: I had been a longtime Pinterest bear, but after parsing through the company's latest Q2 results and seeing its ability to boost adjusted EBITDA through expense reductions - particularly in G&A spending - I'm more sanguine on Pinterest's prospects. Some core issues with Pinterest still remain that prevent me from being fully bullish on the company, but I am now neutral on the company's trajectory through the rest of the year - I don't think there will be much either downside or upside from here.

I view the Pinterest bull and bear cases to be relatively balanced. Here are some of the positive drivers to be aware of:

- Intentional, purpose-driven user base leads to a very easily monetized platform. Because Pinterest users are already scrolling through items that they are interested in, among social media platforms, Pinterest is one of the most directly appealing to advertisers. The company has been building out its advertiser solutions and has succeeded at retaining large brand partners.

- High gross margins. Pinterest's high-70s gross margins leads to plenty of scalability for the company, if it can manage to both bring in a steady recurring advertising revenue base plus keep spending in check.

On the flipside, here are the key red flags on the bearish side to watch out for:

- Pinterest's core user base is not seeing growth. Pinterest generates the majority of its revenue (just like any other social media company) in the U.S. Unfortunately, user growth domestically has been stagnant for several quarters, which is a reflection of Pinterest's high penetration within its target audience plus the rampant competition among social media apps in the U.S.

- ARPU is no longer a revenue tailwind. Social media companies that have run out of the user growth lever typically can lean on increased ad load to chase revenue growth. But in this climate, with advertisers pulling back, Pinterest's chances of meaningfully resuscitating its ad revenue stream are also under fire.

Pinterest's valuation, meanwhile, positions it neither as a value stock nor as overvalued for its fundamentals (and hence another reason for my neutral rating). At current share prices near $28, Pinterest trades at a $18.53 billion market cap. After we net off the $2.30 billion of cash on the company's most recent balance sheet (against no debt, which is another minor bull driver in Pinterest's favor), the company's resulting enterprise value is $16.23 billion.

Meanwhile, for FY24, Wall Street analysts are expecting Pinterest to generate $3.46 billion in revenue (+14% y/y) and $1.14 in pro forma EPS (+19% y/y). This positions Pinterest's multiples at:

- 4.7x EV/FY24 revenue

- 24.3x FY24 P/E

In my view, the best move here remains to "watch and wait" from the sidelines. Considering the more recent cost cuts that Pinterest has enacted to enable growth in adjusted EBITDA and pro forma EPS, I think the company has offsets to its weaker user growth story - but I'd wait for a more reasonable price in the low $20s before jumping in.

Q2 download

Let's now go through Pinterest's latest quarterly results in greater detail, first going through the latest user trends.

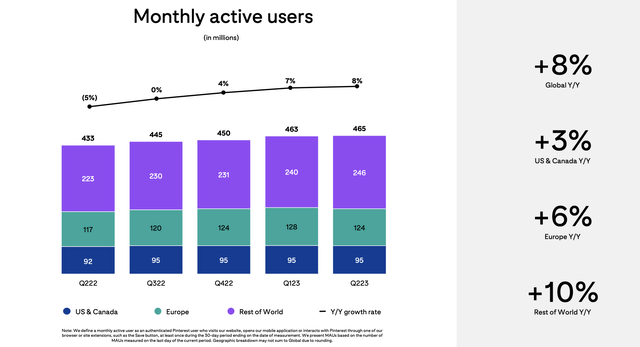

Pinterest MAUs (Pinterest Q2 earnings deck)

Pinterest's MAUs did grow 8% y/y, but as I've pointed out in prior analyses on Pinterest (as well as Snap, which shares a common issue), the concentration of this growth lies in the "Rest of World" space. In the U.S. and Canada, meanwhile, y/y growth was only 3%, and sequentially stayed flat at 95 million MAUs.

This shift away from the U.S. and Canada, meanwhile, is causing a drop in ARPUs. While ARPU in every region individually is growing, the mix shift toward the "Rest of World" user base, which generated only 2% of the ARPU levels of a U.S. user in Q2, caused a -1% y/y decline in ARPU.

Pinterest ARPU (Pinterest Q2 earnings deck)

Overall revenue did still grow 6% y/y to $708.0 million, accelerating slightly over Q1's 5% y/y revenue growth pace and beating Wall Street's $695.6 million (+4% y/y) expectations.

Do note that Pinterest has grown its ad load over the past year, meaning the density of ads it serves on the platform (and even so here, the geographic mix of users is not providing a lift to ARPUs). I view ARPUs as a very limited cannon that the company can fire for revenue growth, as too much ad load can eventually drive users off the platform. So far, management has noted that user engagement levels have remained steady.

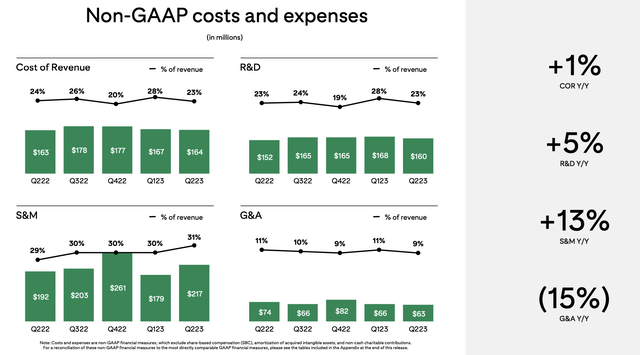

It's on cost, however, that Pinterest shines in Q2 - and where it didn't in prior quarters. Note particularly in the chart below the G&A spending line, which declined -15% y/y and dropped to just 9% of revenue, versus 11% in Q1 and in the prior-year Q2. Note as well that R&D spend declined sequentially from Q1 as well, though this was offset by higher sales and marketing spend driven by a shift in advertising timing from Q1 to Q2.

Pinterest expense trends (Pinterest Q2 earnings deck)

A chunk of the company's savings also come from real estate rationalization. Per CEO Bill Ready's remarks on cost takedowns during the Q2 earnings call:

As we've said in the past, we're instilling a culture where we are more focused on what drives results for users and advertisers and being more rigorous with our expenses, ultimately making us a more durable company. We've been able to accelerate our pace of innovation while also being disciplined on expense management, resulting in positive outcomes for our users, advertisers and shareholders.

In Q1, we took steps to reduce our expenses and drive greater efficiencies in our business, including rightsizing our workforce to align talent to our strategic priorities and restructuring our real estate portfolio. In Q2, we identified further cost efficiencies, leading to operating expenses that were lower than we guided to. Later in the prepared remarks, Julia will share our latest outlook on expenses and margin expansion for the year."

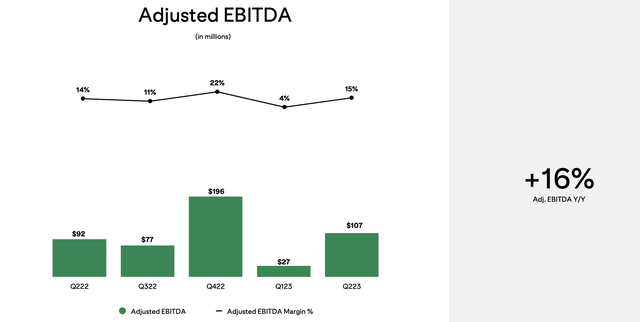

These actions have driven a tremendous lift in adjusted EBITDA, up 16% y/y in nominal terms to $107 million, and a 15% margin - up one point y/y and a substantial improvement sequentially.

Pinterest adjusted EBITDA (Pinterest Q2 earnings deck)

Pro forma EPS of $0.21, meanwhile, nearly doubled y/y and came in well ahead of Wall Street's $0.12 expectations.

Key takeaways

Now that Pinterest is generating a real bottom line, it's difficult to be too bearish on the company at a mid-20s P/E level, especially if the company is continuing to grow. Whether Pinterest can continue to build a user base in the U.S. and Canada will remain one of its biggest challenges, and whether it can boost monetization outside of this region is the other core issue.

Keep an eye out on this stock, but don't rush in too quickly.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.