Vontier: Staying On My Radar As Potentials Grow

Summary

- Vontier Corporation's share price has increased but still trades at a discount compared to the sector.

- The company focuses on developing and selling technical equipment and software for the mobility ecosystem.

- Rising interest rates may impact Vontier's earnings potential, but the company is making positive financial moves.

LaylaBird

Investment Rundown

The share price for Vontier Corporation (NYSE:VNT) has increased strongly over the last couple of months but still doesn't seem to display a valuation that is at a high premium to the sector. Based on earnings alone, VNT is trading at a near 50% discount. What has me worried though is the impact of rising interest rates and the fact that they may be very well sticking around for quite some time. This would put continued pressure on the earnings potential of VNT as the margins contracted last quarter and the interest expenses reached an all-time high of $89 million in total. For the moment, I think that investors are better off holding shares in the company instead of buying.

Company Segments

VNT focuses on the research, development, manufacturing, sale, and distribution of cutting-edge technical equipment, components, software, and services. A beginning-to-end sort of business for their product, limiting the need for supply chains and issues that come along with them. Their comprehensive offerings are tailored to the diverse needs of the mobility ecosystem on a worldwide scale. The company offers a wide spectrum of innovative solutions that encompass environmental sensors, fueling equipment, field payment hardware, as well as advanced point-of-sale systems. Additionally, their portfolio includes state-of-the-art workflow management software and robust monitoring solutions.

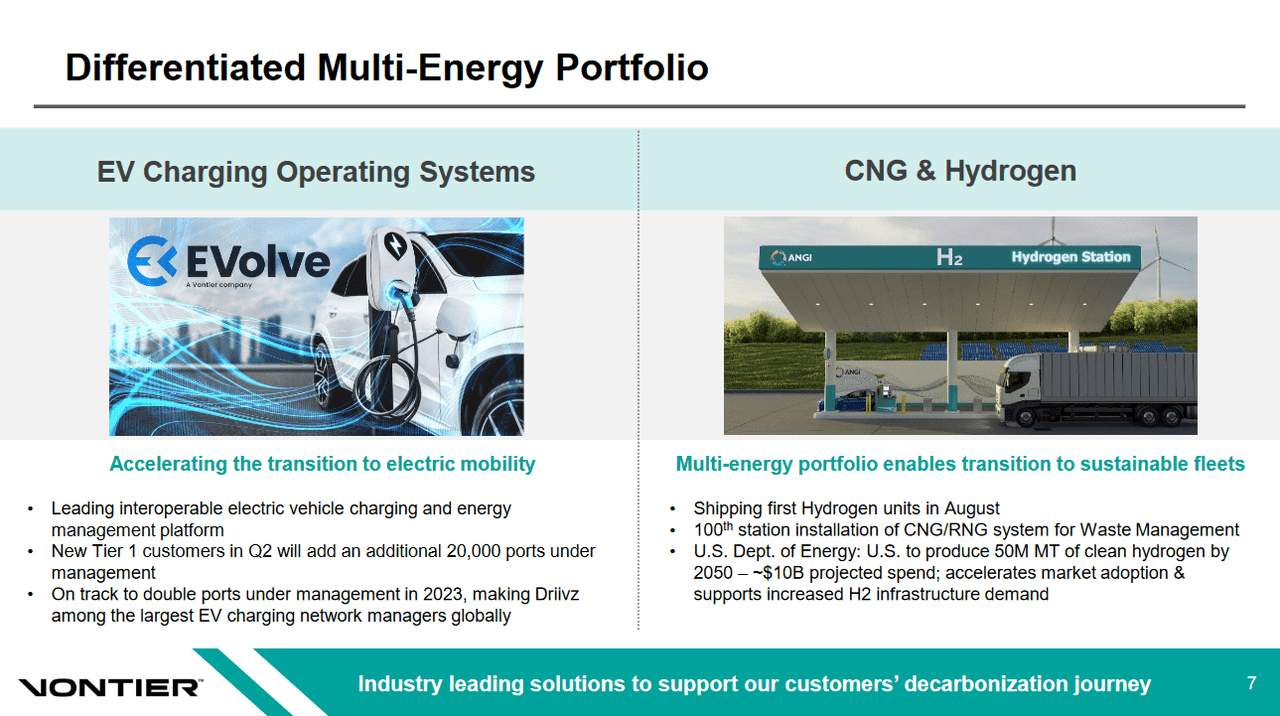

Company Portfolio (Investor Presentation)

Besides the mentioned focus of the business, they're also managing a multi-energy portfolio that is only in August now beginning to start shipping the first hydrogen, a very exciting new potential market for VNT to enter in my opinion. The clean hydrogen spending is only accelerating and VNT is expecting it to reach $10 billion in spending by 2050 in efforts to reach 50 MT in production at least.

Earnings Highlights

In the most recent report from VNT, there were some shifted results, but this hasn't seemed to affect the share price growth that much as it continues to trend upward strongly.

Q2 Results (Investor Presentation)

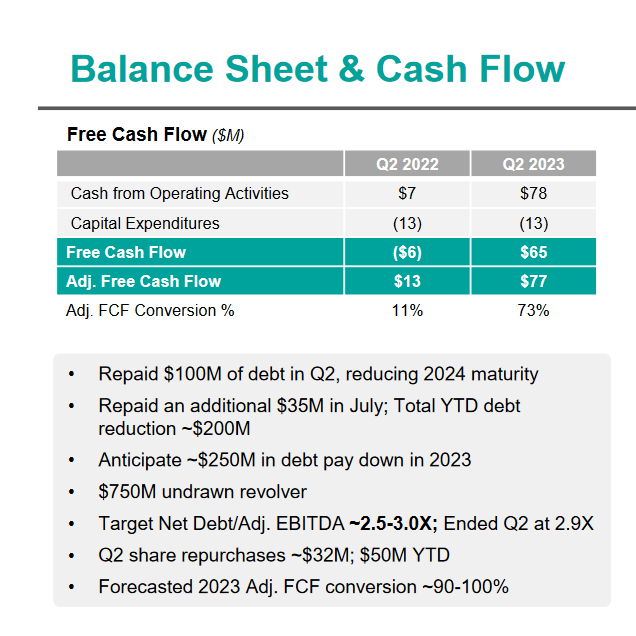

Looking at the topline, the sales for the business came in at $764 million in total, a $12 million decline on a YoY basis for the business. This together with the profit margin contraction is showcasing that perhaps VNT has some tough times ahead as the interest rates are increasing and hurting earnings. What has been impressive though is the large increase in the FCF for the business, going from $13 million in Q2 FY2022 to $77 million in Q3 FY2023.

Cash Flows (Investor Presentation)

Furthermore, looking at the cash flows and the usage of it by the company, I think that they have continued very well to get to a better financial position. Paying back over $100 million of debt in a single quarter is great, and it doesn't seem to have come from diluting shares either as that has been declining steadily since 2021. Furthermore, with the strong FCF for Q2, VNT was able to buy back shares for $32 million, or $50 million YTD. This displays that the management finds the price undervalued right now. Based on metrics alone, I would agree, but as I have said, the risk of prolonged interest rates muting margin expansion is very real and a reason for a hold currently.

Risks

It's crucial to keep in mind VNT's susceptibility to economic downturns, with a particular focus on the threat posed by increasing interest rates. As the US Federal Reserve takes measures to address inflation concerns, pushing rates up to levels not seen in over two decades, various economic factors come into play, impacting corporate profit margins. Rising interest rates can exert significant pressure on businesses across various sectors, affecting their financial performance and outlook. This dynamic could introduce a range of challenges for VNT and its peers, influencing strategic decisions and financial planning.

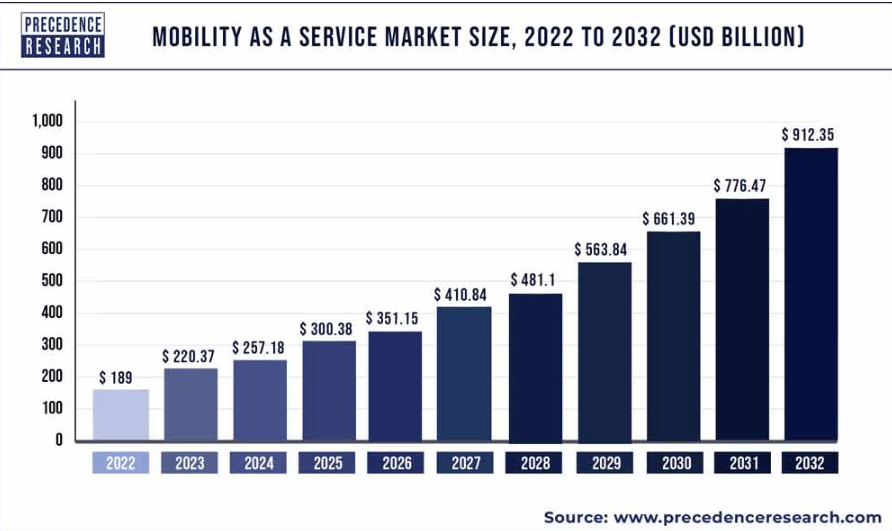

Mobility Industry (precedence research)

The mobility industry has shown resilience by maintaining its spending despite various economic challenges. However, it's worth considering the potential consequences if economic conditions take a downturn. In such a scenario, the industry's spending behavior could shift, and this change might have ripple effects for VNT. For VNT the R&D expenses have continued to steadily climb over the years and right now they sit at $156 million for the last 12 months. What may be worrying is that whilst R&D expenses have increased since 2021, the operating income has declined by $20 million. A further continuation of this trend is likely to upset the market and result in the share price correcting to show a more sour or pessimistic view of the business.

Financials

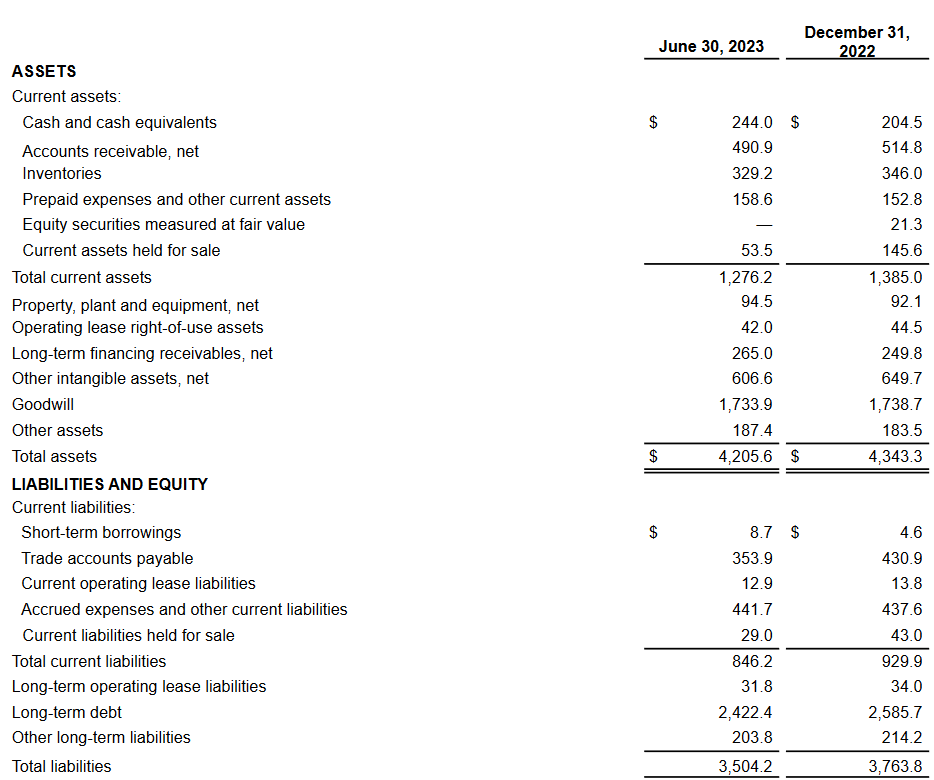

Balance Sheet (Earnings Report)

On the balance sheet side of things we can see that as mentioned before, the long-term debts are decreasing thanks to the improvement of the FCF for the business. Nonetheless, the company still has a significant debt position at over $2.4 billion. On the asset side, the cash position has been increasing nicely to $244 million in total, up $40 million from December 31, 2022. What I think can be worked on more here is paying down debt. I think it's really that simple. If VNT wants to accelerate growth, then they can't have a debt position that large weighing on them during that, it will blow out of proportion and they could have to dilute shares to meet obligations. For now, though, I see the right moves being made at least.

Final Words

VNT has been on a steady trajectory upward as its share price is approaching all-time highs. The recent report showcases some difficulties in margin retention as the heightened interest rates are taking a toll on the earnings of the business. In my opinion, VNT has a lot of growth potential once the rates begin to decline, but my conviction right now is that rates will continue to be higher for a prolonged period and that will mute earnings growth and ultimately result in the hold rating I have for them now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.