Lyft: Stabilizing In The Near Term, But It's Not Secure For The Long Haul

Summary

- Uber's dominance in the mobility and delivery space has grown, while Lyft has faded into the background.

- Lyft has adopted a strategy of shrinking, focusing on core markets, and pricing aggressively to compete with Uber.

- Despite a recent shift toward minor profitability, the company faces a potentially expensive insurance renewal. In addition, price competition with Uber may drive down margins.

- Though a cheap stock at <1x revenue, it's best to monitor Lyft from the sidelines.

Klaus Vedfelt/DigitalVision via Getty Images

Ever since the pandemic faded, Uber (UBER) has made its dominance clear. The mobility giant's delivery bookings have continued to grow as consumers' attachment to takeout orders has endured, while a return to cities has made rideshare demand robust again.

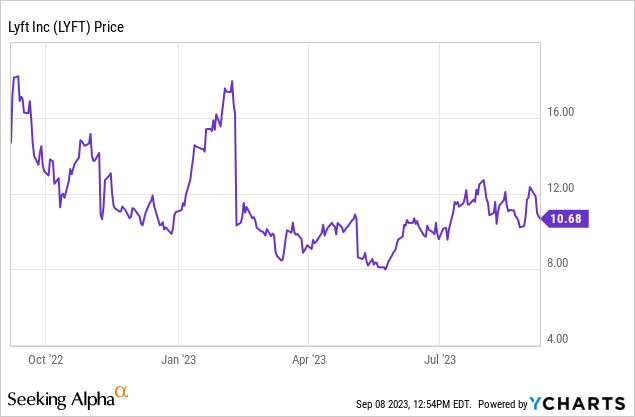

Lyft (NASDAQ:LYFT), meanwhile, has faded to the background. The #2 player in the rideshare space, Lyft has seen its share price decline in the single digits this year while Uber stock has nearly doubled - reflecting the divergence of fortunes in two companies that many American riders thought to be neck and neck in the race.

To its credit, Lyft has adopted a prudent strategy to compete in this arena: shrink, focus on a few core markets, and price aggressively in those markets to stand on equal footing with Uber. At the same time, the company has embarked on massive layoffs covering nearly 30% of its headcount, which has pushed the company to minor adjusted EBITDA profitability.

After going through Lyft's latest Q2 earnings results (released in early August, and which did little to either reassure investors of Lyft's future or spell imminent doom for the company), I remain neutral on the stock as per my prior opinion.

However, I do think some of the key considerations for both the bull and bear cases have changed, even if they remain balanced. Some of the core things that investors should keep in mind, starting with the positives for Lyft:

- On top of prudent expense management, Lyft has also amassed quite a sizable cash balance. The company has $1.70 billion of cash on its balance sheet, or $890 million of net cash after stripping out $808 million of debt. On top of small adjusted EBITDA profits and moderate cash burn, Lyft has time and liquidity to refine its competitive strategy.

- Lyft has built a network of partnerships and loyalty drivers to retain a core user base. Partnerships with Chase Ultimate Rewards and airlines including Delta (DAL) and Alaska (ALK) has given Lyft a pool of dedicated users, so there is potential for Lyft to continue serving this loyal market even if smaller than Uber's.

At the same time, however, we have to be wary of the following:

- Lyft's growth pales Uber's, even at a much smaller scale. Lyft is about a quarter of Uber's scale and it's growing slower, and in a business that relies on network effects and economies of scale, this may prove to be dire if played out over time.

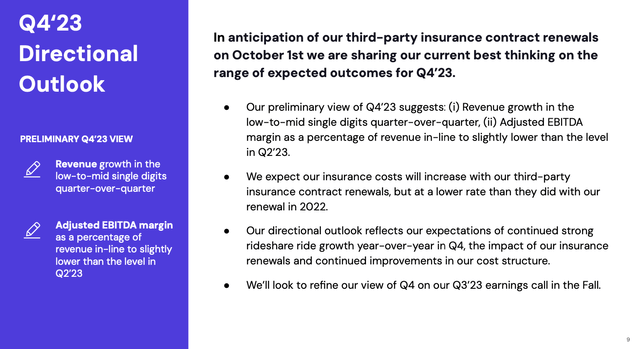

- Insurance renewals are expected to throw a wrench in Lyft's profitability. Higher costs here may threaten the company's recent price-competition strategy with Uber.

More details on the above in the snapshot below, taken from the company's recent Q2 earnings deck:

Lyft Q4 directional outlook (Lyft Q2 earnings deck)

Adjusted EBITDA margins of ~4% are already quite slim, so a shock here in insurance renewal costs may threaten the company's recent streak of minor profits.

The bottom line here: there isn't a clear incentive to remain invested in Lyft or make a big new bet on it. Lyft may be appealing if the stock declines for no reason, but after the recent summer rally back up past $10, I don't see a value opportunity here. Keep this on the watchlist, but remain on the sidelines.

Q2 download

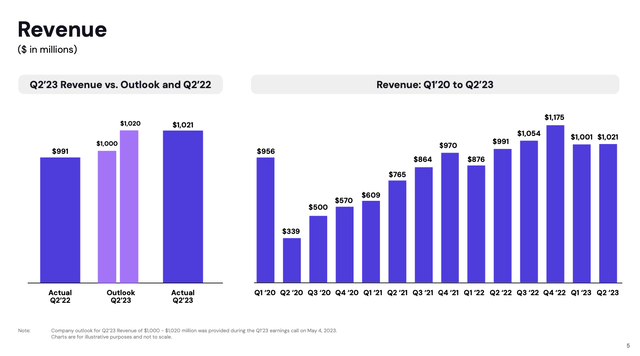

Let's now go through Lyft's latest Q2 results in greater detail. The latest revenue trends are shown in the snapshot below:

Lyft Q2 revenue trends (Lyft Q2 earnings deck)

Lyft's revenue grew 3% y/y (and 2% sequentially) to $1.02 billion, which was essentially in-line with Wall Street's expectations and at the high end of the company's own guidance.

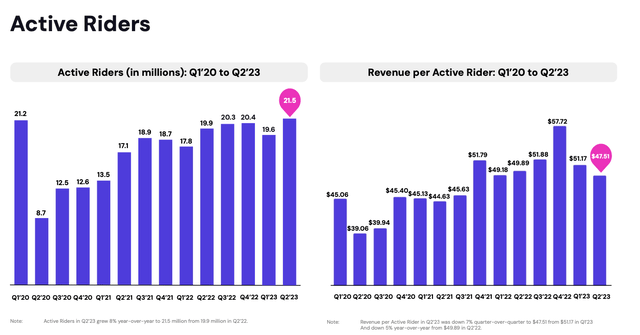

Lyft Q2 active riders (Lyft Q2 earnings deck)

And as shown in the view above, where Lyft excelled this quarter was returning active riders to 21.5 million (as a reminder here, an "active rider" is defined by a person who has taken at least one ride during this period). This is a direct result of lowering prices in the markets where Lyft has deemed it is able to compete with Uber.

The result, however, is a drop in revenue per active rider to $47.51: a -5% y/y decline, and a ~$4 sequential drop.

Here is more commentary on rider behavior from CEO David Risher's remarks on the Q2 earnings call:

First, our customer obsession and focus on strong execution is really paying off. The effects can be seen in our Q2 performance. Rideshare rides grew 18% year-on-year, accelerating for the second quarter in a row, and standard rides reached the second highest level in our history. Active rider and drivers, each reached multiyear highs, resulting in an improved balance in our marketplace. So relative to Q1, the share of rides affected by prime time pricing dropped by 35% and a larger percentage of ride intents converted into rides taken. With more people getting out to work and travel, the market is growing. And with the strength of our actions, they're increasingly choosing Lyft."

The company notes that Lyft's "wait and save" feature (which is more prominent than Uber's, which rarely offers the option) has been a big stimulator of demand on the platform. On the supply side as well, the company has rolled out a number of new and more flexible Ride Challenges to incentivize drivers.

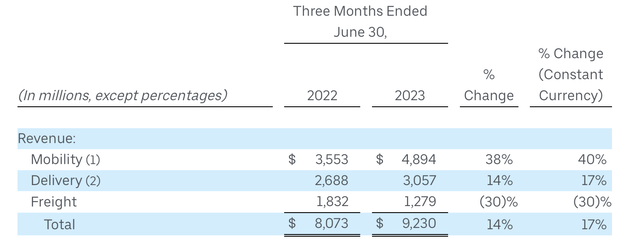

Do note, however, the sobering fact that in the same quarter, Uber rideshare revenue grew 38% y/y to $4.9 billion:

Uber Q2 trends (Uber Q2 earnings release)

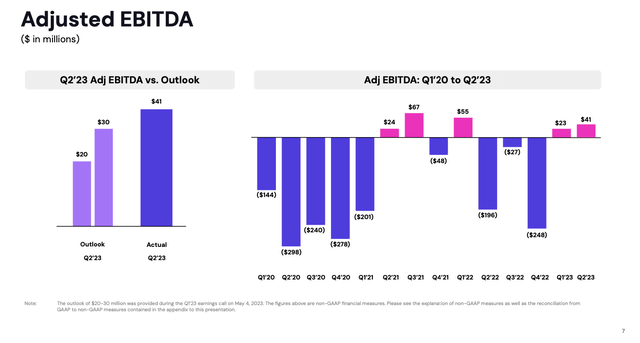

From a profitability perspective, Lyft achieved a $41 million adjusted EBITDA in the second quarter, representing a 4% margin and essentially in line with Q1. This was driven by savings on opex, partially offset by lower revenue per active rider and higher insurance costs on a y/y basis.

Lyft adjusted EBITDA (Lyft Q2 earnings deck)

Valuation and key takeaways

At current share prices near $10, Lyft trades at a $4.13 billion market cap. After we net off the $890 million of net cash on the company's most recent balance sheet, Lyft's resulting enterprise value is $3.24 billion.

For next fiscal year FY24, Wall Street analysts are expecting Lyft to generate $4.84 billion in revenue, representing a re-acceleration to 12% y/y growth. If we take this estimate at face value, Lyft's valuation is 0.7x EV/FY24 revenue. And if we apply the company's latest ~4% adjusted EBITDA margin to this revenue profile, its multiple would be 16.7x EV/FY24 adjusted EBITDA (note, however, the unknown dynamics on both insurance costs as well as the pricing levels needed to remain competitive with Uber to drive double-digit revenue growth).

From this lens, we can certainly say Lyft is cheap, but there are a lot of question marks on the horizon. I'd prefer a "watch and wait" approach here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.