Visa: Competition Will Impact Value

Summary

- Visa is a global leader in payments technology, offering a comprehensive range of payment solutions and value-added services.

- The company has a strong foundation in payments consulting and advisory services, serving diverse clientele including consumers, merchants, financial institutions, and government entities.

- Visa faces potential challenges from the rise of Apple Pay, cryptocurrencies, and changes in payment methods.

- Visa has also embraced digital wallets and mobile payments to adapt to the changing landscape.

- DCF analysis shows little margin of safety.

Drs Producoes

Visa (NYSE:V) is a powerhouse of a company. Wherever you need to make a payment, Visa is there. If you have more than one card in your wallet, very likely one of them is a Visa. These are the types of companies that everyone should want a piece of at a fair price. Since its founding in 1958, Visa Inc. has become a global leader in payments technology, operating the VisaNet transaction processing network that facilitates secure authorization, clearing, and settlement of payment transactions worldwide. The company offers a comprehensive range of payment solutions, including credit, debit, and prepaid card products, as well as innovative services like tap to pay, tokenization, and Visa Direct for real-time payments. Visa also excels in the B2B space with Visa B2B Connect, a cross-border payments network, and Visa Treasury as a Service for cross-border consumer payments.

Complementing its offerings are value-added services such as fraud prevention, dispute management, data analytics, and digital solutions. Visa's commitment to security extends to its risk and identity solutions, including Visa Secure and Visa Advanced Authorization. With a strong foundation in payments consulting and advisory services through Visa Consulting and Analytics, the company serves a diverse clientele, including consumers, merchants, financial institutions, and government entities.

In the short to medium term, I see Visa continuing to dominate. In a decade, I see many possibilities for Visa including shrinking revenues and increased competition. For these reasons, I rate Visa as a hold and would not be buying

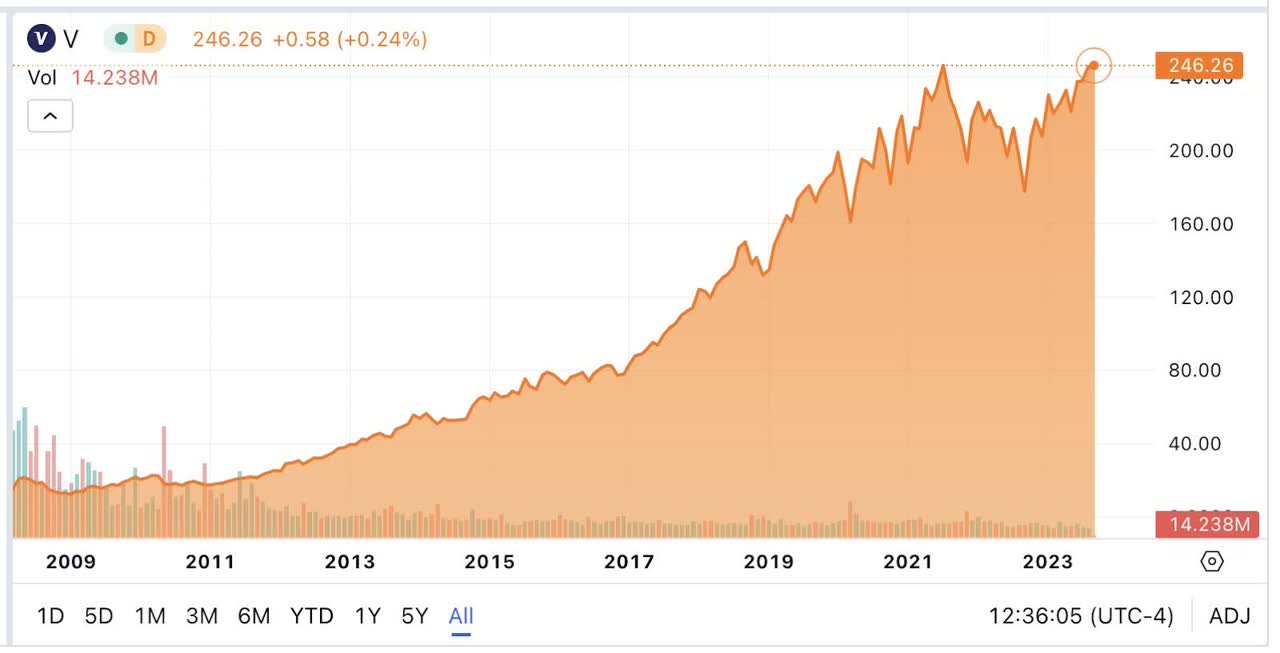

Its chart since inception, shows strength, resilience, and growth. For long-term investors, it truly is a thing of beauty. The only concern one can have is whether it will continue or not. Visa has shown that it can stay one step ahead, but anyone looking closely has to understand that how we pay for things in 10 years might be totally different. If it changes too much, maybe Visa starts to shrink. Maybe fees for swipes disappear or get regulated like utilities.

Investors in almost any time period have benefited from ownership. Every drop has seen a rebound. As the world economy has grown, so has Visa.

Returning an absurd over 100% annually since 2009, Visa has been a must own stock that benefited from the adoption of electronic payments through innovation and the capturing of market share. Currently, Visa trades at a PE of 28 which is lower than its historic PE but still shows the market's belief that Visa is still a growth company. This slight discount to historic PE combined with the coming increases in swipe fees outlined here paint a bullish future that matches the past.

In the long term, I believe these fee increases will be deleterious to the business. The public demands ways to use their money without the use itself costing anything. Although many of these fees have been absorbed by merchants, continuous increases will impact consumers. Once Visa and other card companies ask for too much, they are inviting competition and further regulation.

The biggest threat to Visa in my humble opinion is Apple Pay, cryptocurrencies, and changes to current payment methods.

Apple Pay

Apple Pay presents both opportunities and challenges for Visa. While Apple Pay is not a direct competitor to Visa, it does impact Visa's business in several ways:

- Disintermediation: Apple Pay has the potential to disintermediate traditional payment networks like Visa. When consumers link their credit or debit cards to Apple Pay, transactions can occur directly between the consumer and the merchant, bypassing Visa's network. This means that Visa may lose out on certain transaction fees.

- Security and Trust: Apple Pay places a strong emphasis on security and privacy. With features like Touch ID and Face ID, consumers may feel more secure using Apple Pay than traditional payment methods. This could lead to a shift in consumer preferences away from physical cards, impacting Visa's card issuance business.

- Contactless Payments: Apple Pay popularized contactless payments using smartphones and wearables. While Visa benefits from the increased use of contactless payments, it also faces competition from tech giants like Apple in this space.

- Global Expansion: Apple Pay has expanded its presence globally, often in partnership with local banks and payment networks. In some regions, this means Apple Pay competes directly with Visa in the mobile payments space.

- Innovation and Expectations: Apple's innovation and customer-centric approach set high standards for the industry. Visa must continue to innovate and provide added value to consumers and merchants to remain competitive.

These concerns are real but it is important to note that Visa has also embraced digital wallets and mobile payments. Visa cards can be added to Apple Pay, and the company benefits from the increased adoption of digital payment methods. Additionally, partnerships between tech companies like Apple and traditional payment networks can create opportunities for collaboration and expanding the digital payment ecosystem. Visa's ability to adapt and collaborate in this changing landscape will determine how it navigates the challenges posed by Apple Pay and similar technologies.

Cryptocurrencies

Cryptocurrencies pose both challenges and opportunities to Visa, one of the world's largest payment technology companies. Here's how cryptocurrencies can be seen as a threat to Visa:

- Disintermediation: Cryptocurrencies like Bitcoin enable peer-to-peer transactions without the need for traditional intermediaries like banks and payment networks. This could potentially reduce the demand for Visa's services, such as transaction processing, as users can transfer value directly to each other using cryptocurrencies.

- Competing Payment Systems: Some cryptocurrencies are designed to function as digital currencies for everyday transactions. If these cryptocurrencies gain widespread adoption, they could directly compete with traditional payment methods, including Visa cards, for everyday purchases.

- Cross-Border Transactions: Cryptocurrencies are often touted as a solution for cross-border payments, offering faster and cheaper alternatives to traditional remittance services. If widely adopted for international money transfers, cryptocurrencies could reduce the demand for Visa's cross-border payment services.

- Digital Wallets: Cryptocurrency wallets, both hardware and software-based, are increasingly being used for storing and transacting with cryptocurrencies. Some digital wallets also support traditional payment methods, potentially reducing the reliance on Visa cards for everyday spending.

- Privacy and Security Concerns: While cryptocurrencies offer enhanced privacy for users, they can also be used for illicit activities. Regulatory concerns and potential crackdowns on cryptocurrencies could impact their acceptance and use in legitimate transactions, which could indirectly affect Visa's business.

- Innovation and Competition: Cryptocurrencies are driving innovation in the payments space. As more businesses explore blockchain technology and digital assets, Visa faces competition from emerging fintech companies and startups that are leveraging cryptocurrencies to offer new payment solutions.

- Consumer Preferences: As cryptocurrencies gain popularity, consumer preferences for payment methods may shift. If a significant portion of consumers prefers to use cryptocurrencies, it could impact the demand for traditional payment cards issued by Visa.

It's essential to note that Visa has also taken steps to adapt to the changing landscape:

- Partnerships: Visa has partnered with various cryptocurrency platforms and exchanges to enable the issuance of Visa-branded crypto debit cards. This allows users to spend cryptocurrencies at merchants that accept Visa.

- Innovation: Visa is exploring blockchain technology and digital currencies as part of its long-term strategy. It is investing in research and development to remain at the forefront of digital payments.

- Regulatory Compliance: Visa is closely monitoring regulatory developments related to cryptocurrencies. Ensuring compliance with evolving regulations is crucial to its continued operations.

- Digital Wallets: Visa has expanded its presence in the digital wallet space, offering services that allow users to make contactless payments using smartphones and wearables, which aligns with the shift toward digital payment methods.

While cryptocurrencies present challenges to Visa's traditional business model, Visa is actively exploring opportunities in the digital currency space and adapting to changing consumer preferences to remain a significant player in the evolving payments ecosystem. Let's look at how these factors impact valuation.

Valuation

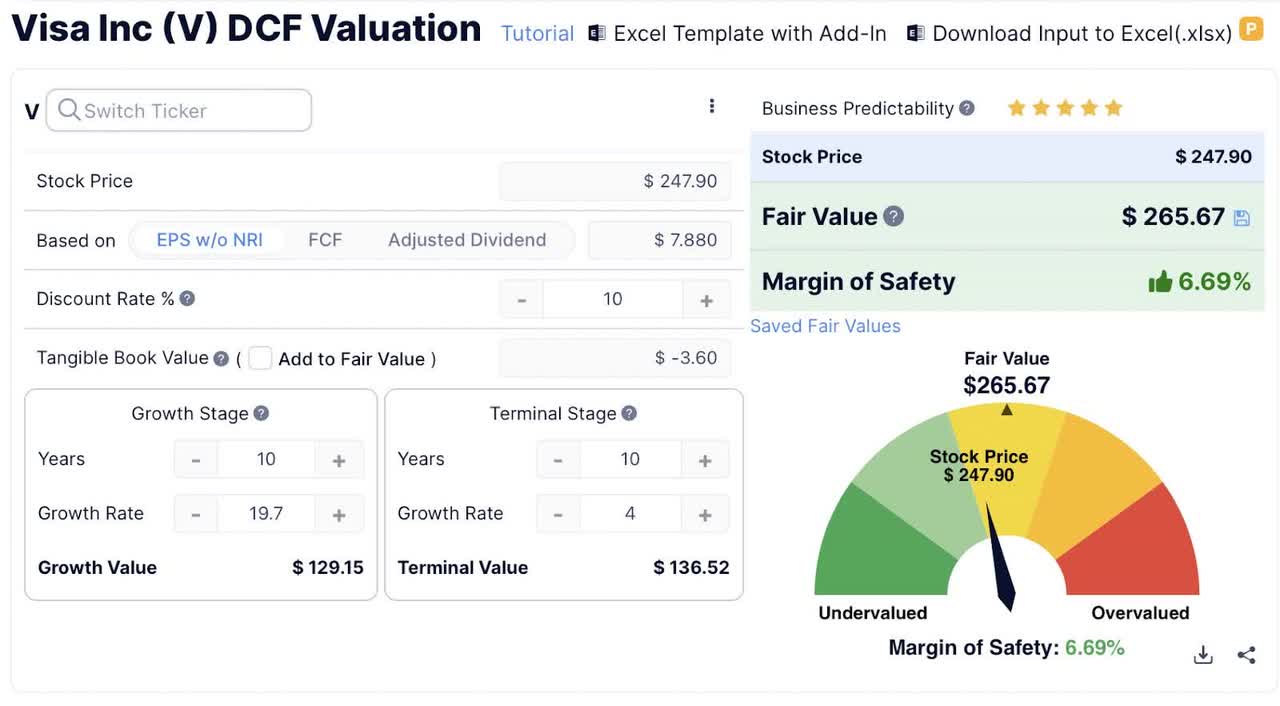

Scenario 1 - Visa Continues To Grow at Current Rates:

A current DCF analysis based on EPS puts Visa close to fair value currently. This is assuming Visa maintains current growth rates. This makes Visa a very non-compelling buy even if things go well for the company. The only way for Visa to show serious earnings growth is to raise fees and this only makes them more vulnerable to competition.

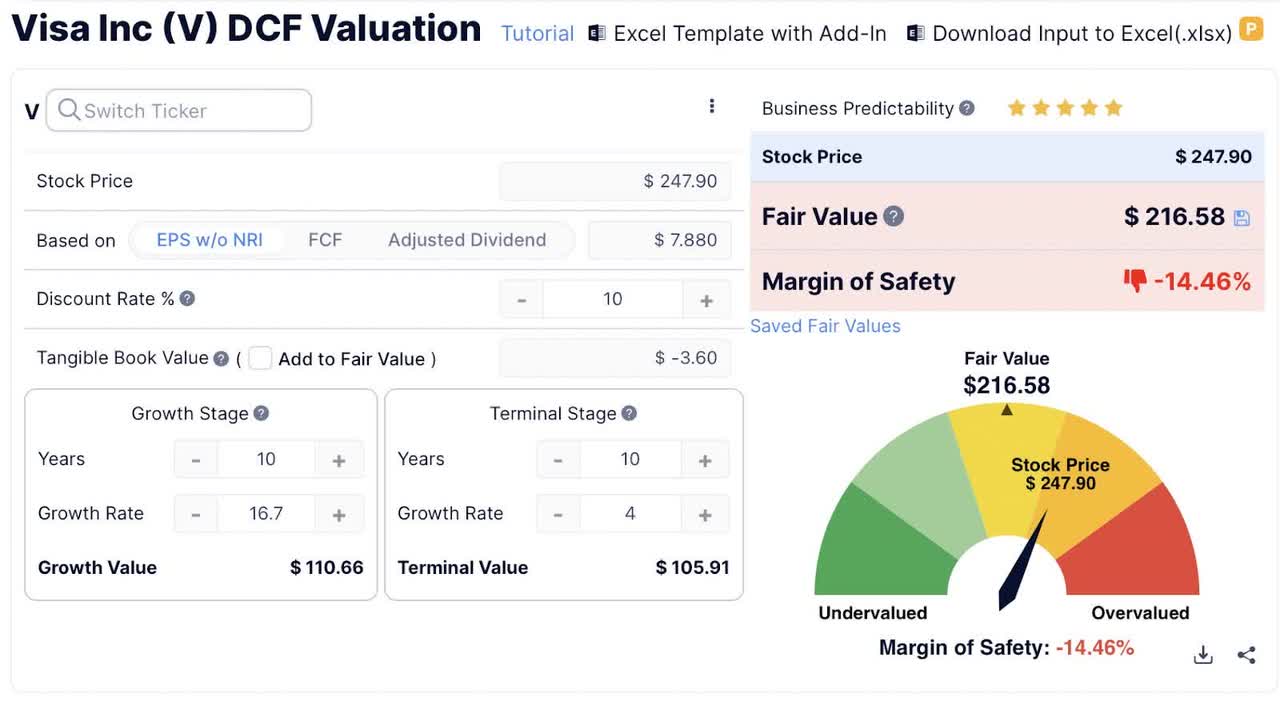

Scenario 2 - Visa loses 15% of its business to competition:

If Visa was to lose 15% of its business to competition, the fair value would drop significantly to $216.

Scenario 3 - Visa loses 30% of its business to competition:

If Visa was to lose 30% of its business to competition, the fair value could plummet to $175 a share.

In looking at these scenarios, I would say that Visa should continue to grow earnings per share over the next 5 years. At some point competition and compressed margins should impact Visa's growth. The only way to avoid these three scenarios is to find other growth engines, take business from competitors, or grow the business at higher rates. Perhaps growing use of electronic payments is enough to create the possibility of a never-ending virtuous cycle, but I tend to believe this virtual cycle is nearing its end and the margin of safety for Visa is not compelling enough to warrant a buy.

Final Thoughts

Visa Inc. stands as a formidable force in the world of payments, with a rich history of innovation and global reach. Over the years, it has developed a comprehensive suite of payment solutions, serving a diverse clientele that includes consumers, merchants, financial institutions, and government entities.

As we look to the future, there are factors that warrant careful consideration for investors. In the short to medium term, Visa appears poised to maintain its dominance. Still, in the long run, there are potential challenges on the horizon. The evolving landscape of payment methods, including the rise of Apple Pay, presents both opportunities and disruptions. The growing influence of cryptocurrencies, with their potential to disintermediate traditional financial networks, is another factor to monitor closely.

Visa's ability to adapt, innovate, and collaborate will be crucial in navigating these challenges. While it has embraced digital wallets and mobile payments, the company must remain vigilant in meeting changing consumer preferences and industry standards. Additionally, the company's pursuit of fee increases, while potentially profitable in the short term, may carry long-term risks, including regulatory scrutiny and competition.

For investors, Visa's track record of growth and resilience is undoubtedly impressive. Still, the dynamic nature of the payments industry demands ongoing assessment and a watchful eye on emerging trends and technologies. Visa's success in this ever-evolving landscape will depend on its ability to balance tradition with innovation, ensuring it remains a key player in the future of payments. As such, it's prudent for investors to approach Visa with a "hold" stance, recognizing its strengths but also acknowledging the uncertainties and potential disruptors on the horizon. As always, please do your own due diligence before buying any positions and good luck investing. If you like the article, give me a like and a follow. Thanks for reading.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.