Splunk: The Profit Story Is Really Shining

Summary

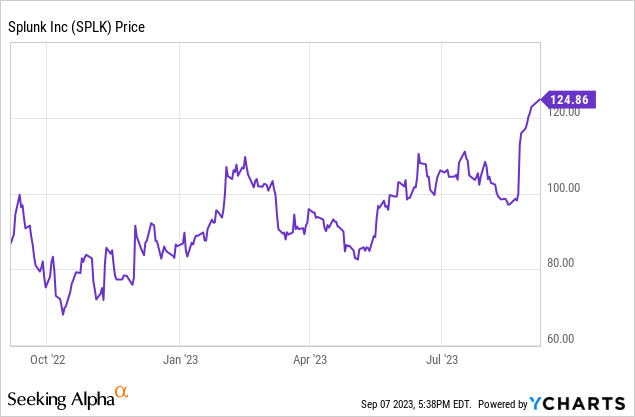

- Splunk's stock price has jumped around 40% this year after reporting strong Q2 results and raising its guidance for the year.

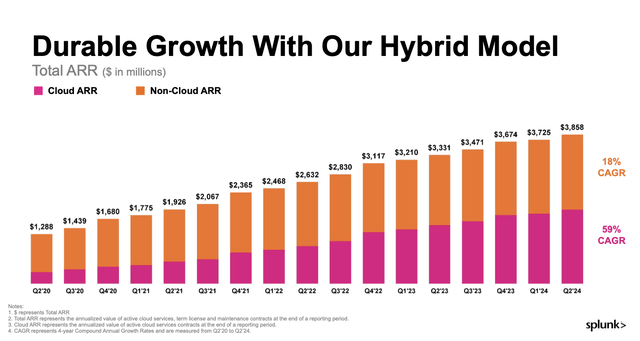

- The company continues to grow cloud ARR at a >20% y/y pace, while executing well in a tough sales environment.

- At the same time, management has sliced opex spending, allowing the company to dramatically boost its margin performance.

- Splunk trades at ~5x FY25 revenue, leaving room for further upside.

JHVEPhoto/iStock Editorial via Getty Images

In the current world of high interest rates, investors need to make sure we're not completely allocating away from equities: but the stocks we pick must be exceptional to compete with ~5% risk-free yields. That's why individual stock selection is so critical.

Enter Splunk (NASDAQ:SPLK), the machine data software company that has seen a vigorous ~40% jump in its stock price year to date. Gains picked up steam after Splunk reported a terrific Q2 and lifted its guidance for the balance of the year.

After parsing through the company's latest results, in spite of Splunk's massive gains over the past few months, I remain bullish on the name (consistent with my prior view) and have even more conviction in the stock's ability to continue rallying.

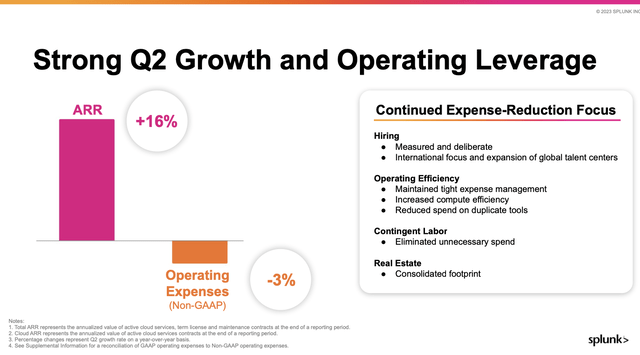

What's new? In a nutshell, the slide below captures how Splunk has surprised us to the upside:

Splunk growth + margin achievements (Splunk Q2 earnings deck)

Splunk is effectively fulfilling the promise of a company that has converted to a high-margin subscription business model. The company continues to build up its ARR base, while leveraging this high-margin revenue stream to capture operating efficiencies and deliver tremendous profitability gains. As shown above, Splunk is leaving no stone unturned when it comes to cost, slowing down hiring and streamlining contract labor, ensuring infrastructure efficiency, and rationalizing its real estate footprint.

These cost measures are additive on top of my existing long-term bull case for Splunk, which I'll reiterate below:

The use cases for Splunk are infinite. In its early days, Splunk's machine data-mining capabilities were often used for security purposes to flag and respond to anomalies within corporate systems. But as Splunk has evolved, the company's machine data capabilities are applicable across virtually any industry and across many functions.

Usage-based pricing. Some of the most successful software stocks are usage-based, meaning that revenue climbs proportionally to a customer's usage of the product. Splunk's platform is charged on a data volumes/computing power basis. As data volumes continue to explode and companies push the boundaries of how they integrate data into operations and decision-making, Splunk has a tremendous opportunity to derive growth from within its install base.

Splunk isn't without competitors, but the company's focus on machine data is unique. It's also the largest company in the space. The company's closest large/public peers are the monitoring companies like Datadog (DDOG) and New Relic (NEWR), which primarily focus on monitoring the performance and uptime of applications and infrastructure. Splunk focuses on visualizing and analyzing machine data (information passively generated by computers, phones, and other endpoints within networks). We note as well that Splunk's ~$4 billion annual revenue scale makes it twice as large as its next-closest competitor, Datadog.

Industry-wide recognition. More to the point above, it's fine to have competition when Splunk also is widely considered the best-in-breed vendor for machine data analytics. Gartner, the software industry's leading analyst and reviewer, has bestowed the "Leader" designation to Splunk in the security information and event management space, and also named it as the vendor with the highest ability to execute. These commendations don't come lightly to IT buyers when making a purchase decision.

Significant international expansion opportunity. Splunk has become a global brand name, and it's time for Splunk to chase more opportunities overseas. Currently, only about ~35% of its revenue base comes from international markets (and an even smaller ~20% slice of the cloud business is overseas). I see significant opportunity for Splunk to expand its presence outside of the U.S.

Valuation update

Of course, with Splunk's latest rally, the stock isn't exactly cheap - but I still think Splunk's valuation leaves room for upside.

At current share prices near $125, Splunk trades at a market cap of $20.93 billion. After we net off the $2.49 billion of cash and $3.88 billion of debt on Splunk's most recent balance sheet, the company's resulting enterprise value is $22.32 billion.

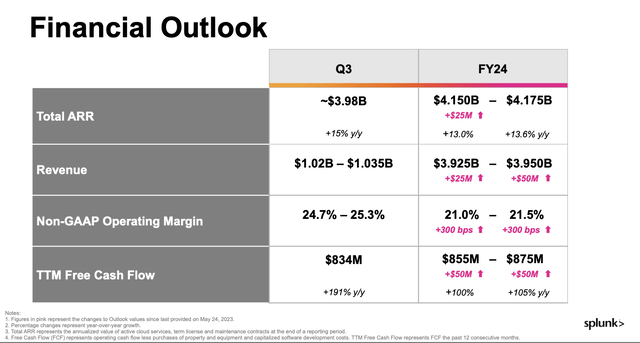

Meanwhile, for the current fiscal year, note that Splunk has raised its revenue outlook by $25 million on the low end and $50 million on the high end to a new range of $3.93-$3.95 billion:

Splunk outlook (Splunk Q2 earnings deck)

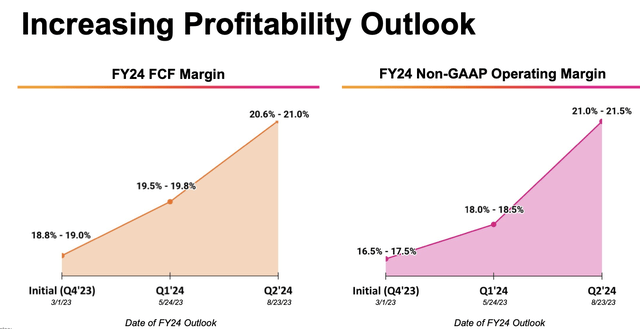

More impressively still, it has boosted its pro forma operating margin guidance for the year by 300bps, driven by the cost takedowns the company has achieved across opex categories.

Zooming ahead to FY25 (the year for Splunk ending in January 2025), Wall Street analysts are expecting the company to generate $4.39 billion in revenue (+12% y/y) and $4.39 in pro forma EPS (+15% y/y), which puts the company's FY25 valuation multiples at:

- 5.1x EV/FY25 revenue

- 28.5x FY25 P/E

I'd be wary of Splunk when it reaches 6x FY25 revenue (implying a $167 price target "threshold", also implying a 38x P/E), but until then, I'm content to hold on for more upside.

Q2 download

Let's now discuss Splunk's latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Splunk Q2 results (Splunk Q2 earnings deck)

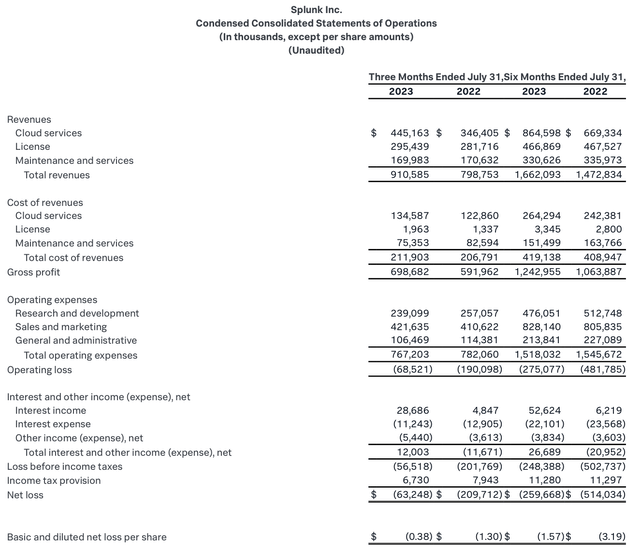

Splunk generated $910.6 million in revenue in Q2, up 14% y/y and decimating Wall Street's expectations of $888.7 million (+11% y/y) by a wide three-point margin. Revenue growth also accelerated three points versus Q1's 14% y/y growth rate.

The company continues an impressive buildup in ARR, adding $133 million in net-new ARR for the second quarter and growing ARR at 16% y/y. Underneath this, cloud ARR of $19.2 billion grew 27% y/y, reflecting Splunk customers' increased preference for cloud deployment (as in, not running Splunk on local data centers).

Splunk ARR trends (Splunk Q2 earnings deck)

Splunk's CEO, Gary Steele, noted on the Q2 earnings call that despite the company running into a macro-challenged environment, the sales team continued to execute consistently:

We're proud of what we delivered this quarter even as the uncertain macro environment remain largely consistent with what we've seen throughout this year. Our Q2 performance clearly demonstrates that we have dialed in our ability to navigate the current landscape and execute with consistency to deliver durable growth and profitability. What's also evident is that organizations around the world need Splunk's world-class unified security and observability platform more than ever to underpin the resilience of their digital systems."

The cost side, however, is where Splunk shone even more. The company noted that it "expanded scope" for team members (which is corporate code for asking workers to do more, and eliminating superfluous headcount) and reduce spending on third-party vendors and contractors. The company managed to bring down opex by -3% y/y, though it had actually forecasted opex growth of up to 2.5% for the quarter. In turn, this delivered a pro forma operating margin of 16.7%, up from just 3.6% in the year-ago quarter.

The outperformance on margin has led to a sharp increase in the full-year margin outlook since the start of the year, as shown in the chart below:

Splunk margin guidance increases (Splunk Q2 earnings deck)

Pro forma EPS of $0.71 also grew nearly 8x y/y and beat Wall Street's expectations of $0.46 with 54% upside.

Key takeaways

Splunk has been rallying to highs not seen since early 2022, but it has done so for a great reason: improving profit execution, which is what investors care about in this volatile and risk-averse market. Hold on here for more upside.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.