Hingham Institution For Savings: Strong Book Value Growth And Operational Performance

Summary

- Hingham Institution for Savings (HIFS) has struggled to grow its deposit base, resulting in added risk and a 10% short interest in its shares.

- HIFS has seen consistent growth in book value and dividend yields, with potential for further growth if deposits increase.

- HIFS has a strong business structure, with impressive commercial loan growth and an efficient ratio, but may face consolidation due to rising interest rates.

Kobus Louw

Introduction

The history of the Hingham Institution for Savings (NASDAQ:HIFS) is rich, dating back to 1834. The company has in the last few years struggled somewhat in growing its deposit base and this seems to have resulted in some risk being added to the company by the market right now and over 10% short interest applies to the shares. As part of the regional bank industry, the share price fell quite sharply earlier this year and has since not been able to recover at all.

The appealing part about HIFS right now I think comes from the growth of the book value in the last few years, which has averaged a CAGR of 15.5% in total. This I think will eventually translate to even stronger dividend yields from the company. The growth rate for the dividend in the last 5 years has averaged a 12% increase at least annually, and something along the lines of double-digit growth I think is plausible if deposits increase further and HIFS can retain it too.

Company Structure

As mentioned, HIFS is in the regional banks industry, which has been a very volatile place to keep moment the last 12 months. But I think the worst has passed and now we are heading higher. Major financial institutions like JPMorgan Chase (JPM) saw their value decline as well, but have recovered very decently so far. For HIFS that hasn't been the case and could be likely reasoned because of the smaller size of the business and the slightly unimpressive deposit growth it has had up until 2018.

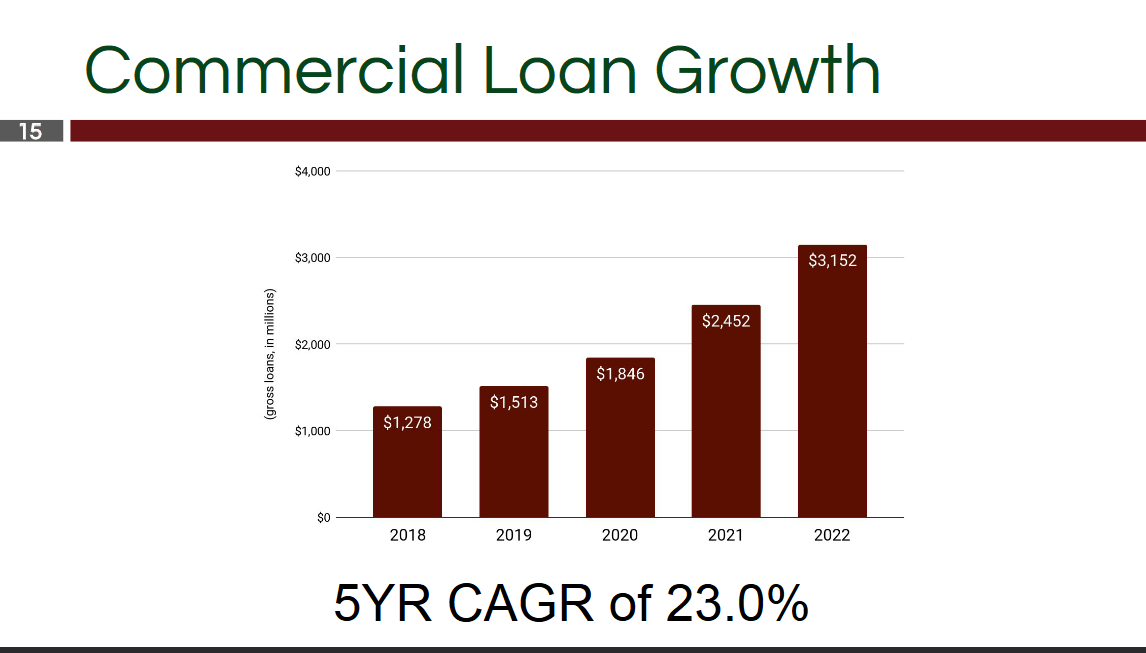

Loan Growth (Investor Presentation)

The last 5 years have averaged a commercial loan growth rate of 23%, which I quite frankly think is incredible and a true testament that HIFS is recovering very well and should be able to deliver a strong return to shareholders over the long term if they can efficiently leveraged and capitalize from this. The efficiency ratio for the company is incredible, at under 25% which I haven't come across that many times when assessing regional banks.

Looking at the core of HIFS's business strategy lies a straightforward approach: the pursuit of numerous sound loans while upholding the utmost operational efficiency. This philosophy underscores the bank's commitment to its primary function – facilitating lending that fosters economic growth and supports the financial aspirations of its clients. It has worked out very well so far for the company, but I do think a slight consolidation is possible as interest rates are climbing and taking on loans becomes more expensive for people.

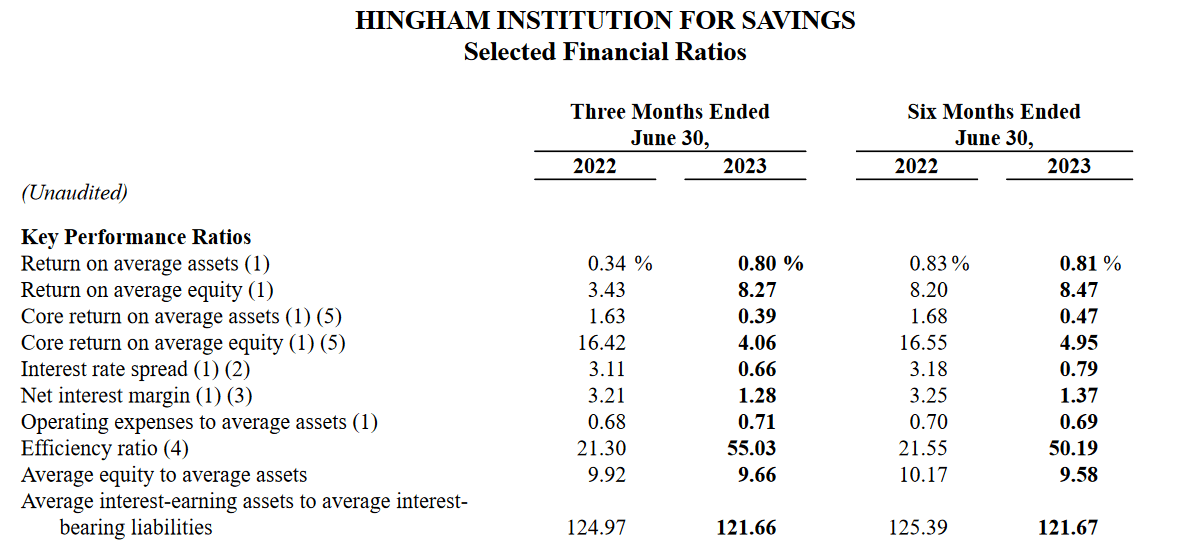

Ratios (Earnings Report)

Looking more at the returns and results from the company they continue to impress very well I think as the ROA has been increasing from 0.34% to 0.8% in the last 12 months and should add more fuel to HIFS as they can continue boosting the dividend yield. The return on average equity has also been increasing at a very good rate so far and displayed a return of 8.27% in the last quarter alone, up from 3.43%. For the coming quarterly reports for the company, these are some of the factors that I will be looking particularly at and if they continue the trend then I will continue seeing them as a buy.

Valuation & Comparison

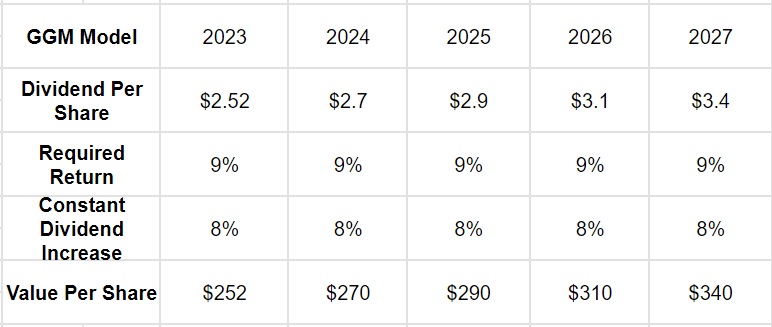

GGM Model (Author)

Looking at the GGM model above here for HIFS, I think it becomes further clear that the company offers a solid potential return for investors right now at the current price level. I said before, the company has had an average dividend increase over the last 5 years of over 12% annually, and even giving it an 8% terminal increase might not do it justify. But it does highlight that even with some more risk adjustments, HIFS remains a very sound investment opportunity right now. Under a p/e of 11, I think the company continues to look very appealing. Comparing it to a peer like Cambridge Bancorp (CATC) I think it further accentuates the positives of going with HIFS right now. The company has a stronger history of growing the dividend and even has a lower payout ratio, leaving more room for increases without overleveraging or destabilizing the business.

Risk Associated

A significant concern casting a shadow over HIFS shares revolves around its vulnerability stemming from a relatively fragile deposit base. Throughout the 2010s, the landscape of bank deposits was notably influenced by the Federal Reserve's dovish monetary policy, which translated to nearly negligible costs associated with these deposits. Consequently, HIFS' strategic approach during this period leaned toward not placing substantial emphasis on accumulating its deposits.

Stock Chart (Seeking Alpha)

Weighing on the share price I think will be the short interest there currently is. The shirt interest has reached a remarkable level at over 10%, and I think this is indicative that the market might want to capitalize as much as possible from the banking crisis that happened earlier this year. But HIFS doesn't have any significant exposure to it and has historically been very good at avoiding overexposing themselves to such risks too much. I think that given the growth strategy, the company has, and the recent performance short-sellers will likely get burned by holding these positions as eventually, the market will realize the actual value of the business and that will likely result in the share price increasing quite quickly.

Investor Takeaway

The shares for HIFS are under some scrutiny, it seems as if a decent amount of them seem to be held as short at a total rate of over 10%. I think this will in the short-term improve the share price but leave a decent buying opportunity for us investors. As HIFS is building up the loans and deposits they are also generating stronger earnings and this will eventually be noticed and result in the share price jumping up quickly to display the actual value of the business, which would in my opinion be somewhere around a P/E of 11 - 13 at least.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)