Smith Douglas Homes Begins U.S. IPO Rollout

Summary

- Smith Douglas Homes Corp. has filed for a $100 million IPO of its Class A common stock, although the final figure may differ.

- The company builds residential homes in the Southeastern United States region.

- However, its top line revenue growth has slowed in the most recent reporting period.

- I'll provide an update when we learn more about the IPO's pricing and valuation assumptions.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Thomas Barwick

A Quick Take On Smith Douglas Homes Corp.

Smith Douglas Homes Corp. (SDHC) has filed to raise $100 million in an IPO of its Class A common stock, according to an SEC S-1 registration statement.

The firm builds residential single-family and multifamily homes in several states in the Southeastern United States region.

However, top line revenue growth has slowed markedly in the most recent reporting period.

I'll provide an update when we learn more IPO information from management.

Smith Douglas Homes Corp. Overview

Woodstock, Georgia-based Smith Douglas Homes Corp. was founded to develop residential real estate properties for sale in the United States and is currently active in the five states of Texas, Alabama, Georgia, Tennessee, and North Carolina.

Management is headed by Founder and Executive Chairman, Tom Bradbury, who has been with the firm since its inception in 2008 and was previously the founder of Colony Homes, a prominent Southeastern U.S. homebuilder in the 1990s and early 2000s.

The firm believes it is the sixth largest U.S. homebuilder founded after 2007, based on 2022 home closings.

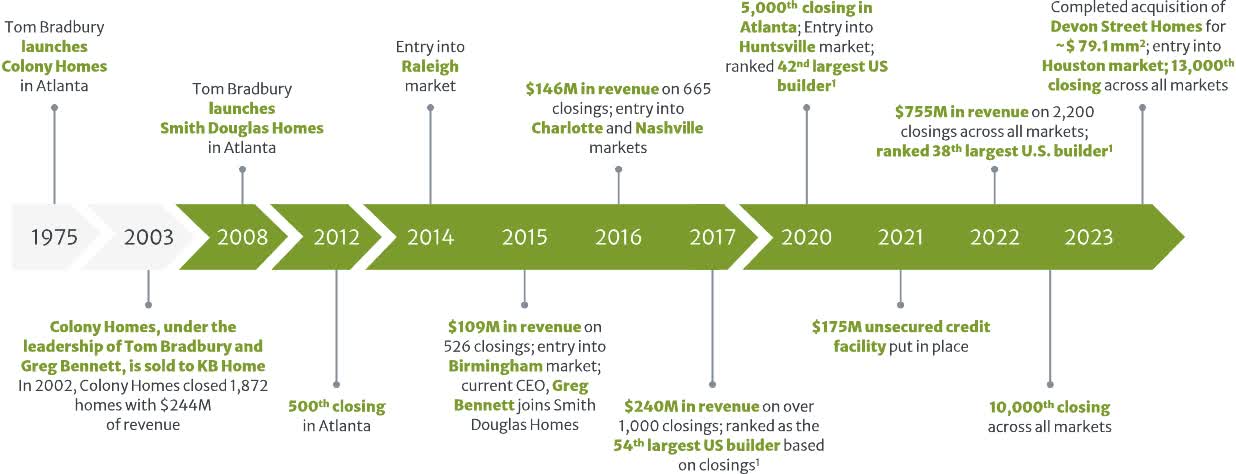

Below is a timeline of the firm's history:

Company Timeline (SEC)

As of June 30, 2023, Smith Douglas has booked a fair market value investment of $176 million in equity from investors, including Founder Fund and GSB Holdings.

Smith Douglas Homes Corp.'s Customer Acquisition

The firm markets its homes for sale directly through its own agents as well as through independent brokers and word of mouth.

The company caters to the entry-level homebuyer segment.

Selling, G&A expenses as a percentage of total revenue have trended lower as revenues have increased, as the figures below indicate:

Selling, G&A | Expenses vs. Revenue |

Period | Percentage |

Six Mos. Ended June 30, 2023 | 12.0% |

2022 | 11.0% |

2021 | 12.4% |

(Source - SEC)

The selling, G&A efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of selling, G&A expense, has fallen to 0.6x in the most recent reporting period, as shown in the table below:

Selling, G&A | Efficiency Rate |

Period | Multiple |

Six Mos. Ended June 30, 2023 | 0.6 |

2022 | 2.8 |

(Source - SEC)

Smith Douglas Homes Corp.'s Market & Competition

According to a 2023 market research report by Mordor Intelligence, the North American residential construction market was an estimated $950 billion in 2022 and is expected to reach a value of $1.2 trillion by 2028.

This represents a forecast CAGR of 4% from 2023 to 2028.

The main drivers for this expected growth are continued pent-up demand for housing and low interest rates.

Also, the recent rise in interest rates has significantly increased the cost of mortgages, creating an 'affordability crisis' for many people.

The COVID-19 pandemic also induced migration from cities to less populous areas, fueling demand for homes in lower-density regions.

Major competitive or other industry participants include the following:

D.R. Horton

Lennar Corporation

PulteGroup

NVR

KB Home

Taylor Morrison

Meritage Homes

Toll Brothers

LGI Homes

M/I Homes

Others

Smith Douglas Homes Corp.'s Financial Performance

The company's recent financial results can be summarized as follows:

Slowing topline revenue growth

Reduced gross profit and dropping gross margin

Lower operating profit

Smaller cash flow from operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | $349,666,000 | 7.4% |

2022 | $755,353,000 | 45.6% |

2021 | $518,863,000 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | $101,231,000 | 6.1% |

2022 | $222,754,000 | 81.2% |

2021 | $122,946,000 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Six Mos. Ended June 30, 2023 | 28.95% | -0.4% |

2022 | 29.49% | 24.5% |

2021 | 23.70% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Six Mos. Ended June 30, 2023 | $59,363,000 | 17.0% |

2022 | $139,485,000 | 18.5% |

2021 | $58,715,000 | 11.3% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Six Mos. Ended June 30, 2023 | $59,567,000 | 17.0% |

2022 | $140,444,000 | 18.6% |

2021 | $62,530,000 | 12.1% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Six Mos. Ended June 30, 2023 | $35,902,000 | |

2022 | $132,095,000 | |

2021 | $30,870,000 | |

(Source - SEC)

As of June 30, 2023, Smith Douglas had $11.4 million in cash and $49.7 million in total liabilities.

Free cash flow during the twelve months ending June 30, 2023, was $138.0 million.

Smith Douglas Homes Corp.'s IPO Details

Smith Douglas intends to raise $100 million in gross proceeds from an IPO of its Class A common stock, although the final amount may differ.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Immediately post-IPO, the company will be a 'controlled company' according to NYSE's rules.

Management says it will use the net proceeds from the IPO as follows:

IPO Proposed Use Of Proceeds (SEC)

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management did not characterize its legal proceedings status or state an opinion about any material adverse impact.

The listed bookrunners of the IPO are J.P. Morgan, BofA Securities, RBC Capital Markets, and other investment banks.

Commentary About Smith Douglas' IPO

SDHC is seeking U.S. public capital market investment to fund its growth plans and provide for working capital.

The firm's financials have generated declining topline revenue growth, lowered gross profit and gross margin, reduced operating profit, and less cash flow from operations.

Free cash flow for the twelve months ending June 30, 2023, was $138.0 million, an impressive result.

Selling, G&A expenses as a percentage of total revenue have trended lower as revenue has increased; its selling, G&A efficiency multiple fell to 0.6x in the most recent reporting period.

The firm currently plans to pay no dividends and to retain future earnings for reinvesting back into the firm's growth and expansion capital requirements.

SDHC's recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for homebuilding in the United States is large and growing but is subject to macroeconomic factors such as interest rates and employment.

J.P. Morgan is the lead underwriter on the IPO, and its IPOs have performed reasonably well in the past 12 months.

Business risks to the company's outlook as a public company include continued higher interest rates that increase the cost of financing, a weakening job market as employers have been reducing job openings and quit rates have been dropping.

When we learn more IPO details from management, I'll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.