Yes, Gold Is An Alternative Form Of Money

Summary

- Gold should be treated as money and considered in a broader asset allocation strategy.

- Gold is considered a liquid asset and the closest thing to "money" that's immune to government control.

- Gold has a history of outperforming short-term US Treasuries and keeping pace with long-term Treasury bills.

brightstars

Few assets confuse and confound the average investor as much as gold. But there’s an easy solution for cutting through the noise and thinking rationally about how the metal can fit into a broader asset allocation strategy: It’s money and should be treated as such.

Depending on your perspective, the world’s favorite precious metal is also considered in some circles as a hedge against chaos, protection from inflation, and a general source of financial comfort. Some also use it as a speculative vehicle with time horizons measured in minutes, days, or weeks. Another school of thought sees gold as one more risk asset that deserves to be considered in the same breath as stocks. At times, it’s all (or sometimes none) of those things. But I prefer to think of it as money, which is the main takeaway over long sweeps of financial history.

There was a time when gold was formally used as money by the US and other governments. Those days are long gone, but the metal’s lengthy, evolving history as a coin of the realm lives on, if only in the collective minds of investors and financial markets. We can debate about whether that’s reasonable or practical, but it’s a simple fact that dates to at least the Roman Empire.

For ill or good, much of the world considers gold to be a liquid asset. True, you can’t buy a loaf of bread or rent an apartment with it, short of tortured negotiations. But compared with every other commodity or non-currency asset on the planet, gold is the closest thing to “money” that’s immune to government control. Simply put: no one worries that you’ll have a problem liquidating your gold hoard at a fair, widely traded price in the world’s financial centers (and beyond).

To be fair, bitcoin and other cryptocurrencies are the new kids on the block that arguably offer the capacity to out-gold gold as an alternative form of money. But there are reasons to be skeptical. In the interest of brevity, I’ll sidestep this debate here, other than to note that these are still very early days for deciding if the likes of bitcoin will replace gold’s millennia-long run as a store of value. Centuries of history aren’t easily or persuasively overturned with a track record that effectively launches with the start of the Obama administration.

Critics will rightly point out that gold, like bitcoin, is volatile in the short term, and so its value as money is weak if your time horizon doesn’t extend beyond a few years. Agreed, and so on that basis, you’ll have to look elsewhere for a “safe” asset.

But let’s also recognize that however you define “money,” there will be a unique set of pros and cons to your preference. Meanwhile, gold’s history as an alternative, if flawed, form of money is convincing as a possible addition to your “cash” allocation.

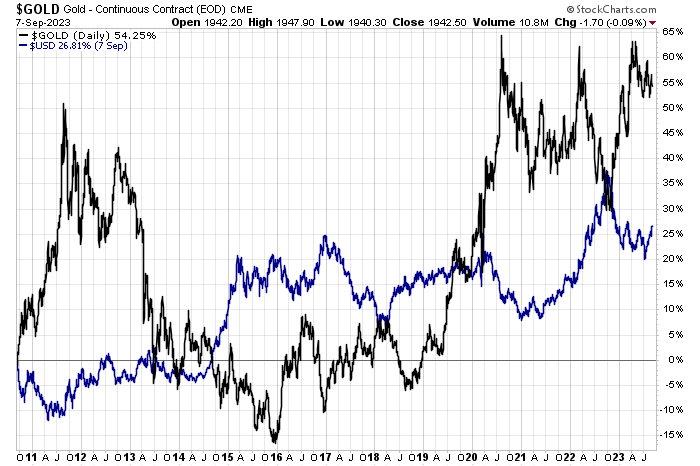

Consider, for instance, how gold performs against its arch-fiat rival: the US dollar. Notably, gold and the greenback tend to be negatively correlated. When one rises, the other tends to weaken, and vice versa, as the chart below shows (based on history starting in 2010). That’s exactly what you’d expect to see from an alternative to US currency in the forex space.

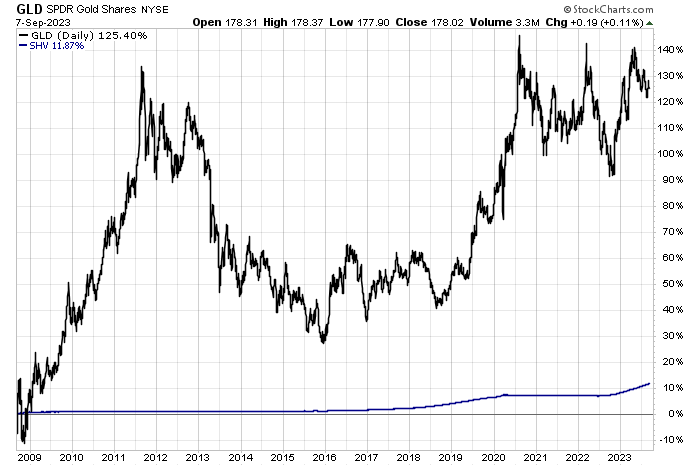

Another test of gold’s claim to be an alternate, albeit informal currency: it keeps pace and tends to outperform short-term US Treasuries, a cash proxy. Using 2010 as a start date, it’s clear that an investment in SPDR Gold Shares (NYSEARCA:GLD) – an ETF that holds bullion – has outperformed the iShares Short Treasury Bond ETF (SHV) by a wide margin.

Granted, over shorter periods, GLD suffers sharp losses compared with SHV’s relatively stable pricing. Again, gold’s short-term volatility is a major drawback for investors looking for stability in the near term.

But if you have a 10-year-plus horizon, history suggests that gold will likely keep pace and perhaps outperform Treasury bills. The longer the horizon, the higher gold’s advantage, albeit with roller-coaster-like volatility in the shorter term.

Should gold be part of your asset allocation? Minds will differ, but to the extent that gold is held, the “safest” reasoning is that it’s an alternative form of money that compliments and diversifies “cash” holdings.

Alas, gold shares one common feature that applies to every asset class: there are no guarantees. But if you use history as a guide on matters of investment choices, gold’s track record is striking. Namely, it’s outlasted every formal currency in history and outperformed most in the interim.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Recommended For You

Comments (5)

Any reason with gold at $1,930.00 mining stocks are not far off 52 week lows?

Your thoughts?