BDC Weekly Review: More Dilution Worries For BDC Investors

Summary

- We take a look at the action in business development companies through the last week of August and highlight some of the key themes we are watching.

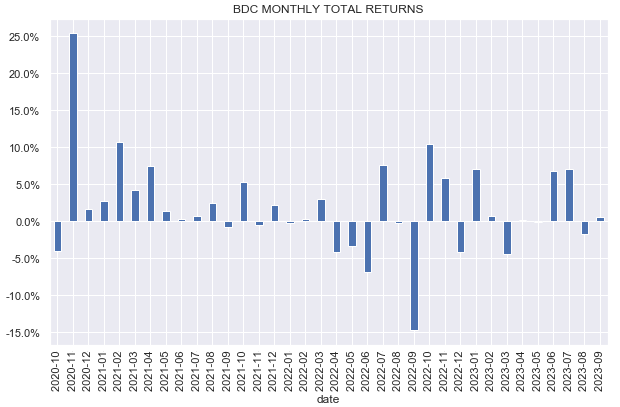

- BDCs had a good week with a 2% total return and finished August with a small loss.

- Investors continue to worry about various types of dilution from BDC share issuance.

- We highlight GSBD and BBDC earnings.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company ("BDC") sector from both the bottom-up - highlighting individual news and events - as well as the top-down - providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the last week of August and the start of September.

Market Action

BDCs had a good week at a 2% total return with a good start to September. The sector finished August with a small loss.

Systematic Income

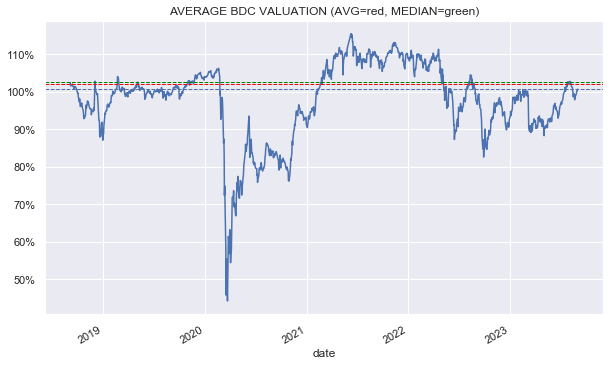

Aggregate sector valuation moved back up over 100% but remains a touch below its longer-term average of 102%.

Systematic Income

Market Themes

Last week we got a question from a reader who was worried about Capital Southwest (CSWC) asking to issue additional shares below the NAV. We discussed this topic earlier but it doesn't hurt to revisit it as it's issuance season.

In short, there isn't much to worry about especially for a company like CSWC which trades at a premium. When CSWC issues shares, it generates positive NAV returns (i.e. the issuance is accretive to the NAV) which is good for holders. The share price does typically drop during public offerings because those offerings are done at a discount to the market price, however the dip is usually temporary and offers investors a chance to add shares at a better price.

The reader was also worried about dilution. Here, it's important to distinguish between three types of dilution. The first one has to do with a given investor's ownership percentage of the company which is the kind of dilution that seems to be the most cited in the internet even though it's one that income investors need to worry about the least. It's true that an investor's ownership stake is diluted after a public offering (unless they participate in the offering in the right amount), however, unless the investor wants to exercise significant control on the board this is the kind of dilution they can happily ignore and this applies to all retail investors.

The second type of dilution has to do with the NAV. Specifically, stock that is issued at a premium to the NAV is accretive to the NAV (i.e. boosts the NAV) and vice-versa. Often BDCs will ask for investor permission to issue stock at a discount to NAV but the reality is that the request is not always acted on - BDCs just want to have this in their back pocket.

The third type of dilution is income dilution. The idea here is the offering will cause the company's net income to be distributed across more shares, meaning there is less net income to go around for each share. This is true, however, the additional share issuance also means there is additional capital to put to work. The BDC can, in theory, just let the capital sit there or it can be used to repay debt, however, more often than not it will be put to work and then leveraged with the net result being that the company will generate additional net income in line with the growth in additional shares, leaving net income per share at about the same level as before.

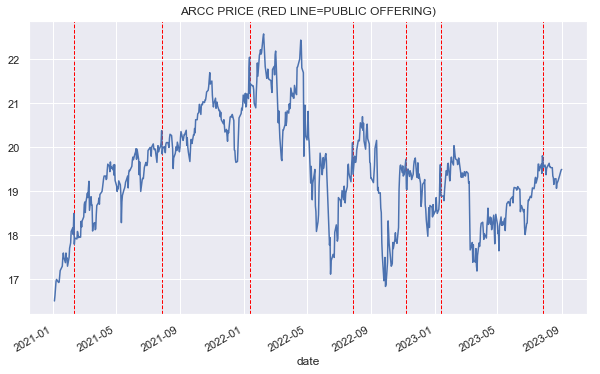

The obvious question for investors is whether the drop in price is permanent or not. Our view is that it should only be temporary and as the supply/demand dynamic wears off and the additional capital is put to work the stock should trade back higher. This is not a very scientific analysis but a quick look at ARCC which has done 7 public offerings in the last couple of years shows that after a brief drop the price tends to regain its former level in short order.

Systematic Income

Market Commentary

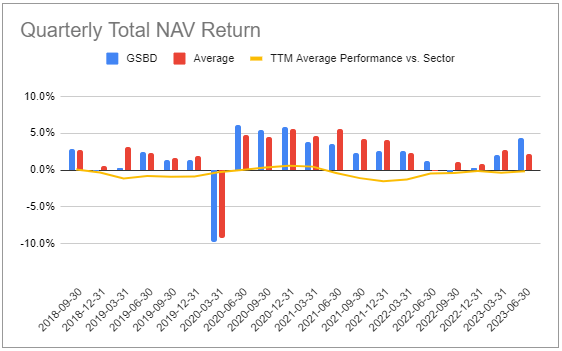

Goldman Sachs BDC (GSBD) delivered a good quarter with a 4.3% return. The company has been an odd one in the sector. Despite fairly consistent underperformance it has tended to trade at a premium to the sector. The stock has underperformed across all major time periods which has been the case for some time.

Until Q2 it underperformed the sector in 7 of the last 9 quarters.

Systematic Income BDC Tool

However, its valuation only dipped below the sector average earlier this year.

Systematic Income BDC Tool

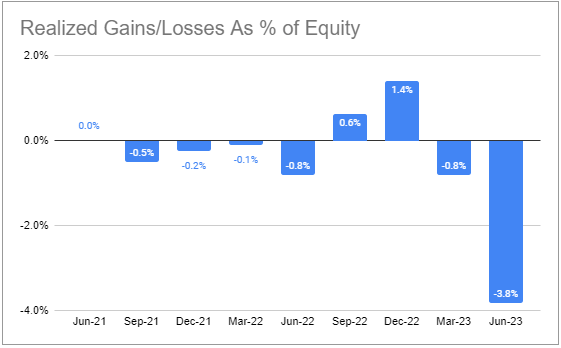

One concern is its steady drip of net realized losses that we have in each of the last 5 quarters. This is likely due to the combination of imperfect underwriting and lack of upside from a low level of equity holdings. It remains slightly expensive but no longer stupidly expensive.

The Barings BDC (BBDC) raised the dividend by a penny to $0.26. Non-accruals remained at 1.1%. Realized losses came in at nearly 4% - enough to flush a quarter’s net income down the drain.

Systematic Income BDC Tool

However unrealized losses more than made up for it which pushed the NAV higher on the quarter. Such big realized losses remain big question marks for the company’s underwriting process.

In our last update on BBDC in the third week of June, the last line of the article was that the stock was a compelling play for tactical investors. As it happens, it has enjoyed the best run in the sector since then with an 18% total return. This is not unusual - we often tend to see low-valuation underperformers get the biggest boost during sector rallies.

However, they also tend to see the biggest drawdowns during sell-offs. The stock managed a good couple of quarters and has delivered a 1Y total NAV return that’s on par with the sector. Time will tell if it can stop being consistently inconsistent.

Stance and Takeaways

We stayed on the sidelines this week as the BDC sector remains on the expensive side of fair-value. Until this changes our focus remains relative value rotations in the sector. The Fed has signaled they are likely to keep rates steady but are unlikely to cut in the near term. This will continue to put pressure on borrower interest coverage and we expect this should push sector valuations lower over the rest of the year.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)