PTY: Risks Lurking Behind 10% Yield

Summary

- The PIMCO Corporate and Income Opportunity Fund is popular among income investors for good reasons.

- It is yielding ~10% currently, and dividends are paid monthly - a quite appealing combination.

- However, potential investors should be aware of the risks lurking behind the yield.

- The yield is not that attractive when properly benchmarked.

- Macroscopic risks such as high interest rates and credit risks are likely to cause price depreciation at the same time.

- I do much more than just articles at Envision Early Retirement: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Oskari Porkka

Thesis: 10% yield is not enough

Investors seeking current income have good reasons to like the PIMCO Corporate and Income Opportunity Fund (NYSE:PTY). By focusing on investments in high-yield bonds (such as corporate bonds) and employee leverages, PTY currently offers a 10%+ yield (10.03% on a TTM basis as of this writing). The yield is about 2x higher than both treasury bonds (in the range of ~4.5% to ~5.5% depending on duration) and is also much higher than BAA Corporate Bond (about 6.1%).

However, potential investors should be aware of the risks lurking behind the yield before engaging. And the thesis of this article is that the current yield is not sufficient to compensate for these risks. In the remainder of this article, I will detail the top 3 risks that I see: interest rates, valuation risks, and also the use of leverage. These risks are likely to cause market-lagging or even negative total return potential in the next few years.

PTY: Basic information

Before diving in, a quick intro to the fund itself in case there are readers new to it. As its name suggests, the fund places an emphasis on corporate bonds to generate high current income. Although the fund also has substantial exposure to other sectors as stated in its fund description below (the highlights were added by me):

PTY seeks maximum total return through a combination of current income and capital appreciation. The Fund seeks to achieve its investment objective by utilizing a dynamic asset allocation strategy among multiple fixed income sectors in the global credit markets, including corporate debt, mortgage-related and other asset-backed securities, government and sovereign debt, taxable municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers.

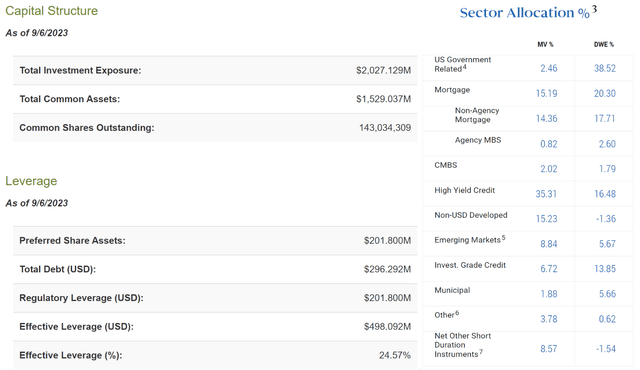

The following chart summarizes more specific details about its basic capital structure and sector exposure. As seen, it uses an effective leverage of 24.57%). And the fund's largest sector exposure is indeed high-yield credit (35% by market value). Also, when adjusted for duration, its largest exposure are U.S. government (38.5%) and mortgage (20.3%).

Next, I will detail such exposure risks under the current interest rate environment.

Source: CEFconnect and PTY fund webpage

Macroeconomic risks

My view for the dominant macroeconomic force in the foreseeable future is persisting high interest rates. As seen in the first chart below, risk-free rates (measured by the benchmark 10-year treasury rates) currently hover around 4.3%, the highest level since 2008. Furthermore, such high rates can persist in the way I see things. As the latest example, at the recent Jackson Hole symposium, Fed chair Jerome Powell just reminded us of the Federal Reserve's firm stance on potential interest hikes to fight inflation.

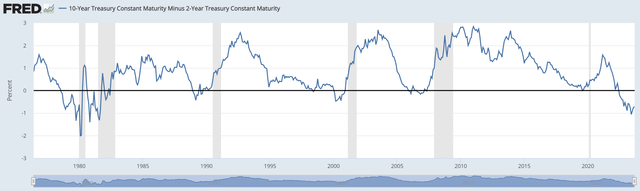

A high (or higher) interest rate can impact PTY negatively on several fronts. First, the rate raises have caused an inverted yield curve (see the second chart below). Actually, the current yield curve is the most inverted in more than 4 decades. Such a severely inverted yield curve puts huge pressure on the mortgage-related exposure that the PTY holds. If you recall from the previous section, mortgage-related exposure is the second largest exposure in the fund when adjusted for the duration. The basic dynamics of mortgage exposures have been detailed in our other articles. In a nutshell, such exposure in general benefits when there is a wide gap between long-term lending rates and short-term borrowing rates. When the gap narrows (or inverts like now), such exposure faces headwinds.

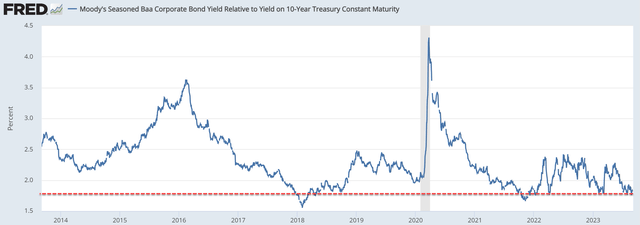

Second, a higher risk-free rate compresses the value of its other holdings too and automatically reduces the true value of its dividends. As seen in the next chart, the spread between Baa Corporate Bond Yield Relative to 10-year Treasury rates is currently only 1.84%, close to the thinnest level since at least 2014. This means that its corporate bond exposure, no matter what their yields are, is simply worth less relative to risk-free assets compared to, say, 2020 when the spread was thicker than 3.5%. The same idea applies to its dividends. As mentioned in the first section, PTY is generating a yield of ~10% currently, which is also its average yield in the past 4 years. A 10% dividend yield 2~3 years ago when 10-year treasury rates were around 1% is worth much more than the same 10% yield now when 10-year Treasury rates are above 4%.

Valuation risks

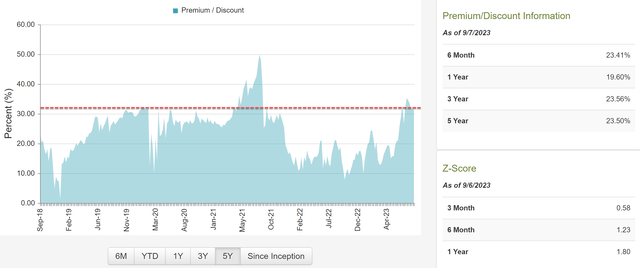

Despite the risks analyzed above, the fund is not cheap in terms of valuation. On the opposite, both by horizontal and vertical comparison, the fund is trading at a premium. As you can see from the following chart, PTY is trading above its NAV by a whopping 33%, among the highest levels in the past 5 years and far above the 5-year average of 23.5%.

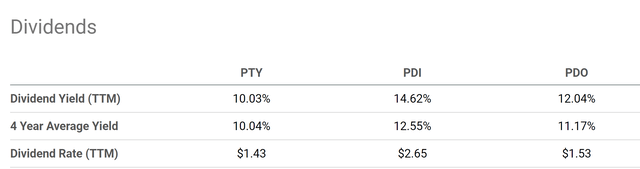

Measured by dividends, the fund is trading at a premium relative to its sister funds such as the PIMCO Dynamic Income Fund (PDI) and PIMCO Dynamic Income Opportunities Fund (PDO). As you can see from the next chart, the fund is yielding 10.03% as aforementioned, which is on par with its 4-year average of 10.04%. In contrast, its sister funds like PDI and PDO are trading at a TTM yield substantially higher than their 4-year averages, signaling some valuation discount.

Other risks and final thoughts

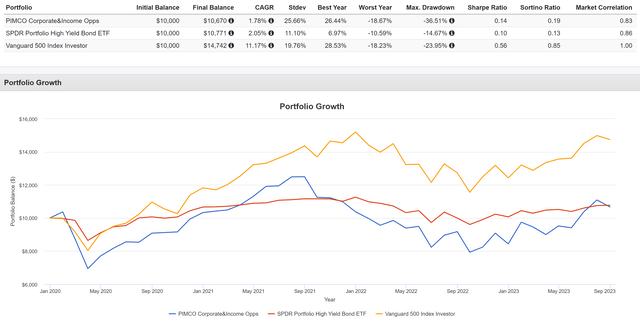

Finally, as aforementioned, the PTY fund also employs a substantial amount of leverage. I have nothing against leverage at a fundamental level (and I use leverage myself routinely). Furthermore, if you do decide to use leverage, there are certain positives to leverage through PIMCO's funds such as PTY. A leader like PIMCO can enjoy lower borrowing rates than many of us can get. PIMCO also offers better liquidity than many individual investors when things go in the wrong direction. However, I just do not think now is the best setting to use substantial leverage. The prevailing rates cause borrowing costs to be high, and likely to stay high. Moreover, the diminishing yield spreads as mentioned above effectively reduce the effectiveness of the leverage. As seen in the chart below, in the past 3 years (when the overall trend for rate is up), PTY not only lagged the S&P 500, but also slightly lagged a simply high-yield bond fund despite the use of leverage and the larger volatility risks.

To conclude, my goal is to caution potential investors about the risks behind PTY's 10% yield. I don't see the yield as sufficient to compensate for the risks. The fund's allocation is sensitive to several macroscopic risks, with high interest rates and narrow spread being the top two on my mind. Relatively expensive valuation premiums further compound these risks.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.

This article was written by

** Disclosure** I am associated with Envision Research

I am an economist by training, with a focus on financial economics. After I completed my PhD, I have been professionally working as a quantitative modeler, with a focus on the mortgage market, commercial market, and the banking industry for more than a decade. And at the same time, I have been managing several investment accounts for my family for the past 15 years, going through two market crashes and an incredible long bull market in between.

My writing interests are mostly asset allocation and ETFs, particularly those related to the overall market, bonds, banking and financial sectors, and housing markets. I have been a long time SA reader, and am excited to become a more active participator in this wonderful community!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.