Sangamo Therapeutics: Recent Updates Bolster My Long-Term Conviction

Summary

- Sangamo Therapeutics has faced challenges in recent years but has made moves and closed deals that have reignited interest in the company.

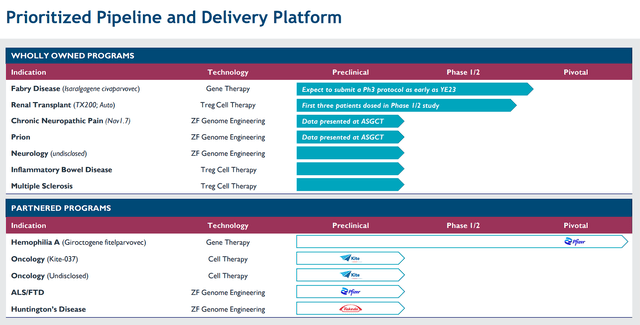

- The company has provided updates on its pipeline progress, including positive feedback from the FDA for its Fabry Disease program and progress in its Hemophilia A gene therapy program.

- Sangamo is actively seeking strategic partnerships and exploring collaborations in various areas, which could provide funding and support for its diverse programs.

- Looking for a portfolio of ideas like this one? Members of Compounding Healthcare get exclusive access to our subscriber-only portfolios. Learn More »

Melpomenem

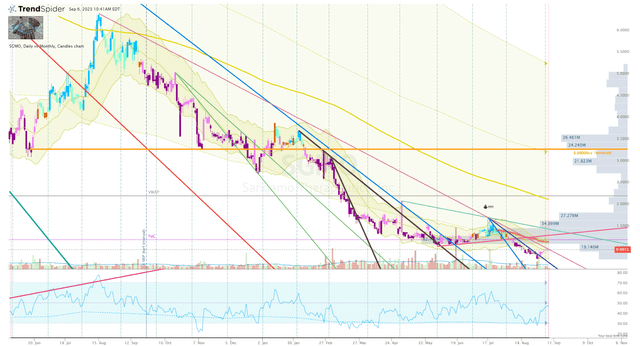

Sangamo Therapeutics (NASDAQ:SGMO) has had a rough road over the past couple of years as the company dealt with clinical holds, key departures, canceled partnerships, and restructuring. The ticker has also had a rough go and is down over 70% over the past twelve months. However, the company has been making some moves and closing deals that have reignited my interest in the ticker and have bolstered my long-term conviction in SGMO. Like most biotechs, SGMO has experienced elevated selling pressure that pushed the share price down to an attractive discount. I believe SGMO is offering a great opportunity for investors to start or add to their positions.

I intend to review some of the company's updates and they have impacted the ticker's share price. Then, I will discuss how they bolster my conviction. In addition, I will highlight some key downside risks that SGMO investors should consider when managing their position. Finally, I reveal my plans for my SGMO position in the fourth quarter of 2023.

Concerning Updates

Sangamo has publicized several noteworthy updates since the beginning of 2023 including some clinical data readouts, regulatory updates, restructuring, and agreements. Some of these updates did have a negative impact on the share price, however, I believe I am starting to see what the company is trying to achieve.

Perhaps the most important update came from their Q1 earnings report, where they informed investors about a "strategic update" that included restructuring and reducing their US workforce by roughly 27%. Typically, this is not a positive event and it often precedes a rough patch for the company, or possibly the beginning of a death spiral. In Sangamo's case, it was the company's efforts to prioritize their efforts to some of their more promising candidates, as well as some of their most advanced pipeline programs. One of which, is their Fabry Disease program which is moving closer to Phase III of the regulatory pathway. In addition, the restructuring was expected to save the company roughly $31M. Indeed, the restructuring signaled the company was not in good health, and the company's Phase III study for Hemophilia A with Pfizer (PFE) was over a year away from a pivotal readout and submission for approval.

Although this appears to have been a prudent move, the market has crushed SGMO's share price in reaction to the news.

Encouraging Updates

Last month, Sangamo reported their Q2 earnings and provided some key updates regarding their pipeline progress as well as bringing us up to date with partnerships.

Clinical Progress with Fabry Disease

First and foremost, Sangamo provided us with an update regarding their Fabry Disease program. Sangamo received constructive feedback from the FDA and is gearing up for two pivotal Phase III studies for Fabry disease, catering to both treatment-naïve and pseudo-naïve patients, as well as those already on enzyme replacement therapy "ERT". Encouragingly, the company revealed that the FDA's positive feedback eliminates the need for an ERT comparator study for certain patient groups. While specific study details are pending, Sangamo refining its trial strategy and plans to submit the Phase III protocol for Fabry disease by year-end, pending further FDA clarification.

Reminder, isaralgagene civaparvovec has the FDA's fast track designation as well as orphan drug designation, so we could see the therapy on the market sooner than later with up to seven years of market exclusivity if it is able to outperform Amicus Therapeutics' Galafold.

Hemophilia A Gene Therapy

Another program to keep an eye on is Sangamo's gene therapy for Hemophilia A. The company conveyed that their partner, Pfizer, believes the program remains on track, with anticipated top-line data in the first half of 2024 and a planned BLA submission in the second half of the same year.

Their Hemophilia A gene therapy, Giroctocogene fitelparvovec, has garnered recognition and special designations from regulatory agencies, including Fast Track, Orphan Drug, and regenerative medicine advanced therapy "RMAT" designations from the FDA, as well as Orphan Medicinal Product designation from the EMA. This means that not only could Giroctocogene fitelparvovec be the first therapy for Hemophilia A, but it could also be available on the market within two years.

TX200 Program

Another interesting program is Sangamo's TX200, a CAR-Treg cell therapy candidate aimed at combating HLA A2 mismatched kidney transplantation, which was proclaimed to be advancing smoothly. The therapy involves taking regulatory T cells "Tregs" from patients, modifying them with a chimeric antigen receptor "CAR" that recognizes a specific antigen, expanding these cells outside the body, and freezing them for later use. This study aimed to assess the feasibility of creating this therapy for kidney transplant recipients with end-stage renal disease "ESRD".

Sangamo also announced that The Safety Monitoring Committee has endorsed the move to the next dose cohort, signifying progress in the program. Additionally, European regulators have granted initial approvals for an updated study protocol designed to expedite dose escalation.

If this program is successful, Sangamo might have the answer to prevent kidney transplant rejection, and possibly other organ transplants. I will make note that Sangamo publicized that their platform has garnered significant interest from potential partners eager to collaborate in this exciting space.

Business Development and Partnerships

Sangamo also reported that they are actively fostering strategic partnerships, highlighting the recognition of their technology and expertise. A large percentage of my bull thesis is centered on the company's partnerships and Sangamo's ability to advance genomic medicines and innovative payload delivery technology that could attract big-name partners. These partnerships provide upfront payments, milestones, and royalties to Sangamo, which can be used to fund their pipeline and day-to-day operations.

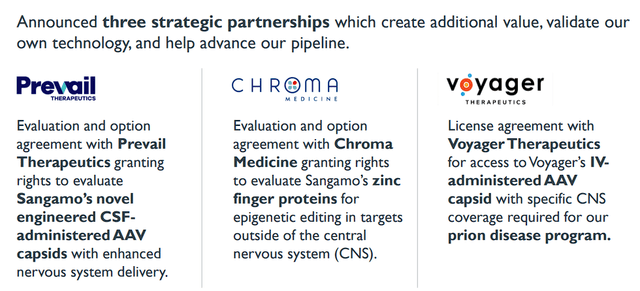

Recent partnerships of note include collaborations with Prevail Therapeutics, Voyager Therapeutics (VYGR), and Chroma Medicine, all geared towards pioneering breakthrough treatments.

Sangamo Therapeutics Recent Partnerships (Sangamo Therapeutics)

It is important to note, that most of these recent partnerships are novel endeavors for Sangamo and their technology. For example, the recent collaboration with Prevail Therapeutics underscores Sangamo's commitment to pushing the boundaries of gene therapy in the neurology domain. One potential partnership opportunity is using Sangamo's zinc finger platform for in vivo genome engineering in non-neurology fields. The company stated that this concept has attracted interest from prospective partners.

The point here is that the company is actively exploring additional partnerships and potential monetization of royalty streams to bolster its diverse programs. So, the market's reaction to one terminated partnership is a bit overblown because Sangamo's technology continues to sign additional partnerships.

Prion Disease

One of the more intriguing developments is Sangamo's efforts to explore collaborations related to its capsid evolution platform. Sangamo publicized a licensing agreement with Voyager Therapeutics to develop an epigenetic treatment for Prion Disease. Using Voyager's capsid technology, Sangamo expects their zinc finger transcriptional regulators "ZF-TRs" to inhibit expression of the prion protein, thus, restricting the accumulation of toxic prion masses. According to the announcement, Sangamo is responsible for the R&D, regulatory development, and commercialization. In return, Voyager is eligible for fees and royalties. Sangamo plans to submit an IND for Prion Disease in 2025.

If the program is successful, Sangamo would be able to alleviate prion diseases in humans would not only benefit those suffering from such conditions but also bolster their other central nervous system and neurology programs.

A Note on the Prevail Partnership

Back in July, Sangamo announced that they had signed a deal with Prevail Therapeutics, a subsidiary of Eli Lilly (LLY), allowing Prevail to evaluate Sangamo's AAV capsids for potential use in gene therapy for neurological conditions. These capsids have shown promise in efficiently delivering gene therapy constructs to the CNS. Prevail will assess these capsids in lab and animal studies and has the option to obtain licenses for specific neurological targets. Sangamo would receive payments and royalties if Prevail exercised its option and developed products using these capsids, with potential total earnings of up to $415M in fees and milestones, plus up to $775M in commercial milestones. Prevail would handle further development and commercialization.

Like most of Sangamo's recent updates, the Prevail partnership kind of slid under the radar with little response from the market. I believe this is primarily due to Prevail Therapeutics being the named partner, despite it being a subsidiary of Eli Lilly. Whereas, a headline with Eli Lilly being named the partner would most likely generate a more pronounced reaction from the market.

Cash Runway and Financials

As of the reporting period, Sangamo maintained a robust financial position, with approximately $182M in cash and securities. Their commitment to fiscal responsibility is reflected in their non-GAAP operating expenses of approximately $72M for the quarter. Projections indicate non-GAAP operating expenses for 2023 to be in the range of $240M to $260M. With a cash runway of $182M, Sangamo believes they are well-positioned to sustain operations for at least 12 months.

Sangamo's cautious financial approach and current cash reserves may enable them to reach pivotal milestones and potential regulatory filings without the need for substantial dilutive funding. Admittedly, the company will need to find a way to secure additional funding, however, I believe we could see some developmental milestones that could help bolster their cash position to alleviate the threat of a crushing dilutive financing event.

I understand that the market is going to be cautious about the company's deteriorating cash position and relatively short runway… but the company is not limited to just running offerings and taking on debt to get the cash to fund the company. The partnership revenue has helped fund this company in previous years and it appears it will continue to do so for the foreseeable future. However, the market continues to treat the stock as if it is headed for ruin.

Bolstered Conviction

Admittedly, Sangamo has experienced a tough transition over the past couple of years that justifies the market's apprehension about SGMO. Conversely, considering the points above, I can say that Sangamo is forging ahead on multiple fronts, from evolving their pipeline to developing strategic partnerships and maintaining fiscal prudence. Their dedication to bringing innovative genomic medicines to patients with severe genetic diseases remains resolute. It appears that Sangamo remains committed to advancing their current clinical and preclinical programs while actively seeking additional funding avenues and cost reductions. Their primary focus areas encompass Fabry disease, TX200, and the development of a promising their neurology pipeline, AAV capsids, and epigenetic regulation technology.

Sangamo Therapeutics Prioritized Pipeline (Sangamo Therapeutics)

In addition, Pfizer is moving the Hemophilia A program closer to the finish line. For me, I have yet to see any indication that Sangamo won't succeed in unlocking genomic breakthroughs that translate into tangible therapies for patients and providers grappling with severe genetic disorders and that will lead to lucrative business in the coming years.

Downside Risks

Like many speculative biotech firms, SGMO faces downside risks. The primary concern is the intense competition in the gene and cell therapy arena. Sangamo's platform technologies are advanced, but researchers worldwide are striving to develop therapies that have superior performance and are more cost-effective. It's possible that Sangamo will secure regulatory approval and enter the market, but they might face stiff competition in certain areas. The future landscape for gene therapies remains uncertain, with limited room for second or third-place products as next-generation therapies emerge.

Another endemic issue amongst pre-commercial gene and cell therapy companies is funding. Yes, Sangamo does pull in a significant amount of partner revenue throughout the year, but the company's "burn" might outpace their "earn". Therefore, investors should keep an eye on the company's cash position over the next twelve months and be on the lookout for any potential partnership revenue that could extend that cash runway into 2025. Without another supplementary cash infusion, investors need to accept the market is going to remain cautious about SGMO.

Consequently, I have assigned SGMO a conviction level of 2 out of 5. Therefore, SGMO will remain in the Compounding Healthcare "Bio Boom" speculative portfolio for the time being.

My Plan

As for my strategy with SGMO, I've been cautious in my speculative biotech positions throughout 2023, particularly in companies with high operating expenses committed to gene and cell therapies. SGMO falls into this category, but I am making an exception with SGMO due to the company's healthy financial position and potential milestones, which gives me confidence in participating in a speculative stock that is still a considerable way from commercialization.

For now, I'm looking to add to my position as the share price continues to trade under my Buy Target 2 of $2 per share.

Currently, the ticker continues to be harassed by algorithms applying solid selling pressure. However, I am seeing a couple of signs of a potential reversal setup. First, the ticker did break a near-term downtrend ray, after a sharp reversal off the lows. Second, we can see there is a bullish divergence between the share price and the Daily RSI. A break of the long-term downtrend ray and the anchored-VWAP from the July-high should be an adequate signal to click the buy button.

SGMO Daily Chart (Trendspider)

Conversely, I will set sell orders at my Sell Targets to secure profits and secure profits and ensure that my SGMO position is in a 'House Money' state.

Long term, my plan is to hold an SGMO position for no less than three more years, anticipating that the company will successfully advance their programs to become leaders in gene and cell therapies.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Thank you for reading my research on Seeking Alpha. If you want to learn even more about my method and how I discover these investment opportunities, please check out my subscription marketplace service, Compounding Healthcare, and sign up for a free trial.

This article was written by

After years of working in the medical field, I have developed a passion for biotech and lifesaving therapies. Now, I am a full-time healthcare investor who is in search of the next breakthrough therapy, device, or pharmaceutical. My trade focus is around catalysts and potential acquisitions. In addition, I provide a marketplace service, Compounding Healthcare through Seeking Alpha.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SGMO. LLY, PFE, GILD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)