Cohu: Business Continues To Execute Well And Should See Growth Recovery In FY24/25

Summary

- I upgraded my rating from hold to buy due to a 2x decrease in valuation and clear visibility to FY24/25 growth, anticipating accelerating growth over the next 2 years.

- COHU's 2Q23 results showed a 22% drop in revenue but included positive factors like non-GAAP gross margin expansion to 47.8% and non-GAAP EPS exceeding expectations at $0.48.

- Despite challenges in certain segments like Automotive and Industrial, COHU is expected to exhibit steady growth over the next two years, mirroring historical cycles.

da-kuk

Summary

Readers may find my previous coverage via this link. My previous rating was a hold, as I believed Cohu (NASDAQ:COHU) valuation was cheap. However, valuation has since fallen by around 2x to the current levels. Along with the latest 2Q23 data which provided me with clear visibility to FY24/25 growth, I believe the valuation is relatively cheaper today. Hence, I am upgrading to a buy rating as I expect COHU to see accelerating growth over the next 2 years, just as it has performed in past cycles.

Financials/Valuation

The 22% drop in revenue that COHU reported for 2Q23 to $169 million was in line with expectations. In it, Systems revenue was down 33% to $88 million, while recurring revenue of $81 million was down 5%. The company's non-GAAP gross margin increased by 130bps, reaching 47.8%. Adjusted EBITDA margin came in at 19.7%, or $33.3 million. At $0.48, non-GAAP EPS was 9 percent higher than expected.

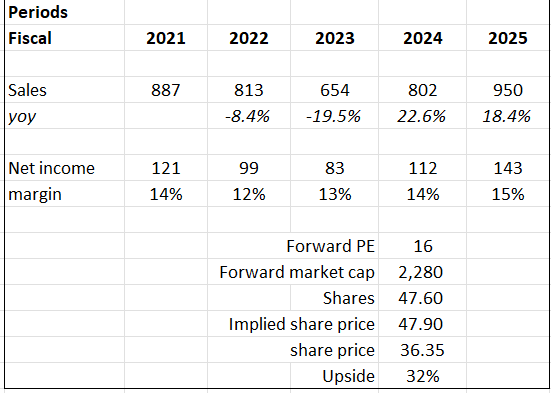

Based on author's own math

Based on my view of the business, COHU should be able to grow at a steady pace over the next 2 years as the upcycle starts. Based on historical cycles, I expect COHU to see a similar rate of 40+% growth from the trough in FY23. This strong growth should come together with increased margins as recurring revenue becomes a larger part of the mix. Gross margin expansion, as evident in the performance so far, should help with net margin expansion as well. Unlike previously, where it was trading at 18x forward PE (above the standard deviation range), the valuation is not relatively cheaper at 16x. Also unlike my previous post in July, with the 2Q23 updated data, I see a clearer path to growth acceleration in FY24. Hence, I believe the market will continue to value at the current 16x multiple in the near term.

Comments

Despite the 18% drop following earnings, I still think the 2Q23 results are positive and warrant a buy. The headline numbers were negative (when compared to the previous year), but I do not believe they accurately represent the situation. Previously, I discussed COHU's strong demand, noting that the company's recurring revenue has grown for four consecutive quarters. Despite the difficult environment in the semiconductor industry, 2Q23 still managed to grow by 6% quarter over quarter. The recurring business also continues to represent a bigger part of the revenue mix (from 35% in 2Q21 to 48% in 2Q23). Increases in the proportion of recurring revenue streams contribute to financial stability, a stronger free cash flow generation, and a higher rate of return to shareholders. In addition, demand-driven sequential order growth is anticipated as businesses anticipate a pick-up in spending from clients with ties to the Automotive and Industrial sectors. Most importantly, as I mentioned in a previous post, COHU delivered a non-GAAP gross margin of 47.8% in 2Q23, 80bps above guidance despite the uncertain market conditions.

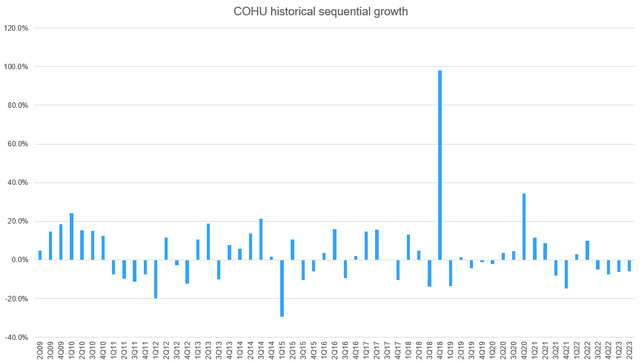

Looking ahead, I expect the recovery in FY24 (or FY25) to be a strong one, as COHU is now in the 4th quarter of sequential negative growth. Based on previous cycles, COHU has only seen such growth rates in 2011 and 1Q23, where thereafter revenue soared from a low of $200 million to $333 million in FY14, an almost 50% growth rate. I expect this to happen in the next two years.

Accordingly, I believe COHU is currently executing very well, and the company may have reached a bottom. However, I believe it is also fair to say that there are growing warning signs that need to be watched. Despite my optimism regarding the recovery of the Automotive and Industrial markets, the combined sales from these segments fell by 9% in the 2Q23 (after falling by 12% in the first quarter) to $52 million. Customers in the Mobility segment also continue to hold back on their spending, with 2Q23 Mobility revenue falling 43% sequentially and 71% year-over-year. It's possible that this extreme weakness signals a bottoming, but given the low tester utilization rates, it's hard to say when or by how much the cycle will recover.

Conclusion

COHU continues to exhibit robust performance, and I upgraded my rating to buy with optimism for the next two years. Despite a 22% drop in 2Q23 revenue, the company's non-GAAP gross margin increased by 130bps to reach 47.8%, and adjusted EBITDA margin stood at 19.7%. Non-GAAP EPS exceeded expectations at $0.48, reflecting resilience in challenging market conditions. I anticipate steady growth over the next two years as the industry upcycle gains momentum, mirroring historical cycles with 40+% growth rates. The expanding recurring revenue segment and improving gross margins contribute to this positive outlook. However, caution is warranted, as some segments, such as Automotive and Industrial, have faced declines. COHU's performance is closely linked to tester utilization rates, and the timing and extent of recovery in these segments remain uncertain.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.