DraftKings Is Priced For Perfection

Summary

- DraftKings stock has been a big winner in 2023, but the rally may be overdone.

- The company has delivered strong revenue growth and market share gains, all while executing on margin expansion.

- I discuss the stock valuation using management's long-term targets and aggressive underlying assumptions.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Scott Olson

DraftKings (NASDAQ:DKNG) has been a big winner in 2023, as the stock benefited from a return of growth investing appetite in spite of persistently higher interest rates. DKNG has delivered strong top-line growth coupled with market share gains this year and continues to look like a top tier online gambling company. Management is guiding for "meaningfully" positive adjusted EBITDA generation next year and just delivered positive adjusted EBITDA in the latest quarter. Despite the solid results, I am of the view that this rally has gone too far. The stock appears to be pricing in perfect execution, but the current setup is arguably one of significant execution risk given ongoing GAAP losses and the imminent entrance of a new sports betting competitor. That said, some investors may still be drawn to DKNG as it is legitimately an owner-operator company, with the CEO having plenty of "skin in the game."

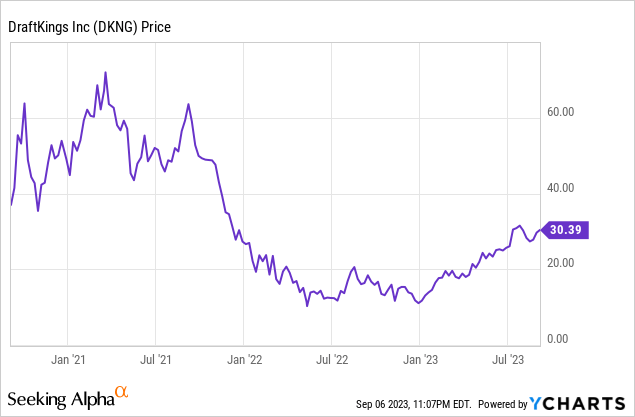

DKNG Stock Price

DKNG was one of the most hyped SPACs amidst the pandemic, and saw its stock crash to the low double-digits during the tech crash. The stock is now up around 200% higher from those lows.

I last covered DKNG in May of 2021 where I explained why the stock was too expensive even incorporating the strong growth outlook. The stock has since fallen 36%, but I remain neutral on the valuation as the risk-reward proposition is not looking so favorable for prospective investors.

DKNG Stock Key Metrics

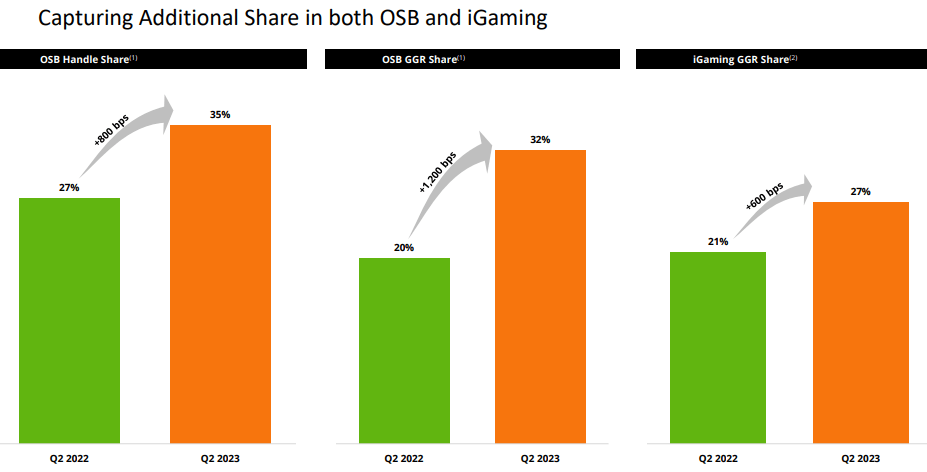

In its most recent quarter, DKNG delivered 88% YoY revenue growth to $875 million and $73 million of positive adjusted EBITDA, up $191 million YoY. DKNG saw strong market share gains in both online sports betting and iGaming.

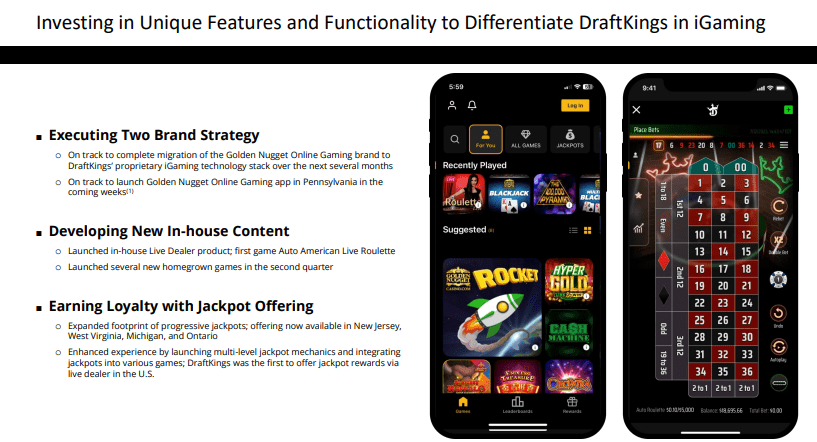

2023 Q2 Presentation

It has become clear that DKNG has been able to differentiate its product offerings through innovation and ease of gameplay - investors may have previously feared about the risks of commoditization. DKNG may face another test in this regard in the near future with Penn Gaming (PENN) striking a deal with Disney (DIS) to license the ESPN name for online sports betting.

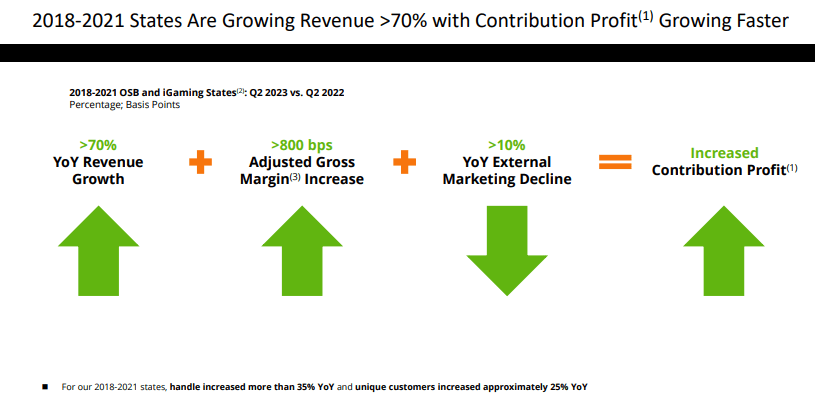

DKNG noted that it was seeing sustained strong growth from states that came online in 2018 to 2021 along with reduced external marketing spend, leading to substantially improved contribution margins.

2023 Q2 Presentation

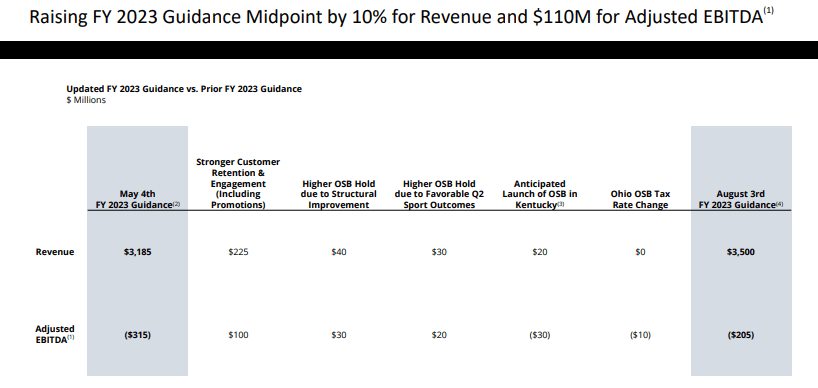

The strong results led DKNG to raise full-year guidance for both revenue and adjusted EBITDA, as management now expects $3.5 billion in full-year revenue and $205 million in adjusted EBITDA losses.

2023 Q2 Presentation

DKNG ended the quarter with $1.1 billion of cash versus $1.3 billion of convertible notes. Management expects to end the year with over $1 billion of cash and to generate "meaningfully positive" adjusted EBITDA in 2024. Like many other tech companies, DKNG has done a tremendous job in pivoting towards profitability amidst the rising interest rate environment.

On the conference call, management noted that the targeted September launch of Kentucky's Horse Racing Commission is expected to boost revenues by $20 million and negatively impact adjusted EBITDA by $30 million - DKNG typically invests aggressively in new markets in order to win market share. DKNG expects Ohio's increased tax rate from 10% to 20% to lead to $10 million of additional costs this year.

Is DKNG Stock A Buy, Sell, or Hold?

DKNG represents a pure-play investment on the growth of online gambling. DKNG is like the "Amazon of casinos."

2022 Investor Day

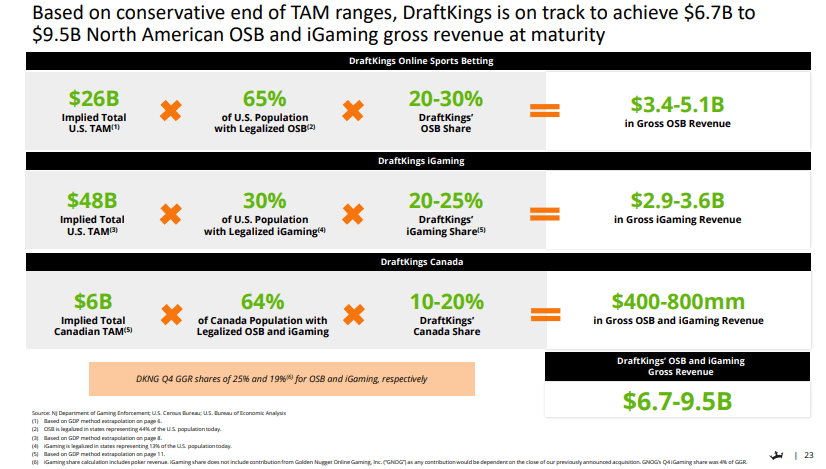

At its 2022 Investor Day, management outlined a path to between $6.7 billion and $9.5 billion in revenue at "maturity."

2022 Investor Day

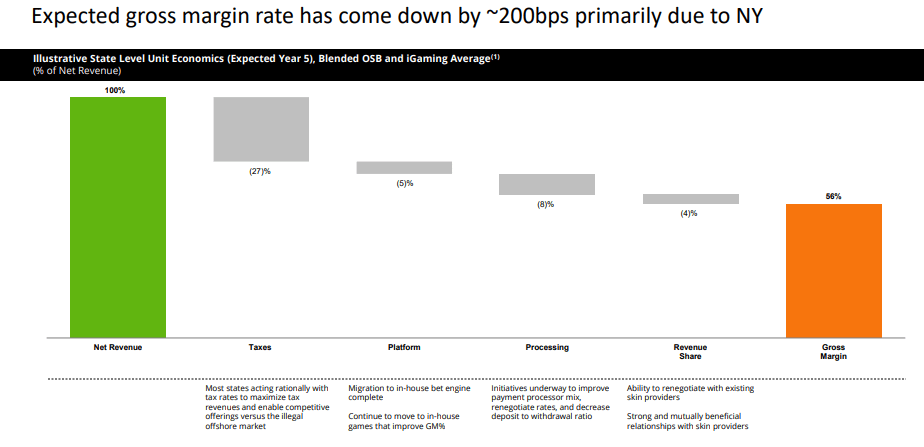

DKNG expects gross margins to rise from the 43% level today to 56% at maturity. Local state governments charge a large special tax rate due to gambling being a "sinful" activity. I note that this tax is in addition to any corporate income tax payable to the federal government.

2022 Investor Day

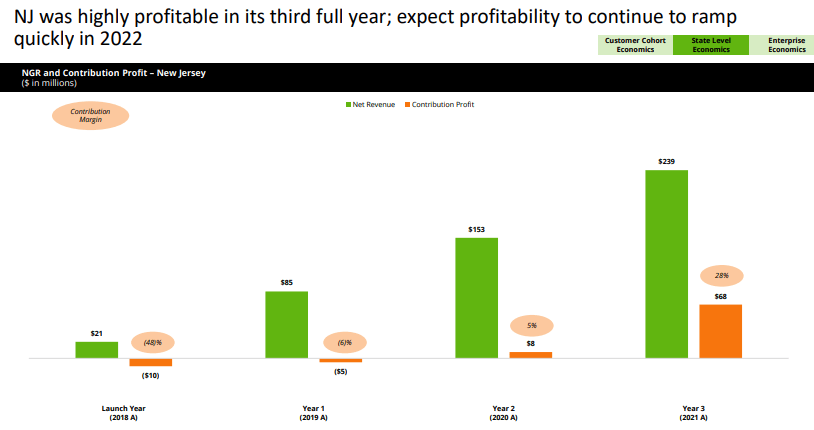

DKNG notes that while contribution margins are poor in the early years of new markets, they tend to improve rapidly as the company can spend less and less on external marketing.

2022 Investor Day

DKNG expects to generate a 31% adjusted EBITDA margin at maturity as marketing spend levels and the company achieves operating leverage.

2022 Investor Day

On the conference call, management stated that they do not see "material changes to either of those targets." Consensus estimates call for DKNG to hit the high end of that long-term guidance in 2029.

Seeking Alpha

That implies around $3 billion in 2029 adjusted EBITDA. Consensus estimates have DKNG earning a 14.5% net margin in 2029.

Seeking Alpha

While it is possible that DKNG may be able to convert more than this implied 50% of adjusted EBITDA into net income at some point, consensus estimates are arguably very reasonable, if not optimistic. We can see below that adjusted EBITDA adds back items such as depreciation & amortization, stock-based compensation, and income taxes.

2023 Q2 Presentation

Being a digital-first company, actual CapEx outlay tends to be less than depreciation & amortization, but it is not immaterial. DKNG spent $96 million on CapEx and software amortization in 2022 or 4.3% of revenue, and is guiding for $120 million this year, or 3.4% of revenue. Stock-based compensation made up more than the adjusted EBITDA generated in the latest quarter. Perhaps that eventually levels off to around 25% of adjusted EBITDA. After then accounting for income taxes and future interest expenses, we can see that a 50% conversion to net income isn't exactly a lowball guess.

What kind of earnings multiple should the stock trade at? Perhaps the stock deserves to trade at a premium to the 6x multiple at PENN, as online gambling is arguably the disruptor. But online gambling may be more susceptible to price competition than experience-based land casinos, and online gambling is a highly competitive space with competitors like Fanduel, BetMGM (MGM), and the aforementioned ESPN-PENN tie-up. Even so, let's assume a 2x price to earnings growth ratio ('PEG ratio'). Based on 10% growth exiting 2029, DKNG might trade at around 20x earnings. That implies a stock price of $59 per share in 2029, or around 11% annual upside potential over the next 6.3 years. At a 25x earnings multiple the stock might trade at $74 per share, offering 14.5% annual upside potential. DKNG is not even adjusted EBITDA profitable on a full-year basis, but the stock is offering arguably meager upside potential even assuming a rich exit multiple. Some readers may argue that with the market trading near all-time highs, projected returns for the broader market might not be as high as in the past. I have some doubts regarding such views, but even so I think that it would be a mistake to lower one's return hurdles based on such a view, especially when it comes to higher risk names like DKNG. Incidentally, a stock price of around $17.50 increases the potential annual upside potential to over 20% (assuming a $59 stock price in 2029).

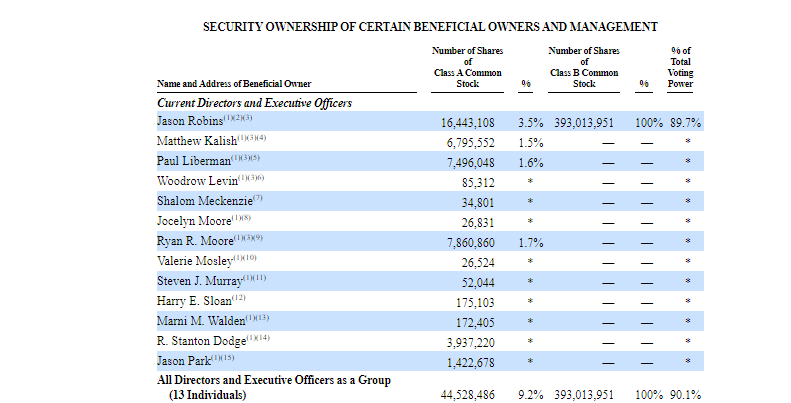

I should point out that DKNG is an owner-operator company, as its founders and management own a large stake in the business. CEO and co-founder Jason Robins owns around $500 million worth of stock. I note that the 393 million Class B shares owned by CEO Robins give him voting control of the company, but carry no economic rights.

2023 DEF 14A

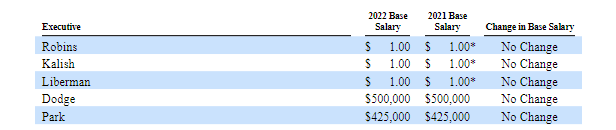

CEO Robins and two other executives have elected to receive a $1 base salary through 2023.

2023 DEF 14A

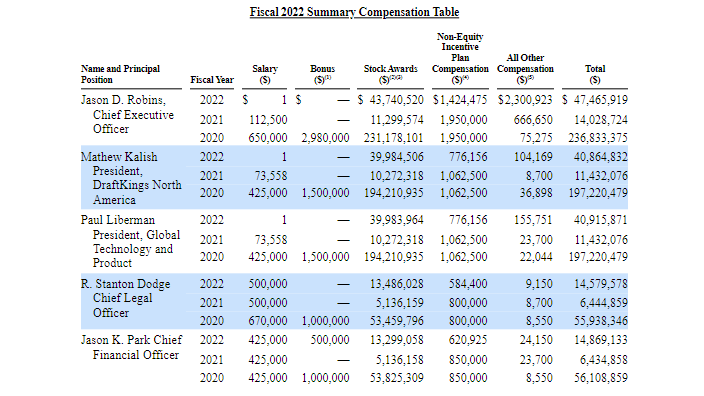

I mustn't omit that these executives nonetheless were still generously compensated with stock awards over the past 2 years.

2023 DEF 14A

I wouldn't be surprised to see DKNG trade up to very bubbly valuations, but the current stock price requires aggressive long-term assumptions in order to justify an insufficient potential return. I will continue to monitor DKNG as it is clearly a top tier operator in the online gambling sector, but must exercise discipline in waiting for better valuations.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.