Marine Products: Strong Financial Metrics, Moderate Revenue Growth

Summary

- Marine Products is a strong candidate for a long-term position due to its strong financial metrics and moderate revenue growth.

- The company's revenue growth is expected to be maintained as backorders from pandemic-related supply chain constraints are filled.

- Risks include potential sales dips, adverse weather conditions, and potential negative impact on margins from new boat models.

Giancarlo Restuccia

Investment Thesis

I wanted to take a look at a company that one of my friends suggested, that is Marine Products (NYSE:MPX). The company has traded down a little bit since the last earnings report. I wanted to take a look at the company’s financial health to see if this slight pullback is a good time to jump in. The company has really strong financial metrics and with a moderate revenue growth model, the company seems to be a strong candidate for a long-term position, therefore, I rate MPX a buy.

Briefly on the company

The company manufactures, designs, and distributes luxury pleasure boats, fishing boats, and sports deck boats in the US and internationally. As simple as it gets.

Briefly on Outlook

I believe the company will be able to maintain such revenue growth because of the filling of backorders from pandemic-related supply chain constraints. The company managed to grow its revenues by around 28% in FY22, which is well above the expected growth through 2028 of 5.1% for leisure boats. The pandemic seemed to have spurred boat sales because in ’21 first-time boat buyers accounted for around a third of total boat sales. It is safe to say the demand is still there and stronger than ever because of the lockdowns we experienced. These may normalize in the near future but will still be strong.

The company’s margins may improve further with the new 2024 boat models coming out soon, which are supposedly more efficient and higher quality than ever before, according to the transcript.

Risks

Sales may dip once again because of some unforeseen events like the pandemic. The boom in sales of boats that we saw after 2020 will normalize, which may turn into lower revenues, which will affect the company tremendously in the short term.

We could have some bad weather coming up in the future and that is not going to drive a lot of demand for outdoor leisure like going out to the sea.

Margins may be affected negatively if the next models are much more expensive to produce or have some faulty mechanisms and would require a recall of the affected models. This will result in a lower share price and damage the company’s reputation.

Since the company is relatively unknown in the investing world, no matter how well the financials of the company look, the share price may never reflect it because it is not covered by many analysts on Wall Street.

Financials

As of Q2 ’23, the company had around $66m in cash and zero debt on its books. That is a fantastic position to be in. This allows the company to be more flexible in how it wants to expand its reach globally and be a little more aggressive in growth too without any interest burden weighing the company down. The company wouldn’t have any issues if we saw some more economic headwinds.

The company also has a very strong current ratio, which is a bit too strong in my opinion as it is becoming a little too high. The good thing is that it can easily cover its short-term obligations, but the bad is that it may not be using its cash very efficiently and is hoarding it for no reason. I would rather see the company be more aggressive in expanding its footprint globally. I would like to see a current ratio of 1.5-2.0, which is what I would consider an efficient ratio.

Current Ratio (Author)

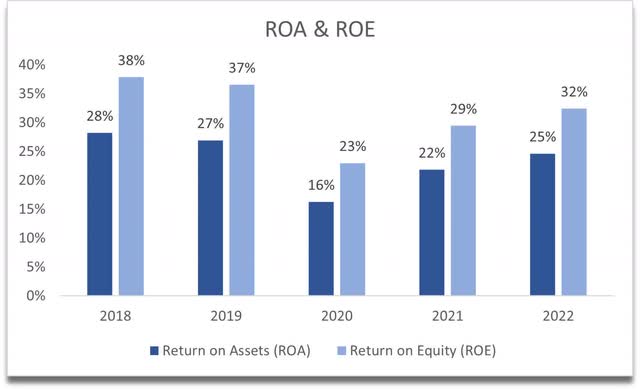

Speaking of efficiency, the company's ROA and ROE have been phenomenal and well above my minimums of 5% for ROA and 10% for ROE. This tells me that the company is very efficient at using its assets and shareholder capital, thus creating value.

ROA and ROE (Author)

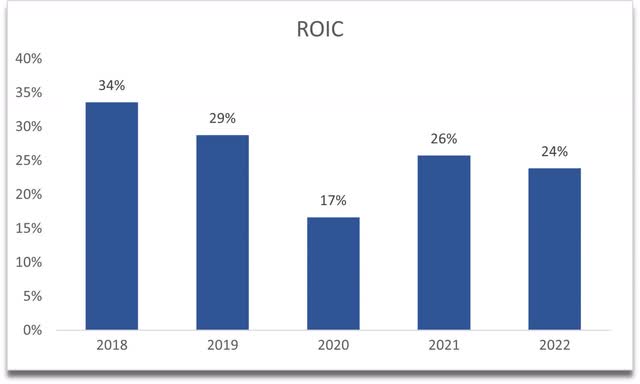

Another impressive and very important metric to me when judging a company's competitive advantage and whether it has a strong moat is the return on invested capital. I am looking for at least 10% from investments, and MPX’s historical average has been more than double my minimum, which is really impressive. This tells me that the company has a competitive edge and a really strong moat. For such a high ROIC, I would be willing to pay a premium on shares. A slight downtrend seems to be forming; however, it is still very high.

ROIC (Author)

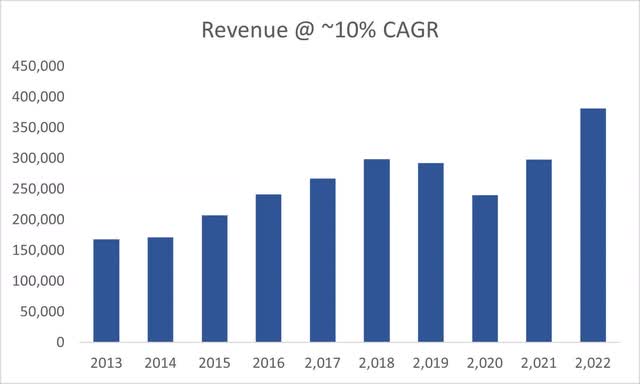

The company's revenue growth has been quite steady over the last decade, with a slight hiccup during the pandemic year, which was a black swan event. It has gone up around 10% CAGR over the last decade, which is decent growth in such a niche market in my opinion.

Revenue growth (Author)

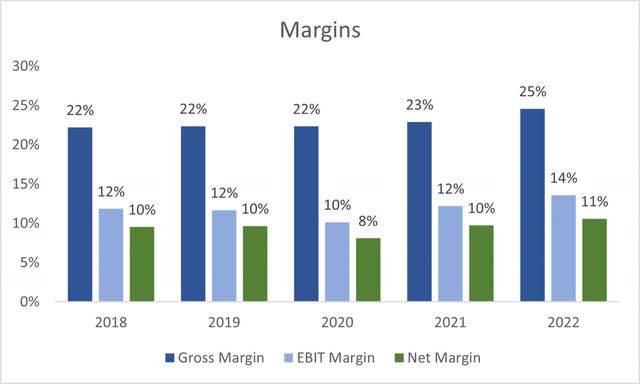

In terms of margins, these have been quite steady over the last while, with slight improvements in FY22, which is a good sign. Very nice net margins overall. I believe the company will be able to keep these margins going forward or even improve them a little further.

Margins (Author)

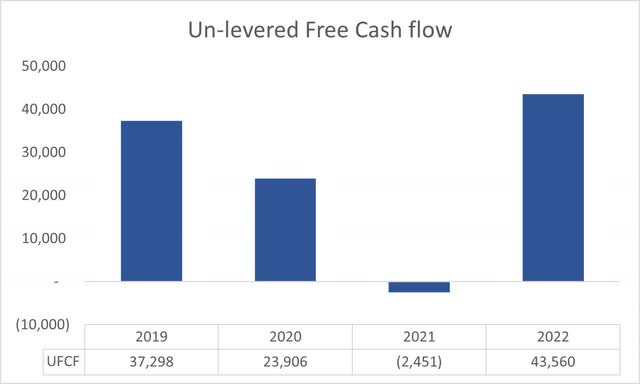

The company's unlevered free cash flow or UFCF has been very strong in the last 5 years, except for one, which is also very promising, and by the looks of it, it may continue to achieve such numbers going forward.

UFCF (Author)

Overall, I am very impressed by the company's financials. The company seems to have a good competitive advantage, a strong moat, is very liquid, and is in no financial risk even if we see some headwinds in the future, which I doubt. So, let’s look at what I would be willing to pay for such a company in terms of its share price.

Valuation

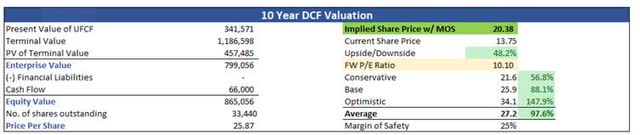

So, the company’s revenues grew at around 10% on average over the previous decade. I’ll be slightly more conservative here, so for my base case, I went with around 7% CAGR over the next decade. For my optimistic case, I went with around 11% CAGR, while for the conservative case, I went with around 5% CAGR to get a range of possible outcomes.

In terms of margins, I decided to improve these slightly. Gross margins will improve by 200 bps or 2% in the next decade while keeping operating margins as of FY22. This will bring net margins from around 11% in FY22 to around 12% by FY32, which I think is quite conservative in my opinion.

Just to give myself even more breathing room, I decided to add a 25% margin of safety to the final calculation. With all of that in place, Marine Products Corp.’s intrinsic value calculation suggests the company is trading at a 44% discount to its fair price.

Intrinsic Value (Author)

Closing Comments

The company seems to be running very smoothly and the management is doing a commendable job at running it. It seems that even with my quite conservative assumptions, the share price is very cheap and trading at an FW P/E ratio of about 10 which is cheap in my opinion. I will be looking at opening a position very soon here and see where it leads me over the next while.

I think the potential reward outweighs the risks, mainly because the company has been very profitable over the years with very high profitability and efficiency metrics. However, as I said earlier, the share price may not ever reflect the potential that the company has because it is not very well known with very low daily trading volume, which may bring a lot of volatility, and if you are an investor who isn’t patient or cannot stomach large fluctuations, this may not be an investment for you.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MPX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.