Oatly: Leaves A Bad Taste, With Pain Ahead

Summary

- Oatly has grown revenue at a CAGR of 46% during the last few years, owing to the increased adoption of non-dairy products. Demand for these products will continue to grow.

- Oatly has executed terribly on its strategy (excessive spending, growth at all costs) and is now in the process of transformation.

- We expect major issues with this, as competition continues to increase and inflationary pressures drive down GPM%. Oatly currently has an FCF margin of (50)% and so will likely raise.

- Beneath the various issues is a solid business but to invest today, investors must receive a price that adequately prices in risk. We do not see this.

Scott Olson/Getty Images News

Investment thesis

Our current investment thesis is:

- Oatly has a strong range of products in a high-growth industry but is facing increased competition and demand below the levels expected.

- The company is bloated with costs and burning cash at an alarming rate. We believe Management’s transformational exercise is correct but even post-delivery, the company has a difficult time ahead to reach sustainable profitability.

- Oatly is trading at >1x revenue, which is excess in our view despite the >90% decline in share price, owing to the substantial execution risk associated with creating a sustainable business model.

Company description

Oatly (NASDAQ:OTLY) is a Sweden-based food company that specializes in plant-based dairy alternatives, with a primary focus on oat milk. Founded in the early 1990s, Oatly has gained international recognition for its innovative and sustainable approach to food production.

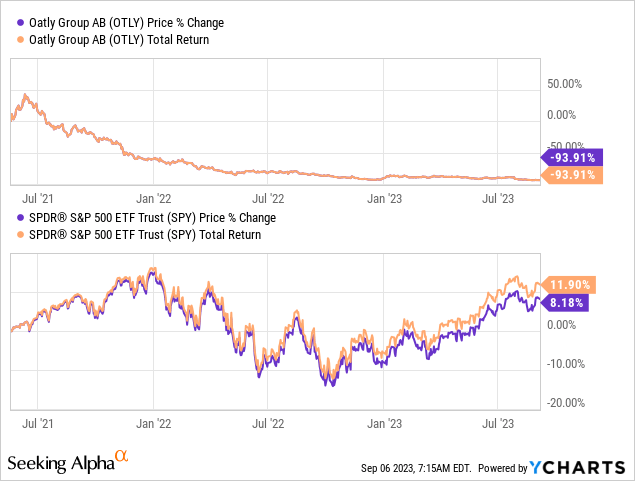

Share price

Oatly’s share price performance has been disastrous, with the stock losing over 90% of its value in a short period of time. This is a reflection of a change in investor sentiment, as growth and margin improvement expectations have shrunk.

Financial analysis

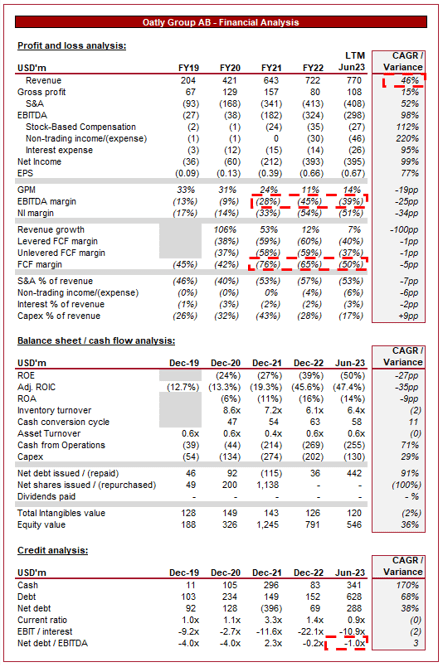

Oatly financials (Capital IQ)

Presented above are Oatly's financial results.

Revenue & Commercial Factors

Oatly’s revenue growth in the last few years has been strong, with a CAGR of 46% into the LTM period. This said, growth has materially slowed, with only 12% in FY22 and <20% growth in the most recent quarters.

Business Model

Oatly's core business centers around plant-based, dairy-free products. This focus aligns with the growing consumer trend toward plant-based diets due to health, environmental, and ethical considerations. The company’s objective is to be a specialist in this area and become a market leader (which it has), allowing the company to capture a significant portion of this growing market. Specialization is beneficial as it allows Oatly to communicate its expertise to consumers and create a brand synonymous with the segment. The issue, however, is that the company requires the market to be large enough to accommodate attractive, sustainable profits.

This industry has scope to be substantial, with Management estimating its current size to be $23bn, with the global dairy retail industry being $631bn.

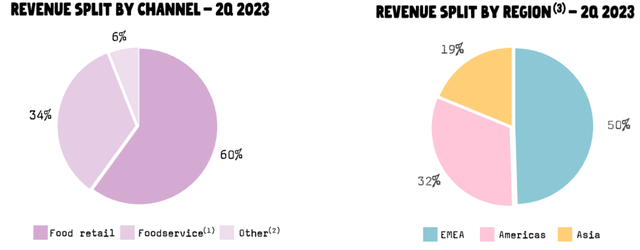

Oatly’s revenue is primarily in the Food Retail segment, followed by Foodservice, both of which provide consistent demand for its products. The company is truly global, with a good split between regions, weighted mainly toward EMEA.

Oatly employs a strategic distribution approach, forming partnerships with coffee shops, cafes, and restaurants to offer their oat milk as an alternative to dairy in beverages like lattes and cappuccinos. This strategy has fueled brand visibility and adoption, while acting as a proof of concept for its traditional products (milk alternative). This has been extremely successful, with new customers including McDonald's (MCD), Starbucks (SBUX), and Qatar Airways.

Oatly positions its products as healthy alternatives to traditional dairy, emphasizing lower saturated fat content and the absence of lactose and cholesterol. This appeals to health-conscious consumers, as well as those who would not like to consume dairy.

Oatly pioneered the development of oat milk as a milk alternative. Their product line has expanded to include various dairy alternatives like oat-based yogurt, ice cream, and creamers. These products cater to consumers seeking dairy-free alternatives that taste and function like traditional dairy products. The expansion of products is critical to developing a “market” for dairy alternatives, as consumers who transition will ideally seek to replace dairy-related products they consume regularly, such as yogurts.

Oatly has taken a unique approach to marketing as a means of differentiating itself. Its playful and irreverent marketing campaigns have set it apart in the crowded plant-based food market, appealing to a younger, socially aware demographic.

Oatly has successfully expanded its presence beyond Sweden to international markets, particularly in the United States. This has allowed the business to expand its total addressable market, utilizing its brand and product expertise to capture similar markets globally.

From this attractive business model, what has gone wrong? We see the following as key issues:

- The company has focused far too much on growth and not enough on developing a sustainable financial model. The industry is still in development (meaning convincing consumers, bringing prices in line with milk, etc) so a more nuanced, long-term approach should have been taken.

- S&A spending has run away from Management and the response has been poor. There is no reason why a company losing the amount of cash it is continues to spend over 50% of revenue on S&A.

- Inflationary pressure has wreaked havoc on the company’s finances, contributing to a rapid deterioration in GPM%.

- Competition has been underestimated, with Oatly’s position materially challenged, contributing to downward pressure on prices. There is now a range of products available to consumers, many of which are low-cost private labels. Given that diary-free milk is priced at a noticeable premium to traditional milk, these low-cost options are growing rapidly.

- Economic conditions are weighing heavily on the business given the premium pricing on the milk alternatives. Consumers are forgoing or reducing purchases where possible.

Management’s strategic response is the following:

- “Balance performance and purpose” - Oatly’s expansion has been rapid but arguably beyond a sustainable level. Slowing down its desire to be a dairy-free super-business is needed.

- “Must have a stronger business before we have a significantly bigger business” - This involves operational improvement to create the foundations for a solid business, reallocating resources from marketing and other areas. Management has stabilized its supply chain in the Americas (YAYA Partnership), initiated an improvement plan in Asia, and streamlined processes in EMEA.

- “Disciplined resource allocation driven by rigorous fact-based analyses” - Disciplined resource allocation is as simple as cutting costs where possible. Management is reducing management layers, consolidating co-packers, and reducing spending where possible.

- “Increased regional accountability and aligned incentives” - Runaway spending has been a major issue so bringing regional teams under a unified approach is critical. This involves aligning with the company’s current strategy, which is transitioning to a sustainable business model.

We believe the current strategic direction of the business is correct and will significantly improve the business, even if growth will slow as a response. This said, we are hesitant to suggest this will be sufficient to right the company. Oatly is losing money at a rapid rate from its operations, and even if this is improved, the subsequent improvements required appear far away.

Competitive Positioning

We consider the following to be Oatly’s competitive advantages / attractive traits:

- Brand Differentiation - Oatly's unique and playful brand image has helped it stand out in a competitive market and appeal to a younger, socially conscious consumer base.

- Innovation - Oatly's pioneering of oat milk as a dairy alternative positioned them as a leader in the segment. Continuous innovation in product development has kept the company ahead thus far and is critical to maintaining this trajectory. Many new entrants are investing heavily in alternatives, such as Alpro and Jord, with many other alternatives (Almond, Soya, favored, etc.).

- Plant-Based Trend - The rising trend toward plant-based diets, driven by health, sustainability, and ethical concerns, appears to be sustainable.

- Partnerships - Collaborations with coffee shops and restaurants have expanded their distribution network and increased product visibility.

Margins

Oatly’s margins are bad. The company has an EBITDA-M of (39)%, primarily due to its completely unbalanced operations. Despite operating with a <35% GPM%, Management has invested heavily in S&A, bloating the business.

The company is targeting substantial savings in the coming years, with costs cut across all geographies. An $85m reduction represents 21% of its current S&A spending and a 29% improvement in EBITDA. This is good progress but still leaves the business burning cash.

The truth is, we cannot see a clear route to sustainable profitability. Management believes positive adj. EBITDA will be achieved in FY24F, which feels optimistic but also based on the maximum extraction of value.

Balance sheet & Cash Flows

Oatly is burning cash at an impressive level, it has a FCF yield of (50)%, one of the largest levels I have ever seen. Despite this, the company is in a negative ND/EBITDA position, thanks to shareholders. With the rate at which cash is being burned, shareholders should expect to finance this business going forward, at least in a single additional tranche to sure up its balance.

Outlook

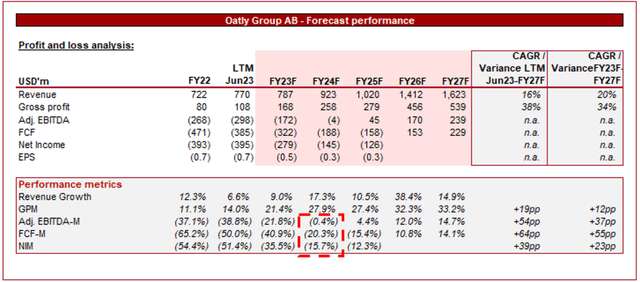

Presented above is Wall Street's consensus view on the coming 5 years.

Analysts are forecasting an improvement in growth, with a CAGR of 20% into FY27F. Alongside this, aggressive margin improvement, with EBITDA profitability in FY25F and a 15% EBITDA-M in FY27F.

The growth assessment appears excessive in our view, as growth in this market will be partnered with a range of new and existing brands vying for market share. Analysts, on the other hand, likely believe Oatly’s strong market share in conjunction with high industry growth will propel the company forward. We suspect 8-13% is the realistic top-end achievable.

Further, the margin development appears more reasonable into FY25F, although we do not think the subsequent improvement is reasonable. This will only play out if the top-line revenue can be maintained, which we disagree with. An EBITDA-M <10% and breakeven FCF would be our target in FY25F-FY27F.

Valuation

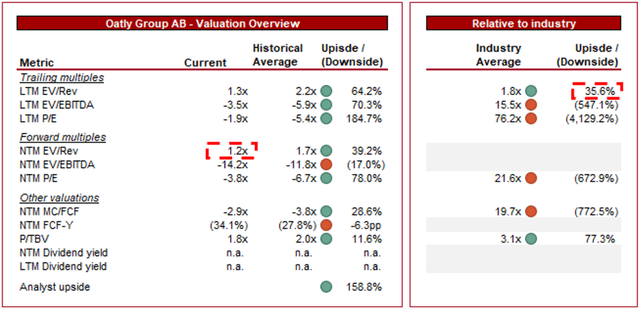

Oatly is currently trading at 1.3x LTM Revenue and 1.2x NTM Revenue. This is a discount to its historical average.

A discount to its short historical average is warranted given the deterioration in financial performance. Further, a discount to its peer group (Packaged foods and meats) is equally warranted, although the current level appears unreasonable.

Our target for a loss-making business with an uncertain profitability trajectory is <1x revenue. This essentially prices the company for an extended period of loss-making. Oatly’s issues are compounded due to the amount of cash it is burning on a quarterly basis. For this reason, we would suggest even deeper than 1x revenue.

With a depressed share price, there is the potential for a takeover, if a larger consolidator believes they can manufacture products economically, while gaining a valuable brand at a cut price. We consider this unlikely.

Analysts disagree, with a target upside in excess of 150% (Source: Capital IQ). This appears to price in the impressive trajectory of the business forecast above with no execution risk. We believe the above can be achieved, certainly, but the risk of it is substantial. The valuation must be discounted to reflect this. The inherent risk to our thesis is how Wall St. analysts look at this company, which is starkly different from ourselves.

Final thoughts

Oatly was likely “too early”. The company developed a fantastic range of products and has marketed and grown its operations aggressively to tap into what it expects to be a highly lucrative industry. Although we concur with its view on the industry, the approach has been all wrong. Dairy-free adoption still requires support by convincing consumers, so growth is not unwaveringly high. Further, The company’s moat is not as wide as Management believes, with increased competition eroding its financial position.

A reset is ongoing, which has the potential to bring the company back on track. This said, we do not believe the job will become any easier. With the company losing cash every quarter, we do not believe a valuation in excess of 1x revenue is appropriate.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.