Reaching For Yield Is Very Dumb, But It's Human

Summary

- Warren Buffett's long-term investment strategy has helped him achieve a 4,200,000% return on Berkshire Hathaway's Class A shares.

- The REIT sector has faced challenges, but there are reasons to be optimistic, including major acquisitions, narrowing spreads between public and private real estate markets, and strong REIT balance sheets.

- Investors should carefully consider their opinions and not be swayed by negativity or unchecked positivity when evaluating REITs like Global Net Lease, EPR Properties, and AGNC Investment Corp.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

DNY59/iStock via Getty Images

Being human.

It’s quite the experience, isn’t it?

Animals work with limited data, taking in the sounds, smells, sights, and other sensations around them. We humans, however, also have moral compasses and advanced mental capacity.

The former helps us determine right from wrong; the latter helps us determine wise from foolish. With “helps” being the keyword.

Neither benefit is foolproof since we don’t just process facts to reach our conclusions. A few days ago, one of my readers asked me to comment on "high yield" stocks and instead of commenting (in the article) I decided to write an article.

Before I get into the weeds (on yield chasing) and my reaction – which, incidentally, also is an opinion that will ultimately be proven right or wrong – I do want to acknowledge that all this was from Aug. 21. And I’ve published multiple articles since then despite my pledge to write more about it immediately.

So, my apologies about not following through. I hope the following information more than makes up for that lapse.

Billions of Reasons to Carefully Consider the Facts and Your Opinions

On Feb. 24, 2020, just as the markets really started crashing, Warren Buffett told CNBC:

“People… think an investment in a stock is different than an investment in a business or an investment in a farm or an investment in an apartment house. But it isn’t. If you get your money’s worth in terms of future earning power over the next 10 or 20 or 30 years, you’re going to make a good investment.”

In case you didn’t know, Warren Buffett is a multi-billionaire and one of the world’s top 10 richest men. His commitment to long-term profits over short-term feelings has helped him net what Motley Fool noted earlier this summer is “a greater than 4,200,000% return on his company’s Class A shares (BRK.A).”

And that includes how badly Berkshire Hathaway lost out from its airline holdings going into the shutdowns. His losses were so bad – down some $20 billion by that September – that CCN published an article that month partially titled “Warren Buffett Is 2020’s Biggest Money Loser…”

That was a fact. The second part of it was an opinion: “… but don’t count him out yet.”

An opinion well-grounded in facts considering how Buffett’s net worth went on to increase from $82.5 billion in 2019 to $106 billion today. That kind of accumulation tends to happen when you buy and hold well-managed, well-placed businesses for the long term.

And when you make sure a good number of those businesses offer dividends – like REITs do – it becomes even more likely.

Buffett knows that even when a stock price drops, he still gets paid just as long as he doesn’t panic and sells his shares. Which, of course, he doesn’t.

Because he’s Warren Buffett.

He carefully considers every move before he makes it.

There’s So Much Underappreciated Strength in the REIT Sector, But…

I hope you carefully consider too before you sell all your REITs.

That was one big takeaway from an Aug. 29 piece by WealthManagement.com.

It acknowledged how “REIT share prices have taken a beating over the past 18 months.”

That’s a fact.

So is this: That “the commercial real estate industry at large is grappling with higher interest rates and declining valuations.”

Meanwhile, using Cohen & Steers data to theorize that REIT prices could be poised for a bounce back?

That these stocks "may be among the first beneficiaries as the real estate cycle moves from recession to recovery?"

Those are opinions.

But, like Buffett’s unperturbed belief three years ago, there are very good reason to hold onto that optimistic assessment, including:

- Major acquisitions made by publicly-traded REITs this year compared to 2022’s increased dispositions.

- The narrowing spread between public and private commercial real estate markets.

- The current state of REIT balance sheets.

To elaborate on that last point, WealthManagement.com writes:

“‘Leverage ratios at, at 34%, are still low,’ Edward F. Pierzak, Nareit senior vice president of research, told WMRE earlier this year. ‘And the type of debt they have is predominantly fixed-rate debt with an average weighted term to maturity of about seven years. The weighted average cost of capital is now at 3.7%.”

So while rate increases can affect REITs, they’re currently working with “attractive debt” and “are well positioned to handle what 2023 has to hand out.'" In which case, it’s opinion more than fact depressing so many REIT share prices these days.

Then again, there are some that deserve their current prices. Which takes me back to carefully considering every move.

Don’t get caught up in opinion-based negativity.

But be just as wary of unchecked positivity, especially when looking at yields like the following.

Global Net Lease (GNL)

Global Net Lease is a real estate investment trust (“REIT”) that's currently externally managed by AR Global and specializes in diversified commercial properties that are typically leased to a single tenant on a net-lease basis.

As of the end of the second quarter, GNL’s portfolio consisted of 317 properties totaling 39.6 million rentable square feet which had a weighted average remaining lease term of 7.6 years and were 97.7% leased.

GNL has a global portfolio with net-leased properties located in the United States, Canada, and Europe and is well diversified by property type with its portfolio consisting of 55% industrial / distribution properties, 40% office properties, and 5% retail properties based on annualized straight line rent.

Last May, Global Net Lease and The Necessity Retail REIT (RTL) entered into a definitive merger agreement. RTL also is externally managed by AR Global and manages a portfolio of retail single tenant and open-air shopping center properties.

Under the agreement GNL will acquire RTL in an all-stock transaction and the merger will result in the internalization of management for the combined company. The deal is expected to close in September 2023 and the combined company will operate as Global Net Lease post-closing.

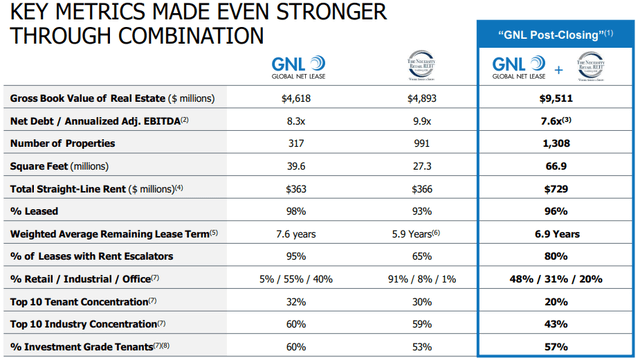

If the deal is approved, GNL’s gross book value of real estate assets will more than double, their property count will go from 317 to 1,308 and their portfolio composition will change from retail (5%), industrial (55%), office (40%) to retail (48%), industrial (31%) and office (20%).

GNL - IR

As part of the internalization merger agreement, GNL will issue approximately 30 million shares valued at $325.0 million (as of May’s weighted average price) to its external manager AR Global in addition to $50.0 million in cash.

Post-closing the existing GNL shareholders will own approximately 47% of the combined company, RTL shareholders will own approximately 39%, and approximately 14% of the combined company will be owned by its former external manager. Additionally, GNL expects the quarterly dividend to be set at $0.354 per share compared to its latest quarterly dividend of $0.40 per share.

Initially, the activist investment firm Blackwells strongly opposed the deal saying:

“The proposed merger is another deceptive effort by AR Global, in complicity with GNL and RTL, to skirt ongoing proxy fights against them, and the ultimate accountability that will face them.

Shareholders should be on high alert that the compromised boards of GNL and RTL approved a deal that would arrogate a $375 million ransom payment ($325M in GNL stock and $50M of cash to AR Global) to AR Global, Michael Weil and Nick Schorsch in return for all the value they’ve destroyed. Blackwells strongly opposes the cockamamie merger and expects most other shareholders to do the same.”

Blackwells withdrew its opposition and agreed to vote in favor of the merger after GNL agreed to issue 495,000 shares of its stock to Blackwells as a settlement fee.

Another large shareholder, Orange Capital, said it will vote against the transaction saying:

"The proposed internalization terms under the merger are certainly an outrageous enrichment of AR Global at the expense of GNL shareholders.”

... and went on to say that “Blackwells is now complicit in this value-destroying event as well.”

Yesterday morning, Orange Capital announced its continued opposition to the proposed merger as they “believe the merger not only lacks substantial financial or strategic value but also erodes shareholder value in both the near and long term.”

One reason investors might be hesitant to give AR Global a large payday is the poor management they have exhibited in recent years.

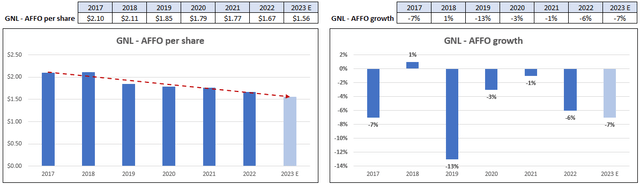

GNL’s adjusted funds from operations (“AFFO”) fell from $2.10 per share in 2017 to $1.67 per share as of the end of 2022 and analysts expect AFFO to fall by another 7% in 2023.

GNL has only delivered one year of positive AFFO growth from 2017 to 2022 and has cut their dividend three times over that period.

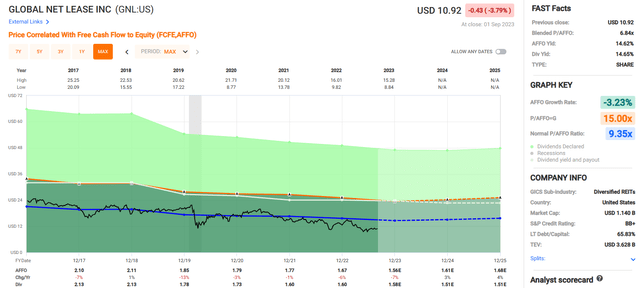

FAST Graphs (compiled by iREIT®)

From 2018 to 2019 GNL cut their dividend from $2.13 to $1.78 per share, representing a dividend cut of -16.67%. In 2020 they cut their dividend again by -2.39%, and then by -7.65% in 2021.

GNL’s dividend of $1.60 per share was maintained in 2022, but according to GNL’s merger overview, the new quarterly rate is expected to be $0.354 per share, or $1.42 per share annualized, which would represent a dividend cut of approximately -11.25% when compared to the amount paid in 2022.

GNL pays a high dividend yield at 14.65% but also has a high AFFO payout ratio of 95.81%. They have improved their AFFO payout ratio from over 100% in 2018 to around 95% as of the end of 2022, but the improved payout ratio has not been the result of increased earnings, but rather the company’s consistent policy of cutting their dividend.

The company is trading at a P/AFFO of 6.84x, which is a discount to their normal AFFO multiple of 9.35x, but we assign a Trim rating to Global Net Lease due to the company’s poor earnings performance along with their poor dividend track record. My recommendation is to avoid.

FAST Graphs

EPR Properties (EPR)

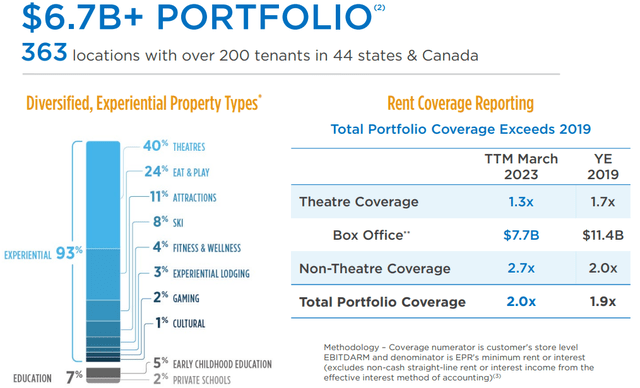

EPR Properties is a diversified net-lease REIT that primarily specializes in experiential properties, but also holds a portfolio of educational properties as well. The experiential portfolio includes movie theaters, eat and play venues, theme park / attractions, ski resorts, gaming properties, and experiential lodging while their educational portfolio consists of early childhood education and private schools.

EPR generates the vast majority of its earnings from its experiential portfolio, which made up 93% of their annualized adjusted EBITDAre as of the end of the second quarter. Within their experiential portfolio, movie theaters make up their largest property type and contribute 40% of their adjusted EBITDAre, while eat & play venues is their second largest property type and contributes 24% of their adjusted EBITDAre.

In total EPR’s experiential portfolio is 98% leased, covers approximately 20.1 million square feet, and consists of 171 movie theaters, 57 eat and play venues, 24 attraction properties, 11 ski resorts, seven lodging properties, 16 fitness centers, three cultural properties, and 1 gaming property.

EPR’s educational portfolio makes up 7% of their adjusted EBITDAre, is 93% leased, and consists of 64 early childhood education centers and nine private schools. EPR’s combined portfolio (experiential and educational) totals 363 properties located across 44 U.S. states and Canada covering 21.5 million square feet and is 97% leased.

EPR - IR

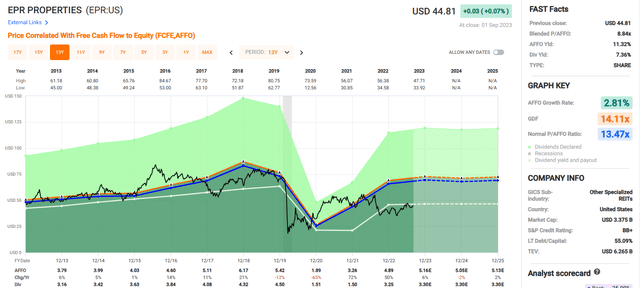

EPR is trading at a valuation below many of its net-lease peers with a P/AFFO of 8.84x compared to Realty Income at 14.17x, W.P. Carey at 12.22x, Postal Realty at 13.95x, and Spirit Realty at 10.78x.

The discounted valuation is in large part due to investor concerns over EPR’s heavy concentration in movie theater properties. Most of you know how severely theaters were impacted by COVID and the mandatory shut-downs, but to me the greatest risk for movie theaters going forward is the increasing adoption of streaming services.

Since the reopening movie theaters have recovered to some extent, but box office sales for the trailing twelve months ending March 2023 were reported at $7.7 billion, compared to $11.4 billion during 2019 and theater rent coverage dropped from 1.7x in 2019 to 1.3x as of the end of the first quarter of 2023.

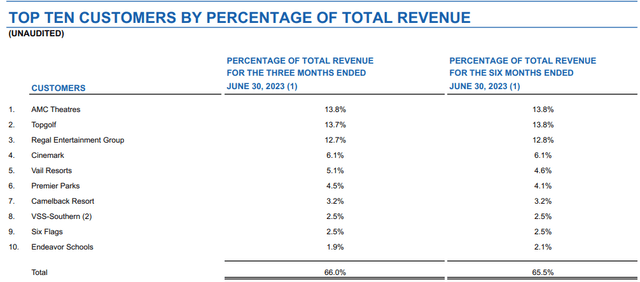

Since the pandemic, many movie theater operators have been struggling, including several of EPR’s top tenants. Three out of their top four tenants operate movie theaters (AMC, Regal, Cinemark) and combined they made up 32.6% of EPR’s total revenue during the second quarter.

Additionally, EPR continues to recognize revenue on a cash basis for AMC and Regal due to the uncertainty in the industry.

EPR - IR

Due to the long-term contractual obligations that are built into net-leases, many REITs in the net-lease space sailed through COVID (2020) without any significant impact to their earnings or dividend.

During 2020, Agree Realty’s AFFO per share increased by 6%, Realty Income’s AFFO per share increase by 2%, Getty Realty’s AFFO per share increase by 7%, and Essential Properties Realty Trust’s AFFO per share fell by only -3%.

This compares to EPR which saw its AFFO per share fall by -65% in 2020, forcing the REIT to slash its dividend from $4.50 to $1.52 per share, representing a -66.33% dividend cut. EPR was able to raise its dividend to $3.25 per share during 2022, but this is still approximately -28% below their pre-pandemic dividend of $4.50 per share.

While EPR’s 7.36% dividend yield is tempting and the stock is trading at a low valuation, we rate EPR Properties a Sell due to the concentration they have in movie theaters and the uncertainty that surrounds the industry. My recommendation is to avoid.

FAST Graphs

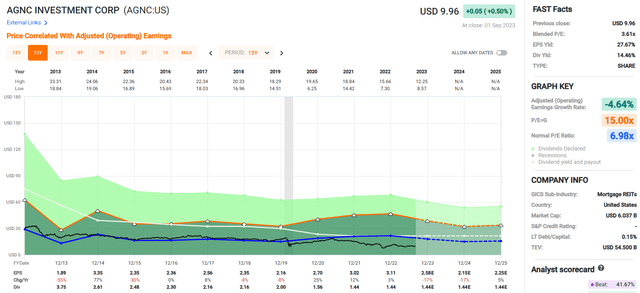

AGNC Investment Corp (AGNC)

AGNC investment Corp is an internally managed mortgage REIT (“mREIT”) that was formed in 2008 to provide private capital to the U.S. housing market. AGNC primarily invests in agency residential mortgage-backed securities (“Agency RMBS”) on a leveraged basis.

Agency RMBS are securities backed by a U.S. Government Sponsored Enterprise (“GSEs”) such as Freddie Mac or Fannie Mae and represent an interest in a pool of mortgage loans originated for residential properties. In addition to investing in Agency RMBSs, AGNC invests in Credit Risk Transfer (“CRT”) securities, non-agency RMBSs, and commercial mortgage-backed securities (“CMBS”).

As of the end of the second quarter, AGNC managed a $58.0 billion investment portfolio consisting of $46.7 billion in Agency MBSs, $10.2 billion in TBA (“to be announced”) mortgage securities, and $1.1 billion in Credit Risk Transfer and non-Agency securities.

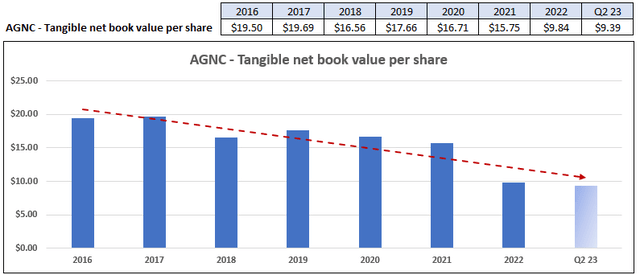

As of the end of the second quarter 2023, AGNC reported a tangible net book value per share of $9.39, which is in line with the stock’s price of $9.96 as of the previous close.

Upon a closer look though, we can see that AGNC has eroded its tangible net book value since 2016 when it was reported at $19.50 per share compared to its most recent figure of $9.39 per share, which represents a decline of over 50%.

AGNC - IR (compiled by iREIT®)

The stock price has followed suit, falling -47.88% over the past five years.

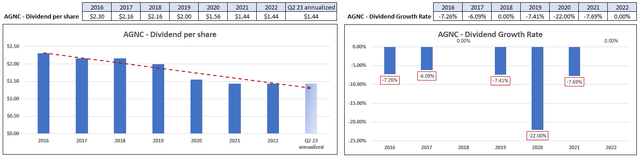

From 2016 to 2022, AGNC has had an average adjusted operating earnings growth rate of 4.08%, but analysts expect EPS to fall by -17% in the current year and then fall by another 17% in 2024, giving AGNC a blended earnings growth rate of -0.43% since 2016.

When including forward earnings estimates, AGNC’s adjusted operating earnings have remained stagnant yet they have cut the dividend in 5 out of the last seven years, going from $2.30 per share in 2016 to $1.44 per share in 2022, representing an average annual dividend growth rate of -7.21%.

FAST Graphs (compiled by iREIT®)

AGNC trades at a P/E ratio of 3.61x, which is a significant discount to the average P/E ratio of 6.86x. They also pay a mouthwatering dividend yield of 14.46% that is well covered with a dividend payout ratio of 46.30% based on their 2022 adjusted operating earnings.

We assign AGNC Investment a Spec Buy due to the discounted valuation and low dividend payout ratio. However, we must emphasize that this is a speculative buy given the company’s history of eroding its tangible net book value and its recent track record of cutting its dividend. My recommendation is to avoid.

FAST Graphs

Don't Be Stupid

In referenced to the chase for yield, Charlie Munger said it best:

"Try not to be stupid.”

Howard Marks also has a similar philosophy of focusing on minimizing risk when investing and let the upside take care of itself. He uses a great analogy, how does an amateur Tennis Player win matches?

By not hitting losers. Rather than by trying to hit powerful, hard "winning shots" with high likelihood of missing.

As always, thank you for reading and commenting. Stay tuned for my next article, Realty Income: My Largest Position And Sleeping Well At Night.

Note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Sign Up For A FREE 2-Week Trial

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, Builders, Asset Managers, and we added Prop Tech SPACs to the lineup.

We recently added an all-new Ratings Tracker called iREIT Buy Zone to help members screen for value. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 175,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022 and 2023 (based on page views) and has over 111,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies (Wiley/Amazon).

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)