BRZU: Brazilian Equities Bull Market Hinting At Decline

Summary

- Direxion Daily MSCI Brazil Bull 2X Shares aims to achieve daily investment results that are 200% of the performance of the MSCI Brazil 25/50 Index.

- The Brazilian economy faces uncertainties on the fiscal and political fronts, with factors like interest rate cuts and political disputes impacting the real-dollar exchange rate and investor sentiment.

- While low volatility conditions may benefit BRZU, the second half of the year may not be as bullish as the first due to already priced-in interest rate reductions.

Edson Souza

The Direxion Daily MSCI Brazil Bull 2X Shares ETF (NYSEARCA:BRZU) aims to achieve daily investment results, before fees and expenses, that are 200% of the performance of the MSCI Brazil 25/50 Index.

This leveraged ETF seeks to deliver 200% of its benchmark index's returns daily. It should not be expected to provide returns double the benchmark's cumulative return for periods longer than a day.

The MSCI Brazil 25/50 Index is designed to gauge the performance of the Brazilian equity market's large- and mid-capitalization segments, covering approximately 85% of Brazilian issuers' free float-adjusted market capitalization.

Leveraged and inverse ETFs pursue daily leveraged investment objectives, meaning they carry more risk than non-leveraged alternatives. They aim for daily goals and should not be relied upon to track the underlying index over periods longer than one day.

To clarify, this product is primarily designed for traders rather than long-term investors, whether they are bullish or bearish. It's ideally suited for situations with solid opportunities on one side of the trade.

The Brazilian economy enters September following a weak earnings season, during which, on average, holdings in EWZ experienced a substantial 40% contraction in profits and a 15% decline in revenues compared to the previous year. However, the expected interest rate cut, anticipated to reach 11.75% by the year's end, appears to have already been factored into the market, as reflected in EWZ's performance throughout the year. EWZ has posted approximately 40% year-to-date gains for BRZU.

Without the visibility of a more concrete catalyst on either side and considering the risks associated with rising inflation, as reported in recent updates, a potential slowdown in interest rate reductions at a less aggressive pace could be bearish for Brazilian equities. This scenario might temporarily overshadow BRZU's objective of seeking a specific catalyst for taking long or short positions.

Brazilian economy overview

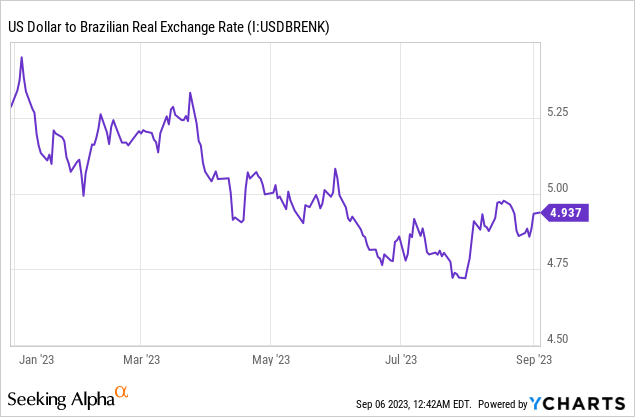

Brazilian Real: After closing July at R$4.74, the real-dollar exchange rate experienced a series of devaluations in August, with rates exceeding R$4.98 at one point, a level not seen since June of this year. Ultimately, the dollar closed at R$4.92 at the end of August.

Several factors contributed to this pressure on the exchange rate. Notably, the Brazilian Central Bank initiated a cycle of interest rate cuts at the beginning of the month. As previously mentioned in our report, this was expected to drive the dollar higher due to the narrowing interest rate differential between Brazil and the United States. In simpler terms, as the Brazilian base interest rate (Selic) decreases while the US interest rate remains stable, the difference between the rates decreases.

When the gap between domestic and foreign interest rates narrows, it becomes less attractive for foreign investors to invest in Brazil, reducing dollar inflows or outflows. Consequently, this causes the dollar price to rise, resulting in a Brazilian real depreciation.

Several other events have added to the dollar's rise on the domestic front in Brazil. First, political disputes between Finance Minister Fernando Haddad and the President of the Chamber of Deputies, Arthur Lira, regarding the Chamber's power led to the postponement of the vote on the new fiscal framework. This created uncertainty and disrupted the previously stable political landscape.

Additionally, delays in ministerial reforms and broadening the government's support base have further increased market skepticism, especially concerning meeting the fiscal targets outlined in the new fiscal framework, such as achieving a zero deficit next year. Addressing this issue will depend on the willingness of lawmakers to vote on these measures.

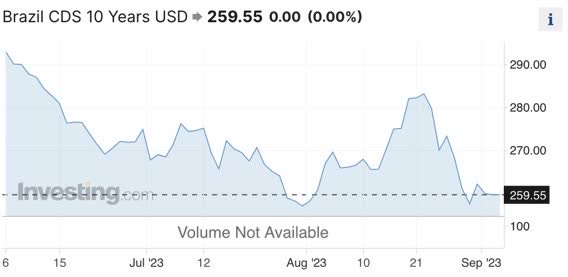

One way to gauge the impact of these domestic factors on the dollar is by examining the relationship between the exchange rate and the Credit Default Swap (CDS), an indicator of country risk. When Brazil's risk increases (or decreases), the exchange rate depreciates or appreciates. In August, the CDS increased, coinciding with the rise in the dollar, following a decline in July.

Investing.com

When we analyze foreign flows on Ibovespa, the Brazilian stock exchange, there were more outflows than inflows in August, totaling R$10.1 billion by August's end. During the month, the Ibovespa experienced a historic sequence of 14 declines.

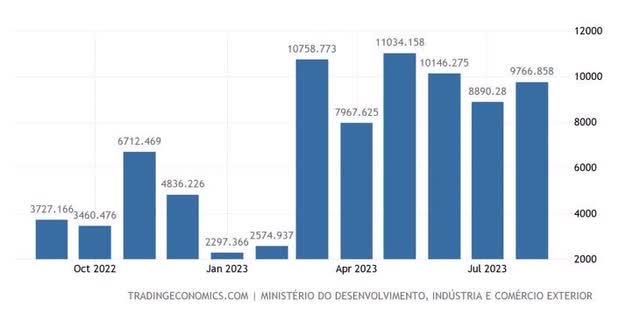

On a positive note, the foreign exchange flow, representing the balance between dollar inflows and outflows in Brazil, remained positive at $1.992 billion by the end of August. This result was driven by the trade flow, which saw a US$ 3.009 billion inflow, and the financial flow, which experienced a US$ 1 billion outflow.

The trade flow encompasses the trade balance, considering exports minus imports of goods and services. The financial flow encompasses foreign direct and portfolio investments, profit remittances, and interest payments, among other financial operations. There were more dollar inflows than outflows, increasing the supply of dollars and keeping the exchange rate below R$5.

Brazil Balance of Trade (Trading Economics)

The interest rate differential will continue affecting the exchange rate in the short term. However, even with potential cuts in the Selic rate and the maintenance of interest rates in the US, we do not foresee significant additional pressure on the dollar that would push it above R$5.10.

Macroeconomic environment: Another contributing factor is the adverse external environment, which has dampened investors' risk appetite. Fitch Ratings downgraded the US debt rating from AAA to AA+ in early August due to fiscal concerns. Mid-month, the US Treasury announced increased bond issuance due to rising debt levels. Additionally, the market is closely monitoring the actions of the US Federal Reserve (the Fed) after their recent interest rate hike, eagerly awaiting their next moves in monetary policy.

All these factors have influenced global financial markets, including the US bond market, where the 10-year bond yield reached 4.26%, the highest level since the 2008 financial crisis.

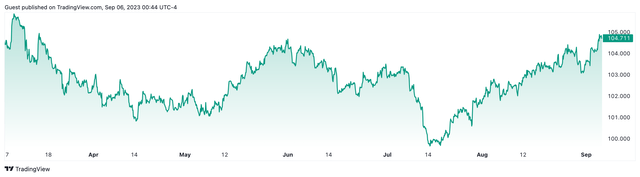

The DXY index, tracking the dollar's strength against a basket of six currencies, increased in August due to the turmoil in the US, causing the dollar to strengthen while other currencies, including the Brazilian real, weakened or devalued.

U.S. Dollar Index - 6 months chart (TradingView)

However, it's essential to note that the DXY index remains above its historical average and pre-pandemic levels. Suppose the expected end-of-cycle scenario occurs in the second half of the year. In that case, there may be room for the dollar to weaken, benefiting other currencies, particularly those of emerging markets.

Furthermore, uncertainties surrounding the Chinese economy's growth, government stimulus measures, issues in the real estate sector, rising interest rates, and a slowdown in Eurozone activity have all contributed to the trajectory of the Brazilian exchange rate.

The Bottom line

The upcoming announcement regarding the conclusion of the US interest rate hike cycle may relieve the markets. The FOMC meeting is scheduled for September 19 and 20 this year.

In Brazil, uncertainties persist, particularly on the fiscal and political fronts. These uncertainties are exacerbated by the dynamic between the Executive and Legislative branches, which is expected to play a significant role in shaping the landscape for the rest of the year. It's important to note that the parliamentary agenda will likely center around the government's tax collection initiatives and reform proposals. A Copom (Brazilian Monetary Policy Committee) meeting in Brazil is scheduled for the same week as the US monetary policy decision.

Looking ahead to 2024, it is probable that there will be currency devaluation due to the lingering uncertainties in the Brazilian landscape. These uncertainties include the implementation of the new fiscal framework, municipal elections characterized by polarization, the progress of crucial reforms, and the persistently challenging global economic environment.

It's essential to clarify that attempting to capitalize on the Brazilian equity markets makes BRZU unsuitable for the typical buy-and-hold investor. Furthermore, adding leverage to Brazilian equities requires a trader-oriented mindset focusing on correct timing and daily performance monitoring.

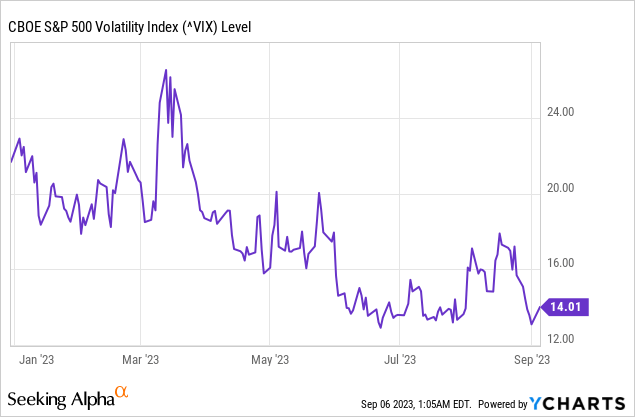

However, as volatility indicators like the CBOE S&P 500 Volatility Index (VIX) remain low, this implies reduced nervousness among investors regarding sharp fluctuations in stock prices. This can benefit ETFs like BRZU because they typically perform better in low-volatility markets.

When these indicators are low, investors are less anxious or concerned about abrupt changes in stock prices. This can be advantageous for investments like BRZU, based on Brazilian stocks, as it tends to be more stable and predictable in low-volatility markets.

Therefore, the passage highlights that the current low volatility conditions can be favorable for the performance of BRZU since it tends to excel when the markets are calmer and more stable.

While the VIX suggests that it could be a good time to leverage Brazilian equities, I don't anticipate the second half of the year to be as bullish as the first, as exemplified by the performance of the iShares MSCI Brazil ETF (EWZ). This is primarily because the market has already priced in the expected interest rate reduction.

While personally, I don't feel comfortable with leveraging, I maintain an optimistic long-term outlook for Brazilian equities. This optimism is based on the appealing valuation of the Brazilian stock market, which trades at a P/E ratio of 5.5x, and the prospects for a more devalued USD compared to the BRL as we enter 2024. Consequently, at this juncture, I would opt for a more cautious choice, such as EWZ.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.