ProPetro: The Worst Is Over But Don't Chase The Rally

Summary

- PUMP is up close to 50% since the recent lows and is now flat YTD.

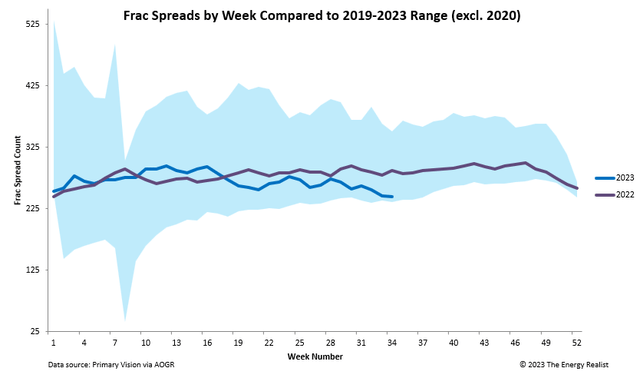

- Rig and frac spread counts haven't bottomed yet, but the sentiment is this will happen in Q3.

- Onshore services stocks may already be discounting this, so over the next few months the risks are probably a bit more to the downside.

MajaPhoto

Investment thesis

ProPetro Holding Corp. (NYSE:PUMP) is up more than 40% since my prior article, so it's probably a good time to update my thesis:

When I covered this ticker back in May, the hydraulic fracturing players including Liberty Energy (LBRT), NexTier Oilfield Solutions (NEX) and Calfrac (CFW:CA) were priced almost for a repeat of the 2020 halt in oilfield activity.

However, fast forward 4 months and most of these stocks have recouped their YTD losses despite U.S. rig counts and frac fleets not having quite yet bottomed. Only ProFrac (ACDC), which has higher financial leverage and exposure to private operators, appears to be still in the doghouse:

PUMP's Q2 wasn't as bad and the Q3 guidance also looks a lot more favorable than what one could infer from the crashing stock price earlier this spring. The contributing factors include ProPetro's 100% focus on the Permian (no gas basins), negligible exposure to the spot market and a healthy proportion of modern electric units among its fleet.

With Saudi Arabia now extending its voluntary 1 million bpd cuts until the end of the year and Brent close to $90 (BNO), the setup for the frackers going into 2024 looks strong, especially as ProPetro has suffered limited utilization losses so far. However, at the same time, the stock's outrageous mispricing from March to May has been somewhat repaired and it wouldn't be a surprise if negative macro news with the Fed meeting this September prompt another correction.

Frac fleets haven't officially bottomed

As of last Friday, the frac spread count was still trending down:

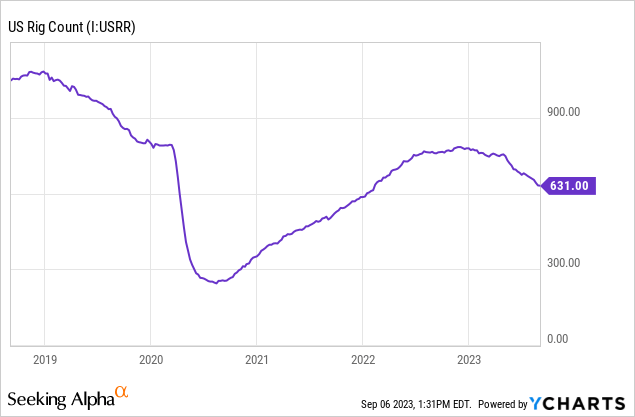

Rigs, which lead frac fleets, may have yet to bottom too although last week was flat:

However, the market is forward looking, so the onshore services bull run over the last couple of months may suggest the bottom is near. ProPetro's management affirmed this view at their Q2 earnings call:

We do expect the second half of the year will be only slightly down from operational levels that we saw in the first half. Therefore, we believe the current rig count is approaching the bottom and it's possible it might already be on bottom.

Other industry peers have shared similar sentiment on their Q2 calls and indicated a decent pipeline of customer inquiries for 2024.

We will have to watch how things play out over the next few weeks. Rigs should bottom before frac fleets, so if rigs finally bounce, that will confirm the bottom. However, this may already have been baked into the stock price.

Bifurcation is the new buzzword

ProPetro and some other land services providers like to talk about "bifurcation" as they are on the good side of this trend. Bifurcation here means that operators, especially the large public companies which have the most steady capex programs, have a strong preference for premium equipment (more modern, more efficient) whether we are talking about rigs or frac fleets. So the companies that own the coveted equipment will be better protected from drops in headline activity. In PUMP's words:

ProPetro offers differentiation in our service quality, equipment, customer portfolio and operational density in the Permian. We believe in this bifurcation internally and also hear this directly from our customers. This differentiation continues to insulate us from some of the market inconsistency outside of the Permian and in the spot market.

There also seems to be a better sense of margin protection in the industry, even if it means idling equipment - especially among the premium providers who stand more to lose from incurring depreciation for a low day rate. According to PUMP, "price undercutting" is more common for the spot market:

Undisciplined pricing concessions at the expense of keeping fleets utilized, especially from some of our distant peers exposed to the spot market, did have an impact on the overall frac market. Due to some of these circumstances, we elected to sideline 1 fleet during the quarter. This was an easy decision for us given the low pricing we would have had to put forward to keep the fleet operating, and we are now able to strategically preserve these assets and not run the equipment at sub-economic levels.

Pricing discipline is also helped by the industry consolidation. One example of this is the recent merger between Patterson-UTI (PTEN) and NEX:

PTEN & NEX merger presentation

Q2 wasn't so bad and Q3 may be decent too

Q2 revenue was actually up 2.8% sequentially and EBITDA down 5% only. ProPetro's utilization isn't falling as much as the headline index. Per management:

In spite of those impacts in the quarter, our effective frac fleet utilization of 15.9 fleets was on the high end of our prior guidance of 15 to 16 fleets. Consistent with our disciplined asset deployment, or margin-over-market share strategy, we will not run our equipment at sub-economic levels. Therefore, our second half 2023 guidance for frac fleet utilization is slightly down, to 14 to 15 fleets.

ProPetro sees sustained $80 oil as the next catalyst:

So I think we're kind of waiting to see how that pairs with customer decisions and just remaining as disciplined as possible around only putting assets in the field at prices that make sense to us. So I think if you see $80-plus crude persist through the end of the year, I think the likelihood of putting the 15th back in the system is pretty good. But we'll see if that's what the market gives us.

This tells me the next big move may not be until late fall when the oil narrative has hopefully finally changed. However, no one can time the market which is why I still hold some of my original position despite having taken some gains.

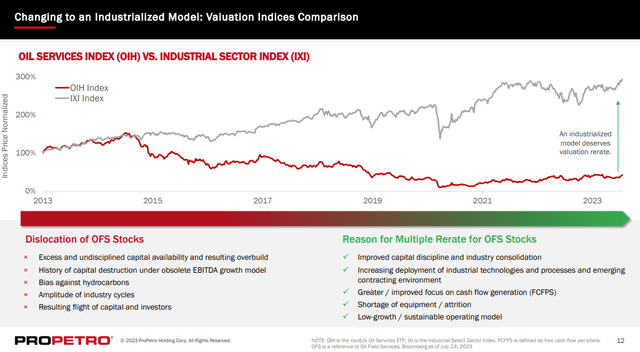

The bull case for oilfield services remains strong

ProPetro emphasized in its earnings presentation some of the bullish factors that I have also been highlighting in my past research:

Generally, I think the bullish thesis is stronger offshore, particularly with regard to equipment shortage, but many of these points are also valid onshore albeit on a smaller scale.

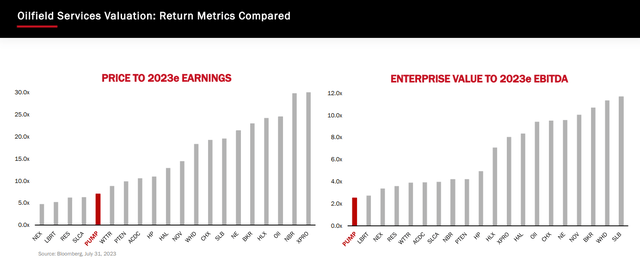

Valuation

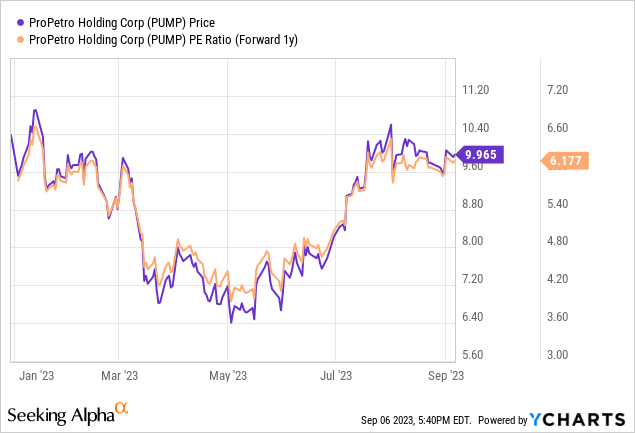

PUMP's valuation is still reasonable, even if not the screaming bargain it was a couple of months back:

Relative to other oilfield services stocks, PUMP still looks quite undervalued although majors such as SLB (SLB) or Baker Hughes (BKR) naturally attract higher multiples:

Interestingly, direct competitor ACDC, which is in worse shape in a number of ways, attracts a premium valuation relative to PUMP. So a further multiple expansion for ProPetro is certainly possible.

Wall Street currently sees 26% upside, which given PUMP's volatility, is probably consistent with a "hold":

Bottom line

ProPetro is an onshore oilfield services provider which got beaten pretty badly earlier this spring but has now made up the lost ground and is basically flat YTD. If you caught it close to the bottom, you are almost 50% up by now.

Despite having taken some gains, I maintain exposure to ProPetro (and competitors LBRT and CFW:CA), but I wouldn't necessarily chase the rally right now and would rather wait for another correction to get in. It is not guaranteed such an opportunity will indeed come, but I think the rigs and frac spreads bottoming has already been priced in, so this fall the risk is probably a bit more to the downside.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PUMP; LBRT; CFW:CA; SLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

My articles, blog posts, and comments on this platform do not constitute investment recommendations, but rather express my personal opinions and are for informational purposes only. I am not a registered investment advisor and none of my writings should be considered as investment advice. While I do my best to ensure I present correct factual information, I cannot guarantee that my articles or posts are error-free. You should perform your own due diligence before acting upon any information contained therein.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.