ITB: The Hidden Supply Of Housing Could Be A Problem For Homebuilders

Summary

- Baby boomers and empty nesters are downsizing and planning to sell their homes to supplement retirement funds.

- This "hidden supply" of homes not yet listed for sale could lead to a significant increase in existing home listings and a sharp correction in home prices.

- The recent "boom" in existing home sales is about to end, which is a major negative for home construction stocks, as proxied by ITB.

S_Bachstroem

I had several interesting conversations over the Labor Day weekend, which led me to conclude that the housing market is likely to crash hard over the next 6-12 months. Specifically, the people are aware that their houses are overpriced and are planning to sell and cash out. They have not listed their houses for sale yet, but they are planning to. My source from the real estate industry confirmed that there is a "hidden supply" of unlisted homes, as many of his clients are hoping to sell their homes soon to cash out.

ITB Investment thesis

iShares U.S. Home Construction ETF (BATS:ITB) is up by 37% YTD and this strong performance has been led by the bounce in new home sales. The central thesis in this article is that the "bounce" in new home sales is only temporary due to the "frozen" existing housing market, or the record low inventory of existing houses for sale.

As I explain in this article, there is a "hidden supply" of existing homes for sales, or the homes that are likely to be listed for sales over the next 6-12 months. Thus, as these homes "hit" the market, exactly at the time when the demand drops due to higher mortgage rates slowing economy, the housing market will face the supply/demand imbalance and a significant home price correction, by possibly over 30%. As a result, the new home sales are likely to significantly slow, and the home construction stocks, as proxied by ITB, are likely to significantly decrease in value.

But first, here are the reasons I suspect there is a hidden supply of existing homes for sales, based on my recent conversations.

The Baby-boomer case

The first conversation I had was with a person in his mid-60s, who just plainly asked me if I think it's a good time to sell his home now - the first line of conversation.

His house is fairly large with a pool and a giant yard - one of the older houses from established neighborhoods. His income is related to the auto sector, and he plans to retire this coming year. He's been trying to sell his business, which I consider a commercial real estate deal, but cannot find a buyer. His plan is to retire and sell his house and buy a smaller house in the 55+ senior community - he already visited the new house, but has not listed his current house for sale yet.

Over the last two years, he's been getting lots of offers (via letters) to sell his house, and the price offered is about 30% of what he considers fair value. Other than the potential sale of his business, his home equity is his major retirement asset.

The empty-nester case

The second conversation I had was with a person in her late 40s whose youngest child is a high school senior this year. They have lived in a desirable suburb with an excellent public school district, but the plan is to sell once all the kids finish high school and move on to college.

They also received many offers to sell the house, and also at about 30% premium. Apparently, many people from California move into this Texas neighborhood and buy with cash.

The husband works in the city, but the plan is to request remote work and move to deeper suburbs, and start planning for a retirement (the husband is in late 50s). Thus, this story also touches on the commercial real estate crisis - via remote work vs office work. Their home equity is also a major part of their retirement funds.

The real estate industry source

I asked a local Texas real estate broker about the trends in his area, and he confirmed that lots of his clients are planning to sell, but have not listed their houses for sale yet. They have all been getting offers to sell their homes at high premiums, and are counting on the sale proceeds to supplement their retirement planning, and downsizing.

Broadly speaking, the baby-boomer case is a major unfolding macro trend, as the large segment of population could be looking to downsize and cash-out the current home equity to supplement their retirement funds.

What does the data show?

The housing market has been essentially frozen over the last 12 months as the mortgage rates spiked to over 7%.

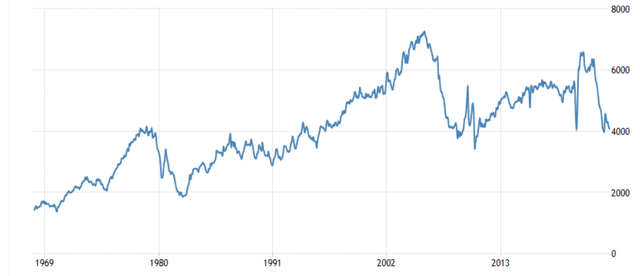

The buyers are not able to afford the houses at this point given the still near record home prices and much higher mortgage rates. The sellers have not listed their homes for sales given that they have locked-in a 3% mortgage, and knowing that the new house purchase would require a 7% mortgage. Thus, the activity in existing home sales has dropped to the 2008 financial crisis level of 4000, as the chart below shows.

But it seems that people are looking to cash out their home equity and downsize to the point where the existing home sale profit could allow them to downside and buy the new home for cash, avoiding getting a new mortgage.

Given the demographic trends, the cases of baby boomers and empty nesters downsizing are likely a national trend. Generally, the baby-boomers will become the forced sellers, as their retirement approaches.

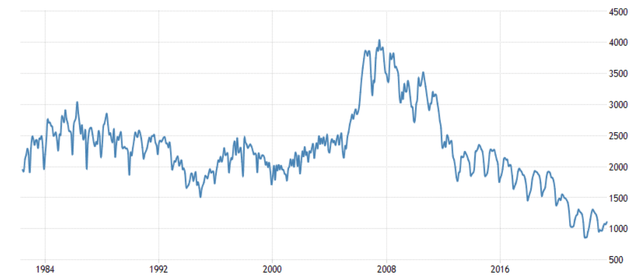

The official data shows that the supply of existing homes for sale is at the record low number (total housing inventory), as the chart below shows.

However, it seems like the people who are planning to sell have not listed their homes for sale yet. They even plan to sell privately without listing to "one of these lucrative offers". Thus, there is a significant "hidden" supply of homes not shown in the data, yet. However, it's likely that these homes will hit the market over the next 6-12 months.

The "premium offers" were part of the Fed-induced post-pandemic liquidity boom. The times have changed, and the Fed is specifically targeting the housing market as the source of rent inflation. I assume that these premium offers are disappearing, and once the hidden supply hits the market and meets the regular buyer with a 7+% mortgage, the housing prices are likely to crash by over 30%, which will bring the national house price well below $400,000, just below the pre-pandemic level - which is actually still high.

The ITB ETF specifications and investment implications

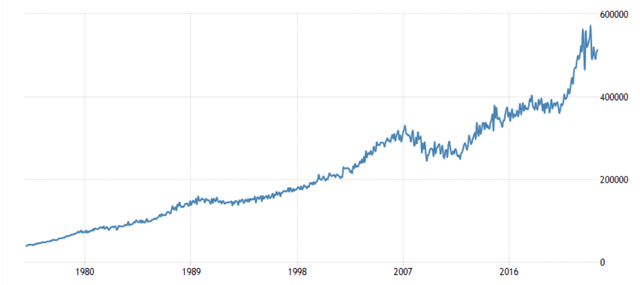

The homebuilders took advantage of the frozen existing home market, and boosted the construction and sales of new homes in 2023, with some "sweeteners". Note, the new home sales are also severely depressed, as the chart below shows, but the small bounce in 2023 made some believe that the housing market has turned the corner.

However, this was a small bounce mainly due to the fact that the existing home market has been frozen. Nevertheless, the homebuilders have bounced strongly in 2023, rising by over 30% YTD.

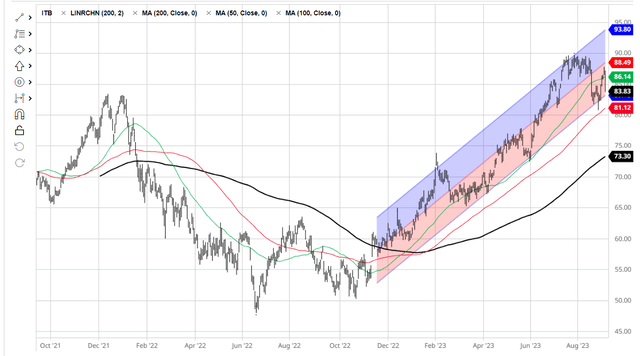

One of the most popular homebuilder ETFs (ITB) iShares U.S. Home Construction ETF is up over 50% over the last 12 months.

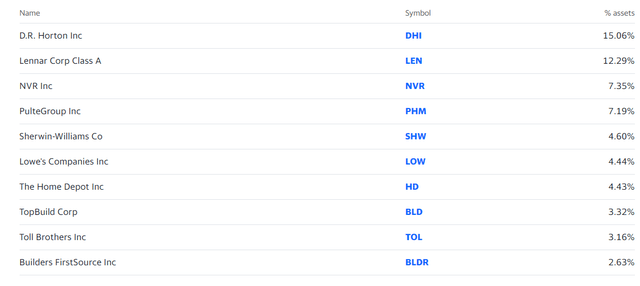

These are the ITB top 10 holdings, mostly homebuilders, but also home improvement retailers such as Home Depot (HD) and Lowe's (LOW).

The recent bounce in ITB is likely overextended, and reflects a temporary bounce in the new home sales. However, it appears that there will be a significant increase in existing home listings, which will likely cause a sharp correction in home prices. These are negatives for homebuilders, and the recent bounce in ITB is the opportunity to sell.

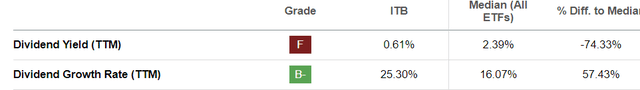

ITB has a very low dividend yield of 0.61%, which is not very attractive for income investors, especially given that Treasury Bills are currently yielding well over 5%. ITB has been increasing the dividends over the last 12 months by 25%, however, this is unlikely to continue given my negative outlook on the housing market in the near term.

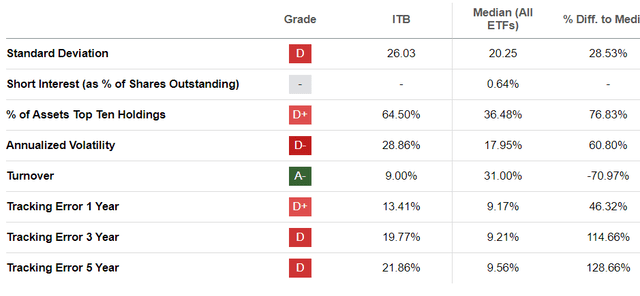

ITB is also very contracted with 64% of assets in the top ten holdings, which increases the risk of a sharp pullback. ITB has a high tracking error, compared to other ETFs, which also makes it a relatively poor investment.

Overall, as a forward-looking recommendation, investors who held ITB over the last 12 months have an opportunity to sell and realize the gains before, in my opinion, ITB revisits the October 2022 lows over the next 6-12 months, as the housing supply/demand balance turns more bearish.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)

www.investopedia.com/...

Will everyone sell at once… no.

Will boomers sell and take a beating… no.

They’ll likely stay in place. Collapsing the market 30%.

Doubtful.