Pfizer: Still Attractive Despite Recent Acquisitions

Summary

- Pfizer has made several acquisitions to expand its future drugs pipeline, including Biohaven and ReViral, with combined peak sales estimated at $6 billion.

- The acquisition of Seagen for $43 billion will significantly bolster Pfizer's oncology segment, which generated $2.9 billion in revenue in 1Q 2023.

- Despite a decline in revenue from COVID-19 vaccines, PFE's sales of Paxlovid surged to $18.9 billion in 2022.

JHVEPhoto

Investment Thesis

Pfizer (NYSE:PFE) has efficiently used the funds from vaccine sales by expanding its future drugs pipeline through the acquisitions of four companies and setting up a deal to purchase Seagen for $43 billion. However, we view the effect of these investments as adverse for the price of the company's shares. The fair value of the acquired assets is estimated to be $42 billion in 2024, while the money spent to buy them is $67.2 billion. Despite disappointing acquisitions we still see attractive upside. Rating is BUY.

Pfizer's acquisitions

In May-June of 2022, Pfizer announced the purchase of Biohaven for $11.6 bln and ReViral for $525 mln. Biohaven has a solid portfolio of migraine drugs, with Nurtec being the most popular with a market share of 47.6%. In this market Pfizer competes with AbbVie, which owns the Ubrelvy and Qulipta drugs with a market share of 52.5%. The combined peak sales of Biohaven and ReViral are estimated at $6 bln.

Shortly after, in August 2022, Pfizer announced the acquisition of Global Blood Therapeutics for $68.5 per share. Pfizer will pay a total of $5.4 bln for the deal.

GBT's main drug is voxelotor, also known as Oxbryta, used to treat sickle cell disease. It was given an accelerated approval by the FDA in November 2019. The drug brought the company a revenue of $71.55 mln in 2Q 2022 (+50.4% y/y). The peak sales of this drug are estimated at about $1 bln, which could be achieved within 3-4 years.

That drug, which GBT already commercialized, obviously wasn't Pfizer's main purpose for the deal, as it is unlikely to become a high-revenue item, given the strong competition from Novartis' Adakveo. There are also effective classic drugs - Droxia, Hydrea, and Siklos, but they have more side effects than Oxbryta.

GBT is developing GBT601, which is being studied in a restarted Phase 1 trial. The drug has a mechanism of action similar to Oxbryta's but requires significantly lower doses, thus reducing side effects. GBT601 also has higher efficacy compared with Oxbryta. The potential peak sales of GBT601 are estimated at $2 billion, but that includes cannibalizing Oxbryta.

Inclacumab is the third significant sales driver, which is a P-selectin inhibitor and a direct competitor to Adakveo. It is currently in two Phase 3 clinical trials. If both trials are successful, the potential of inclacumab is estimated at about $0.5 billion (peak sales).

Pfizer expects to add a combined $10.5 bln in revenue from all the acquisitions by 2030.

In March of 2023, Pfizer announced a deal to buy 100% of Seagen for $43 bln, or $229 per share. To complete the transaction Pfizer will purchase the other company's shares, so its own shares won't be diluted. The financing of the deal will come from $31 bln of new, long-term debt, with the remainder being covered by short-term financing and the company's existing cash. Pfizer currently has $17.8 bln in short-term investments and $2.2 bln in cash.

The companies expect to complete the transaction in late 2023 or early 2024, subject to US regulatory approvals.

Seagen is a biotechnology company developing treatments for various types of cancer based on monoclonal antibody-drug conjugates (ADC). The method competes with classical chemoradiotherapy and immunotherapy, as well as the latest treatments based on CAR therapies (CAR T-cell therapy is approved for the treatment of blood cancer).

The Seagen deal will significantly bolster Pfizer's oncology segment, which generated $2.9 bln, or 16% of the company's total revenue, in 1Q 2023.

To date, Seagen has four approved drugs that generate revenue for the company.

Adcetris is an old drug that gained approval as long ago as 2011. The US patent will expire in 2024. The drug was developed in partnership with Takeda, and Seagen has the rights to distribute it in the US and Canada. It is the first drug that was registered for use in the primary therapy of peripheral T-cell lymphoma in combination with chemotherapy. In 2022, Adcetris generated $0.8 bln in revenue. Its peak US revenue is estimated at $2.7 billion. In 1Q 2023, Adcetris brought in $243 mln, (+34% y/y).

Padcev is an ADC drug that was approved for the treatment of urothelial carcinoma in 2019. The drug is being commercialized jointly with Astellas under a 50/50 collaboration. In 2022, Padcev generated $0.5 bln in revenue. Its peak revenue by 2030 is estimated at $2.8 billion. In 1Q 2023, Padcev earned Seagen $118 mln (+18% y/y).

Tukysa is a drug that is used in combination with others for the treatment of breast and colorectal cancer. The drug gained approval in 2020, and its peak revenue is estimated at $2.3 bln by 2030. In 2022, the drug generated $0.4 billion in revenue, and in 1Q 2023, it earned Seagen $87.4 mln (-3% y/y).

Tivdak is a drug that is used to treat cervical cancer. It was approved in 2021, and Seagen commercializes the drug under a 50/50 worldwide collaboration with Genmab and Zai Lab. In 2022, the drug generated $0.1 bln in revenue, and in 1Q 2023, it earned Seagen $19.5 million (+71% y/y). The potential revenue from the drug is estimated at between $1.3 bln and $1.8 bln.

As such, the 4 approved drugs alone are estimated to earn a potential revenue between $9.1 bln and $9.6 bln by 2030. Seagen is forecast to earn a revenue of between $2.2 bln and $2.3 bln in 2023.

Currently, Seagen has Phase 3 expansion trials going for all of its existing drugs (1 for Adcetris, 3 for Padcev, 4 for Tukysa and 1 for Tivdak). Of the potential new drugs, none are in Phase 3 yet, but there are two drugs in Phase 2: Disitamab Vedotin (for the treatment of metastatic urothelial carcinoma) and Ladiratuzumab Vedotin (for the treatment of breast cancer). Phase 2 takes an average of two years, and Phase 3 between 1 and 4 years. Therefore, it will be a long while before the commercialization of these drugs could start.

We evaluate the EV of all acquisitions, including Seagen, using the EV/S method. To compute potential revenue from drugs we use all drugs of the 5 companies, except Nurtec and Oxbryta, which we include in Pfizer's current financial results. The total potential revenue from all drugs of the acquired companies will reach $19.9 bln by 2030. As a fair multiple, we used the average EV/S multiple of five major pharmaceutical companies over the past 10 years, and it was 4.4х. That allowed us to estimate the EV of the acquired drugs will reach $87.4 billion by 2030. Pfizer will have spent $67.2 bln on acquiring all these companies. When the 2030 EV is discounted to 2024 at a rate of 13% per annum, the fair EV of the acquisitions comes to $42 billion. The difference between the price of the acquisitions and their fair EV value puts pressure on the price of Pfizer's shares, pushing the target capitalization to fall by that difference.

Pfizer's financial results

At the start of the year, Pfizer announced that it would be able to sell 100 million doses of COVID-19 vaccines in 2023. However, during the year's first 6 months, it sold a mere 12.4 million courses. Despite this, Pfizer's share of the vaccine market increased from 60% to 65%. The company has adapted its vaccine to the latest coronavirus strain, the Omicron XBB 1.5, at the request of the FDA. If the new variant of the vaccine is approved in August, deliveries will start as soon as September.

Pfizer has also renegotiated its contract with the EU, spreading out deliveries over the next four years. The contract reduces the total supplies of vaccines to the EU this year, but establishes more certainty for supplies over the next years.

Pfizer expects an increase in COVID-19 infections starting from the fall, which will directly correlate with demand for the vaccine and the antiviral pills Paxlovid. Despite the decline in revenue from COVID-19 vaccines, Pfizer's sales of Paxlovid surged to $18.9 billion in 2022, the first full year the antiviral pill was available.

We expect shipments of the vaccines to the US and the EU to rebound, but given the delay with the contracts, we are lowering the total revenue from the vaccines and the pills from $21.1 (-63% y/y) to $19.4 bln (-66% y/y).

We expect revenue from antiviral COVID-19 pills to reach $18.6 bln (-4% y/y) in 2024, up from our prior forecast of $14.6 bln (-31% y/y), on the back of the long-term contract for supplies to the EU.

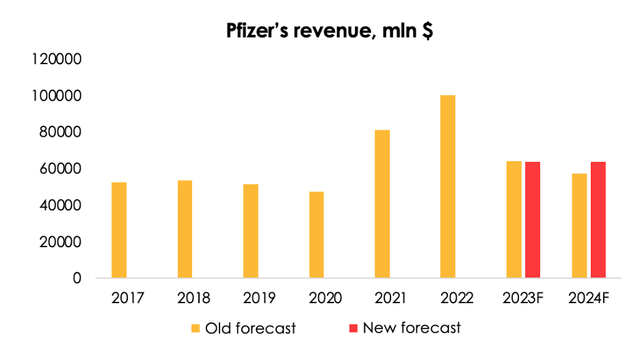

As a result, we are lowering the forecast for Pfizer's revenue from $64.1 (-36% y/y) to $63.8 bln (-37% y/y) for 2023, but are raising it from $57.3 (-11% y/y) to $63.7 bln (-0.1% y/y) for 2024.

Pfizer continues to be busy investing in the development of new and existing drugs. In Q2 2023 alone, the company reported progress in the development of 13 drugs, including the vaccine against COVID-19, the antiviral pills Paxlovid and the following medicines:

Abrysvo - a bivalent vaccine against respiratory syncytial virus (RSV). In May 2023, the vaccine gained FDA approval for use in individuals aged 60 years and older. In June, similar approval was granted in the EU. The potential revenue from the drug is estimated to reach $1.7 bln by 2029.

Litfulo - a kinase inhibitor designed to treat severe alopecia in adults and adolescents aged 12 years and older. The FDA approved the use of Litfulo in June 2023, and the EU is expected to issue a similar approval within the next few months. This marks the first approved treatment for alopecia in the United States. The potential market for the drug is estimated to reach $5+ bln by 2030.

Ngenla - a medication used for the treatment of growth hormone deficiency. The FDA issued an approval for Ngenla in June 2023. The peak revenue from the drug is estimated to reach $1+ bln by 2026.

In other events, Pfizer's plant in North Carolina was hit by a tornado in July 2023. The plant produces 25% of all Pfizer's drugs and 8% of all injectable drugs used in US hospitals. The tornado mainly damaged the warehouse that stored manufactured medicines, while the production line was almost unaffected.

Given Pfizer's intense investment in developing new and existing medicines, several major approvals its gained from the FDA and the ЕС, and the costs required to rebuild the damage from the tornado, we are raising the forecast for the company's R&D spending from $10 (-19% y/y) to $12.1 bln (-2% y/y) and for SG&A costs from $10.2 (-15% y/y) to $15.5 bln (-2% y/y) for 2023. For 2024, we are lifting the forecast for R&D spending from $9.1 (-10% y/y) to $12.2 bln (+0.4% y/y) and SG&A cost from $9.2 (-13% y/y) to $11.8 bln (-12% y/y).

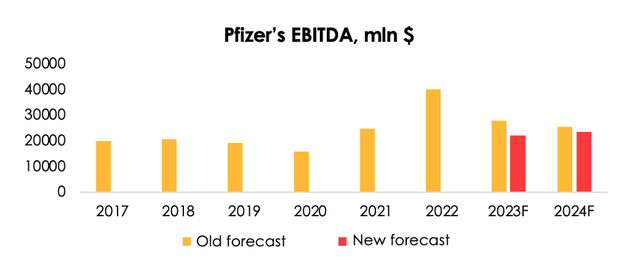

We are lowering the EBITDA forecast from $27.8 bln (-31% y/y) to $21.9 bln (-45% y/y) for 2023, and from $25.4 bln (-9% y/y) to $23.4 bln (+7% y/y) for 2024.

Valuation

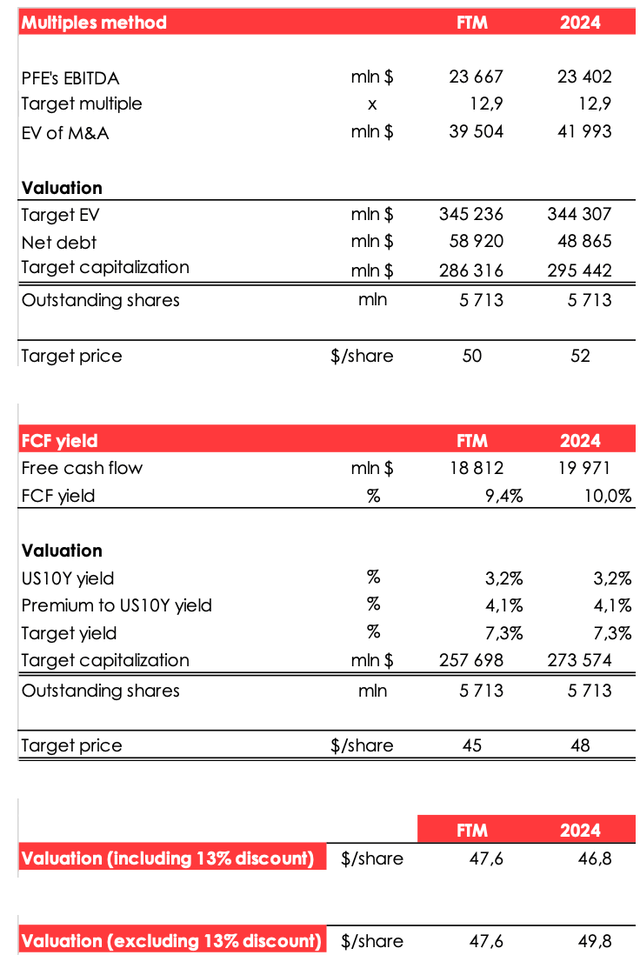

We are lowering the target price of the shares from $46.9 to $46.8 due to:

- the reduced EBITDA forecast for 2024;

- the shift of the FTM valuation period.

Based on the new assumptions, we are maintaining the rating for the shares at BUY.

The price target for Pfizer's shares was achieved by computing the company's fair value for the year 2024 and discounting it to the FTM estimate at the rate of 13% per annum.

Conclusion

The healthcare sector showed one of the worst dynamics in 2023. We are confident that this gives investors the opportunity to increase the shares of promising companies, such as Pfizer, in their portfolios. Despite the slowdown in the business related to the sale of vaccines, the company is actively diversifying its bets on other drugs, which will give tangible support to financial results over the next few years. Moreover, Pfizer can be considered as a defensive stock, with a low correlation to the broad market, which will reduce the overall volatility of the portfolio.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.