Gildan Activewear: Vertical Integration Provides Sustainable Opportunity

Summary

- Gildan Activewear is a manufacturer of unbranded activewear, focusing on sustainable growth in a sector with a 10-year CAGR of 6%.

- The company operates vertically integrated clothing operations, allowing for high-margin production and control over the supply chain.

- GIL faces risks such as dependence on top customers, duty costs in certain regions, and environmental effects on cotton prices.

sorendls/E+ via Getty Images

Investment Thesis

Gildan Activewear (NYSE:GIL) is a manufacturer of unbranded activewear, which is then decorated with branding from other companies or one of its subsidiaries. Gildan Activewear markets its products either wholesale or through online retailers American Apparel, Comfort Colors, or Gildan.

GIL maintains a low 1.8x debt to EBITDA level and has a large vertically integrated manufacturing ecosystem in countries with favorable trade conditions. Despite macroeconomic uncertainty, GIL has a winning formula focusing on sustainable growth in a sector with a 10-year CAGR of 6%.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $3.05 X 13.5 = $41.18

E2023 | E2024 | E2025 | |

Price-to-Sales | 1.65 | 1.57 | 1.51 |

Price-to-Earnings | 11.62 | 9.58 | 8.16 |

Operations

GIL owns and operates vertically integrated clothing operations, owning and operating everything from yarn spooling to finishing facilities. On a wholesale basis, GIL typically produces blanks which are sold to other wholesalers or screen printers. While this leaves GIL unable to respond to consumer preference quickly, it allows it to operate on a high-margin basis. GIL's EBITDA margin is much higher by an average of 900bps compared to peers.

Yarn-Spinning |

| (2) Salisbury, NC Mocksville, NC Eden, NC Clarkton, NC (2) Stanford, NC Stoneville, NC |

Textile Facilities |

| (4) Honduras Dominican Republic Bangladesh |

Sewing and Finish Facilities |

| (3) Honduras (4) Nicaragua (3) Dominican Republic Bangladesh |

Garment-dyeing |

Honduras |

Hosiery |

Honduras |

Most yarn requirements are produced within the United States. However, if there is a shortfall or increase in demand, GIL utilizes third-party yarn suppliers. The same goes for contracting for other steps in the manufacturing process.

Unlike many of its competitors, GIL focuses on the CAC (Central American-Caribbean) as a manufacturing hub. CAC still lags behind Asia in economic productivity; however, aggregate productivity has been on a sharp incline over the last 15 years thanks to extensive investment. Additionally, business regulation and trade terms are favorable in the CAC region, with most CAC countries being duty-and-quota-free importers of textiles to the United States. As a percentage of market share, the CAC region makes up 24.34% of the market share in the United States. South Asian manufacturing hubs do not have this privileged access to US markets but still make up 28.58% market share.

GIL has made extensive commitments to growth goals in a program it calls the Gildan Sustainable Growth Initiative. This policy has 3 key pillars of growth: capacity expansion, innovation, and ESG. Growth capacity has taken the form of vertical acquisition to accelerate GIL's position as a global player with significant competitive advantage. To this effect, GIL has spent significant money on a new facility in Bangladesh. Additionally, GIL has purchased Frontier Yarns for $168 million, a leading American spooler based in NC around existing GIL operations. As consumer preferences begin to shift toward ethically and environmentally sound sourced products, it will be imperative for companies to have control over their supply chain. As a vertically integrated producer, GIL has a significant lead in this area.

Risk

While specific customers are not mentioned by GIL, the top 3 customers make up approximately 48% of its revenue from those contracts, each making up approximately 16%. The loss of one of these customers would immediately affect GIL's top and bottom lines.

As previously discussed, the CAC region has preferred access to US markets, with textiles being duty-free. The Bangladesh Garment Manufacturer Export Association is seeking a similar agreement. Currently, these goods are imported to the United States with a 16% duty, and Bangladesh has a 9.8% market share in the United States for finished textile goods.

While cotton prices have declined 24% from near record highs, cotton is still higher priced than it was pre-pandemic and will likely continue upward. While commodities are normally cyclical, environmental effects like extended droughts and extensive flooding have begun to significantly affect the largest cotton producers like the United States and Pakistan. The US outlook for cotton for FY23, which GIL utilizes, is expected to have a 3.8% decrease in availability. While demand is expected to recover in FY24, cotton output is expected to stay flat or decrease again.

The ESG initiatives hinge on GIL's ability to maintain positive PR and standards. GIL was previously wrapped up in a controversy regarding one of its 3rd party providers who had a poor labor record. Gildan rectified the issues and has avoided major controversy since.

Outlook

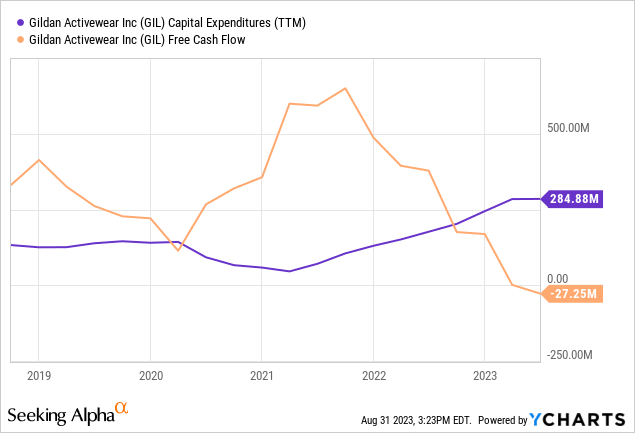

On top of this dividend policy, GIL renewed the share repurchase program. This program allows GIL to repurchase up to 5% of outstanding shares over 12 months. In 1H23, GIL repurchased 2.6 million shares. GIL pays out 2.48% yield, or about $0.74 per year. Free cash flow for GIL has declined year over year by 21%. This can largely be explained by a decrease in revenue and an increase in Capex. Capex saw a 45% year over year growth in 2Q23 to enable the spin-up of the new Bangladesh facilities. Capex is estimated to continue to be slightly elevated until FY24 when the Bangladesh facility is completed.

Ycharts

Despite gains in market share globally and better-than-expected volume, market conditions have negatively impacted all markets as consumers switch toward price-conscious spending. GIL has revised down FY23 expectations considering this and is expecting a full-year single-digit revenue decrease. In context, the United States is expecting to import 26% less clothing year over year, which tracks very closely to the consumption patterns of consumers. In GIL's own results, recessionary spending patterns are already evident, with activewear falling 10.2% year over year in sales, with hosiery/underwear increasing 7.5% year over year. Through its strategic focus on wholesaling and the stability provided by vertical integration, GIL has long-term growth prospects even considering the short-term demand headwinds.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GIL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.