Kraft Heinz: A Broken Business Model With Saturated Brands

Summary

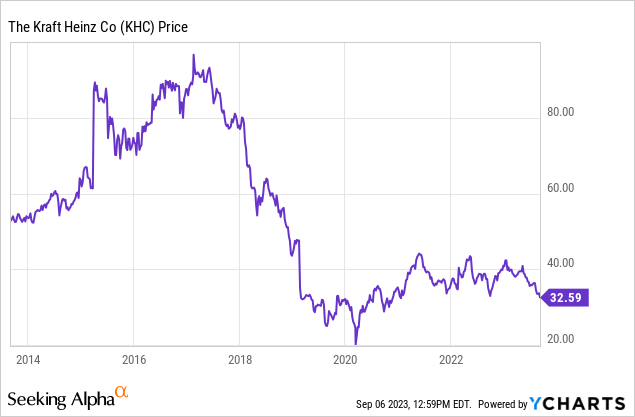

- Kraft Heinz Company's stock has had a negative total return of 26.07% since its merger nearly 8 years ago.

- The company's core brands are not showing consistent organic growth and have reached a point of saturation in key markets.

- Kraft Heinz is overvalued and has significant debt, making it a risky investment with limited potential for growth.

Scott Olson

Iconic brands don't always translate into good investments. While companies with strong labels often have high levels of profitability, investing is about the future, not the past, and most top brands eventually reach a point of saturation.

Two of the most well-known corporations even before their merger were Kraft and Heinz. The companies got regulatory approval for the decision to integrate their operation together in early 2015, and a new company called The Kraft Heinz Company (NASDAQ:KHC) was formed.

This stock has offered investors a miserable total return of negative 26.07% since the merger nearly 8 years ago. The S&P 500 has offered investors a total return of 156.16% during the same time period.

Today, I am initiating my coverage of the Kraft Heinz Company with a sell rating. The company's core brands are not showing any consistent organic growth in the US or overseas, and management has no plan to turn the business around. Most of the company's key labels have clearly reached a point of saturation in the key markets this company sells into. This food distributor also has significant debt and a high current payout ratio for the current modest dividend, and the stock also looks overvalued at current levels using several metrics.

The Kraft Heinz company's recent earnings report highlighted many of the main problems that this food distributor has had for some time. Management recently reported that the company earned $.81 in earnings per share GAAP actual, $6.72 billion for the last quarter. These numbers were reported against expectations of $.75 in earnings per share GAAP actual, and predicted revenues of $7.52 billion. The company missed on revenue expectations by $81.90 million.

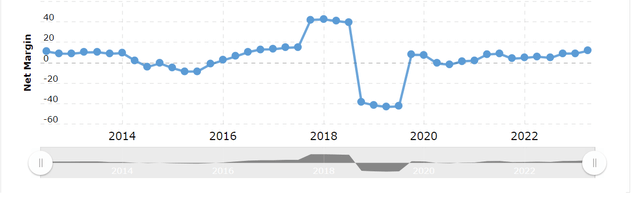

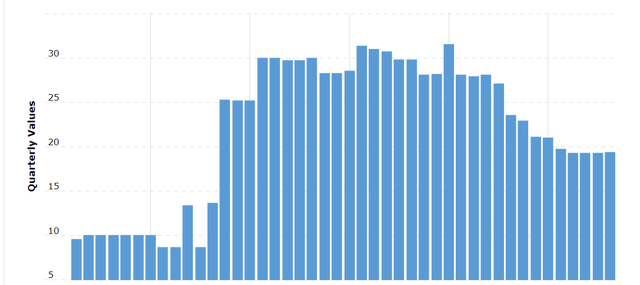

Still, the more concerning part of the leading food distributor's earnings report was the continued decline in sales volume, which was not offset by the minimal increase in net margins. Even though management reported that gross margins increased by 337 basis points on a year-to-year basis for the quarter.

A Chart of the Kraft Heinz company's net margins (Macrotrends)

The company raised guidance slightly for full year margin expectations. Management now expects gross margins to expand 150 to 200 basis points, versus previous expectations of 125 to 175 basis points.

The core problem the Kraft-Heinz company continues to face is declining net sales volume, both in the US and internationally.

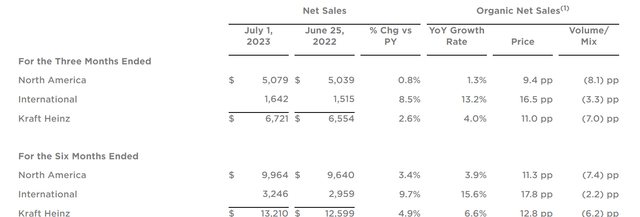

An excerpt from the Kraft Heinz company's second quarter earnings (The Kraft and Heinz company)

This leading food distributor reported that full year organic net sales fell by 7%, which was partially offset by an 11% increase in prices. Net sales were still essentially flat on a year-to-year basis, with an increase from $6.5 billion to $6.7 billion, or 2.2%.

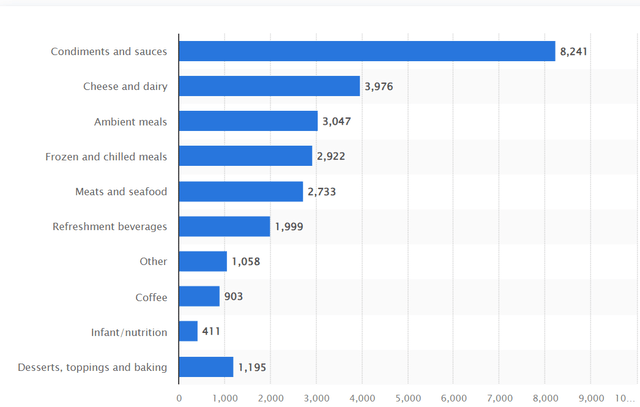

Most of the Kraft-Heinz company's core brands have reached a point of saturation, and management's pricing power isn't enough to offset the marginal growth the food distributor is generating. This company gets more than half of the revenues from their top 4 brands, with condiments and sauces making up nearly a third of revenues alone. Heinz ketchup has nearly 80% market share in Europe, and nearly 60% in the US. The Philadelphia Cream Cheese brand has market share of nearly 70%. These are brands that have reached a saturation point in the US and Europe, and these labels are not growing.

The Kraft Heinz company's product mix (Statista)

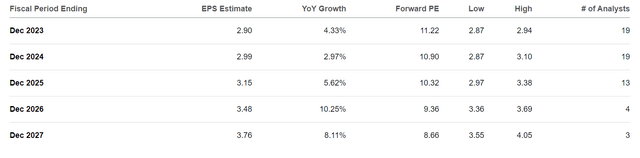

This is why the company still looks overvalued, trading at 10.87x likely forward earnings estimates. Even though the average five-year valuation of the corporation is 12.18x projected forward earnings estimates. This company is expected to see only marginal earnings per share growth over the next several years.

A chart showing the Kraft and Heinz company's expected earnings growth (Seeking Alpha)

The company also trades at 2.19x expect forward sales, which is well above the five-year average valuation of 2.70x projected forward sales. Analysts are only forecasting the company to grow earnings by an average of 4.25% over the next three years, and management has not done a good job with the balance sheet either. Even though the business model is fairly recession resistant, a company growing earnings at a less than 5% a year should not be trading with a double-digit forward multiple. This corporation is also relying on what are likely unsustainable price increases to drive the margin sales growth the company is seeing, and the food distributor's debt levels remain very high.

A chart showing the Kraft and Heinz company's long-term debt (Macrotrends)

Even though the company's long-term debt levels have decline to $19.37 billion, the market cap of this corporation is $40 billion. The move up in rates will also obviously make refinancing these obligations higher as well, and since the company is also already paying out 62.50% of earnings in dividends, the balance sheet does not give management much flexibility to increase cash returns to shareholders.

Still, all investments have risks. If input costs were to fall significantly, Kraft Heinz might be able to rebuild the company's margins. Management could also try to spin off the more saturated brands the company's current business model is built around. Kraft Heinz also has a huge presence overseas, in particular in Europe, a falling dollar would help the company's prospects as well.

However, the reality is that while the Kraft Heinz company has seen some modest recent margin expansion, and management has spun off some of the corporation's less profitable brands, the food distributor still has no clear or viable plan to turn around a business that is relying on 4 saturated brands for nearly half the company's earnings. While the current yield may be appealing to some seeking higher yield, income and dividend investors should be able to find better value elsewhere.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.