Devon: OPEC+ Cuts Remain A Boon To Its Free Cash Flow

Summary

- DVN continues to demonstrate excellent capital allocation across strategic acquisitions and intensified capital expenditure for production growth, fueled by the hyper-pandemic profitability.

- The variable dividend strategy has also allowed the management to effectively allocate its cash flow across debt deleveraging and share repurchases.

- We are highly encouraged by the recovery in WTI crude oil and natural gas spot prices, since DVN's production capacity is split almost equally among both.

- With the OPEC+ cuts and winter stockpiling likely to occur throughout H2'23, we may see the commodities' spot prices remain higher and DVN's FCF yields expanded.

- Combined with the promising volume guidance in FQ3'23, we may see the producer exceed its upper limit FY2023 production guidance range as well.

ansonsaw

The DVN Investment Thesis Remains Robust, Thanks To The OPEC+ Cuts

We previously covered Devon Energy (NYSE:DVN) in June 2023, discussing the management's stellar capital allocation across strategic acquisitions and intensified capital expenditure for production growth, fueled by the hyper-pandemic profitability.

For now, the DVN management has further demonstrated excellent use of capital in FQ2'23, with $699M returned to shareholders (-41.7% QoQ/ -40% YoY), comprising $462M of fixed/ variable dividends and $237M of share repurchases.

The latter has already reduced the oil/ gas producer's shares outstanding to 639M (-1.2% QoQ/ -2.2% YoY) by the latest quarter, otherwise, down by -5.8% from its peak of 679M in FQ2'21.

This is on top of DVN's $6M debt repayment in FQ2'23 and another $242M in August 2023, bringing its overall debt down to approximately $5.92B (-3.8% QoQ/ -4.3% YoY).

Recovery In Commodity Prices

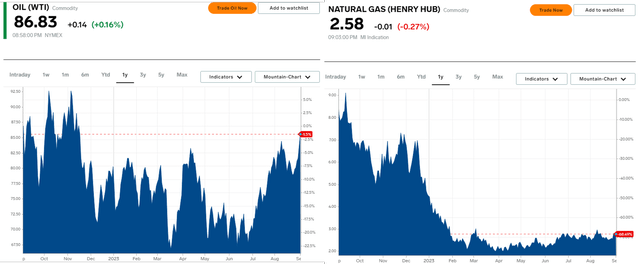

Therefore, while some investors may lament DVN's lower FQ2'23 dividend payout of $0.49 (-31.9% QoQ/ -68.3% YoY), we are not concerned at all. Most of our optimism is attributed to the recovering spot prices by +26.5% for the WTI Crude Oil to $86.83 and by +22.8% for Natural Gas to $2.58/MMBtu from the May 2023 bottom.

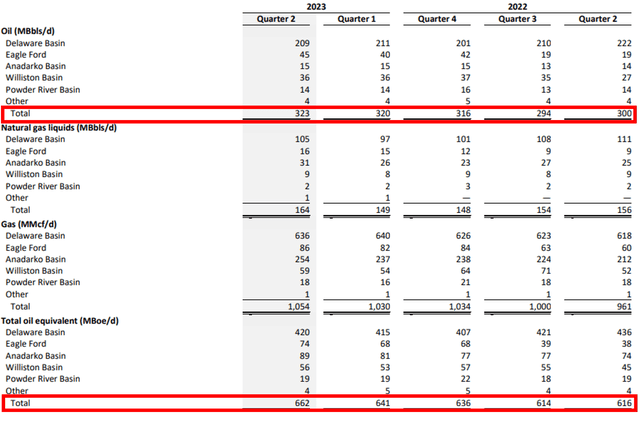

This is an important development indeed, since its production capacity is split almost equally between Oil at 323 MBbls/d (+1% QoQ/ +7.6% YoY) and Natural Gas Liquids/ Gas at 339 MBOED (+5.6% QoQ/ +7.2% YoY) in FQ2'23.

While both commodities' spot prices may have been drastically normalized from the hyper-pandemic heights of $122.11 and $9.85, respectively, we are encouraged by this promising development. This is especially since the WTI crude oil spot prices remains elevated by +43.4% compared to the 2019 averages of $60.

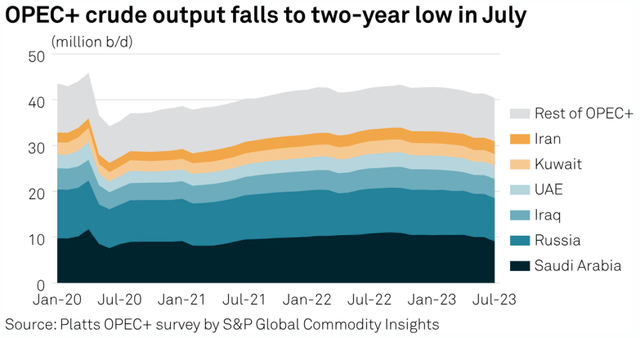

S&P Global Commodity Insights

The higher WTI crude oil prices are likely attributed to the sustained OPEC+ cuts through 2023, with the July 2023 "production at (the) lowest since August 2021." With a tighter OPEC+ supply and consistent global consumption, it is unsurprising that the EIA has estimated that inventories will draw down in H2'23, "placing upward pressure on global oil prices."

While the US government has attempted to refill the US SPR to 349.54M barrels (-100.45M YoY) by August 25, 2023, up by +2.79M from the July 2023 bottom of 346.75M, there remains a great distance of -288.54M from the December 2020 levels of 638.08M.

Depending on the upcoming winter stockpile across the EU and the US, we may see gas prices continue to rise for a little longer as well.

As a result of the great supply/ demand imbalance, we may see the commodities' spot prices remain higher, explaining the DVN stock's recovery since the May 2023 bottom.

DVN's Premium Valuations Reflect Mr. Market's Optimism Surrounding Its Free Cash Flow & Dividend Payouts

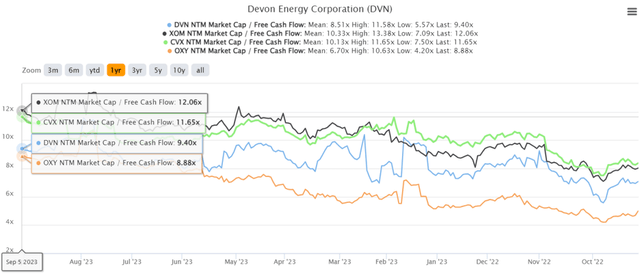

DVN 1Y Market Cap/ FCF Valuations

Therefore, it is unsurprising that DVN is trading at NTM Market Cap/ FCF of 9.40x, elevated compared to its 1Y mean of 8.51x.

The same optimism is also observed with its oil/ gas peers, such as Exxon Mobil (XOM) at 12.06x, Chevron (CVX) at 11.65x, and Occidental Petroleum Corporation (OXY) at 8.88x, against their 1Y mean of 10.33x/ 10.13x/ 6.70x, respectively.

DVN's WTI Break Even & Volume Guidance

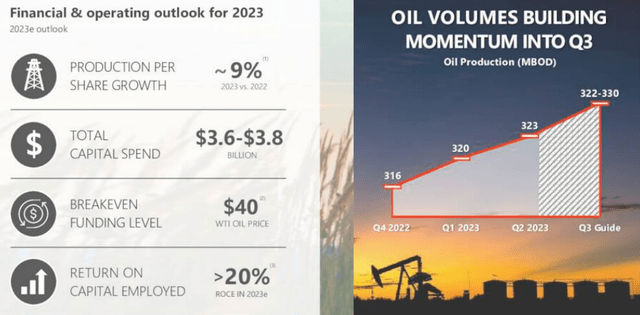

Then again, we believe that DVN is still attractively valued, compared to the oil/ gas sector median Market Cap/ FCF valuation of 10.19x. This is especially due to the widening gap between the producer's WTI breakeven of $40 and the spot prices of $86.09 at the time of writing.

DVN Oil & Gas Production

The DVN management also guided a promising FQ3'23 oil volume of 326 MBOD (+1% QoQ/ +10.8% YoY) at the mid-point.

This builds upon the excellent expansion of its FQ2'23 oil volumes of 323 MBOD (+1% QoQ/ +7.6% YoY)/ overall production of 662 MBOED (+3.2% QoQ/ +7.4% YoY) and FQ1'23 volumes of 320 MBOD (+1.2% QoQ/ +11.1% YoY)/ 641 MBOED (+1% QoQ/ +11.4% YoY), respectively.

Assuming a similar cadence through H2'23 with a moderate ~1% QoQ expansion, we may see the producer exceed its upper limit FY2023 overall production guidance range of between 643 and 663 MBOED.

This is based on our bullish FQ3'23 overall production projection of 668 MBOED (+8.7% YoY) and FQ4'23 projection of 674 MBOED (+5.9% YoY).

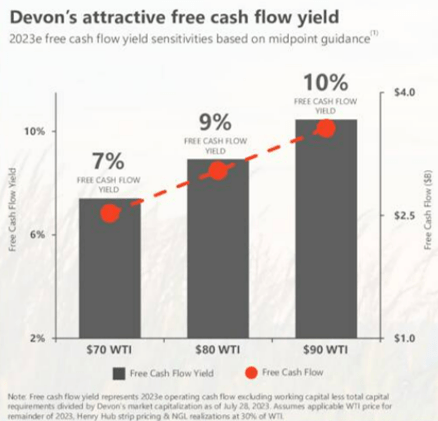

DVN's Projected Free Cash Flow Yield

Seeking Alpha

Thanks to the higher WTI spot prices, we may also see DVN's Free Cash flow margins exceed 9%, as per the management's previous guidance. This is in line to the H1'23 FCF margins and much improved compared to the pre-pandemic average FCF margins of ~4%.

As a result, investors may potentially look forward to an outsized H2'23 variable dividends ahead.

So, Is DVN Stock A Buy, Sell, or Hold?

DVN 1Y Stock Price

While DVN may be trading near its July 2023 resistance levels, we believe that the stock is at a comfortable accumulation range since it is still near its fair value of $49.48, based on its NTM P/E of 8.82x and the consensus FY2023 EPS estimate of $5.61.

Therefore, we maintain our Buy rating for DVN, since the exercise may also allow long-term investors to drip and lower their dollar cost averages accordingly.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.