Iteris: Underappreciated Opportunity With Huge Upside Potential In The Long Term

Summary

- Iteris faced several supply chain issues in F2023 which cause the stock to drop significantly from its 2021-highs.

- These problems are now solved, and ITI is back on a profitable and steady growth path.

- Shares are still undervalued and we see a +100% return in the coming years.

DKart

Investment Thesis

Iteris (NASDAQ:ITI) specializes in intelligent transportation systems technology solutions. They offer a wide range of smart mobility infrastructure solutions, including traveler information systems, transportation performance measurement software, traffic analytics software, and transportation operations software, among others. They also sell original equipment manufacturer products for traffic intersection markets and provide services such as traffic management center design, staffing, and operations, as well as traffic engineering and mobility consulting services.

The stock fell significantly from its 2021 high due to supply chain issues that caused gross margins to vanish. However, the company has fully recovered from these problems and just had one of the best quarters in its history. We believe the stock is undervalued and that it can achieve over $20 in a 5-year period.

Financial Results

Iteris reported Q1 F2024 financial results on August 8, which set records in many aspects. For starters, revenue reached a record high of $43.5 million, marking a 29% YoY increase. The growth was primarily driven by a 44% recovery in sales from the product segment, while the services segment grew by 15% YoY.

The company also achieved record bookings of $53.1 million, reflecting a 25% YoY increase, and a record backlog of $123.8 million, up 14% YoY. Backlog is an operational measure representing future unearned revenue amounts believed to be firm commitments under Iteris' existing agreements, but it does not represent the total contract award if a firm purchase order or task order has not yet been issued under the contract.

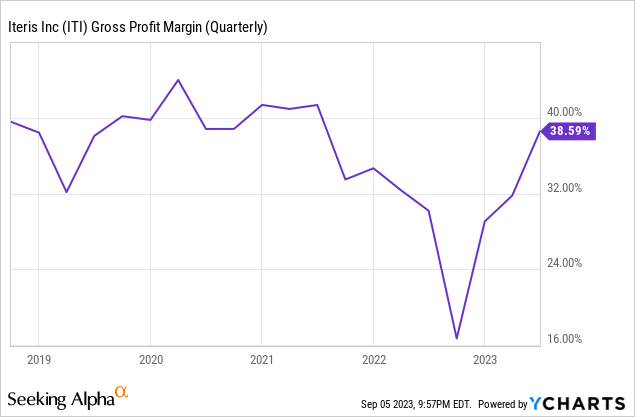

Gross margin was 38.6%, returning to a much more normal level after facing supply issues in the second half of F2022 and F2023. Remember that starting in Q3 F2022, Iteris' sensor business began to encounter component shortages stemming from Chinese COVID lockdowns. As a result, Iteris was forced to source components from other suppliers at 2x-20x regular prices, causing the product gross margins to fall from a high of 49% in Q3 F2022 to just 4% in Q2 F2023. However, these problems are already behind us and gross margin is almost fully recovered.

Iteris also generated record adjusted EBITDA of $3.7 million, a $6.1 million improvement YoY. This represented 8.5% of sales. GAAP net income was $2.1 million, or $0.05 per share, a $7.0 million, or $0.16 per share improvement from the prior year. Overall, Iteris is back in profitable territory.

Cash and equivalents were $20 million, and total long-term liabilities amounted to a mere $10.5 million. The company generated $4.04 million in cash from operations and only spent $0.17 million in capex. As a result, free cash flow was $3.87 million.

Outlook

The management maintained their F2024 guidance. Revenue is expected to be between $168 million and $175 million, representing organic growth of 10% at the midpoint. On the other hand, they estimated an adjusted EBITDA margin in the range of 7%-9% and a net cash flow between $12 million and $16 million.

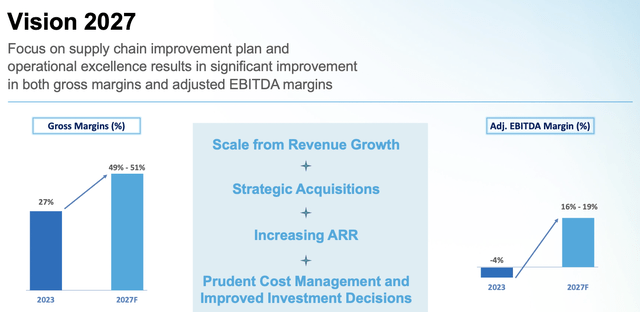

In the long term, they remained committed to achieve their 2027 Vision targets. In other words, they continue to estimate F2027 revenue in the range of $245 million to $265 million before any additional acquisitions, representing a five-year organic revenue CAGR of ~10% at the midpoint. As a result of operation leverage and a higher gross margin, EBITDA margins are expected to increase to the range of 16% to 19%. And additionally, they anticipate improvements in the liquidity to enable Iteris to resume our acquisition program.

Furthermore, the recent enactment of the Infrastructure Investment and Jobs Act (IIJA) and the Safe Streets for All programs promises to direct approximately $600 billion toward transportation enhancements over the next decade. These improvements encompass data collection, analytics, and smart communications. However, Iteris' 2027 Vision guidance does not currently account for the advantages of this expenditure.

And these contracts are moving away from isolated hardware purchases and gravitating toward more extensive, multiyear contracts that incorporate both software and managed services. Iteris has seen positive outcomes from this shift in behavior. The company's Software as a Service revenues have been consistently growing at a compound annual growth rate exceeding 20%, and they are projected to account for over 35% of revenues by FY2027.

Valuation

Iteris is currently trading at 1.15x P/S (FWD), 17.09x P/E (FWD), 13.75x EV/EBITDA (FWD) and has a 6.6% FCF yield. We think these are very attractive multiples for a company growing revenue double-digits and expanding margins rapidly.

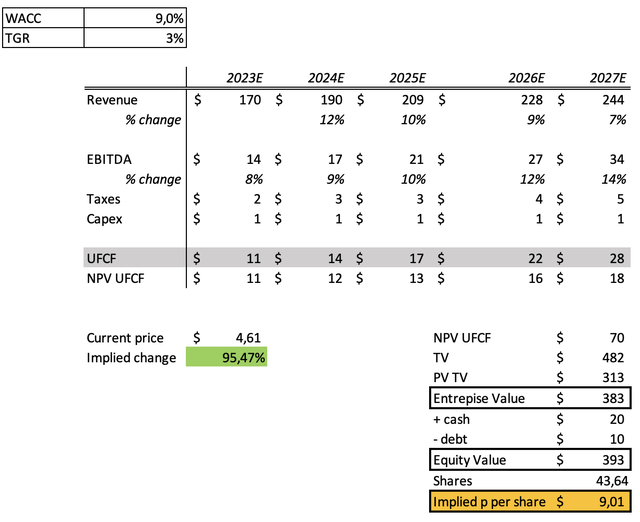

We also decided to do a DCF model. We assumed that revenue will reach the lower-end of their target range for 2027 and EBITDA margin will fall short of estimates and be 14% vs their 16%-19% target. We also assumed a WACC of 9% and a TGR of 3%.

Even with this very conservative estimate, we get an implied value per share of $9.01, which represents a 95.4% increase from current levels. If we were to take the midpoint of the 2027 Vision targets, the implied price per share would be much higher. Overall, we believe that $20 per share is a realistic target the stock can achieve in 5 years.

Risks

As we witnessed last year, supply chain disruptions can have a substantial impact on Iteris' sales and margins. The company primarily sources its products from China, and any disruptions or import restrictions from that region can greatly impact Iteris' bottom line.

The company provides market-leading sensors and is one of the most important players in its market. However, new contenders could emerge and challenge it. We don't see this as a huge risk, but it cannot be overlooked.

Lastly, despite having a large cash position, little debt, and strong free cash flow generation, a recession could quickly turn these things around, and the company may need to seek outside capital. Currently, the company has a $20 million revolving credit facility available.

Takeaway

To sum up, Iteris is a solid company executing on its vision. The stock provided a great entry price at the end of 2021. Even management knew it by announcing a $10 million buyback program. Despite this, it is not too late to get in as we expect the stock to more than double in the coming years.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.