The Enbridge And Dominion Megadeal: Enbridge Wins The Prize

Summary

- Enbridge is acquiring three US utilities from Dominion Energy in a multi-billion dollar deal, bringing diversification and steady growth to Enbridge.

- Enbridge is paying $14 billion for the assets, with $9.4 billion in cash and $4.6 billion in assumed debt.

- Enbridge's exposure to gas distribution will increase from 12% to 22%, boosting profitability from natural gas and renewable energy sources. Dominion will reduce debt by $13.3 billion.

- Enbridge does seem to be the winner in all of this though.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

JHVEPhoto

The management teams at Enbridge (NYSE:ENB) and Dominion Energy (NYSE:D) shocked the investment community when, on September 5, they announced that Enbridge had agreed to acquire three US-based utilities from Dominion in a massive, multi-billion dollar transaction. For Enbridge, this brings additional diversification to its income stream. It also brings an asset that should result in steady and reliable growth in the future. And on top of this, it is all being achieved under terms that are fundamentally attractive to shareholders. Unfortunately, the picture is not as positive for Dominion. While it will get the ability to significantly reduce its debt, which will result in materially lower interest expense on an annual run rate basis, the company did not succeed in getting a great deal for these assets.

A big deal for Enbridge

According to the press release issued by Enbridge regarding the deal, the firm has agreed to purchase three different utilities that are based in the US from Dominion. The first of these is The East Ohio Gas Company. The second is known as Questar Gas Company, and it includes certain companies under the Wexpro banner. And finally, there is Public Service Company of North Carolina. All combined, Enbridge is paying $14 billion for these assets. Of that, $9.4 billion will be in the form of cash, with the other $4.6 billion coming in the form of debt that the enterprise will be assuming.

The largest chunk of this transaction involves The East Ohio Gas Company. The purchase price of it should be roughly $4.3 billion, with assumed indebtedness of $2.3 billion taking the total transaction value up to $6.6 billion. Next in line, we have Questar and Wexpro, which, in the aggregate, will cost $3 billion on top of $1.3 billion of assumed debt. That gives us a final price of $4.3 billion. And lastly, we have Public Service Company of North Carolina. It should cost the company about $2.2 billion, plus another $1 billion in assumed debt. Because of rounding, we end up with a total purchase price of $3.1 billion.

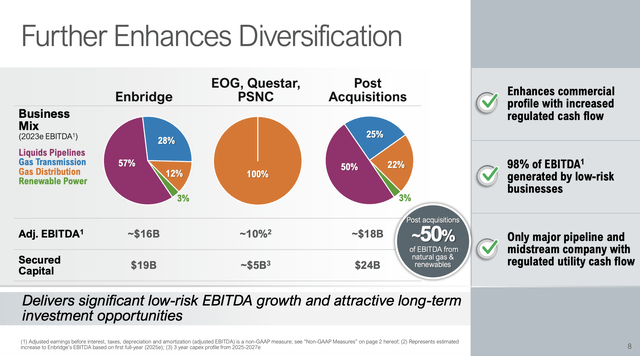

Let us ignore, for a moment, the financial side of this transaction. Let's instead focus on why this deal makes sense, conceptually, for Enbridge. Management has long sought after additional operations that provide low risk for shareholders and that are capable of generating attractive financial results. The utility space has been known for these kinds of opportunities. Today, Enbridge is a diverse business. However, it is also true that the majority of the operation is dedicated to the liquids pipelines space. Using estimates for 2023, this category for the company is responsible for 57% of EBITDA. This is followed by 28% for the gas transmission business, 12% for gas distribution, and the remaining 3% for renewable power.

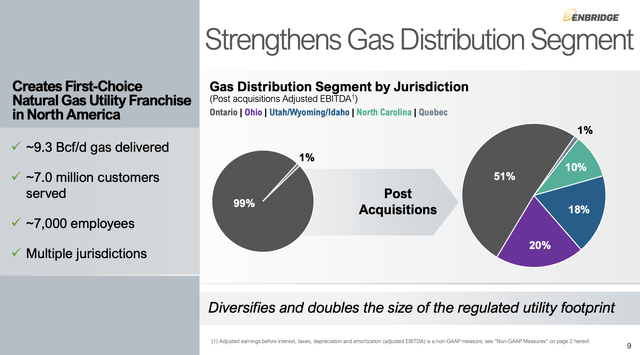

The great thing about these utilities is that 100% of their EBITDA falls under the gas distribution category. After completing the transaction, this will boost Enbridge's exposure to gas distribution from 12% to 22%. In fact, when you combine gas distribution, gas transmission, and renewable power, approximately half of the profitability that the company achieves should come from natural gas or renewable energy sources. This is noteworthy because the company will operate as the only major pipeline and midstream operator out there that has cash flow coming from a regulated utility outfit. Geographically, Enbridge will see its gas distribution operation go from an enterprise that generates 99% of its EBITDA from a single market, that being Ontario, Canada, to generating only 51% of EBITDA from that market. In second place we'll be Ohio at 20%. This should be followed up by Utah, Wyoming, and Idaho, all at 18% in aggregate. North Carolina will account for 10%, while the final 1% will come from Quebec.

Operationally speaking, gas utilities might not seem like such attractive growth areas. However, management has identified around $5 billion worth of investment initiatives that it can focus on over the next three years. It's unclear exactly how the company will grow with the spending. But it wouldn't be shocking to see the volume of gas delivered increase. Already, these three utility companies are responsible for 9.3 Bcf per day of gas delivered to roughly seven million customers throughout North America. Regardless of the growth opportunity, management has said that they expect an 8% cumulative annual growth rate of the consolidated rate base associated with these assets.

Financially speaking, I would argue that this transaction makes a lot of sense for Enbridge. Using the midpoint of expectations, Enbridge was expected to generate about $16.2 billion of EBITDA this year. This number should climb to roughly $17.8 billion on a pro forma basis since, according to management, this purchase will increase profitability by roughly 10%. That's $1.6 billion, which implies an EV to EBITDA multiple on the utilities of 8.6. Operating earnings in 2023 are estimated to be $564 million. And next year, we are looking at about $561 million. That is a price to earnings cash flow multiple of approximately 16.8. We do know that, in order to fund at least some of this purchase, Enbridge is issuing between $2.93 billion and $3.37 billion worth of stock.

Even though this does not even cover most of the purchase price, shares of Enbridge are trading at a price to earnings multiple of 26.4 and at an EV to EBITDA multiple of 9.9. The debt picture is a bit more complicated. We don't yet know what the terms on any debt that it will have to issue will be. But we do know that recent debt issuances have carried interest rates ranging between 4.9% and 5.97%. If we assume that the company uses $500 million of its $1.90 billion in cash on hand, that it uses $3.37 billion worth of cash from its stock issuance, and that the remaining $5.53 billion of the purchase price brings with it a weighted average interest rate of 6%, that would decrease profits on the utilities acquired by roughly $331.8 million on an annual run rate basis. That does eat away at the initial profit base. But the end result would still be extra cash flow coming on to the company that has largely been acquired on fairly attractive terms. Even if we lump together the debt that we assumed that Enbridge will have to take on, add on top of this the $500 million in cash used from the company's balance sheet today, and strip out from the profit forecast for next year the cost of interest, we are still looking at a price to earnings multiple being paid for these assets of 26.3. That is basically in line with what Enbridge is trading for today.

Unfortunately, when it comes to Dominion, I am not as optimistic. Just recently, on September 1, the management team at Dominion completed selling off its 50% ownership interest in Cove Point to Berkshire Hathaway (BRK.A) (BRK.B) in a deal valued at $3.3 billion. It also received $0.2 billion worth of proceeds from the settlement of related interest rate derivatives. I would have thought that the company would have been satisfied with that sale. However, it is clear that I was incorrect. Since the management team at Dominion does not provide detailed guidance for the full fiscal year, we don't really know what to expect for 2023. However, I did calculate that while profits are volatile this year compared to last year, EBITDA is more or less in line. So I don't expect the cash flow picture of the business to be materially different on a forward basis relative to what was seen in 2022. The fact of the matter is that Dominion is currently trading at a price to earnings multiple of 33 and at an EV to EBITDA multiple of 11.4. And yet, it sold off these major utility assets at prices lower than this. Personally, I do not consider that a great move. However, I am happy that this deal will result in the company reducing debt by roughly $13.3 billion. This comes from the $4.6 billion in debt assumed by Enbridge, plus it incorporates $8.7 billion of after-tax proceeds associated with the utilities sales.

Takeaway

From all that I can tell, the transaction between Enbridge and Dominion is interesting. I would definitely say that Enbridge is sitting on the better side of the transaction. Don't get me wrong. There are some benefits for Dominion, but I do not think the price was high enough for the company to be applauded for this deal. All things considered, this transaction has made me feel comfortable with a 'buy' rating for Enbridge while also encouraging me to downgrade Dominion from a 'buy' to a 'hold'.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

As you noted high electricity growth is expected in the markets they acquired, which means more NG revenue. I also expect they plan on a lot of efficiency improvements.