Terex Corporation: Rating Downgrade As Share Price Has Reached My Target Price

Summary

- I revised my Terex stock rating from a buy to a hold as it has reached the previous price target.

- That said, Terex's financials show impressive results with a substantial rise in net sales and an increase in earnings per share projection.

- I believe the market anticipates growth normalization in the future, which will keep valuation at the current levels.

kali9

Summary

Readers may find my previous coverage via this link. My previous rating was a buy, as I believed Terex Corporation's (NYSE:TEX) valuation had corrected to a level where the risk-reward situation became much more attractive. I am revising my rating from a buy to a hold rating as the stock has reached my previous price target. I am confident that TEX can continue to grow at the current pace for the rest of FY23; however, the share price has caught up with my expectations. Growth will eventually normalize in FY24/25, which I expect will continue to keep valuations at their current low levels.

Financials / Valuation

Early August, TEX reported 2Q23 EPS of $2.35, marking a 30% increase over the consensus estimate of $1.66. This impressive result was fueled by a substantial rise in net sales, reaching $1.4 billion. The revenue growth was primarily driven by a 27% increase in volume and a 4% uptick in pricing. Consequently, the 2Q23 EBIT stood at $210 million, accompanied by a remarkable margin increase of 540bps, reaching 15%. Given this strong performance in the second quarter, the company's management decided to revise their 2023 guidance upward. The new guidance includes an EPS projection of $7.00, up from the previous range of $5.60 to $6.00, an expected net sales figure of $5.1 billion, reflecting a 15% top-line growth, and an operating margin of 13% at the midpoint.

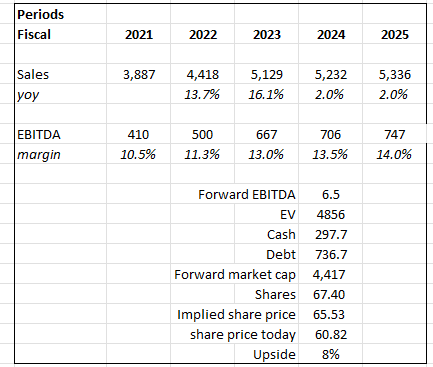

Based on author's own math

Based on my view of the business, TEX should sustain its strong growth for the rest of the year, and I am positive about the business. However, the reality is that the share price has caught up to my previous price target of $60. The market is clearly looking ahead to FY23 performance as valuation has compressed to the lower end of the historical range (6.5x forward EBITDA). This is likely accurate, as after the strong FY23, FY24, and FY25, we should see normalization in growth, especially after the strong FY22 and FY23 growth of 30% in the 2-year growth stack. I would assume valuation to stay at this depressed level as TEX sees growth normalization in FY24/25.

Comments

As I have address the valuation part of the story above, I will now focus on the business. With strong recovery in EBITDA to an all-time high of $222.7 million at 15.9% margin, I think investors’ concern is whether this momentum can continue for FY23, or would we see a slowdown from here. In particular, will volume growth continue next year, and how much of the margin gain can be expected to continue. In terms of volume, I expect the recent growth to persist for the rest of FY23. The results for 2Q23 show the continued strength of growth, with volumes up 27% year over year. Electrification initiatives, onshoring, data warehousing, chip manufacturing, and clean energy all contributed to the expansion of the end markets. AWP also showed strength. Despite being exposed to one of the relatively weaker end markets (housing), concrete may see improvement in the coming months as housing market indicators show a bottoming trend. Also, despite China's economic slowdown, the company has redirected its focus on exports to satisfy the robust demand in other regions and to shield itself from price competition in the domestic market.

Our concrete business is more tied to residential construction of any of our other businesses and you saw the decline in residential starts. I think that's going to bottom out here in the second and third quarter and then pick back up.

A year ago, we would have had more backlog in China. But given the Chinese market and the softness that we've seen in the Chinese market, we chose to take the product from China and export it to other regions rather than fight the pricing levels, frankly, that were going on in China. Source: 2Q23 earnings

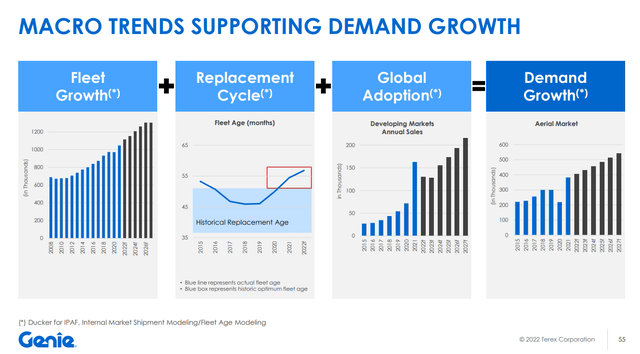

In addition, I think there are visible growth indicators. For instance, during the year 2024, an increase in volume is expected due to the utilization of infrastructure stimulus funds designated for the replacement of an aging vehicle fleet. Additionally, company management has acknowledged that there will likely be sustained demand for AWP (aerial work platform) products, mainly due to the higher-than-average age of customer fleets. TEX shouldn't have any trouble meeting this impending increase in replacement demand because, as far as management is aware, there is currently no supply capacity issue. Government stimulus is also expected to boost MP's aggregate business, while Fuchs' recent efforts to diversify into tree care and environmental applications will lessen the company's reliance on economic cycles.

TEX Analyst day 2022

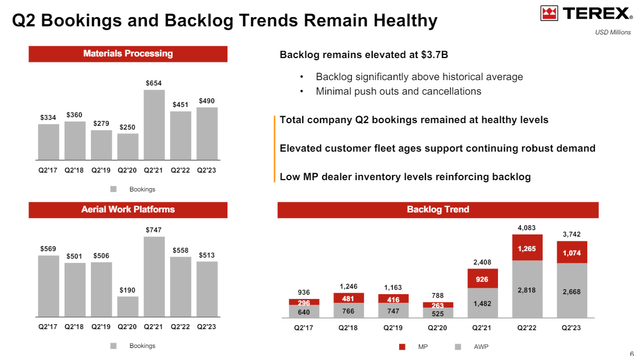

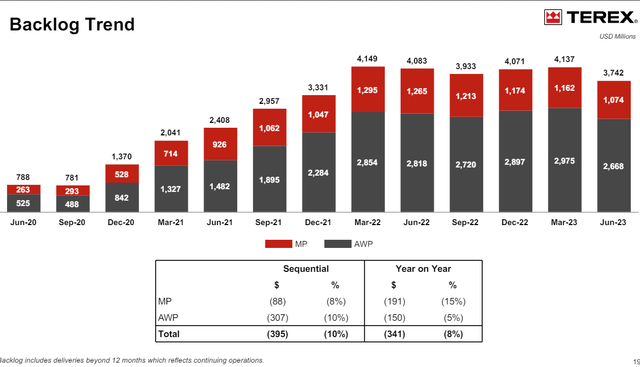

Moreover, TEX should reap the benefits of a normalizing elevated backlog and a relaxing supply chain in the near future. In particular, MP's (materials processing) backlog is still about 2.5x higher than normal, as low dealer inventories contribute to the problem. Meanwhile, AWP's backlog is still 3x the norm. With fewer bottlenecks in the supply chain, TEX would be able to turn its backlog into revenue more quickly.

TEX

TEX

Lastly, I anticipate that this increase in volume will yield a substantial boost in incremental profit margins. In case you overlooked it, management indirectly conveyed the message that profit margins would be greater, as evident in their guidance, where the implied incremental margin was approximately 36%. This figure is notably 500bps higher than the previous 31% at the midpoint. Regarding the sustainability of these improved margins, I believe they are likely to last. My assessment is grounded in the belief that most of the recent margin enhancements were the result of initiatives in areas like value stream optimization, supply chain improvements, and overall cost efficiency rather than relying heavily on price increases.

Conclusion

I am adjusting my rating for TEX from a buy to a hold rating as the stock has reached my previously set price target. While TEX is poised to maintain its strong growth trajectory for the remainder of FY23, the share price has now aligned with my expectations. The market appears to be forward-looking, with valuations at the lower end of the historical range (6.5x forward EBITDA), anticipating a normalization in growth after the robust FY22 and FY23 performance.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.