Aptiv: Positive Momentum Should Continue Through FY25

Summary

- Aptiv's recent performance, particularly in the ASUE segment, shows positive profitability and potential for further growth.

- 2Q23 results demonstrate strong revenue growth, outperforming industry standards, with key segments like active safety and high voltage expanding significantly.

- The long-term risk is that growth will ultimately rely on overcoming competition challenges to expand the number of content per vehicle.

DarioGaona/E+ via Getty Images

Overview

My recommendation for Aptiv (NYSE:APTV) is a buy rating, as I am positive about APTV's ability to continue growing as the ASUE margin is finally seeing signs of positive inflection and growth to persist at this momentum given the visibility from bookings.

Business

APTV manufactures and distributes vehicle components. The company produces connector wires, safety restraint systems, pin headers, and underwater towed arrays for automobiles and commercial vehicles. APTV reports in two segments, namely Signal & Power Solutions [SPS] and Advanced Safety & User Experience [ASUE].

Recent results & updates

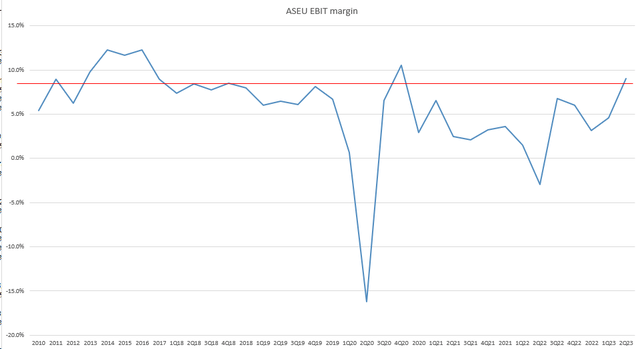

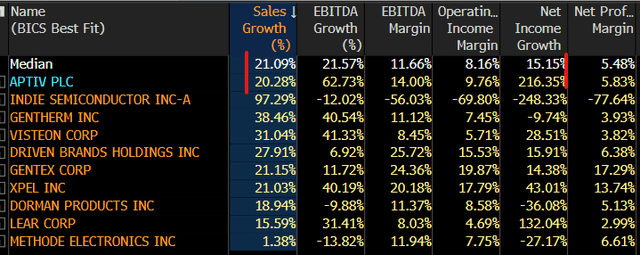

In 2Q23, APTV reported robust financial results thanks to growth in the ASUE segment, particularly in active safety, and consistent demand for the company's high-voltage and commercial vehicle offerings. Organic growth in 2Q23 revenue was 25%, bringing the total to $5.2 billion, which represents a 10% outperformance vs. the industry. Crucially, the company experienced strong GoM in every single region. Despite tougher comparisons from the previous year, high-growth product categories like active safety and high voltage showed solid growth of 49% and 48%, respectively. In particular, I'd like to highlight the APTV ASUE segment, which has recently demonstrated promising growth, producing 9% EBIT margins. Looking back over the past few quarters, the EBIT margin for the ASUE segment has been dismal and has recently deviated into the high single digits. I believe this was a surprise to many, as a steep acceleration was needed from the 5% in 1Q23. If we extrapolate this momentum, it implies that ASEU segment EBIT margin could reach the low teens range.

After taking the biggest hit from the company's cost pressure and inefficiencies over the past year, ASUE appears to be on the mend, thanks to a significant sequential increase in segment margin. You may also remember that during investor day, company management projected that this segment's margin would increase to 13-13.5% by FY25. I see a more direct path to this target for APTV in FY25 if they can hit EBITDA in the low teens in 4Q23.

Based on the company's current bookings and the momentum of its high-growth segments, I expect APTV to continue delivering strong growth in the years to come. Based on the most recent data, APTV has delivered $6.1 billion in bookings during the quarter, bringing the yearly total to $20 billion and putting the company on track to meet its FY23 target of $32 billion in revenue. Importantly, management anticipates active safety (which contributed $400 million in bookings to ASUE $1.7 billion bookings in 2Q23) will grow by more than 30% in the medium term, so the growth outlook is positive. In addition, thanks in large part to the incorporation of Wind River, management anticipates annual growth in its smart vehicle compute & software business of more than 20%. I have faith that APTV will continue to thrive in the coming years as these industries rapidly expand.

Overall, I think the recent performance has significantly boosted my confidence (and the market as can be seen from the price action post earnings) as APTV showed strong growth compared to the industry thanks to its success in niche applications like electric vehicles, it increased its EBIT margins, and it increased its guidance for FY23. Notably, APTV restated its 2025 goals, which entail a sizable increase in margins thanks in part to the company's improved efficiency in running its operations in a more typical supply chain setting.

Valuation and risk

Author's valuation model

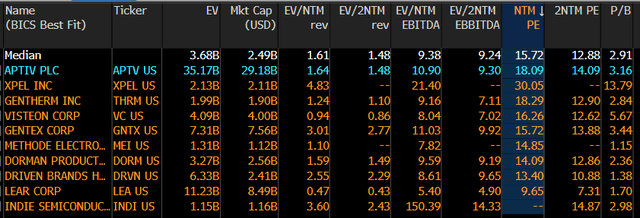

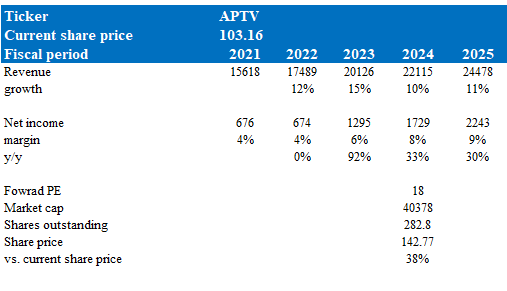

According to my model, APTV is valued at $142 in FY24, back to where it was before the 2022 collapse, representing a 38% increase. This target price is based on consensus growth estimates from FY23-FY25, which forecast low-teens growth and improving margins, both of which I believe are likely to happen based on my view above.

APTV is now trading at 18x forward earnings, which I believe will remain at this premium against other auto parts players as it has better margin across EBITDA/EBIT/Net and comparable growth rates. When looked across history, this multiple is also well within the 10-year trading average of 18x (range between 9x and 27x).

The risk lies in the long-term growth outlook, where APTV needs to increase the number of content per vehicle. To do that, APTV needs to roll out relevant products that are better than existing offerings. I believe APTV will be able to do it, but it is likely that there are already incumbent offerings, and hence, it will not be easy from a market share grab perspective.

Summary

My recommendation for APTV is a buy as the company's recent performance, particularly in the ASUE segment, demonstrates a positive inflection in profitability, with promising signs of further growth. APTV's 2Q23 results also showcased strong revenue growth, outperforming industry standards, and key segments like active safety and high voltage displayed substantial expansion. The ASUE segment's EBIT margin is on an upward trajectory, potentially reaching the low teens range, and management's projection of a 13-13.5% margin by FY25 seems more attainable. However, long-term growth relies on expanding the number of content per vehicle, which poses competition challenges.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.