Tesla: Overvalued Car Company - Likely To Face Further Margin Deterioration

Summary

- Tesla, Inc.'s dwindling margins emphasize its identity as an automaker, refuting the claims of staunch supporters that it deserves a different valuation. Tesla begins to face the hurdles of traditional car companies, including supply chain disruptions, cyclical business patterns, and heightened competition.

- Thorough examination, including both relative and fundamental valuations through an in-depth DCF, exposes Tesla's current share price as unsustainable. Even if we overlook the margin situation, it remains significantly overvalued.

- Elon Musk's unpredictable actions and statements, particularly on social media, introduce an additional layer of risk. His disregard for shareholder concerns and potential political associations could impact the company's success.

Introduction

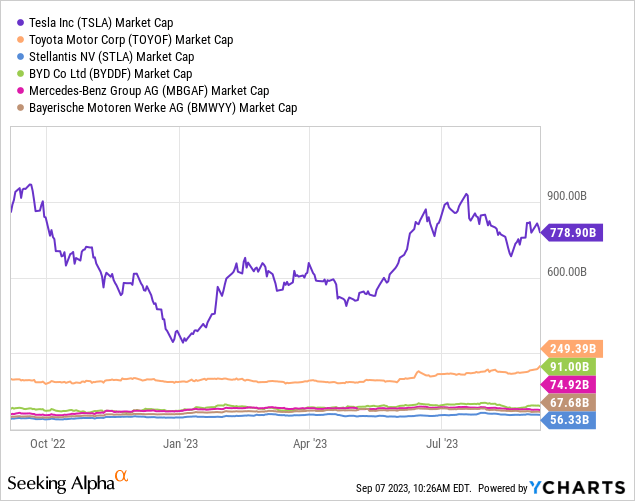

In 2023, Tesla, Inc.'s (NASDAQ:TSLA) stock, has been nothing short of a rollercoaster ride. With a staggering 130% year-to-date increase, it has outperformed the S&P 500's (SP500) modest 17% rise. Even more astonishing, Tesla's shares have soared from a 52-week low of approximately $101 to over $250, propelling its market capitalization to a mind-boggling $800 billion. But as investors, we must now ponder: how much higher can Tesla ascend?

In this article, I am going to discuss the margin situation around Tesla and take a closer look at its fundamentals to assess what is already priced in. In that context, is there even room for Tesla shares to soar further based on reason, or more preciously, on its fundamentals? I discuss why I put a "SELL" tag on Tesla shares at their current price levels.

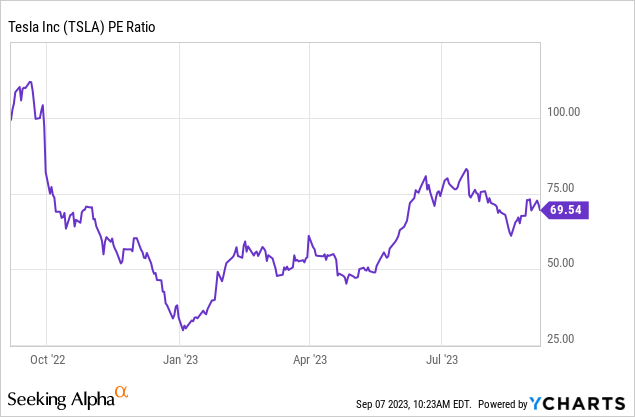

Relative Valuation

At present, Tesla's stock valuation has reached dizzying heights. Its forward price-earnings ratio has escalated to 70 times, a significant surge from the starting point of around 30 at the beginning of the year.

Furthermore, Tesla's market value almost stands at a massive $800 billion, more than three times that of Toyota, the world's largest car manufacturer and far beyond every other existing automaker in the world.

Recent Developments

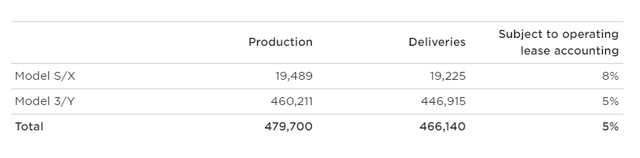

In the second quarter of the year, Tesla showed no signs of slowing down, delivering a staggering 466,140 vehicles, marking an 83% year-over-year increase. This impressive figure not only exceeded analysts' predictions but also represented the company's most substantial delivery beat in nearly two years. Additionally, Tesla's global deliveries experienced an 83% surge in the second quarter, fueled in large part by aggressive price reductions and substantial discounts.

TSLA - Q2/23 Vehicle Production & Deliveries (Tesla)

Moreover, Tesla unveiled a promising partnership with General Motors (GM), allowing drivers to access 12,000 Tesla superchargers through an adapter beginning next year. This breakthrough comes after a similar collaboration with Ford Motor (F).

While these developments appear encouraging, looming headwinds must not be overlooked.

Price Cuts and Margin Deterioration

Despite Tesla's sustained growth, the specter of lower margins in 2023 threatens to offset the profit gains from increasing deliveries. The only scenario in which this margin challenge seems justified is one in which Tesla captures a lion's share of the industry's profit, mirroring Apple's dominance in the mobile phone sector. However, fierce competitive battles in China, the world's most mature EV market, suggest that this path to dominance remains narrow.

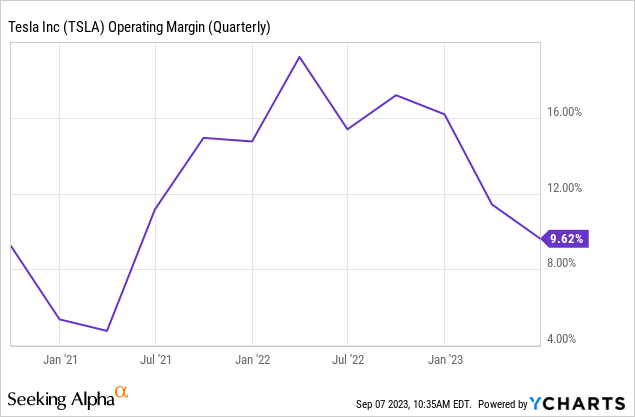

Tesla's price cuts have played a central role in Tesla being able to keep up with its growth ambitions. Nevertheless, they have also eroded the company's once-impressive profit margins, basically offsetting the additional top-line gain in terms of resulting net profits. Since Q2 2022, these margins have been on a steady decline, dipping below the 20% in 2023. The second quarter in 2023 saw Tesla report margins of merely 9.6%, primarily due to extensive price reductions across all models and markets.

Tesla attributes these discounts to lower demand in an uncertain economic climate, but I would also point to additional challenges, including supply chain disruptions and mounting competition. I argue that Tesla is beginning to align with the realities of its status as an automaker.

It's a Car Company

Tesla's status in the market has been an ongoing debate. While it is fundamentally an automaker, its valuation today places it more in the league of tech giants like Apple (AAPL), Nvidia (NVDA), and Microsoft (MSFT). However, the recent decline in margins underscores its factual automaker identity, in my opinion. Tesla's cars serve as just that-vehicles for transportation. Now, Tesla also faces typical automaker challenges, including cyclical fluctuations and competition from emerging players like Chinese powerhouse BYD Company (OTCPK:BYDDF).

Fundamental Valuation

To gain a deeper understanding of Tesla's valuation, let's delve into the company's financials using a Discounted Cash Flow (DCF) analysis, which assesses the stock's potential based on fundamental metrics.

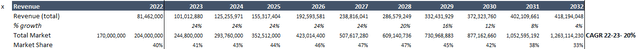

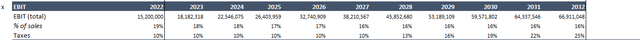

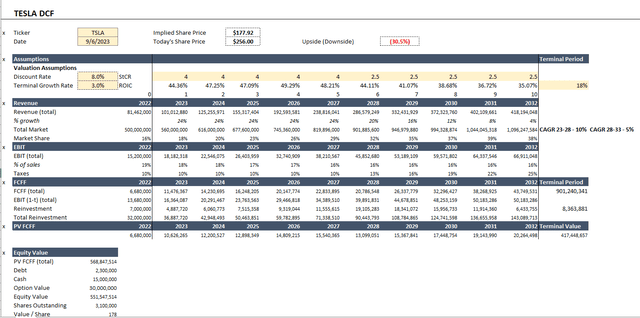

In 2022, Tesla reported total revenue of approximately $81 billion, boasting a robust 19% operating margin. This translated to an EBIT (Earnings Before Interest and Taxes) figure of approximately $15 billion.

TSLA - My DCF at a glance (Author)

It's worth noting that my calculation employs a non-GAAP approach, treating Research and Development (R&D) expenses not as operating costs but as investments amortized over a 5-year period. Consequently, this method results in a higher non-GAAP operating margin, while Tesla's actual operating margin at the end of 2022 stood at 17%.

Within my DCF analysis, I compute Free Cash Flow to the Firm (FCFF) by deducting reinvestments from the EBIT figure, adjusted for taxes. These reinvestments are estimated using the sales capital ratio over a 10-year period and are based on a reinvestment rate during stable growth (g/ROC).

Starting in 2023, I project a stable top line growth of 24%, which gradually decreases to approximately $420 billion in revenue by the fiscal year 2032. This revenue projection equates to a market share of roughly 33% within the global electric vehicle market, which is set to reach more than a $1 trillion in sales by 2032.

This assumption is probably highly optimistic, given the expected competitive pressure from industry peers like BYD and other EV manufacturers. However, I intentionally employ optimistic assumptions for the sake of analysis, proving that even under optimism, there is just no rational room for Tesla shares to grow even higher.

Regarding operating margins, as mentioned, I incorporate R&D adjustments, which typically contribute an additional 200-300 basis points (bps) to the margin. Overall, I essentially assume an optimistic scenario in which Tesla actually manages to recover and maintain its superior margins of the past. For FY 2023, I imply an operating margin of approximately 15%, including the R&D adjustments.

However, it's worth noting that this estimate is likely to be significantly higher than the actual full-year operating margin, which is expected to be around 10%. This is evident from Tesla's reported operating margin of 9.6% at the end of Q2 2023, down from about 11.5% in Q1 2023.

With these optimistic assumptions, along with a 3% implied terminal growth rate and an 8% discount rate, I arrive at a total Equity Value of approximately $580 billion. This considers the value of options or warrants for Tesla. To provide a clearer view of the equity value, after adjusting for these options or warrants, the fair price is estimated to be around $450 billion. This implies a fair share price of approximately $180, representing a downside of around 30% from Tesla's current stock price of approximately $250.

It's important to emphasize that these assumptions are notably optimistic. Thus, it becomes evident that as of today, Tesla is significantly overvalued, and the numbers do not align with the company's current stock price.

So, given these operational uncertainties and Tesla's current valuation, I have placed a "sell" rating on the stock. While Tesla's shares have historically demonstrated remarkable volatility and thus have frequently allowed attractive levels of entry - a buy high, sell low story -, the current valuation is lunacy, and buying the stock at its present valuation presents a significant risk.

Conclusion

In the whirlwind world of Tesla, where stock prices have soared to dizzying heights, it's essential to take a step back and assess the reality beneath the hype.

While Tesla has undoubtedly made significant strides, achieving record-breaking delivery numbers and securing promising partnerships, there are storm clouds on the horizon. One of the most critical factors is the decline in Tesla's operating margins, a clear reminder that it is, at its core, an automaker facing the challenges of pricing pressures, supply chain disruptions, and increasing competition.

The bulls may argue that Tesla deserves a valuation akin to a tech company, given its innovative approach and groundbreaking technologies. Still, the numbers speak a different language. Furthermore, the competitive landscape is evolving rapidly, with Chinese companies like BYD gaining ground and posing a substantial threat to Tesla's dominance.

In my valuation analysis, even with optimistic assumptions about future growth and margins, it becomes evident that Tesla's current stock price is significantly overvalued. The numbers simply do not justify the exuberance surrounding the company's shares.

I prefer investments that possess a favorable risk-reward ratio, which means that under very conservative assumptions, the valuation still points to significant upside. That is not the case for Tesla. Hence, I firmly recommend a "SELL" rating for Tesla, Inc. stock.

Maja Hitij

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this equity analysis article is for informational purposes only and should not be construed as financial or investment advice. The author of this article (hereinafter referred to as "the Author") is not a licensed financial advisor or registered investment advisor. The Author has prepared this article based on publicly available information, financial data, and their own research. While the Author strives to provide accurate and up-to-date information, they make no representations or warranties of any kind, express or implied, regarding the accuracy, completeness, or reliability of the information presented in this article. The Author disclaims any liability for any investment decisions made based on the information provided in this article. Conflict of Interest Disclosure: The Author has no conflict of interest in writing this equity analysis article. At the time of writing, the Author does not own any shares, derivatives, or any other financial interest in the equity of the company under analysis. Additionally, the Author has not received any compensation from any individual or entity for writing this article, other than Seeking Alpha. Forward-Looking Statements: This article may contain forward-looking statements and projections based on the Author's assumptions and beliefs. Such statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. The Author is not responsible for any reliance placed on such statements.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (16)

Included: charging stations at new hotels, motels, amusement parks, hospitals, spas, retirement communities, etc.

Only Tesla cars will be permitted to access/use these underground autobahns.

Tesla stock will soar!!! Buy now!! Buy! Buy! Buy!

- Humanoids: 10 companies now all with protoypes

- FSD: check nvidia to see what is on offer to the world

- Energy: not interesting. If you wanna invest in a renewables company be my guest.

- Cars: competition aboundSo as a bulll, the only thing Tesla has going is Elon and his track record. That's worth to me 5x fold over the competition, tops