XLU: Utilities May Be The Best Undercover Short Opportunity Today

Summary

- Utility stocks are often considered a hedge against recession-related risks due to their non-cyclical nature and virtually guaranteed profits.

- However, utility companies are facing significant risks, such as supply-side issues, infrastructure inadequacies, and an aging workforce.

- Utilities may be the most overvalued sector, trading at a significant premium to bonds that suggests over 20% in downside is needed to normalize its dividend spread to Treasuries.

- Utility companies face negative and falling free cash flow, primarily due to substantial CapEx cost increases.

- XLU may be an "undercover" short opportunity due to its downside risk as it returns to parity with bond yields.

Shenki

Utility stocks, such as those in the popular ETF NYSEARCA:XLU, are often considered an ideal hedge against recession-related risks. The sector is essentially non-cyclical and benefits from nearly guaranteed profits, often mandated through government rate decisions. Historically, utility stocks are "bond-like" compared to most equities. Over the past 36 months, XLU's correlation to the S&P 500 is just 0.6X, while its correlation to the 20-year Treasury bond ETF (TLT) is 0.3X; oddly, the S&P 500's correlation to TLT is significantly elevated at 0.5X, breaking its usual pattern of almost always being negative.

In most circumstances, stocks and long-term bonds have a negative correlation, while utilities have a slightly positive correlation. Fundamentally, this pattern stems from the fact that, although utilities are equities, their earnings are not as cyclical as most companies. Further, they are usually positively correlated to bonds because higher interest rates lower the present value of non-growth dividend stocks, particularly utilities. Today, the pattern is anomalous because stocks, bonds, and utilities correlate positively, indicating that rate sensitivity is higher across the stock market. Further, this indicates that utilities are not adjusting to higher interest rates, unlike REITs and other rate-sensitive sectors.

I discussed some issues in the utility sector relevant to XLU last year in "XLU: Utilities Are No Longer A 'Safety Trade.'" Since then, the ETF has only lost around 3% of its value. That said, it has suffered a relatively large drawdown over the past six weeks, declining by about 10%. Similar losses have been seen in all of the top holdings within XLU, indicating strong breadth to the utility sell-off. With that in mind, I believe it is an opportune time to take another close look at the fund and the utility sector to determine whether or not its downside risks may continue.

Utilities Face Significant Risks

Investors have flocked to utility companies over recent years due to the widespread belief that they're an ideal hedge against market risk. While it is true that utilities do not suffer cyclical demand pressures, that alone does not make utilities low risk. Utility firms are struggling with supply-side issues in the labor and materials market and issues relating to infrastructure inadequacies and dilapidation. The U.S. electrical grid is extremely old as many utilities avoid capital upgrades, exposing many to massive damage-related lawsuits. To make matters worse, most utility company employees are near retirement age, increasing expected labor costs significantly.

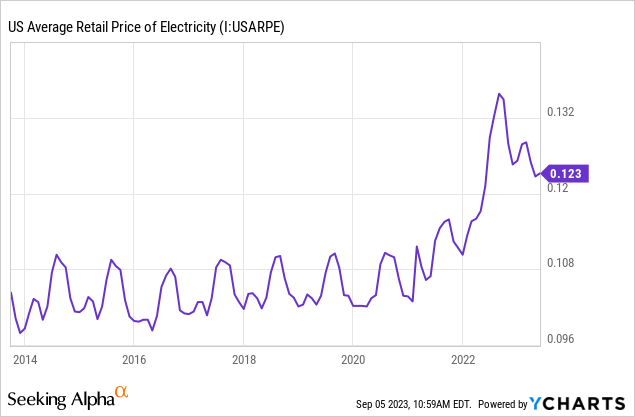

While many utilities are pushing related costs onto customers to ensure constant margins, the considerable increase in electricity costs over recent years has led to growing rate-hike pushback from many local governments (1, 2, 3, 4). Still, electricity retail prices remain at significantly elevated seasonal levels, around 25% above pre-COVID norms. See below:

As this trend has continued, record numbers of American households are falling behind on utility bills. The issue has become so extreme that California, the most expensive electricity state, wants to create an "income-based" utility cost program. While utility companies remain generally protected against cyclical risks, this is far less true today as utilities become more expensive. If unemployment eventually rises in the US, I expect many more people will not pay power bills. As we saw during COVID, many states changed rules that forced utilities to continue to provide service even without payments; thus, similar or larger actions are possible in the event of another recession. State regulators will likely side with voters, not utility companies, if conditions become too difficult for voters.

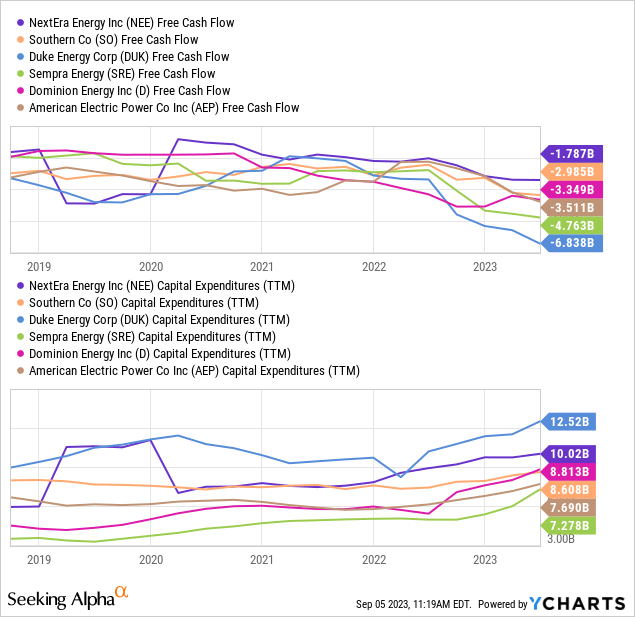

All six of the largest utilities in XLU are seeing considerable increases in CapEx as maintenance costs rise and the need for infrastructure improvement expands. Accordingly, all have negative free cash flow, with a solid negative trend. See below:

Utilities are earning roughly the same profit as they have, but far more is going toward CapEx. All six have also seen increases in accounts receivable over the past two years, indicating a rise in behind payments. I expect this issue to expand following the Hawaiian Electric (HE) debacle, echoing a similar pattern from California's PG&E (PCG) following the devastating Camp Fire event. While legal opinions on this issue will undoubtedly vary, there is an increase in stock value exposure to wildfires relating to utility firms' outdated or poorly maintained infrastructure.

At this point, I would not say utilities are "cyclical," but they are certainly more cyclical than they used to be. As costs grow for customers and will likely continue to due to labor and infrastructure issues in the sector, higher levels of people are falling behind on payments. I expect that this issue may soar during a recession.

Utilities Likely The Most Overvalued Sector

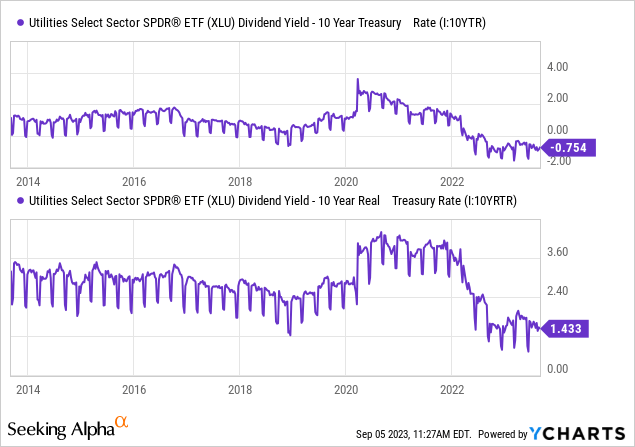

Investors have flocked to utilities due to growing recession risk factors. Even if we assume that utilities are truly defensive, that alone does not make them good investments. Treasury bonds, particularly those indexed to inflation such as inflation-indexed Treasuries (TIP) are more defensive than are utilities. Thus, should the yields on Treasury bonds rise, we should expect utilities to pay equally higher dividend yields. Despite the huge increase in long-term Treasury rates, XLU's yield has hardly budged. See below:

Historically, XLU's yield is around 2.5% above the real yield on 10-year Treasury bonds and ~1.5% above that of "normal" 10-year Treasury bonds. I believe inflation-indexed Treasury bonds are the better comparison because we generally expect utility incomes to rise with inflation. However, that may not be likely for the reasons stated earlier in the current environment. That said, it is clear that XLU is trading at a significant premium to its historically typical relationship with bonds.

For XLU's dividend yield to return to the ~2.5% spread to the 10-year inflation-indexed Treasury bond, XLU's yield would need to increase by about 1%. At a 3.35% dividend yield, a 1% increase to 4.35% would cause XLU's price to decline by ~23%. For its dividend spread to "normal" Treasury bonds to normalize, its yield would need to rise by ~2.25%, or an increase from 3.35% to ~5.6%, requiring a ~40% decline in XLU's value. Since I do not expect XLU's dividend to keep up with inflation, I believe it trades at a roughly 23-40% premium to Treasury bonds based on the historically strong pattern between them.

The Bottom Line

Overall, I remain bearish on XLU and believe that its recent declines may signify a more significant sell-off to come. Fundamentally, XLU is trading at a considerable premium to bonds, given its yield has not improved despite the substantial increase in bond rates. I believe this is likely due to investor's excessive exuberance for the sector as a "safety trade" while disregarding its valuation premium. I think inflation-indexed Treasuries - TIPs - offer a much better risk-adjusted dividend, given the sharp increase in real yields during 2022 that was not seen in XLU.

Further, as detailed more specifically regarding Dominion Energy (D), utilities are simply not as defensive as they used to be. Virtually all struggle with rising maintenance and labor costs due to shortages and infrastructure dilapidation. This issue promotes higher electricity prices as firms try to keep margins constant; however, that is met by a vast increase in CapEx and a significant decline in free cash flow. If this pattern continues, I suspect, many utilities will likely need to use debt or equity financing to restore liquidity. Furthermore, rising political turbulence surrounding higher electricity prices is creating growing pushback from local governments. Fundamentally, utilities' ability to make a profit is determined by state and local governments, so sufficient voter pressure could upset their profitability, particularly during economic strains, as seen during the COVID era.

An "Undercover" Short Opportunity?

While my outlook on bonds remains bearish, I believe XLU is much more overvalued than are bonds. XLU's upside is limited because it generally does not attract speculative activity, unlike "buy and hold" dividend investors. Its upside is also limited due to its low dividend compared to other bonds and stocks. Thus, I believe XLU may be a suitable short opportunity today that is likely overlooked by most short sellers. Since so few would bet against utilities, its short borrowing cost is negligible outside its low dividend yield. XLU's implied volatility is also extremely low at 14%, even lower for the ETF, despite its increased volatility over the past month. Accordingly, put options may inexpensively allow more speculative traders to gain greater exposure to a significant drawdown for XLU. Of course, XLU could fail to decline or rise as investors buy it as a "defensive" trade, creating risks for short-sellers. However, I firmly believe that XLU's downside risk is much greater than its limited upside potential due to its low dividend, making it a solid "undercover" short opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Short position through short-selling of the stock, or purchase of put options or similar derivatives in XLU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.