First Guaranty Bancshares: Too Much Risk For The 9% Preferred Shares

Summary

- First Guaranty Bancshares' preferred shares are trading at a discount due to regional banking woes.

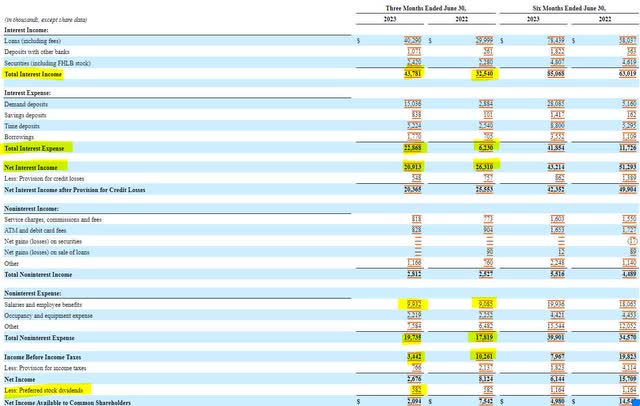

- The bank's net income has dropped by 70% due to increased interest expenses and non-interest expenses.

- The bank's loan composition is heavily invested in commercial real estate, which is under scrutiny due to the pandemic.

champpixs

First Guaranty Bancshares (NASDAQ:FGBI) has been under pressure this year while enduring the regional banking woes that have enveloped the industry. The selloff from the regional banking crisis created an opportunity in the bank’s preferred shares (NASDAQ:FGBIP). These shares are trading at the same discount as they were in March and May after the industry suffered bank failures. Unlike other banks I’ve written about, I’ve decided to pass on these 9.4% yielding preferred shares.

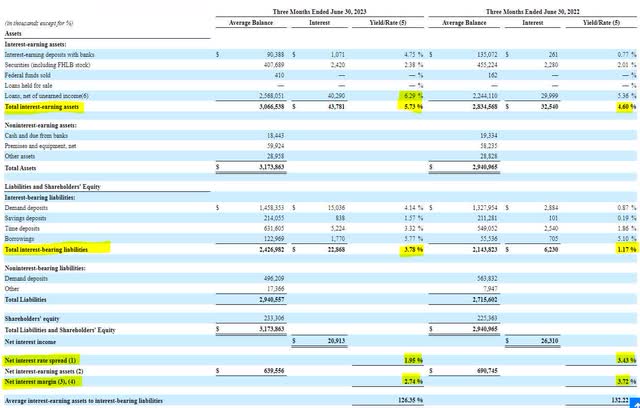

First Guaranty’s net income has been facing strong headwinds. The bank saw interest income increase by $11 million in the second quarter compared to the same period from a year ago. However, interest expenses more than offset the income increase in jumping by more than $16 million, leading to a 20% drop in net interest income. The bank’s non-interest expenses also increased led by an increase in salaries and employee benefits. Ultimately, this led to a two thirds drop in net income.

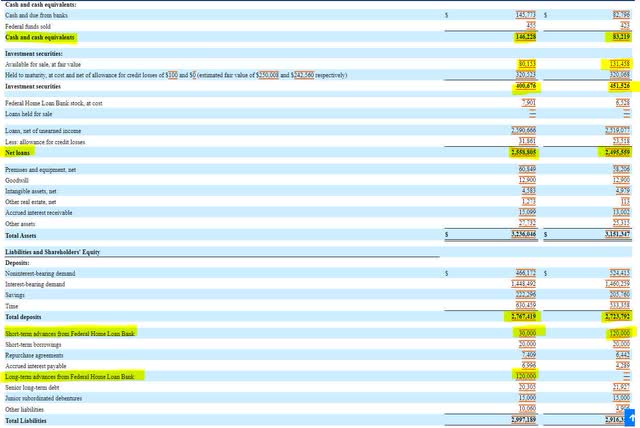

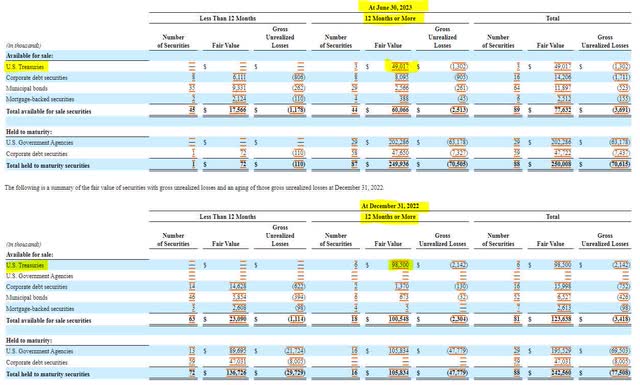

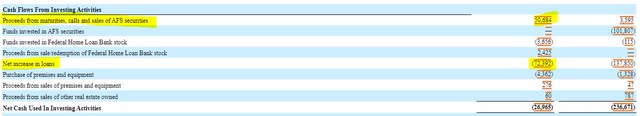

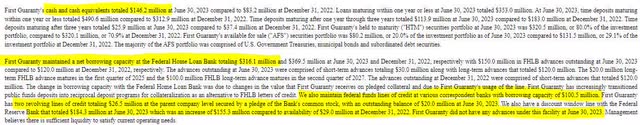

First Guaranty’s balance sheet shows some changes the bank made to get through the volatility of the regional banking crisis. The bank was able to grow its cash on hand, loans, and deposits. It did come at the expense of drawing some funds from the Federal Home Loan Bank and the reduction in investment securities. When the bank’s securities matured (mostly US Treasuries), the bank used the proceeds to lend, reducing its available collateral for the Federal Reserve’s bank term funding program and thus reducing the bank’s available liquidity.

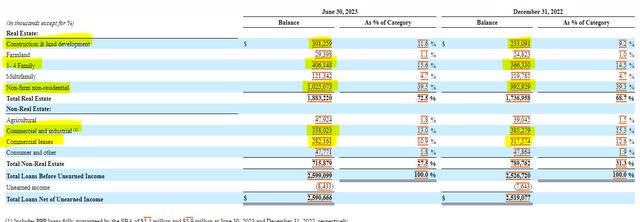

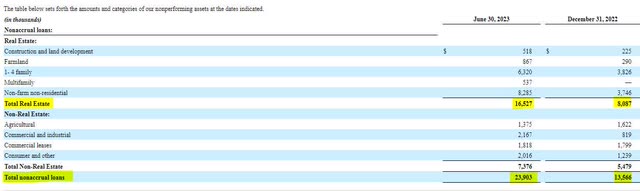

Another concern I have regarding First Guaranty Bancorp is in the bank’s loan composition. Over $1 billion of the bank’s $2.5 billion in loans is invested in commercial real estate (listed as non-farm non-residential). This area of lending is under the most scrutiny as commercial and office properties have come under stress from the pandemic. The bank’s nonaccrual loans have also jumped this year, with commercial real estate leading the way.

First Guaranty’s net interest margin deterioration is also concerning. The bank did see its yield on interest bearing assets grow by 113 basis points from a year ago, but the yield on interest bearing liabilities grew by 261 basis points in the same period, leading to a near 150 basis point drop in net interest spread. The fact that the bank is not controlling costs makes this trend more negative.

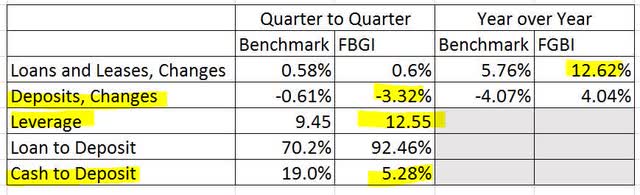

The next problem for First Guaranty is a drop in deposits. While the industry is facing the same problem, First Guaranty’s drop in deposits outpaced the industry benchmark in the second quarter. The bank’s leverage ratio is higher than benchmark and problematic as additional leverage may be needed to supplement the drop in deposits.

FGBI Earnings & Federal Reserve

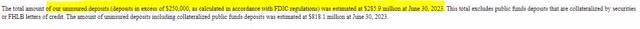

First Guaranty does have the liquidity necessary to cover uninsured deposits should a run occur. However, it is important to highlight that the sources of funds will have to come from multiple lines of credit should the bank need it. The bank’s liquidity disclosure is very convoluted leaving investors having to do math to figure out total liquidity.

While I can still invest in bank preferred securities when isolated risks are present, the compounding of all the risks presented turns me away from this opportunity. First Guaranty Bancorp’s deposit loss combined with its high leverage and compressed net interest margin make its preferred shares too risky for me.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.