Rates Spark: Dis-Inversion From The Back End

Summary

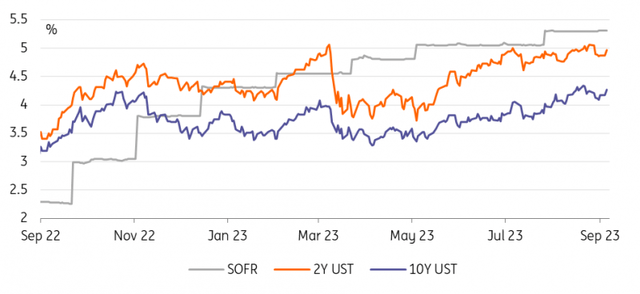

- We rationalise why US longer tenor rates are rising – basically, the curve is inverted and getting used to discounting structurally higher rates.

- If so, reversion to a normal curve must mean dis-inversion from the back end.

- When something breaks, that will change. But for now, it's more of the same: upward pressure on long yields.

scyther5

By Padhraic Garvey, CFA, Regional Head of Research, Americas and Benjamin Schroeder, Senior Rates Strategist

We rationalise why US longer tenor rates are rising – basically, the curve is inverted and getting used to discounting structurally higher rates. If so, reversion to a normal curve must mean dis-inversion from the back end. When something breaks, that will change. But for now, it's more of the same: upward pressure on long yields.

The US curve can't stay inverted forever. So if rates don't get cut, long rates must rise

There are many theories swirling around as to why the US 10yr yield did an about-turn on Friday, post-payrolls. It had initially lurched towards 4%. But in a flash, it was heading back towards 4.25%.

We rationalise this based on two factors. First, the curve remains very inverted, with longer tenor yields anticipating falls in official rates in the future. That’s a normal state of affairs.

But as long as the economy continues to motor along, the wisdom of having many rate cuts at all is being questioned by the market. Less future rate cuts raise the implied floor being set by the Fed funds strip. That floor continues to edge higher. That’s the second (and related) rationale.

Friday’s payroll report was not one that suggested anything had broken. Rather, it hinted at more of the same ahead. There are lots of stories floating around about the rise in the oil price and heavy primary corporate issuance, but we’re not convinced they are the dominant drivers. They certainly push in the same direction, but that's all – contributory rather than driving.

Until activity actually stalls, there is no imminent reason for the Federal Reserve to consider rate cuts, and as that story persists, the floor for market rates is edging higher and becoming more structural at higher levels.

In that environment, the only way for the curve to dis-invert is from longer maturity yields coming under rising pressure as shorter-tenor ones just hold pat.

Something will break eventually, but so far it hasn’t. The path of least resistance therefore remains one for a test higher in longer tenor market rates.

Accommodating structurally higher rates as the Fed stays pat

Today’s events and market views

Rates are drifting higher and a busy primary market is a technical factor – though usually fleeting – that has added to the upward pressure. But it is the data that has provided markets with the waymarks, although first impressions can prove deceptive.

Today’s key data is the ISM services which is expected to soften marginally, suggesting the sector is losing momentum towards the fourth quarter. For now, it would not meaningfully alter the overall situation.

Susan Collins, president of the Boston Fed, is scheduled to speak on the economy and policy. Later tonight, the Fed will also release its Beige Book with anecdotal information on current conditions in the Fed districts.

In the eurozone, we will get retail sales data for July. Yesterday, the European Central Bank’s surveyed consumer inflation expectations saw a slight uptick, but this was balanced by downwardly revised final PMIs – the net impact on market pricing for the September ECB meeting was marginal.

No ECB speakers are scheduled for today. In government bond primary markets, Germany taps its 10Y benchmark for €5bn.

The Bank of Canada will decide on monetary policy today, with no change widely expected after the economy surprisingly contracted in the second quarter.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by