Intel: Second Half Recovery

Summary

- Intel's revenue declined by 26.8% in H1 2023, exceeding projections of -9% for the year.

- The decline was driven by underperformance in the DCAI and Others segments, particularly the NEX segment.

- However, there is optimism for the second half of the year, with expected improvements in the PC and server markets and positive growth in segments like PSG, IFS, and Mobileye.

- We believe PC market stabilization will buoy Intel to a second half recovery.

hapabapa

In our previous analysis of Intel Corporation (NASDAQ:INTC), we highlighted that Intel increased its market share in desktop and laptop CPUs compared to AMD which we attributed to competitive pricing for desktop CPUs and superior laptop CPU performance. Furthermore, we expected a further increase in Intel's CPU market share for desktops and laptops, driven by its competitive pricing and strong laptop CPU performance. However, we anticipated AMD to continue to gain market share in servers due to its better performance and value.

In this analysis, we assessed the company's performance after its Q2 2023 earnings report, which revealed a significant 26.8% decline in total revenue for the first half of 2023. This decline was far more substantial than our initial projection of -9% for the entire year. The company's management attributed this downturn to short-term challenges and is anomalous to its long-term prospects. Our initial projections were skewed because we front-loaded our full-year forecast for Intel.

To delve deeper, we conducted a thorough examination of Intel's revenue distribution across different segments. We then compared our earlier forecasts with the actual revenues to identify which segments fell short of our expectations. Additionally, we scrutinized the pricing and shipment growth within these segments, along with analyzing the performance of the PC and server markets, contrasting them with our predictions. Furthermore, we analyzed the end markets to pinpoint the weaknesses affecting PC, server, automotive, and the overall semiconductor markets. Lastly, we revisited the management's guidance, encompassing insights from Q4 2022 and Q1 2023, segment-wise, and assessed their outlook for the upcoming quarter, as gleaned from the company’s latest earnings briefings.

First Half Performance Down Across All Major Segments

Intel Revenue Growth | Revenue Growth (H1 2023) |

Actual | -26.76% |

Our Forecast | -11.5% |

Analyst Consensus | -31% |

Intel’s Management Guidance | -32% |

Source: Company Data, Seeking Alpha, Khaveen Investments

In terms of actual revenue growth, Intel experienced a significant decline in revenue, with a decrease of approximately 26.8% in H1 2023. This decline contrasts with our forecasts where we anticipated a more moderate contraction of around 11.5%. On the other hand, analyst revenue consensus estimates projected an even more substantial decrease of 31%. Notably, Intel's own guidance expected a revenue decline of 32%. Overall, analyst consensus is the closest to the actual revenue growth for H1 2023 with a difference of only 4.2% to the actual growth followed by Intel’s management guidance with a difference of 5.2%.

Below, we further examined Intel’s revenue growth by segment for H1 2023 compared to the prior year’s period and compared it with our previous full-year 2023 revenue growth forecast.

Intel Revenue ($ mln) | H1 2022 | H1 2023 | Our 2023 Forecast |

CCG Desktop | 4,930 | 4,249 | 7,611 |

Growth % | -13.81% | -28.6% | |

CCG Laptop | 10,710 | 7,303 | 13,410 |

Growth % | -31.81% | -28.6% | |

Datacenter and AI ('DCAI') | 10,769 | 7,722 | 16,771 |

Growth % | -28.29% | -12.6% | |

Others | 5,905 | 4,395 | 16,579 |

Growth % | -25.57% | 40.1% | |

Total | 33,674 | 24,664 | 56,820 |

Growth % | -26.76% | -9.18% |

Source: Company Data, Khaveen Investments

In the first half of 2023, Intel’s CCG Desktop segment declined by -13.81% YoY. Similarly, the CCG Laptop segment faced a substantial reduction in revenue of -31.81% YoY. The DCAI segment was the largest (38% of total revenue) in H1 and also had a significant decrease in revenue of -28.29% YoY. Likewise, the Others segment, which comprises its NEX, Mobileye and IFS segments, accounted for 18% of its total revenues and had a decrease in revenue of -25.57%.

For its Others revenue, the largest segment is NEX which represents 65% of revenues and had declined by 34% in H1 2023. According to the company, the segment decline was attributed to “continued demand softness and elevated inventory levels in the network and edge markets” and the company highlighted its customers were reducing excess inventory and the inventory correction is expected to continue for the next quarter. Additionally, the company also recently announced that it had terminated its planned acquisition of Tower Semiconductor which we previously forecasted to increase its IFS segment revenue by 251%.

Overall, the segment that contributed to the large revenue decline in H1 was the DCAI segment, its largest segment, and declined by 28.3%, and more than its total revenue decline. However, the segment that had the largest underperformance compared to our forecasts was its Others revenue due to the underperformance of its NEX segment.

Moreover, we then analyzed Intel’s CCG Desktop and Laptop as well as its DCAI segment's performance in H1 2023 in terms of revenue, shipments and ASP growth based on its quarterly reports and compared it with our previous forecasts. Also, we compared the actual PC and server market unit sales in the period with our previous forecasts.

Intel CCG and DCAI Segments | Desktop (H1 2023) | Our Forecast (2023) | Laptop (H1 2023) | Our Forecast (2023) | Server (H1 2023) | Our Forecast (2023) |

Revenue Growth | -13.8% | -28.6% | -31.8% | -28.6% | -28.3% | -12.6% |

Shipments Growth | -51.9% | -10.8% | -25.0% | -10.8% | -38.7% | 0.9% |

ASP Growth | 21.8% | -20.0% | -13.6% | -20.0% | 20.2% | -20.0% |

End Market Hardware Shipments Growth | -21.9% | -11.7% | -21.9% | -11.7% | -21.4% | 1.3% |

Source: Company Data, IDC, Khaveen Investments

As mentioned, Intel's revenue growth performed better than expected in the Desktop segment with a decline of -13.8% compared to our forecasted -28.6%. In the Laptop segment, the revenue decline was -31.8%, closely aligning with our projected -28.6% decline. However, in the DCAI segment, Intel experienced a significant revenue drop of -28.3%, exceeding our projected decline of -12.6%.

In terms of shipments, we calculated a -51.9% in shipment growth for Desktop which is substantially lower than our projected decrease of -10.8% for the full year of 2023. For its Laptop segment, we estimated its shipment growth of -25% compared to our projected decrease of -10.8%. Whereas the DCAI segment shipments had a decline of -38.7%, compared to our slight predicted increase of 0.9%.

Additionally, we compiled Intel’s Desktop segment ASP increase of 21.8%, differing significantly from our anticipated decrease of -20% which we previously based on the DigiTimes report of Intel’s talks to cut prices by 20% for its Alder Lake processors. According to its quarterly report, its Desktop ASPs increased due to an “increased mix of product sales to the commercial and gaming market segments”. For example, the Intel Core i7-13700K which is considered one of the best gaming CPUs according to Tom’s Hardware is priced at $409 and is 16% higher compared to our derived average pricing for its Raptor Lake gen in our previous analysis.

In contrast, its Laptop ASP growth showed a substantial reduction of -13.6% compared to our expected decline of -20%. Also, Server ASP growth exhibited a noteworthy increase of 20.2%, which is a large difference from our projected decline of -20%. According to its quarterly report, the segment had “higher ASPs from an increased mix of high core count products”. Based on Intel’s website, its 4th gen Xeon processor with 60 cores is priced at $17,000 and is over 6x higher compared to its processor with 32 cores ($2,771)

In terms of the total PC end market sales growth, the actual figure of -21.9% in H1 2023 deviated from our forecast of -11.7%. Additionally, the total server market displayed a substantial decline of -21.4%, in contrast to our forecasted growth of 1.3% for the full year.

Overall, the company’s underperformance compared to our forecasts was due to the DCAI segment which was well below our expectations as well as its Others segment mainly due to the decline of its NEX revenue. Moreover, in the next section, we examined why our end market projections differed from the actual growth for the PC and servers as well as the automotive for Mobileye.

First Half Impacted by Weakness in End Markets

From our previous point, we further examined the end market growth in H1 2023 including PC (CGG Desktop and Laptop), server (DCAI and NEX), automotive (Mobileye) and the total semiconductor market ('IFS') as well as comparison to our previous forecasts.

End Markets Sales ('mln') | H1 2022 | H1 2023 | Growth % | Our 2023 Forecast |

PC Shipments | 151.7 | 118.5 | -21.90% | -11.7% |

Server Shipments* | 14.24 | 11.2 | -21.37% | -11% |

Automotive Unit Sales* | 58.15 | 57.95 | -0.34% | 0.9% |

Total Semiconductor Market ($ bln) | 304.94 | 243.01 | -20.3% | N/A |

*Annualized

Source: IDC, Omdia, VDA, SIA, Khaveen Investments

PC End Market (CCG Desktop and Laptop)

From our previous analysis of TSMC, in H1 2023, the PC market saw a significant decline of -21.9%. Despite the global economic outlook improved since the start of the year with higher average GDP growth projections from the UN, World Bank and IMF at an average of 2.1% for 2023, the PC market declined amid economic uncertainties and weak demand as consumer confidence eroded in H1 2023. Furthermore, according to HP, the second largest PC maker by market share, the company highlighted economic uncertainty and “consumer discretionary spending, while enterprises are delaying capital investments”.

Furthermore, from our previous analysis, we highlighted that consumer confidence was weak and personal savings increased. However, we highlighted that the PC market grew QoQ in Q2 2023 and inventory levels at retail channels have also improved. Thus, we believed...

the higher decline in excess shipments supports our assumption for the excess shipments to be eliminated this year in our forecast model”.

Therefore, we believe Intel’s CCG Desktop and Laptop segments were impacted by the PC market weakness due to economic uncertainty and declined consumer confidence in H1 2023. However, we expect a better outlook for the second half of the year...

at a prorated growth of -1.9% compared to H1 growth of -21.9% and we maintain our forecast of -11.7% for the full year.

Server End Market (DCAI and NEX)

In our analysis of TSMC, we also highlighted that the server market shipments declined by 21.4% on an annualized basis compared to 2022 as well as the preference for GPU-equipped AI servers over traditional ones but the substantial costs for AI servers led to the deferral of upgrades by cloud providers and enterprises. Additionally, we highlighted the increasing lifespan of traditional servers...

from between 3 to 4 years to 6 years for Tier 1 companies and up to 10 years for Tier 2 companies.

As AI servers only account for below 10% of the server market, we believe that...

...the increasing server life is negative for the server market sales with a longer replacement cycle”.

Furthermore, we examine the top cloud companies’ capex in H1 2023 in comparison with the last year.

Top Cloud Companies Capex ($ mln) | H1 2022 | H1 2023 |

Amazon (AMZN) | 30,675 | 25,662 |

Microsoft (MSFT) | 12,211 | 15,550 |

Google (GOOG) | 16,614 | 13,177 |

Total | 59,500 | 54,389 |

Growth % | -8.6% |

Source: Company Data, Khaveen Investments

Based on the table above, in H1 2023, the total capex for all three companies decreased by -8.6%. According to Amazon, Google and Microsoft, these companies highlighted that their cloud growth slowed as customers were cautious and optimized costs amid macroeconomic uncertainties in Q1 as well as Q2. Positively, Amazon highlighted that more customers were “bringing new workloads to the cloud”. Additionally, Amazon highlighted that the company expected capex to be lower for 2023 compared to the previous year but highlighted its continued additional investments to support LLMs and generative AI for AWS. Furthermore, Microsoft’s capex growth had accelerated in its last quarter for data centers and stated that the company will continue to invest in cloud infrastructure “particularly AI-related spend” and expects capex to accelerate in the next quarter. Google highlighted that one of the reasons that capex growth was lower than expected was due to delays in some data center projects. However, the company highlighted increased investments to handle AI computing and expects infrastructure investments for H2 2023 and 2024.

We expect increased AI investment to benefit the server market growth as cloud service providers like Amazon, Microsoft, and Google enhance their product offerings and competitiveness through AI development and the integration of new features. Therefore, although we believe the better outlook for the server market could benefit Intel’s DCAI and NEX segments. Moreover, Omdia forecasts the total server market shipments to decline by 11% for the full year in 2023 compared to the annualized decline of -21.4% which translates to an improved H2 growth of -0.6% YoY.

Automotive End Market (Mobileye)

For the automotive end market, we calculated an annualized growth rate of -0.34%. According to the Economist Intelligence Unit, the total vehicle sales growth is forecasted to be flattish in 2023 with a growth rate of 0.9%. Similar to the PC and smartphone markets, the automotive sector has experienced increased inventory levels, suggesting weaker demand.

From our analysis of TSMC...

We believe the inventory levels in June 2023 of nearly 2 mln vehicles which is higher compared to 1.96 mln in May indicates the situation has not improved and we are cautious on the growth outlook for the rest of the year.

Overall, we believe the slowdown in the automotive end market impacted the Mobileye segment growth which had slowed to 6.4% in H1 2023 compared to its 3-year average of 29%. However, its revenue only represents 3.7% of total revenues.

Total Semiconductor Market (IFS)

According to data from the SIA, the total semiconductor market declined by 20.3% in H1 2023. This can be attributed to the decline of the logic and memory market segments of the semicon industry. For example, both Intel’s and AMD’s (AMD) revenues declined by 27% and 14% YoY respectively, which we believe is attributed to the PC end market weakness. Moreover, in the memory market, we previously highlighted the decline of Micron’s (MU) revenues, one of the top DRAM and NAND companies, due to the persistent downturn in memory pricing. Therefore, we believe Intel’s foundry segment which caters to semicon companies such as Qualcomm (QCOM) was affected by the overall industry slowdown in H1 2023.

Overall, we anticipate an improvement for the end markets including PC and servers second half of the year as consumer confidence increases and inventory levels decrease in the PC market while we expect AI spending for servers to increase as highlighted by the top cloud companies which we believe could benefit Intel’s growth outlook in the second half of the year for its DCAI and NEX segments. However, we remain cautious about its growth outlook for the Mobileye and IFS segments which we believe had also been impacted by the semicon industry downturn and flattish automotive end market growth.

More Positive Second Half Outlook

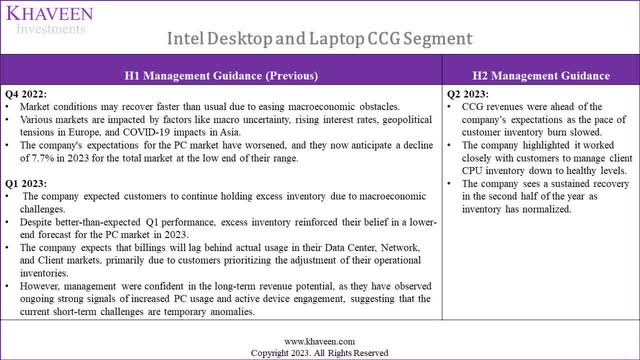

Furthermore, in this point, we analyzed the past guidance from Intel’s Q4 2022 and Q1 2023 briefings for CCG, DCAI and other segments. Moreover, we compiled the company’s outlook for Q3 2023 based on its latest earnings briefing.

CCG Desktop and Laptop

Company Data, Khaveen Investments

From Intel’s Q4 2022 earnings briefing, the company expected ongoing macroeconomic challenges to continue in the first half of 2023 but saw potential for improvement in the second half. Management acknowledged the impact of macroeconomic uncertainties, rising interest rates, geopolitical tensions, and COVID-19 on the CCG segment's outlook for 2023. Intel estimated PC market shipments of 270 mln to 295 mln for 2023, with the lower range being more likely, indicating a -7.7% growth. In Q1 2023, the CCG Laptop segment performed better than expected, despite macroeconomic challenges, suggesting a potential recovery in the PC market. Management emphasized efforts to manage client CPU inventory and projected sustained recovery in the latter half of the year. Furthermore, management indicated that they were confident of the long-term opportunity and suggested that its short-term challenges were temporary anomalies.

Regarding the Q3 outlook, Intel anticipated a gradual recovery in the latter half of the year as inventory levels balanced out, thanks to active collaboration with clients to optimize CPU inventory. CCG revenues exceeded expectations due to a decrease in the rate of customer inventory depletion.

Overall, our forecast differed from Intel’s past guidance in that we projected a lower growth rate for the total PC market of -11.7% compared to -7.7% based on Intel’s low-range projection. However, the company cited that it believed its short-term challenges were an anomaly and sees a more optimistic second half. Thus, this suggests that Intel’s forecast was front-ended where it expected the market challenges to affect its growth in the first half of the year compared to our forecasts which was smothered as we assumed the growth rate to be relatively more stable throughout the year.

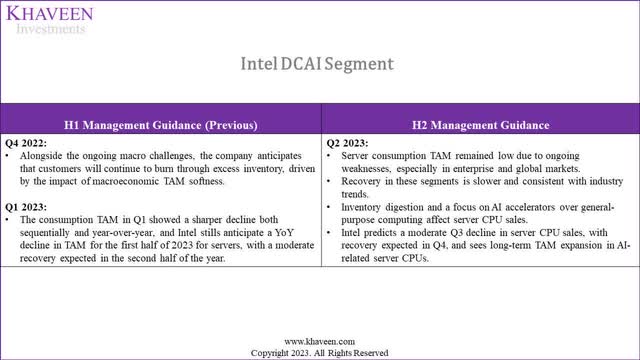

DCAI

Company Data, Khaveen Investments

In the DCAI segment, in Q4 2022, despite macroeconomic challenges, the company expected customers to reduce excess inventory due to market weakness. In Q1 2023, the company highlighted consumption TAM decreased significantly. The company also anticipated a YoY decline in server TAM for H1 2023 but expected a modest recovery later. In Q2 2023, the company stated that server TAM exceeded expectations, but growth was limited especially in enterprise and global markets. Furthermore, the recovery was slower than the company predicted and expected server CPU inventory reductions to continue in the second half with a focus on AI chips.

For the company’s guidance for Q3 2023, Intel foresees a moderate sequential decline in server CPU sales, followed by a rebound in Q4. Looking ahead, the company sees the potential for AI to drive the expansion of the TAM for server CPUs over the long term.

Therefore, our forecast of the server market was different compared to Intel which forecasted a decline in the server market while we previously projected flattish growth for the full year. Notwithstanding, our outlook for the second half of the year is in line with management for the server market to improve with AI potentially supporting the market growth outlook positively.

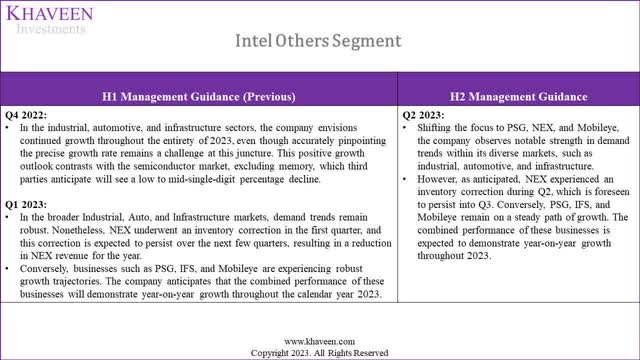

Others

Company Data, Khaveen Investments

In Q4 2022, the company expected continued growth in the “industrial, automotive and infrastructure” end markets for 2023. However, management also acknowledged the difficulty in predicting exact growth rates but held a more optimistic view compared to third-party expectations of a low to mid-single-digit decline in the semiconductor market including memory. In Q1 2023, the company stated that demand remained strong in these markets, but NEX experienced an inventory correction expected to continue in the coming quarters. However, segments like PSG, IFS, and Mobileye were anticipated to collectively achieve positive YoY growth in 2023 by management.

In Q4 2022, the company anticipates growth in the industrial, automotive, and infrastructure throughout 2023. The company highlighted that the exact growth rate is challenging to predict accurately but had a more positive outlook in contrast with third-party expectations of a decline in the semiconductor market (excluding memory), by a low to mid-single-digit percentage. In Q1 2023, the company highlighted that demand remains robust across the broader Industrial, Automotive, and Infrastructure markets. However, NEX faced an inventory correction and had projected to persist over the upcoming quarters, leading to a decline in NEX revenue for the year. Conversely, segments like PSG, IFS, and Mobileye are predicted to collectively have positive YoY growth for 2023.

For its Q3 2023 outlook, the company highlighted that PSG, IFS, and Mobileye remain on a “steady path of growth” but did not provide more guidance and only indicated it expects positive YoY growth which is a strong outlook for the second half given its weak performance in the first half. However, its NEX segment continued to have inventory correction during Q2 2023, and the company expects it to likely persist into Q3 2023 but did not provide its guidance for Q4 2023.

Overall, our previous expectations of Intel’s Others segment, which includes NEX, PSG, Mobileye and IFS to perform positively was in line with its past guidance that it provided in its Q4 2022 earnings call. However, Intel has become more cautious of its outlook, especially for NEX which we believe is also impacted by the server market weakness. Nonetheless, the company highlighted that it saw strength for its PSG, IFS and Mobileye segments outlook and still expects these businesses to grow YoY which indicates a better second-half outlook overall.

Risk: Competition within the Data Center Segment

Despite our positive outlook for the company for the second half of the year, we believe the competitive threats to the company, especially in the data center segment, could affect its growth outlook. Its DCAI segment represented the largest segment of its revenue (31%) followed by CCG Laptop (30%) and CCG Desktop (17.2%). We compiled Intel, Nvidia (NVDA) and AMD’s data center segments revenue in the table below and compared the growth. As seen, Nvidia experienced explosive growth in comparison with both Intel and AMD following the ramp-up of its H100 AI accelerators among cloud companies such as AWS and Azure. We believe that this indicates the superior performance of Nvidia compared to Intel and AMD and could be gaining a significant share from both companies.

Company Data Center Segment Revenue | H1 2022 | H1 2023 | Growth % |

Intel | 10,769 | 7,722 | -28.3% |

Nvidia | 7,556 | 14,607 | 93.3% |

AMD | 2,779 | 2,616 | -5.9% |

Source: Company Data, Khaveen Investments

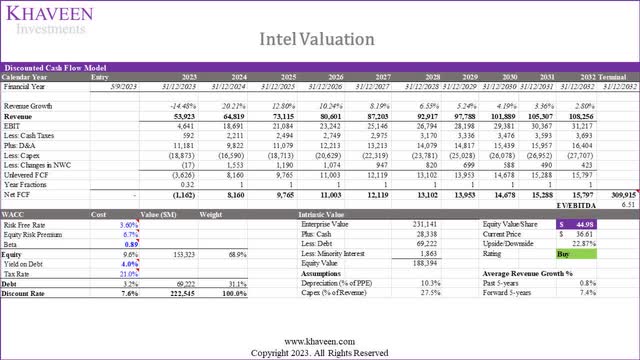

Valuation

Intel Revenue Projections ($ bln) | 2022 | 2023F | 2024F | 2025F |

Client Computing Group | 31.708 | 23.47 | 29.99 | 33.61 |

Growth % | -22.8% | -26.0% | 27.8% | 12.1% |

Datacenter and AI | 19.196 | 16.77 | 18.53 | 20.10 |

Growth % | -15.4% | -12.6% | 10.5% | 8.5% |

Network & Edge | 8.873 | 9.58 | 11.19 | 13.07 |

Growth % | 11.2% | 8.0% | 16.8% | 16.8% |

AXG | 0.837 | 0.97 | 1.11 | 1.26 |

Growth % | 8.1% | 15.7% | 14.6% | 13.6% |

Mobileye | 1.869 | 2.45 | 3.20 | 4.13 |

Growth % | 34.8% | 31.3% | 30.3% | 29.3% |

IFS | 0.895 | 1.00 | 1.12 | 1.25 |

Growth % | 13.9% | 11.9% | 11.9% | 11.9% |

All Others | 0.196 | 0.196 | 0.196 | 0.196 |

Growth % | -96.1% | 0.0% | 0.0% | 0.0% |

Intersegment Revenue | -0.520 | -0.52 | -0.52 | -0.52 |

Total | 63.05 | 53.92 | 64.82 | 73.11 |

Growth % | -20.2% | -14.5% | 20.2% | 12.8% |

Source: Company Data, Khaveen Investments

For our revenue projections, we maintained our projections from our previous analysis for all of its segments except for NEX and IFS. We maintain our projections from our previous analysis despite our forecast being off compared to its H1 actual growth as we expect the company’s outlook to improve in the second half of the year supported by an anticipated recovery in the PC and server end markets. Our projections were forecasted on a yearly basis and smoothed, which resulted in our projections in a more moderate decline in the first half, and we expect the company’s growth for the second half to be more in line with our projections.

Additionally, we believe more robust pricing growth in CCG and DCAI than we previously expected offsets our shipments decline under projections. For its NEX segment, we adjusted our growth projection lower taking account of the company’s uncertainty for this segment in the second half of the year. Moreover, we updated our IFS segment projection by excluding our previous estimates for its Tower Semiconductor acquisition. Overall, we forecasted its revenue growth to be -14.5% for the full year which is better compared to its H1 2023 decline of -27% before recovery beyond 2023 to grow by a forward 5-year average of 7.4%.

Khaveen Investments

Based on our updated DCF model, we obtained an upside of 22.9% with a discount rate of 7.6% (company’s WACC) and an average 5-year company EV/EBITDA of 6.51x.

Verdict

In summary, Intel's performance in H1 fell short of our expectations, with a decline of 27% compared to our projected growth. This underperformance was driven by the DCAI segment which decreased by 28.3%. However, the most significant underperformance was in the Others revenue category, mainly due to the NEX segment's underperformance. We identified its weakness in CCG and DCAI influenced by the PC and server end market weakness which declined significantly in H1 2023 due to economic uncertainty, poor consumer confidence and lower spending by cloud companies. Notwithstanding, looking ahead, we anticipate improvements in end markets such as PCs and servers in the second half of the year, driven by increased consumer confidence and reduced PC market inventory levels. Additionally, we expect increased AI spending for servers, which could benefit Intel's DCAI and NEX segments. Furthermore, based on our analysis of Intel’s management guidance, the company expects a better outlook in the second half for the PC and server end markets as well as positive growth for its PSG, IFS and Mobileye segments. We determined that our projections were forecasted on a yearly basis and smoothed, which resulted in our projections in a more moderate decline in the first half, and we expect the company’s growth for the second half to be more in line with our projections. Overall, we maintain our Buy rating with a slightly lower price target of $44.98 which is only 3% lower compared with our previous price target of $46.37.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

No information in this publication is intended as investment, tax, accounting, or legal advice, or as an offer/solicitation to sell or buy. Material provided in this publication is for educational purposes only, and was prepared from sources and data believed to be reliable, but we do not guarantee its accuracy or completeness.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)