2 Insanely Cheap REITs I Am Buying

Summary

- REITs are currently trading at significant discounts due to high interest rates, making them a great opportunity for value investors.

- Some sectors are faring better than others, but the Office sector is far and away the worst sector within Real Estate.

- Both of these REITs offer great dividend yields but also some very strong upside as they are both rated strong buys by analysts.

Dragon Claws

If you are a value investor or just in search of some cheap stocks, there are not many better sectors to look at other than the REIT sector. When it comes to REITs, or Real Estate Investment Trusts, many retail investors view the sector purely as an income play, and that is false.

REITs are much more than a fixed-income type investment. For years, they have been a top-performing sector, outside of periods of high inflation and high interest rates, which is why they have been under pressure over the past year and a half. Higher rates have driven share prices way down, and there are plenty of high-quality REITs trading at significant discounts.

Interest rates and the hiking cycle the Federal Reserve has taken us on seem to be coming to an end, which bodes well for REITs, meaning you can add some high-quality REITs to your portfolio at bottom-feeder prices. However, you need to be patient.

In today's article, we are going to be looking at two REITs trading well below their historical norms, representing a great opportunity for long-term investors looking for some real estate exposure.

2 Insanely Cheap REITs

REIT #1 - American Tower

American Tower (NYSE:AMT) is a cell tower REIT, in many ways, it can be viewed as a Technology REIT. Everything we do these days is based on data and connectivity. Whatever it may be, the necessity of data and connectivity is only growing in terms of importance.

As such, there is and will continue to be a demand for cell tower REITs for the foreseeable future. As 5G continues to roll out here in the US, the speeds are much faster for the top bands, but they are unable to travel as far, thus the higher demand for more cell towers. There are some satellite options rolling out, but they are still an extremely small piece of the pie and will take years to make a dent in American Tower's field. Satellite growth is one risk to the business. There is certainly room for satellite providers, but the reliability is still not there yet for consumers to make any sort of full switch. Regardless, this along with rising interest rates has certainly weighed on the stock.

If you want to make an argument that the satellite data industry is a good growth investment, that would be fair over a long period, but it's not taking a sizable market share any time soon.

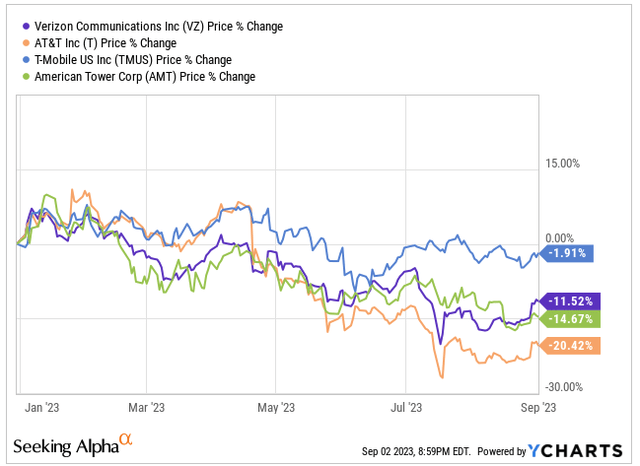

American Tower has a market cap of $87 billion and the stock has been under pressure, along with its telecom partners, Verizon (VZ), AT&T (T), and T-Mobile (TMUS). AMT shares are down nearly 15% on the year.

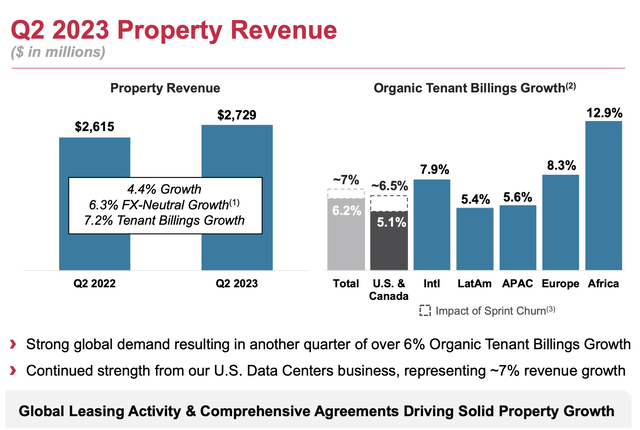

The company recently reported their Q2 earnings that saw revenues grow 4.4%, which equated to 6.3% when you take out the effects of foreign currency. Tenant billings grew 7.2% year over year. The best-performing region was Africa, which saw Organic Tenant Billings growth of nearly 13%.

During the quarter, AMT management increased their 2023 full year revenue guidance from $10.76 billion to now expecting revenues of $10.88 billion. Management also raised their EBITDA, Billings, and AFFO guidance as well. Management expects to end the year generating AFFO of $9.70.

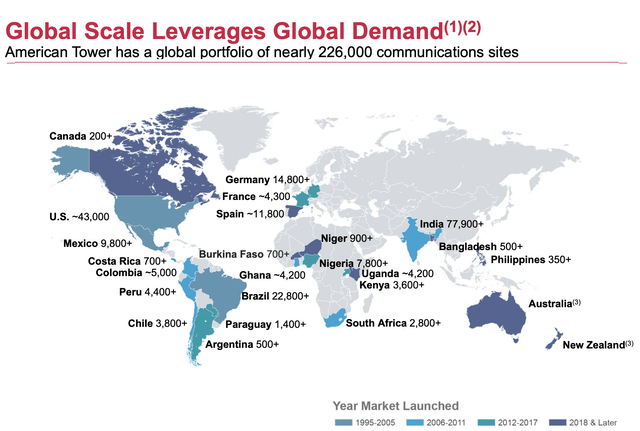

Investors get global exposure when they invest in American Tower, as they have nearly 226,000 communication sites across the globe.

In terms of the balance sheet, AMT has $2.1 billion of cash on hand, including restricted cash, which is in line with where the company ended the year in December 2022. Looking at debt, American Tower has long-term obligations of $35.6 billion. The company has a free cash flow of $1.4 billion through the first six months of the year, which is up 75% from the prior year, when the company generated FCF of $0.8 billion through the same period last year. A good chunk of the difference is related to the company's unearned revenue in 2022 that became earned in 2023.

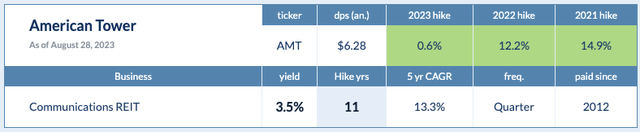

American Tower pays an annual dividend of $6.28 per share, which equates to a dividend yield of 3.5%. They have increased their dividend for 11 consecutive years and counting and have a 5-year dividend growth rate of 13.3%, which is high for a REIT.

Analysts are calling for 2023 AFFO of $9.73 and $10.52 in 2024, which equates to a P/AFFO multiple of 18.5x in 2023 and 17.1x in 2024. These figures are well below the company's 5-year average of 25x, making the REIT look extremely cheap at current levels.

Analysts agree as they rate the stock a strong buy and have a 12-month average PT of $230, implying a 27% upside from current levels.

REIT #2 - Alexandria Real Estate

Alexandria Real Estate (NYSE:ARE) is another REIT I like a lot, and another REIT I own, and yet another REIT that is trading at an incredibly cheap valuation. Shares of ARE have been under pressure over the past year, first for being a REIT, which we discussed above, but also due to the fact that ARE is labeled as an "Office REIT" but they are anything but a typical office REIT.

As you may be aware, office REITs have been getting crushed as more and more employers have moved to at least a flexible work arrangement, which has resulted in a need for much less office space. This does not mean office space is obsolete, just less of a demand. However, Alexandria is not your typical office REIT. The company owns, operates, and develops life science properties and campuses.

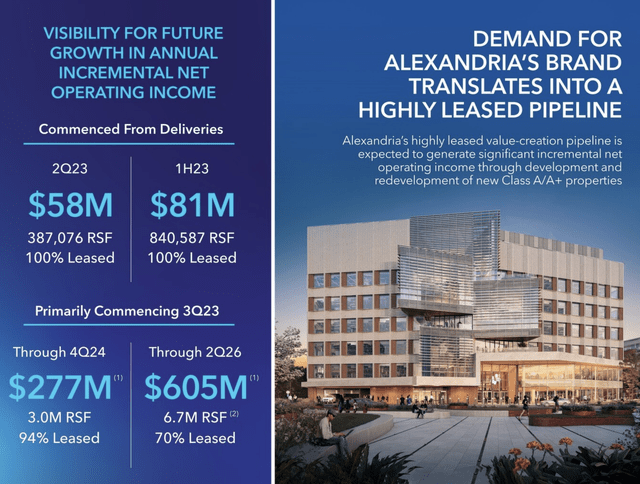

ARE has 850 tenants with a total asset base of 76.5 million square feet, which includes 41.9 million square feet of operating properties, 5.5 million square feet under construction, 9.7 million square feet of intermediate development projects, and 18.5 million square feet of future development projects.

In addition to being labeled an "Office REIT," the company also saw a short report published on them, which studied the cell phone data from some of their properties, which showed the activity to be lower and the report also alluded to leasing pressures. Since that report on June 20th, the stock has been relatively flat.

In the company's latest Q2 results, ARE reported $714 million in revenues, an 11% increase over the same period in 2022. The company's top markets saw a 15-20% increase in demand, signaling a potential turnaround in Biotech funding. North America reported occupancy of 93.6%, and management expects that to rise to 95% by year's end.

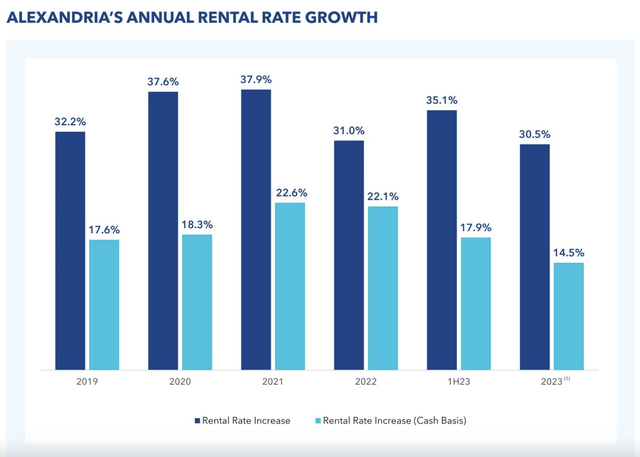

Now for rental rates, an area that office REITs are seeing lower lows every quarter. Not the case with Alexandria as they saw rental rate growth on lease renewals of 16.6% and 14.5% on a cash basis, not the sign of a slowdown that the typical office is seeing.

In terms of the balance sheet, ARE ended the quarter with $960 million in cash on hand, which is up from the $858 million they had at the end of 2022. The company generated $784 million in cash from operations through the first six months, an increase of 47.9% over the same six-month period in the prior year.

With that being said, analysts are calling for AFFO growth of 7-10% each of the next few years. Analysts are calling for an FFO of $8.96 in 2023 and $9.56 in 2024, which equates to a forward P/FFO multiple of 13.1x and 12.2x, respectively. Compare this to the company's 10-year avg. multiple of 25x, and you can see just how cheap the stock looks.

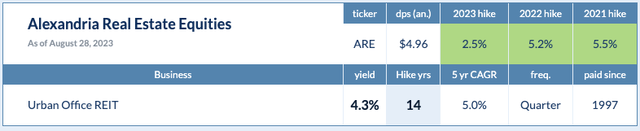

ARE pays a dividend of $4.96 per share, which equates to a dividend yield of 4.3%. The REIT has grown their dividend for 14 consecutive years, and they have a 5-year DGR of 5%.

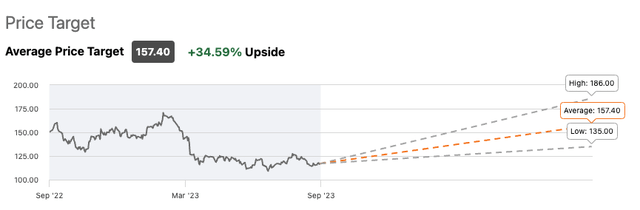

Analysts rate the stock a strong buy with a $157 12-mo PT, implying a nearly 35% upside from current levels.

Investor Takeaway

There is no denying, the REIT sector has been hit hard over the past 12-18 months as it has been a bottom-performing sector within the S&P 500. Interest rates have weighed on the sector as a whole, but certain sectors, like cell towers and office, have performed even worse than the overall sector.

Cell Towers are beginning to see more competition from satellite providers as well as some concerns more recently about lead in the ground around the cell tower sites, but this is more related to the telecom providers than the cell tower owners.

Office continues to be an area of struggle, but as we saw, Alexandria is not your typical office REIT at all, which is giving long-term investors a GREAT opportunity in the market right now.

In the comments section below, let me know which of these 2 REITs you like BEST.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

No marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Author of the weekly financial newsletter, "The Dividend Investor's Edge."

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMT, ARE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)