FTAI Aviation: An Attractive Bet On Growth

Summary

- FTAI Aviation Ltd. owns and leases commercial airplanes and jet engines, with a focus on CFM56 engines.

- Q2 2023 revenues grew by 150%, but adjusting for asset sales, revenues grew by 30%.

- FTAI Aviation is expected to have significant upside based on future projections, with potential for better cost absorption and asset growth.

- Looking for a helping hand in the market? Members of The Aerospace Forum get exclusive ideas and guidance to navigate any climate. Learn More »

Monty Rakusen/DigitalVision via Getty Images

With demand for commercial airplanes and engines being at a level that OEMs cannot meet, the assets that are currently already deployed have significantly appreciated in value meaning that the environment is quite favorable to aircraft lessors. Generally, I am bullish on the long-term prospects of the big lessors such as AerCap (AER) and Air Lease Corporation (AL). With significant consolidation over the years, it is also interesting to assess some smaller lessors. In this report I will be analyzing FTAI Aviation Ltd. (NASDAQ:FTAI) to determine its year-over-year performance and I will provide a stock price target for the company.

What Does FTAI Aviation Do?

FTAI Aviation Ltd. owns 97 commercial airplanes and owns and maintains commercial jet engines with a focus on CFM56 engines manufactured by a joint venture between General Electric and Safran. The Company's segments include Aviation Leasing and Aerospace Products. The Aviation Leasing segment owns and manages aviation assets, including aircraft and aircraft engines, which it leases and sells to customers. The Aerospace Products segment develops and manufactures through a joint venture, and repairs and sells, through arrangements, aircraft engines and aftermarket components for aircraft engines. The Company's portfolio of products, including The Module Factory and a joint venture to manufacture engine PMA, enables it to provide cost savings and flexibility to its airline, lessor, and maintenance, repair, and operations customer base. Additionally, it owns and leases jet aircraft, which often facilitates the acquisition of engines at attractive prices. It invests in aviation assets and aerospace products. It also owns and manages 344 aviation assets.

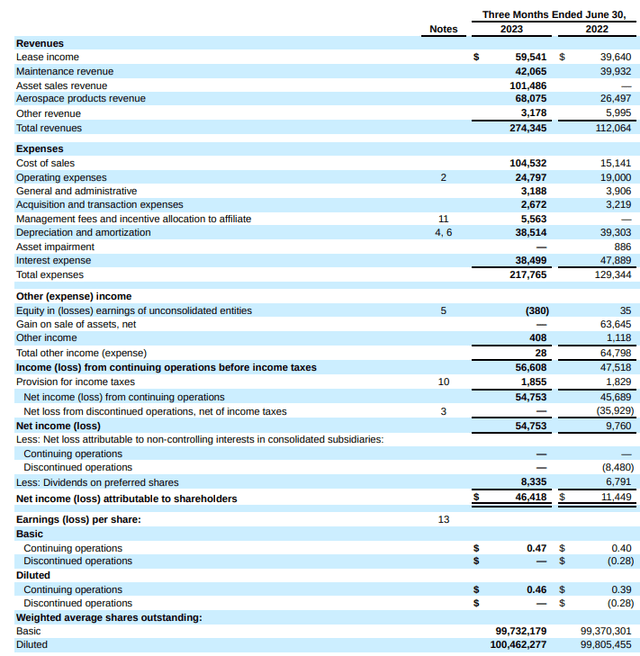

FTAI Aviation: A Dive In The Quarterly Financial Results

Q2 2023 revenues climbed from $112.1 million to $274.3 million indicating revenue growth of almost 150%. This, however, also includes asset sales revenues of $101.5 million. Correcting for this the revenues grew by 30% or $60.8 million. $22 million was driven by higher lease and maintenance revenues with the remaining $41 driven by higher aerospace product revenues partially offset by lower other revenues. Similar to the revenues, the expenses also saw a big one-off item in the cost of sales and that is because the net book value of the asset sales are recorded as an expense.

Income before taxes increased by 19% to $56.6 million, which does not quite compare favorably to the revenue growth, but it should be noted that in Q2 2023 the gain on sales was around $32 million compared to $63.6 million a year earlier, indicating that the underlying recurring business generated $24.7 million in profits compared to a $16.1 million loss a year earlier. So, the cost absorption has been significantly better.

FTAI is scaling its business, and as a result, the company looks at sequential changes. Sequentially, the adjusted EBITDA grew almost 17% in the leasing business and 11% in the aerospace product segment. Year-over-year, the adjusted EBITDA grew around 1.5% to $153.1 million. If we consider the topline growth, it seems that adjusted EBITDA growth is far from favorable, but this is caused by a high portion of the 2022 results being driven by the gains of sales booked. So, solely looking at adjusted EBITDA can be deceiving as the timing and size of asset sales can cause rather big fluctuations in the results.

What Is FTAI Aviation Stock Worth?

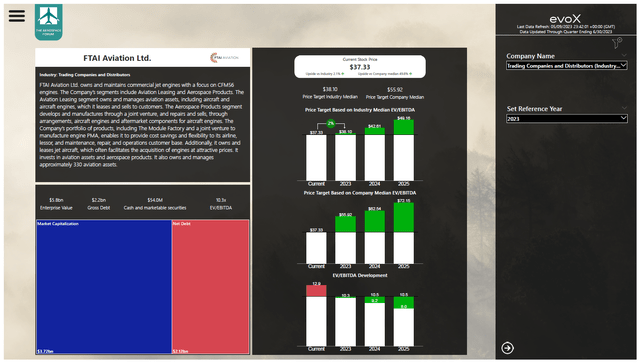

Typically, I assess aircraft lessor on their price-to-book ratio that they historically trade on. With FTAI Aviation stock being relatively new there is no strong dataset to perform such a valuation with confidence. For 2023, the company expects $350 million to $400 million in EBITDA for its leasing business, $100 million in EBITDA from gains on sales and more than $100 million for its aerospace product business. This brings the expected 2023 EBITDA to more than $550 million to $600 million. With a Q2 2023 run rate EBITDA of $623 million I would say that the company might be a bit conservative in their guidance.

FTAI Aviation stock price valuation using evoX Financial Analytics (The Aerospace Forum)

I entered the fundamentals as well as the future projections for FTAI Aviation in the evoX Financial Analytics model and the outcome is that the company has significant upside based on its median EV/EBITDA, but this might not be fully accurate to look at given the fact that FTAI has spun off its infrastructure business. Based on valuations in line with other airplane lessors, I see around 2% upside for FTAI which actually does not make it a strong buy. Wall Street analysts have a similar view with a price target 2.5% higher than the most recent closing price. The stock, however, is rated as a strong buy and I do echo that sentiment because FTAI is growing, so it should be able to better absorb costs as it grows, and its assets are high in demand. Furthermore, the company has no debt maturing until 2025, and it lies in line of expectation that the Senior Notes due 2025 with around $650 million will be refinanced without issues freeing up cash flow to grow the company to a better absorption scale.

Conclusion: FTAI Aviation Is A Buy

Due to the lack of upside in 2023 compared to the most recent closing price, I am marking FTAI Aviation Ltd. a buy rather than a potential strong buy. The company has upside in the years ahead and its debt-free runway until 2025 adds to appeal as the company can elect to grow the company even faster which should result in better cost absorption. FTAI Aviation can also sell assets at attractive prices, which will allow the company to increase the cash pile it can deploy to acquire future-proof assets in the form of next-generation aircraft and engines. With the market shifting to production and OEM services for the new generation engines, this does open up opportunities for other companies such as FTAI Aviation to expand cost-efficient servicing for the current CFM56 engines, which has servicing demand until 2045 with higher annual price escalation on part sales.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum for the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.

This article was written by

His reports have been cited by CNBC, the Puget Sound Business Journal, the Wichita Business Journal and National Public Radio. His expertise is also leveraged in Luchtvaartnieuws Magazine, the biggest aviation magazine in the Benelux.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AER either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)

FD: Long FTAI, FTAIO, FTAIP