Bridgewater Bancshares Offers Compelling 8.8% Yielding Preferred Share

Summary

- Bridgewater Bancshares' 5.875% dividend preferred shares are trading below their March levels, offering an attractive 8.8% dividend yield.

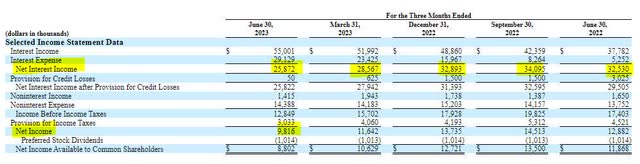

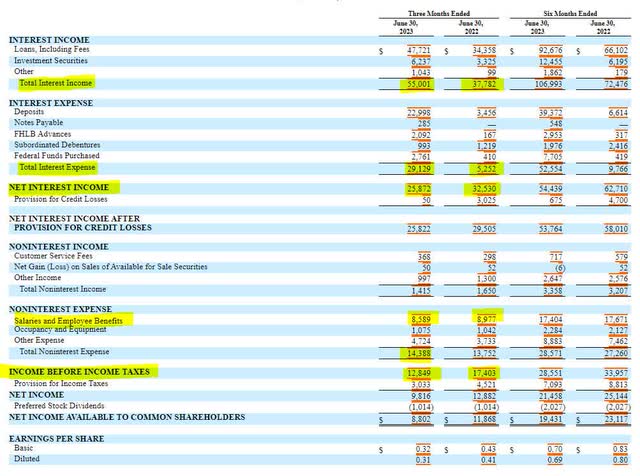

- The bank's net interest income has been declining due to higher borrowing costs, but it has successfully controlled overhead costs.

- BWB has strengthened its capital position but faces challenges such as a drop in net interest margin and a high loan-to-deposit ratio.

Olivier Le Moal

Bridgewater Bancshares (NASDAQ:BWB) is a Minnesota based regional bank operating out of the Twin Cities. Like their peers, the bank has come under pressure from the regional banking crisis, which hit earlier this year. Among the securities affected were Bridgewater's 5.875% dividend preferred shares (NASDAQ:BWBBP). The shares have yet to recover and are trading below their March selloff levels, leaving the 8.8% dividend yield as an attractive draw to income investors.

Bridgewater is not without its share of headwinds. Like many in the industry, the bank's net interest income is lower than it was a year ago, and quarterly net interest income has been in decline for almost a year. In Bridgewater's case, it is due to higher borrowing costs, mainly related to deposits. One area where the bank has bucked the trend is in lower salaries and employee benefit costs. In fact, Bridgewater discussed the secret to its success in keeping overhead under control in the latest earnings presentation through keeping the number of physical branches it has low.

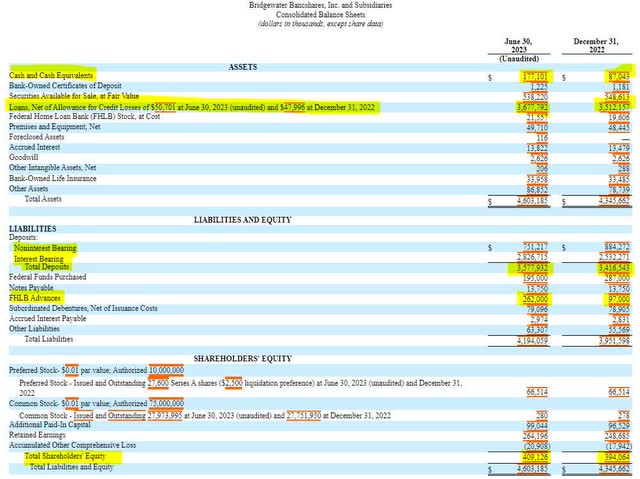

SEC 10-Q SEC 10-Q Management Presentation

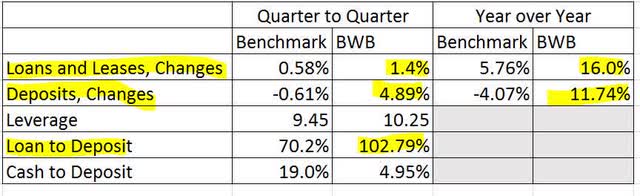

Bridgewater's balance sheet shows the bank has continued to strengthen its capital position in 2023. So far this year, the bank has doubled its cash on hand and grown its loans and deposits by approximately $160 million each. The bank did increase its FHLB borrowings by $165 million, but a majority of those funds were used to pay down federal funds, but it is important to note that the growth in the bank's balance sheet came at the cost of growing its borrowings by more than $70 million. Shareholder equity continues to grow with a healthy $15 million increase in 2023.

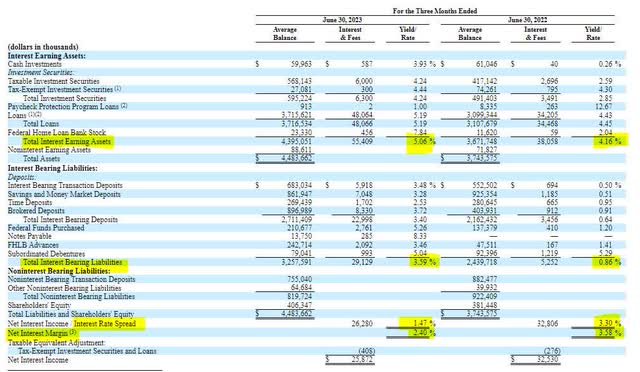

Despite the bank's resiliency, there are a few concerns. The first one is the bank's return on assets. From the second quarter of 2022 to the second quarter of 2023, the banks average yield on interest bearing assets grew by 90 basis points to 5.06%. Unfortunately, the yield on interest bearing liabilities grew by 270 basis points during the same time, leading to a drop in the interest spread of 183 basis points and the net interest margin by 118 basis points to 2.4%. While this is the main reason I am not buying the bank's common shares, I believe Bridgewater's commitment to controlling overhead costs will help them weather this challenge before preferred dividends are affected.

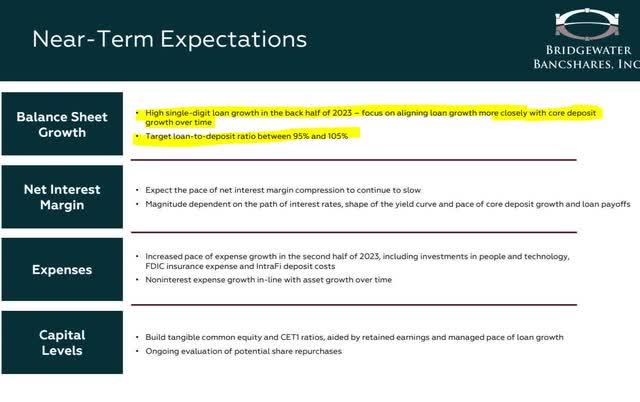

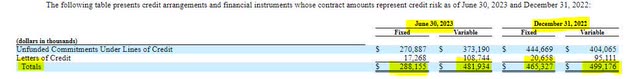

Another challenge is the high loan to deposit ratio, which sits over 100%, far higher than the sector norms. It helps that the bank is bucking the trend of growing deposits while the industry is losing them, but management went a step further to addressing this concern when presenting the second quarter financial results. Management is going to align loan growth with deposit growth over time, with a target range of 95% to 105%. One way the bank has tapered back on lending is through reduced use of letters of credit, which is down by $200 million from year end. I'm expecting deposit growth to outpace loan growth during the second half of this year.

Federal Reserve & Bank Earnings Management Earnings Presentation SEC 10-Q

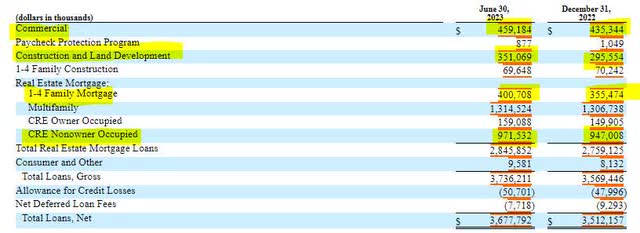

Another concern is the bank's exposure to commercial real estate, especially real estate that is not owner occupied. This area accounts for approximately one quarter of the bank's loan portfolio. Fortunately, the properties involved in this group are well diversified and are 98% current with a 61% loan to value, reducing the likelihood of the bank taking heavy losses in the event of a default.

SEC 10-Q Management Earnings Presentation

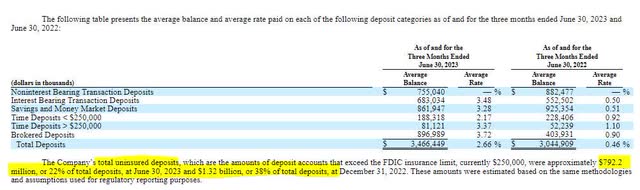

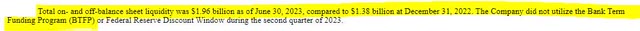

The last risk is a run from uninsured depositors causing a liquidity crisis. I believe the bank has effectively mitigated this risk in 2023 by reducing the amount of uninsured deposits from $1.32 billion to $792 million in six months. The bank's liquidity currently stands at nearly $2 billion, which effectively covers the uninsured deposits 2.5 to 1. The bank has yet to utilize the Bank Term Funding Program.

While the risks involving the bank are real, the management team is committed to publicly addressing these risks along with communicating actions and expectations. The drop in uninsured deposits along with the decrease in salaries and benefits demonstrate that leadership has already been effective in guiding the bank through a rough year. Combine these achievements with deposit growth and income investors should feel comfortable with the high dividend yield generated by the bank's preferred shares.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BWBBP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.