Extra Space Storage: Yielding 5%, May Be My Favorite REIT

Summary

- The self-storage industry, including Extra Space Storage, faces challenges amid rising interest rates and changing demand, but remains resilient due to strong fundamentals.

- Extra Space Storage is a standout player in the industry, with a diversified portfolio and a history of robust growth in core FFO and dividends.

- Despite short-term headwinds, EXR presents a compelling long-term investment opportunity, trading at a reasonable valuation with the potential for capital gains and income growth.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

gorica/iStock via Getty Images

Introduction

Extra Space Storage (NYSE:EXR) was one of the first REITs that I started buying many years ago (although it wasn't an initial holding of my current dividend growth portfolio). I have mentioned in several articles that EXR perfectly aligns with my investment strategy. Although REITs rarely have economic moats, EXR operates in a highly attractive industry that benefits from several tailwinds.

In addition to the stores themselves, self-storage may be the biggest beneficiary of spending-happy consumers. After all, the stuff we buy needs to be stored somewhere.

When adding that the housing market has been an increasing issue for people for many years, the focus shifts to smaller homes, making self-storage even more important to store the stuff we don't need.

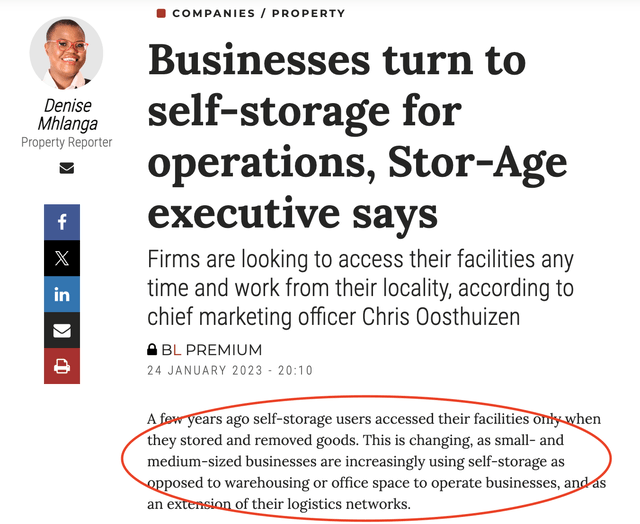

On top of that, I like the prime real estate that comes with self-storage. It is often close to city centers, making self-storage increasingly important in the last-mile supply chain. While it's not that common yet, we'll likely witness a shift to self-storage mini-warehouses to assist companies with inventory and last-mile shipping solutions.

BusinessDay (Author Annotation)

Last but not least, self-storage can be bought in bulk and managed quite efficiently. When rates were still low before 2022, institutional investors used it to pump billions into real estate.

While we're now in a totally different situation, I expect this to happen again the moment rates fall.

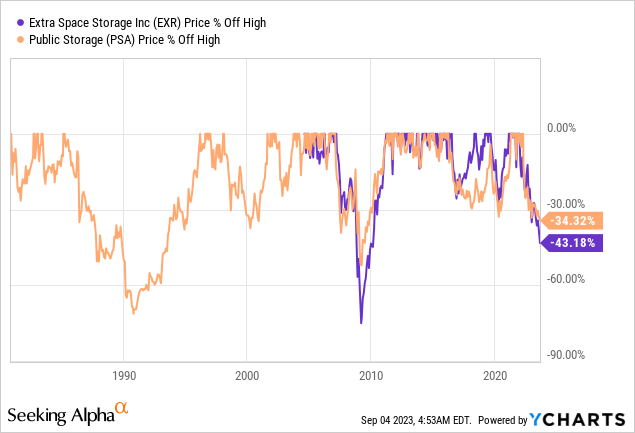

Currently, I own Extra Space Storage and Public Storage (PSA). Both are currently suffering as a result of rising rates, poor consumer confidence, and sticky inflation, amplifying the first two problems.

EXR is currently more than 40% below its all-time high, making it my worst investment.

After averaging down a few times, EXR shares in my portfolio are down 17%.

However, instead of shying away, I'm using this opportunity to further boost my position. While the company had to downgrade its full-year guidance, self-storage remains strong. The company has a top-tier balance sheet with a high likelihood of another upgrade and a strategic acquisition that positions it as the go-to self-storage stock.

Although I do not expect REITs to take off in the short term, I love this buying opportunity to buy a 5%-yielding REIT with one of the best track records in the industry.

So, let's dive into the details!

Weak, But Not Defeated

Last month, the Wall Street Journal wrote an article dedicated to the self-storage industry.

The article noted that for the past 25 years, self-storage facilities have thrived in the United States, driven by Americans' desire to accumulate more belongings than their homes can accommodate.

Self-storage investments have performed well in both prosperous times and periods of economic instability, with the COVID-19 pandemic resulting in a surge in profits as people repurposed their living spaces.

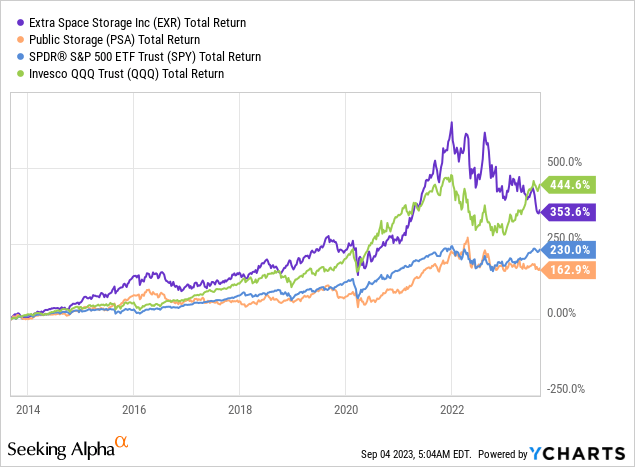

Self-storage company shares have outperformed the broader stock market and even tech giants like the FAANG companies.

However, the industry is facing challenges as office workers return to their workplaces, and rising interest rates slow down home sales, a significant driver of storage demand. Occupancy rates at self-storage facilities have declined, leading to substantial discounts to attract new customers.

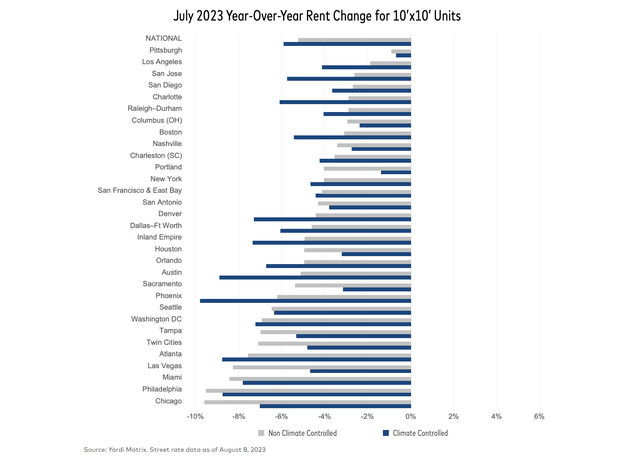

The August self-storage report from Yardi Matrix confirmed these challenges. According to the report, the self-storage industry is dealing with economic challenges, causing its growth to slow down from historical levels.

- Street rates for storage units slipped in July, and year-over-year growth remains negative as both demand and supply trends soften.

- Nationally, rates for combined climate-controlled ("CC") and non-climate-controlled (NON-CC) 10x10 units fell by $1 to $134 in July.

- Lower rates are a result of weak move-in activity and declining occupancy levels.

- The weak home sales market and reduced domestic migration from COVID-19 highs have impacted demand.

However, despite these challenges, the industry benefits from a strong job market and resilient consumer finances, and it historically rebounds quickly following downturns due to flexible lease terms.

Moreover, the national new-supply pipeline slightly decreased in July, with properties under construction making up 3.6% of completed inventory.

Lending conditions and rising construction costs have begun to slow down new construction starts, which is great for pricing and existing players. After all, subdued supply growth is a major tailwind in all real estate sectors.

In other words, self-storage is far from a money-losing industry, as secular tailwinds remain strong, allowing me to buy high-quality players at great prices until we get a fundamental upswing.

What Makes Extra Space Storage So Special

When I was still actively trading (many years ago), the rule was to add to winners and cut losers.

In long-term investing, I'm doing things differently. I don't sell winners and add to stocks that are down (I wouldn't call them losers). However, this can only be done when dealing with high-quality stocks, which is why I usually advise starting investors to stick to ETFs.

Despite the tremendous pressure on Extra Space Storage, I believe this company is the gold standard among self-storage operators.

Founded by its current Chairman, Ken Woolley, in 1977, the company has become an S&P 500 REIT with a market cap of roughly $27 billion.

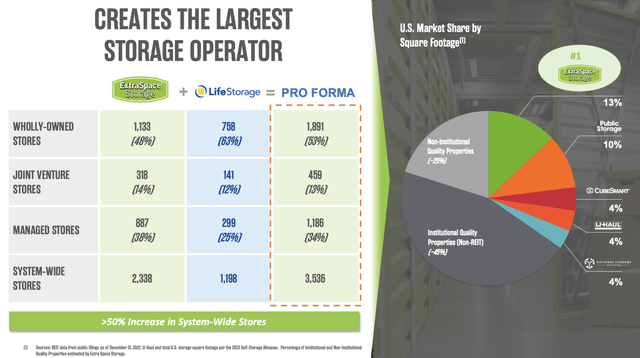

This year, it officially bought LifeStorage, which used to trade under the LSI ticker. Combined, the company now owns close to 1,900 stores, bringing the total store count to more than 3,500 when incorporating joint ventures and managed stores.

This deal de-thrones Public Storage as the market share leader.

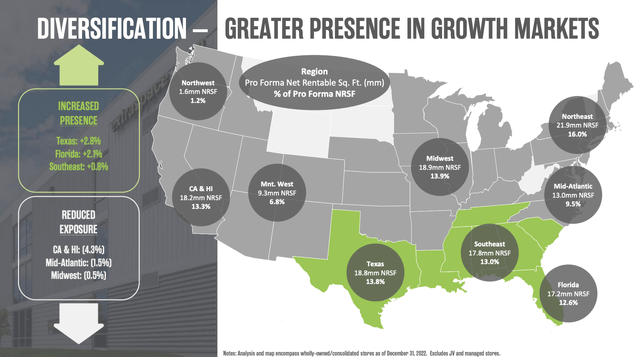

Because of this deal, the company maintains a well-diversified store portfolio with additional exposure in faster-growing Sunbelt states like Texas, Florida, and the Southeast.

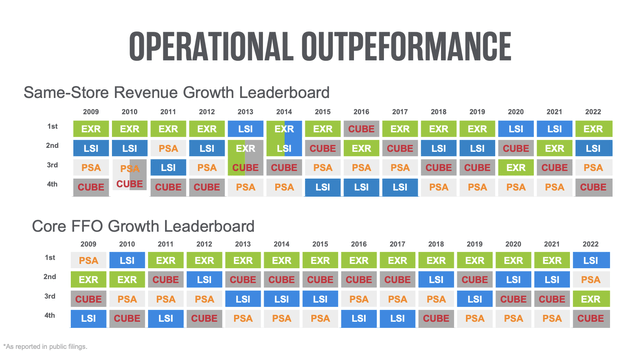

On top of this benefit, the EXR-LSI combination merges the two best-performing players in the industry.

Since 2009, EXR and LSI have dominated the leaderboard among major stock-listed self-storage REITs when it comes to same-store revenue growth and core FFO (funds from operations) growth.

A consistently good performance is no coincidence but the result of top-tier management that has figured out how to get the most value out of every square foot of rentable self-storage space.

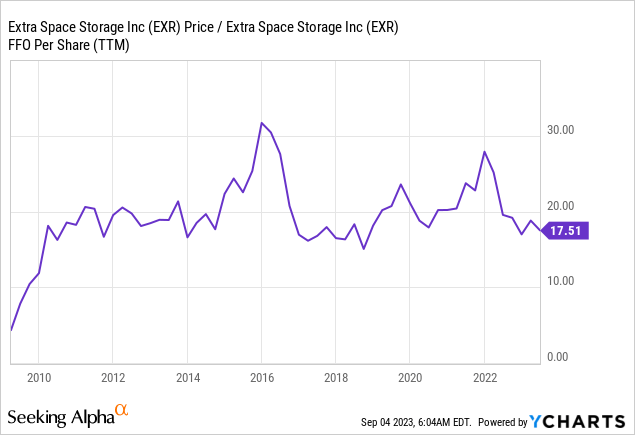

As a result, since 2011, EXR has grown its core FFO per share by 720%.

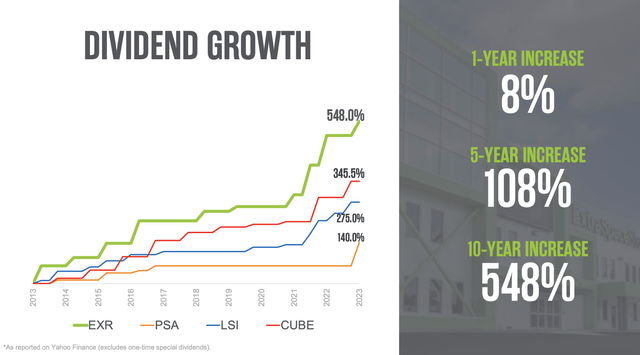

The dividend has risen by roughly 550% since 2013, outperforming its peers by a mile. The five-year dividend CAGR is 14.3%. The company hiked its dividend by 8% on February 16.

EXR currently pays $1.62 per share per quarter.

Please note that a lot of websites will give you a lower payout, as the company has broken up its quarterly payout due to the LSI acquisition. It has NOT cut its dividend.

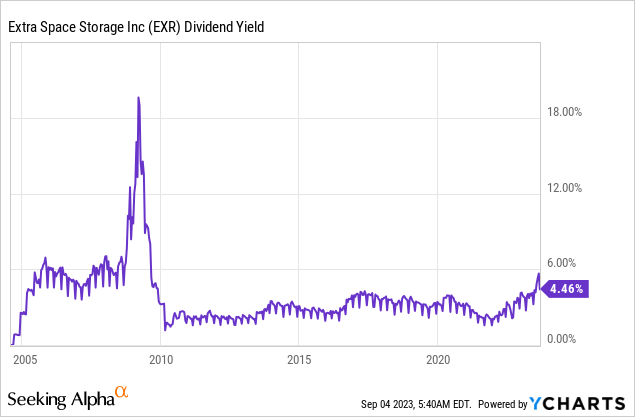

This dividend translates to a yield of 5.0%. This is the highest number since the Great Financial Crisis.

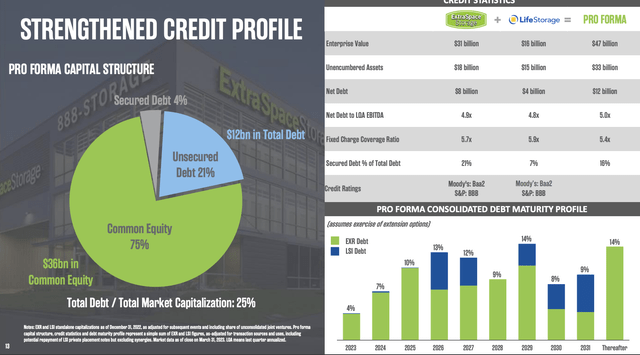

It's also backed by a healthy balance sheet.

The combined company has $12 billion in net debt. Its net leverage ratio is 5.0x EBITDA. Only 16% of its debt is secured. Just 11% of its debt matures before 2025.

Its credit rating has been bumped up to BBB+ (not visible in the overview above), as credit rating agencies like the additional value potential of the EXR/LSI deal.

And second, last week, S&P Global raised our credit rating to a BBB+ to reflect our larger and stronger company, which will have an immediate and future benefit on our cost of debt capital. So while we have just closed and we know it is still early, we are excited as we begin to realize the many future opportunities this merger creates for Extra Space and our shareholders. - EXR 2Q23 Earnings Call

The dividend is also backed by healthy funds from operations, which brings me to the next part of this article.

Challenges & A Fantastic Valuation

As we discussed at the start of this article, the self-storage industry isn't in great shape. However, EXR continues to do well.

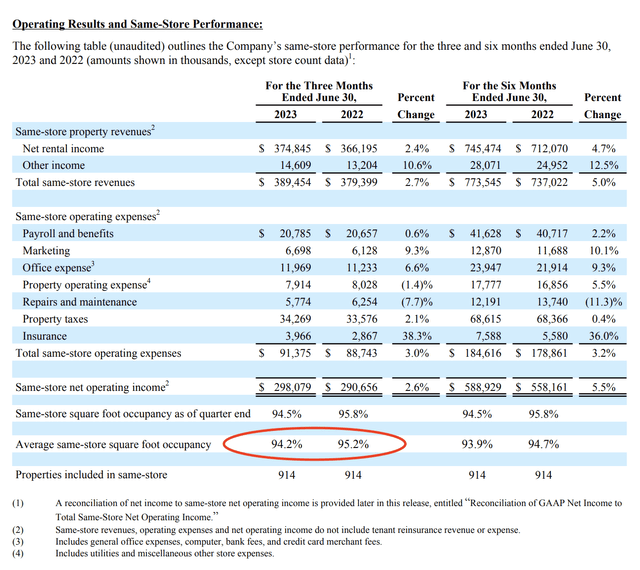

In the second quarter, the same-store occupancy remained high at 94.5% throughout the quarter - but down from 95.2%.

Although rental volume declined compared to the previous year, low vacate rates allowed for sequential improvement in occupancy each month.

Extra Space Storage (Author Annotations)

Existing customer health was robust, with low bad debt levels and customer acceptance of rate increases.

Despite challenges, Extra Space remained optimistic about the storage industry.

Occupancy rates are at 95%, with a 15% increase in new customer rates from pre-pandemic levels in 2019, while new supply remains manageable. Favorable external growth drivers such as acquisitions and third-party management have also strengthened the company's position.

Unfortunately, the company had to incorporate some weakness into its guidance, which is one of the reasons why its stock price hasn't been doing so well recently.

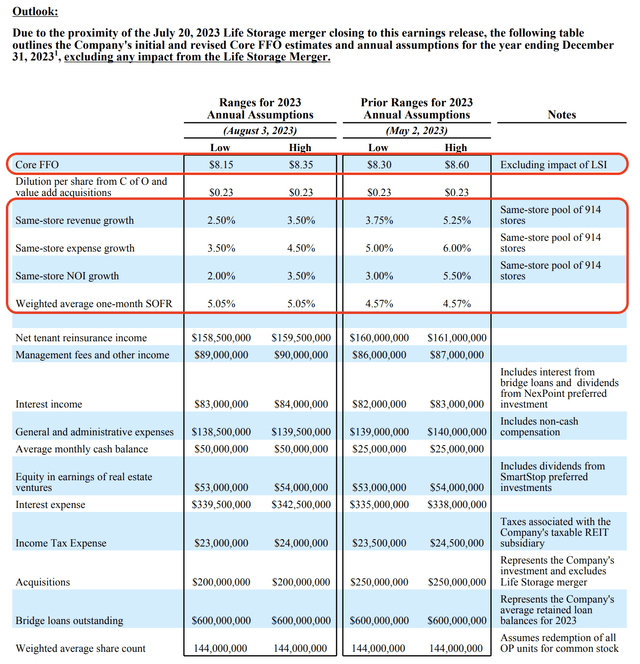

In its second-quarter earnings release, EXR updated its 2023 guidance ranges for same-store growth and core FFO, excluding the impact of the Life Storage merger.

This update was influenced by lower-than-expected pricing power and rental volume in June and July, along with changes in the forward interest rate curve.

- Same-store revenue growth expectations (excluding Life Storage assets) were adjusted to a range of 2.5% to 3.5%, while same-store expense projections were revised to 3.5% to 4.5%.

- This resulted in a revised NOI range of 2% to 3.5%.

Extra Space Storage (Author Annotations)

The company anticipates that the rate of revenue growth deceleration will stabilize in the latter part of the year as comparables ease.

Core FFO guidance (excluding Life Storage) was reduced to the new range of $8.15 to $8.35 per share, primarily due to lower property revenues and expected higher interest rates.

So, to go back to the dividend, the company has a 78% payout ratio based on its core FFO guidance midpoint.

Moreover, despite the adjustments to guidance and the merger, EXR remains optimistic about the storage asset class, considering it among the most resilient in the REIT space.

The company believes that its operating platform and highly diversified portfolio have strengthened further through the Life Storage merger, positioning it for robust growth in the future.

I could not agree more.

Having said that, EXR is now trading at 15.6x the core FFO guidance midpoint.

This valuation multiple is close to the lower bound of its long-term valuation range. The median sector multiple is 12.6x, which gives EXR a slight premium.

First of all, I believe that a lower multiple is warranted compared to pre-2022 levels. Rates are elevated, inflation is sticky, and general headwinds have changed the self-storage landscape - at least for now.

I also believe that a premium over the median sector valuation is warranted, as EXR is in a much better spot than the median REIT.

Over the past five years, EXR has grown its FFO by 14% per year. The sector median compounding growth rate was just 2%.

The current consensus price target is $156, which is 21% above the current price.

While I do believe that EXR is a Strong Buy, I do not believe that the stock will take off anytime soon. Hence, it's a long-term rating.

EXR remains a terrific buy on weakness until we get a more sustainable economic recovery. At that point, dividend growth will likely pick up again, allowing investors to benefit from accelerating capital gains and income.

I truly believe that EXR can become one of my best long-term investments, which is why I keep accumulating on weakness, especially if the Fed's actions cause REITs to drop further.

Takeaway

While EXR has faced headwinds due to rising interest rates and a shifting economic landscape, it stands out as the gold standard among self-storage operators.

With a diversified store portfolio, strong financials, and a track record of consistent growth, EXR holds its own even in turbulent times. Its resilient occupancy rates, customer loyalty, and favorable growth drivers position it for a bright future.

Although the stock is currently trading at a reasonable valuation, I don't expect an immediate takeoff.

However, I view EXR as a strong long-term buy, especially if market conditions push REITs further down.

I firmly believe in its potential to become one of my best long-term investments, making it a compelling choice for investors seeking both capital gains and steadily growing income.

Reasons To be Bullish

- Resilience in Tough Times: EXR has maintained high occupancy rates and customer acceptance of rate increases in challenging economic conditions.

- Industry Leader: As the market share leader following its acquisition of LifeStorage, EXR has a strong market position and diverse store portfolio.

- Solid Financial Performance: EXR boasts consistent growth in core FFO per share and dividends, offering a 5.0% dividend yield.

- Healthy Balance Sheet: With manageable debt and a favorable credit rating, EXR remains financially stable.

- Long-Term Growth Potential: Historically, EXR has outperformed sector growth rates, making it a compelling long-term investment.

- Attractive Valuation: EXR's valuation is reasonable, considering its market strength.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of EXR, PSA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.