That Syncing Feeling

Summary

- The perceived low correlation between equity and bond returns is the basis of the construction of the "balanced" portfolio.

- A recent study by FTSE Russell has noted that for most of the past year, stocks and bonds "have moved in virtual lockstep, undermining faith in the long-term efficacy of this classic framework".

- This hasn’t just been happening during periods of market stress, but the overall trend has been to higher equity-bond correlation.

tadamichi

By Dewi John

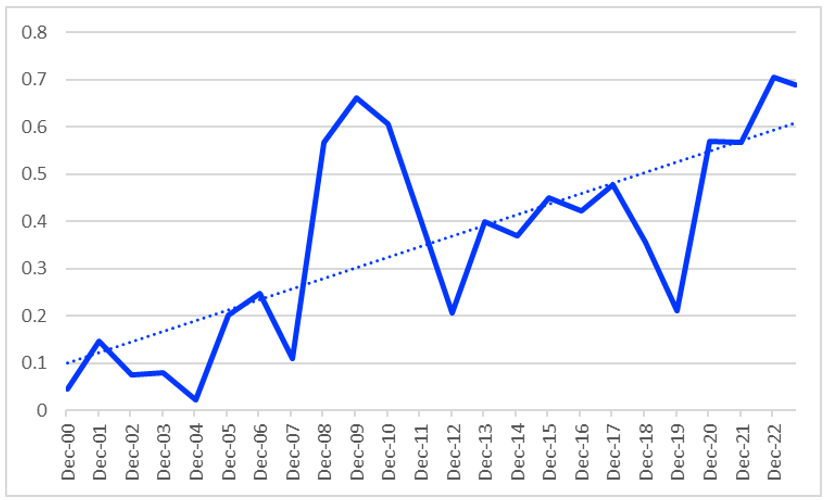

Bond and equity fund correlations have trended up this century

Increasing equity-bond correlations over decades poses questions for traditional portfolio construction.

The perceived low correlation between equity and bond returns is the basis of the construction of the “balanced” portfolio. The split between equities and bonds provides diversification benefits that should lead to better risk-adjusted returns over the longer term. Indeed, multi-asset sales (particularly those with a stronger equity tilt) have proven popular over the past three years, despite ongoing volatility and swings in market leadership.

A recent study by FTSE Russell has noted that for most of the past year, stocks and bonds “have moved in virtual lockstep, undermining faith in the long-term efficacy of this classic framework”. Over the period, the two-month-rolling correlation coefficient between the FTSE Global All-World equity index and the FTSE World Government Bond Index grew sharply positive, breaching 0.8 in February, and reaching a 10-year peak of 0.86 at the end of March.

FTSE Russell notes that equity-bond correlations spike during bouts of high market anxiety, such as the Taper Tantrum in 2013, at the start of Fed tightening in December 2015, and as post-lockdown inflation gained traction. All of these situations saw falls in both equities and bonds.

The increase in asset class correlation during times of market stress has been well-documented, with one study noting that “there appears to be more co-movements among the various asset classes during periods of global shocks. This seems to be more pronounced in the case of the Covid pandemic”, while another observed “during the current financial crisis, many of these asset classes experienced high degrees of correlation as they all decreased in value” and that “many asset classes can be highly correlated in a downturn”.

I ran rolling three-year monthly correlations1 of all equity funds and bond funds registered for sale in the UK and noted that correlations spike broadly at the mid-point of the 36-month period during times of market stress. Correlations peak for the period ending December 2009 (0.662) and December 2022 (0.704), these periods capturing the Global Financial Crisis and COVID crisis at broadly the same point (Chart 1).

Chart 1: Rolling 36-Month Equity-Bond Fund Correlation

Source: LSEG Lipper

What’s also clear from the chart is that this hasn’t just been happening during periods of market stress, but that the overall trend has been to higher equity-bond correlation. The mean correlation from 2000 to 2007 is 0.092, and from 2008 to YTD, 0.442. That’s a significant increase over the two-plus decades. What’s interesting is that this hasn’t led to an increase in the average volatility of multi-asset funds, using the Lipper Global Classification, Mixed Asset GBP Balanced as an example - indeed, there’s a slight negative relationship that increases in strength when annualised standard deviation is moved one, then two, years back from the end of the 36-month rolling volatility period. Though, rather less surprisingly, the peaks in volatility are 2008 and 2020.

It’s not altogether clear what’s causing this, although it’s likely that quantitative easing, in supporting financial asset prices in general, has increased correlations. What also seems likely is that quantitative tightening won’t initially weaken the relationship, as withdrawing support will pull in the same direction for batch asset classes. What is worth considering, though, is that correlations are at around the level they were at during the Global Financial Crisis, so would likely surpass this in the event of additional market stress.

____________

1 To year-end, plus one of 36 months to the end of August 2023

The views expressed are the views of the author and not necessarily those of LSEG Lipper. This material is provided as market commentary and for educational purposes only and does not constitute investment research or advice. LSEG Lipper cannot be held responsible for any direct or incidental loss resulting from applying any of the information provided in this publication or from any other source mentioned. Please consult with a qualified professional for financial advice.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by