JMBS: When Employment Falls, Mortgages Fall Into Focus

Summary

- JMBS is an actively managed ETF focused on producing alpha on mortgage-backed securities.

- The ETF managers employ leverage to give an extra push to long allocations focused on agency MBS.

- There is downside risk in the event of a recession, but JMBS may provide some protection due to its longer duration and historical outperformance during credit crunches.

- Nonetheless, you can't really hide anywhere in large portfolios in those events, and select corporate credit, possibly in alternative geographies, makes more sense.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

PM Images

The Janus Henderson Mortgage-Backed Securities ETF (NYSEARCA:JMBS) is a pretty actively managed ETF with decent turnover, looking to produce alpha on mortgage-backed securities. They are leveraged-long MBS. The duration is high, which is less of an issue now because deflationary elements are on the horizon, and more rate hikes are not too likely, although it is possible there will be revisions to long-term rate expectations to the upside if there aren't economic pressures due to underappreciated trends in degloblisation. The issue is just the reality of maturity walls. We think higher unemployment is inevitable when that happens, and that will become a revision in credit spreads. JMBS is solid on a credit rating basis, but there will still be negative effects. The mitigating factor is that there may also be positive duration effects with expectations in long-term rates possibly falling in that instance. Still, mortgages are in the firing line when employment becomes an issue, although historically agency MBS outperform when credit becomes a concern.

JMBS Key Data

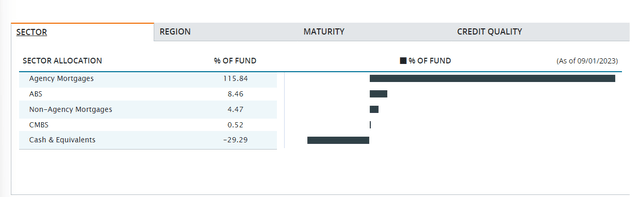

The key data to know is that the ETF is leveraged. It isn't a leveraged ETF in the sense that it mirrors daily changes in an index with a factor, it is simply leveraged in that the fund has borrowed cash in order to make its own investments. They have a -29% position in cash, and the majority of its long portfolio is in agency MBS.

Agency MBS are sponsored by US Treasury backed government-sponsored enterprises, and therefore have a credit risk almost in line with the government's credit risk.

The ETF is actively managed, about half of its portfolio turns over annually. It has almost a 7-year duration. Considering that, the expense ratio is pretty low at 0.28%.

Analysis

The first thing to note is that there is downside risk in the event there is a recession. We think a recession is likely to happen, not because of higher rates crimping household spending, also since mortgages are not that often variable rate for households, but because higher rates are going to crimp corporate profits upon refinancing and it will cause more layoffs in order to preserve profits. Effects on employment will always concern MBS' assets. Agency assets are going to be low credit risk, but there should still be some drawdown once the effects of the maturity wall take hold in the corporate world.

Lower housing prices also give some push to rents, where higher rates and lower housing transactions usually mean more demand for renting, which means blowback effects on the short-term plans for rates to affect CPI. With JMBS duration being a bit high, there is a chance that more rate hikes are needed in the short term, which will impact this high duration ETF even in that time horizon.

The mitigating factor is that if there is a recession, inflationary pressures from deglobalisation should be offset by falling demand, which should revise down long-term rates. JMBS is longer duration, and that is going to help limit price and value declines if rate expectations in later periods are revised upwards. Moreover, there is a historical argument that demonstrates that agency MBS outperform when there are credit concerns, which is exactly the risk factor that is concerning investors in this rate-led cycle. The slight premium on MBS today mirrors that of previous periods, and provides some margin of safety in the event of drawdowns.

Bottom Line

Maybe they will outperform some broad classes within credit, but they are still in the firing line if there are economic troubles that start hitting employment figures. There is more downside protection in select corporate credit, possibly in alternative geographies that are going to be more resilient, in companies who are more recession-resistant and where bonds are priced with more pronounced risk premiums. Outperformance in an underperforming class of assets is still not desirable performance. JMBS has some helpful effects, and it is more of an ambiguous call than other credit assets which have a clearer downside argument, but investors can do better and should be thinking more narrowly considering autopilot is off in markets.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.