CyberArk Software: Transition Complete, ARR Growth Accelerates

Summary

- We are buy-rated on CyberArk Software Ltd.

- We see a favorable risk-reward profile as the company has now almost completed its transition to a SaaS business model with accelerating profitability.

- We think CyberArk deserves a higher multiple as it's able to accelerate its ARR growth.

- While we understand investor concern about increased competition and the possibility of its customers rationalizing IT spending further, we believe the company is well positioned to offset these headwinds.

- We believe CyberArk can continue to outperform its peer group in 2024.

- Looking for a portfolio of ideas like this one? Members of Tech Contrarians get exclusive access to our subscriber-only portfolios. Learn More »

GoodLifeStudio/E+ via Getty Images

We maintain our BUY rating on CyberArk Software Ltd. (NASDAQ:CYBR). The shift from a perpetual to a subscription-based business model to a subscription-based model is almost entirely done. We expect the transition will accelerate profitability while expanding CyberArk's dominant position in the Privilege Access Management (PAM) space. We see a more favorable risk-reward profile for the stock as we see CyberArk outperforming into 2024.

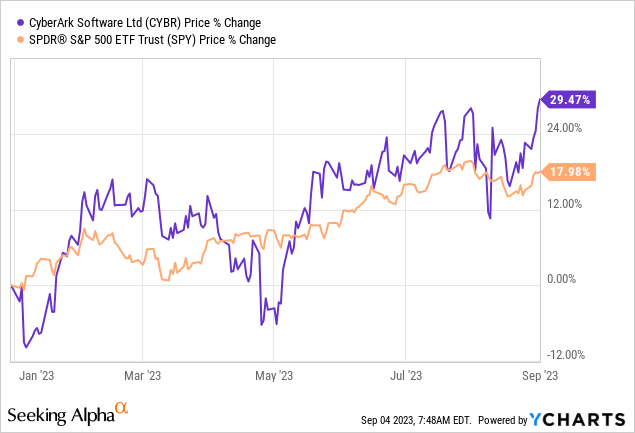

CyberArk has outperformed the S&P 500 (SPY) YTD by 11.49%. Macroeconomic headwinds, namely inflationary pressures and interest rate hikes, throughout 1H23, pushed the stock down in January and May to form a double bottom before rallying at the company's 1Q23 earnings outperformance.

Below is the CYBR YTD chart compared to the S&P 500.

YCharts

What is Privilege Access Management?

PAM is a type of cybersecurity technology that protects organizations from cyber-attacks by protecting unauthorized individuals' access to critical resources of any given company. PAM is a trifecta of people, processes, and technology that gives you an eagle-eye view of who is accessing what and when. Our bullish sentiment on CyberArk is largely driven by the company's position in the PAM space.

CYBR has cemented its place in the identity space by being among the only vendors positioned as a leader in both the Gartner magic quadrant and access management reports. Given how important data protection is nowadays, organizations seek to safeguard their data using the best available technology, and that's where we believe CyberArk excels.

Below are two figures taken from CyberArk's recent earnings presentation. Figure 1 details the Gartner's quadrant for PAM and Figure 2 for AM. Cybersecurity remains a top spending priority, even more so with the A.I. boom expanding the cyberthreat landscape.

We understand investor concern about competition with alternatives to CyberArk, such as Okta, Inc. (OKTA), CrowdStrike (CRWD), or even cheaper alternative packages from Microsoft (MSFT). However, we believe CyberArk is the only platform that covers all identities end-to-end, humans and machines. CyberArk offers a holistic security-first approach from workforce and customer access, end-point privilege security, privilege access management, secret management going through cloud security, and ending at identity management.

Competitors have one, two, or three of the above supply chains, but CyberArk encompasses all six. While we understand increasing competition as the cybersecurity market expands, we believe the growth opportunity is wide enough to encompass multiple players, with the cybersecurity market estimated to grow at a CAGR of 13.8% between 2023-2030. Our bullish sentiment on CyberArk is driven by our belief that the company will be one of the more resilient and profitable growth names in the cybersecurity space.

The above figure showcases CYBR end-to-end protection.

Why is the transition to SaaS important?

Before jumping into the importance of the transition, let's quickly recap what a SaaS business model is. Software as a service, or SaaS, is the business model that allows businesses to provide a monthly or annual subscription fee to access a vendor's products. SaaS has many benefits that range from fostering great relationships with customers by providing them access to the software at a much lower price than paying it upfront. In other words, the customer has a lower barrier to entry to use the product, thus leading to a higher customer retention rate. Subscription revenue for CyberArk grew 61% of total revenue in 2Q23 compared to 46% in 2Q22. CyberArk currently has more than 90% of its revenue in 2Q23 as recurring, up from 85% in 2Q22, which translates to a 31% Y/Y recurring revenue growth. Management noted on the call that they "expect the subscription mix will continue to be above the 95% level."

When talking about a SaaS model company, what will enable us to track growth and profitability will be continued growth in ARR. Subscription annual recurring revenue, or ARR, grew 77% this quarter, accounting for 69% of total ARR, an increase of 40% Y/Y. We think CyberArk is faring well in ARR growth compared to peers struggling with flat or low-digit ARR growth in the current macro environment.

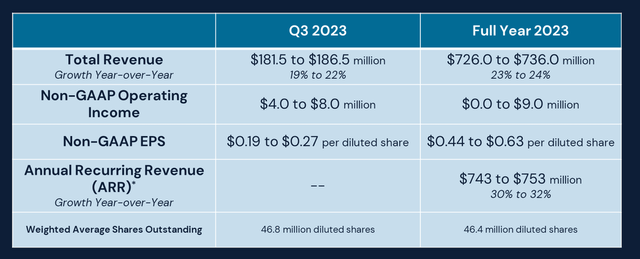

We all know the market is forward-looking; that's why we have to look at CyberArk's guidance. For its third quarter, management expects to generate between $181.5M and $186.5M in revenue, translating to double-digit growth of between 19% - 22% Y/Y versus consensus at $187.44M. What makes CyberArk even more attractive for investors looking to add growth cybersecurity names to their portfolio is the fact that management is raising ARR guidance and improving operating profitability for the entire year of 2023 - ARR guidance was raised from $735M-$745M to $743 to $753M, which translates to Y/Y growth between 30-32%.

The below figure pulled from CyberArk's 2Q23 presentation will give you a better understanding of CyberArk's guidance. Please don't take it from me; CyberArk's shares popped 13% after earnings were released.

Valuation

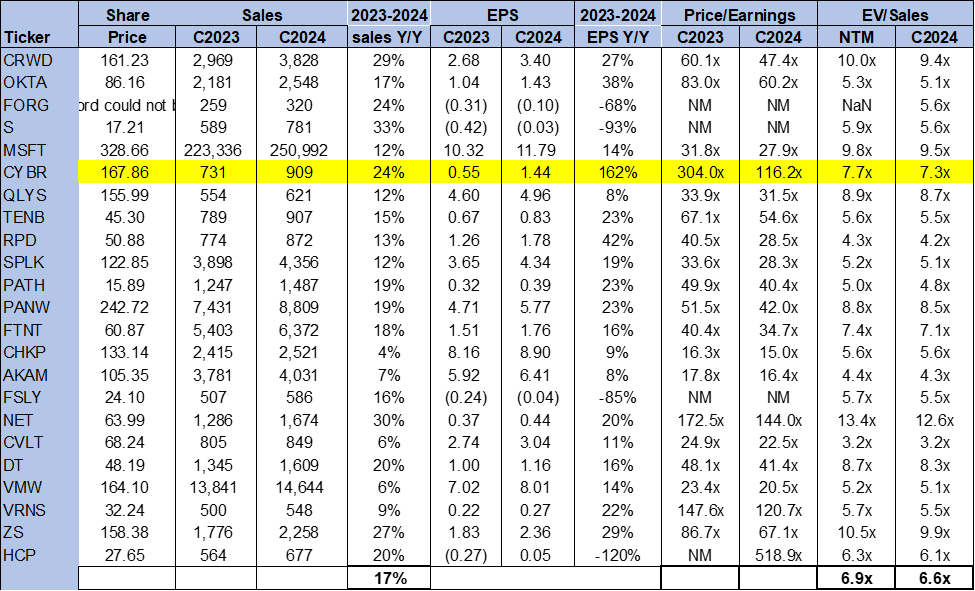

We believe CyberArk should be seen on an Enterprise value-to-sales ratio. For C2024, CyberArk is trading at a 7.3 multiple compared to the industry average of 6.6. Of course, some prefer the Price-to-earnings ratio, which is 116.2x C2024 EPS $1.44, versus the peer group average of 73.9x. We think the higher valuation is justified at current levels for three main reasons: first, CyberArk's position in the PAM space; second, the high entry threshold for competition; and lastly, the almost complete transition from a perpetual to a SaaS business model.

The following chart that we made using Refinitiv date should outline the valuation of CyberArk.

TSP

Word On Wall Street

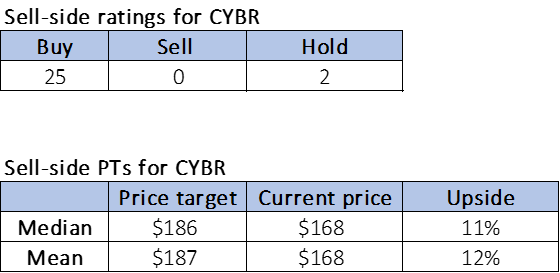

Wall Street shares our bullish sentiment on CyberArk Software Ltd. stock. Out of 27 Analysts, 25 are BUY-rated, and two are HOLD. The stock closed on Friday, September 1st at $168. Using the median of Wall Street Price target of $186, we can calculate an upside of 11%, and using the means, we have an upside of 12% for a price target of $187.

TSP

What to do with the stock

We think CyberArk Software Ltd. is a must-have name for any portfolio manager looking to add exposure to the cybersecurity space. We see a favorable risk-reward profile as the company is in its eighth innings of completing its transition to a SaaS business model with accelerating profitability. CyberArk trades well above the peer group average, but we think the accelerated ARR growth and transition justify its multiple. While we don't think CyberArk is immune to deals scrutiny and a longer approval cycle, we believe management's go-to-market strategy is well-equipped to weather the harsher macro backdrop.

Headwinds are there; we all know the macroeconomic adversity, but we are currently at the apex of a cybersecurity environment. Companies are willing to pay top dollar to protect their IP, data, and business practices. We suggest investors look for an attractive entry point in CyberArk Software Ltd. shares when a selloff opportunity arises.

Appreciate your interest in our tech coverage. If you want first-hand access to our analysis of software/hardware and semiconductor spaces, best ideas within the current macro backdrop, and our coveted research process, we hope you'll take a 2 week free trial of Tech Contrarians, our Investing Group service. The first wave of subscribers gets a significant lifetime discount on annual subscriptions after the 2 week free trial so we hope to see you in our group soon.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)