Dave & Buster's: Attractive Valuation But Near Term Headwinds Outweigh The Upside

Summary

- Dave & Buster's Entertainment is a high-quality entertainment business trading at a discount, but entry opportunities may be better in the future due to the current macro environment.

- The company's substantial indebtedness and target market of economically vulnerable customers may hinder revenue growth in the near term.

- Financial performance has shown solid recovery post-COVID, but liquidity and financial strength metrics are not strong.

ozgurcankaya/iStock via Getty Images

Investment thesis

Dave & Buster's Entertainment (NASDAQ:PLAY) is a high-quality entertainment business traded at a substantial discount. But I think there would be better entry opportunities ahead as the current harsh macro-environment does not favor discretionary spending. The company mostly targets the most economically vulnerable group of customers earning less than $100 thousand per year. The company's substantial indebtedness will also be a bottleneck to fuel revenue growth in the near term. To become a financially strong borrower, the company will likely need to pause its aggressive growth and reallocate spare financial resources to improve the balance sheet. That said, these temporary headwinds will pressure on the stock price in the near term. All in all, I assign the stock a "Hold" rating.

Company information

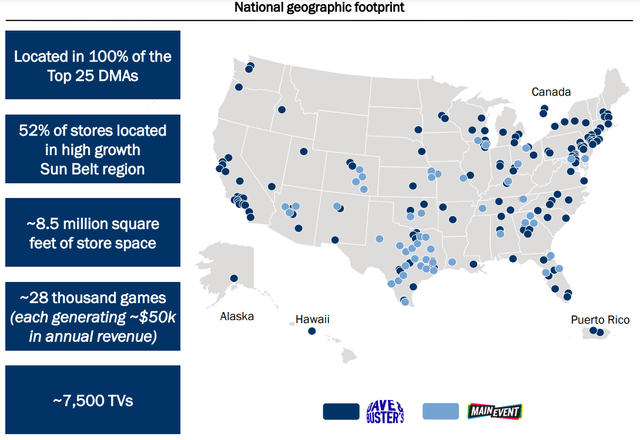

Dave & Buster's Entertainment, Inc. (D&B) is the owner and operator of 204 venues in North America that offer entertainment and dining experiences to its guests. The Company has 151 D&B branded stores in 41 states, Puerto Rico, and Canada and offers guests the opportunity to "Eat, Drink, Play, and Watch" all in one location.

D&B's fiscal year ends on the Sunday closest to January 31. The company operates as two segments based on its major brands, Dave & Buster's and Main Event. On June 29, 2022, the company acquired Main Event for approximately $832 million in net cash and contingent consideration.

PLAY's latest earnings presentation

Financials

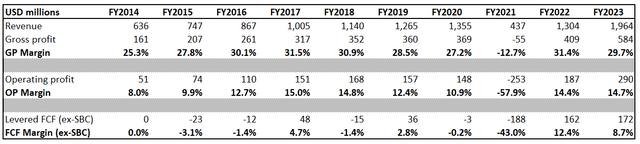

The company's financial performance over the past decade has been impressive, with a 13% revenue CAGR. Profitability metrics demonstrated consistent expansion as the business scaled up, apart from FY 2021, when the company's earnings significantly suffered from the Covid-19 pandemic and subsequent quarantine measures. Since the COVID-related crisis, the company's financial performance has demonstrated solid recovery, with a much higher free cash flow (FCF) margin than pre-pandemic levels.

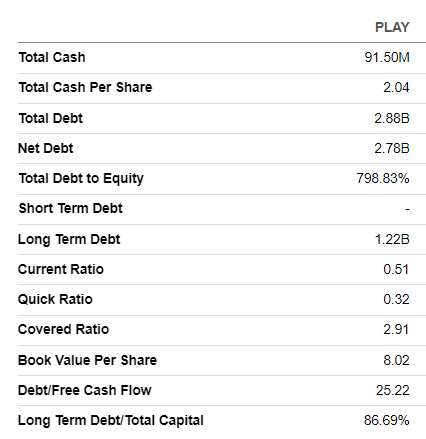

The business is capital-intensive, and the company needs to invest substantial amounts in new locations to fuel revenue growth. Therefore, it is unsurprising that the company is in a substantial net debt position. The covered ratio below three looks thin to me, especially given the harsh macro environment. Liquidity metrics also do not look very strong. From the financial strength perspective, I do not consider PLAY's position as strong.

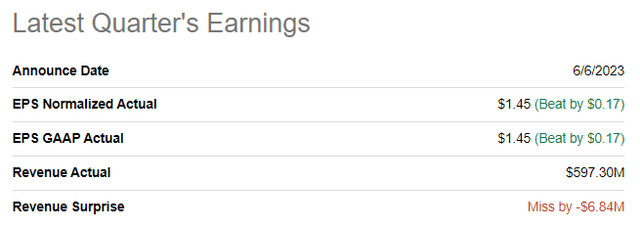

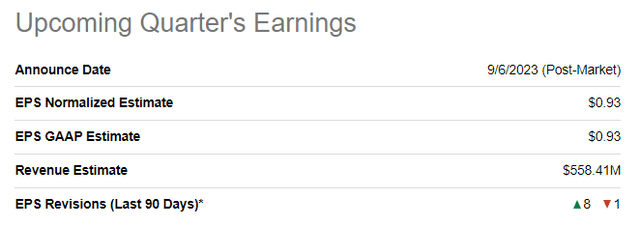

Seeking Alpha

The latest quarterly earnings were released on June 6, when the company missed consensus revenue estimates but outperformed from the bottom line perspective. Revenue demonstrated solid revenue growth momentum with a 32% YoY growth. Despite massive revenue growth, profitability metrics went in the opposite direction. Both the gross and operating margins narrowed by about 150 basis points. These are mainly due to inflationary pressure on the food and beverage cost of goods sold and due to an increase in hourly wages.

The upcoming quarter's earnings are scheduled to be released on September 6. Quarterly revenue is expected by consensus at $558 million, which indicates a 19% YoY growth. The adjusted EPS is expected to follow the topline and expand notably from $0.59 to $0.93.

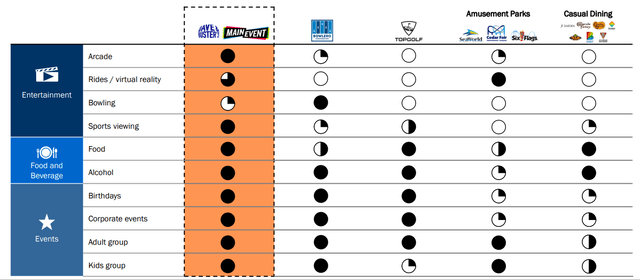

I see apparent strengths of the business. The company demonstrates strong revenue growth, meaning the management is robust in selecting new locations and providing compelling offerings to guests. To me, the all-in-one "Eat, Drink, Play, and Watch" approach makes PLAY a good choice for people to have nice weekends or family occasions. The wide variety of entertainment, together with foods and beverages, makes D&B differentiated from other entertainment venues.

PLAY's latest earnings presentation

I also like the diversified business model. The revenue mix looks relatively balanced, where Entertainment represents two-thirds of the total revenue, and Food and Beverage also represents a notable one-third. PLAY also has a solidly diversified geographic presence. I think that the company's diversified approach was the key to delivering a 13% revenue CAGR over the past decade within a relatively mature industry. But not only the top-line growth matters. Keeping an eye on costs is also crucial to increase value for shareholders. I like that during the latest earnings call, the management emphasized its commitment to increasing operating efficiency, which is also likely to be a solid driver for profitability expansion over the long term.

Valuation

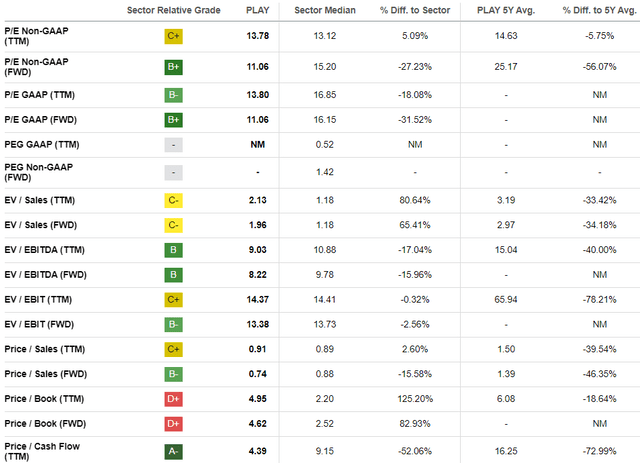

The stock underperforms the broader U.S. market this year, though it rallied 12% year-to-date. Seeking Alpha Quant assigns the stock an average "C" valuation grade, which indicates the stock is approximately fairly valued. To me, it is important that the current multiples are substantially lower than the historical averages. This might mean undervaluation.

I want to proceed with the discounted cash flow (DCF) simulation to get more evidence. I use a 9% WACC for discounting. Consensus revenue estimates are available up to FY 2026, and for the years beyond, I incorporate a very conservative 5% revenue CAGR. I use the TTM FCF margin, which equals 5.2% for my base year, and expect a 50 basis points expansion yearly.

According to my calculations, the business's fair value is almost $2.7 billion, which indicates the stock is massively undervalued.

Risks to consider

Now, let me discuss threats to the business, which look apparent amid the harsh environment. First, according to the latest earnings presentation, 76% of visitors earn below $100 thousand per year. That said, the central part of PLAY's audience is very price-conscious and is vulnerable to cutting their discretionary entertainment spending during economic downturns. While recent quarters demonstrated strong revenue growth momentum, I expect revenue growth to decelerate as interest rates remain high and the unemployment rate climbs steadily. Households with earnings less than $100 thousand per year are also more price-conscious, meaning it would be challenging for PLAY to exercise pricing power in the current inflationary environment.

Another big near-term challenge I see is the substantial indebtedness of the company. Financial leverage is the essential tool to drive revenue growth for PLAY, and the massive current net debt position together with profitability metrics is likely to continue shrinking in the near term, making it harder for the company to obtain new debt financing. That said, the company might need to sacrifice its aggressive growth trajectory in the near term to allocate funds to improve the balance sheet and wait for a more favorable environment for borrowers, i.e. the decrease in interest rates.

Bottom line

I like PLAY as a business. The company's diversified approach and unique proposition to customers of a wide variety of leisure activities together with foods and beverages make it well-positioned to sustain its aggressive revenue growth profile over the long term. The valuation also looks very attractive, especially considering the strong revenue growth momentum in recent quarters. However, I think that near-term challenges will likely adversely affect the company's financial performance in the next few quarters. The U.S. economy is probably heading toward a recession as the unemployment rate increases. Discretionary spending is likely to decrease amid the uncertain macro environment. To conclude, I assign PLAY a "Hold" rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.