Installed Building Products: Returns On Invested Capital Are Unsustainably High

Summary

- Installed Building Products is benefitting from the current housing market and is earning historically high returns on invested capital.

- I believe that these returns will revert to their mean due to typical competitive market dynamics and due to management's short-term oriented incentive structure.

- I am initiating coverage with a sell rating and a $107 price target.

- My price target assumes another 12-18 months of a favorable housing market dynamics followed by a more balanced supply/demand environment.

artursfoto/iStock via Getty Images

Installed Building Products, Inc. (NYSE:IBP) is benefitting from the current low inventory, high demand residential real estate environment alongside the homebuilding companies. In this market, homebuilders are the source of marginal housing supply as current homeowners are not willing to sell their homes due to locked in fixed mortgage rates. Buyers are buying up the homebuilder inventory as soon as it is built and IBP is supplying many parts and pieces for these new buildings.

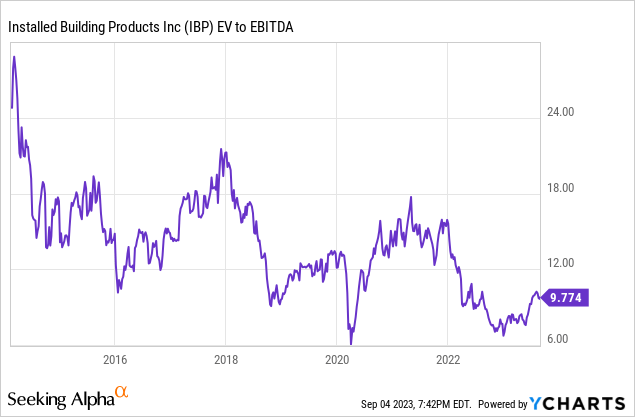

All of this means that both homebuilders and IBP are enjoying elevated earnings and returns on invested capital due to both volume and prices increases over the last few years. Investors have clearly noticed this trend as homebuilder stocks and IBP’s stock are at all-time highs, but they don’t necessarily seem convinced that this trend is a permanent shift in industry earnings and returns. I say this because, while higher earnings have driven these stocks higher, the market is paying a lower multiple for these earnings than they have in the past. This is very typical in cyclical industries like the housing industry, as these types of trends always revert to the mean.

This means that IBP investors should have an opinion on both IBP’s competitive advantages and the future of the housing market. Longer term investors must believe that IBP’s strategy gives them an edge in the highly competitive insulation and housing component market that will allow them to gain market share during a downturn. This will make the stock easier to hold as the investor would be confident that IBP would be better positioned on the other side of the downturn.

I personally don’t believe that IBP has much of a competitive advantage. The company is selling a commoditized product and management’s growth incentives are more aligned with short-term thinking as opposed to long-term value creation. This short-term thinking may lead to a higher stock price when times are good, but over time it will lead to value destruction.

While the stock may head higher over the next 12 months due to its acquisition strategy coupled with the favorable real estate market, I am initiating coverage with a sell rating and estimate that the stock is worth closer to $107 per share based on its future cash flows.

Past Financial Results

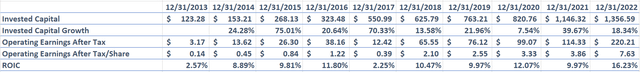

Business moats are generally apparent when viewing a company’s returns on invested capital over time. A business with a strong moat will have sustainably high returns on invested capital, while a business without a strong moat will have lower and more volatile returns on invested capital.

The volatility will especially be true for businesses in more cyclical industries. This does not mean that these businesses can’t have sustainably higher returns on invested capital, but they will be more volatile. Additionally, stronger businesses in cyclical industries can take advantage of downturns by gaining market share when weaker competitors exit the industry.

An examination of IBP’s returns on invested capital indicate that the business does not have much of a strong moat.

The recent increase in ROIC is due to the favorable housing market that I mentioned above. The business model has not changed in this period, and the only additional benefit the company currently has is that of a larger scale.

However, when taking the management incentive plan into account, I don’t necessarily think a larger scale will benefit the company over the long term. This above trend ROIC has more to do with the current housing environment and should revert back closer to 10% once the environment changes.

Incorrect Incentives

Businesses that grow via acquisitions must have strict discipline when making these acquisitions in order to maximize returns. This is easier said than done, and serial acquirers that deliver sustainably high returns on acquisitions are rare in public markets. The two most well-known and successful examples are Berkshire Hathaway Inc. (BRK.A) and Constellation Software Inc. (CSU:CA). These companies have delivered incredible returns for investors due to their strict discipline in making deals only for the right price. This discipline in M&A can be attributed to both company culture and proper incentives.

I don’t think IBP has the correct incentive structure in place to build long-term shareholder value. Management’s bonus structure is based on achievement of adjusted EBITDA numbers according to the proxy statement that reads, “Any performance-based cash or restricted stock award earned by our NEOs depends upon the Company’s achieved Adjusted EBITDA during the performance period as compared against the target set by the Compensation and Human Capital Committee.”

The proxy statement further explains IBP’s philosophy on compensation:

The Compensation and Human Capital Committee believes Adjusted EBITDA is the most useful measure of profitability and operating performance as it measures changes in pricing decisions, cost controls and other factors that impact operating performance and removes the effect of our capital structure, asset base, items outside our control and volatility related to the timing and extent of activities such as asset impairments and non-core income and expenses.

Contrast this with Constellation’s compensation philosophy from their proxy statement in 2022:

As such, our corporate bonus plan, which compensates employees at all levels of our organization, is based upon return on invested capital (“ROIC”) and net revenue growth (ROIC is calculated by dividing net income for bonus purposes for the year by the Average Invested Equity Capital for the period.)… The company performance factor is determined by reference to net revenue growth and ROIC. ROIC is calculated by dividing net income for bonus purposes for the year by the Average Invested Equity Capital for the period. A ‘risk free’ rate of return established by the board (currently 5%) is netted from the ROIC. If the ROIC does not exceed the risk-free rate of return, then the manager of the business receives no bonus.

IBP specifically points out that they wish to remove the effects of capital structure and their asset base, and there is no mention of equity capital from their consideration of performance while Constellation makes it a crucial part of their plan. This means that IBP management could meet their adjusted EBITDA goals for bonus purposes by making as many acquisitions as possible with little regard for returns on those acquisitions. Over the long run, I believe that there is a good chance that this type of compensation structure can lead to value destruction for shareholders.

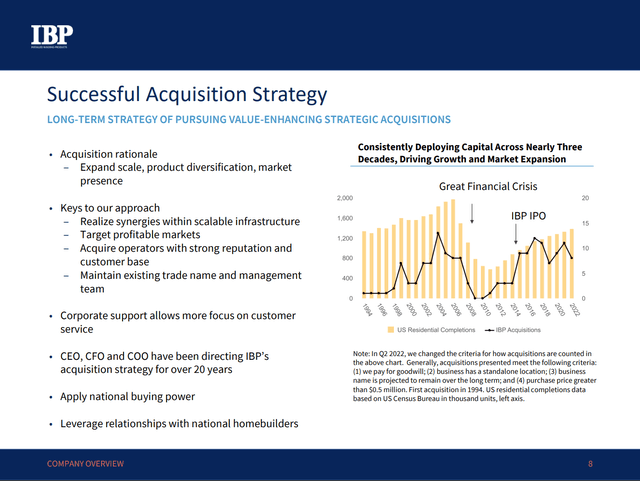

IBP Acquisition Strategy (Q2 2023 Investor Presentation)

The above slide from their most recent investor presentation shows their acquisition strategy; most of it focuses on growth and gaining market share, and there is no mention of returns on those acquisitions.

Price Target

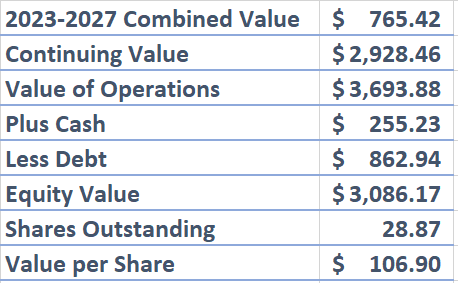

In my price target estimate, I am generally assuming that past trends for IBP and the real estate market will return. This means that the current housing supply/demand dynamics will balance out and excess returns above the cost of capital for homebuilders and housing component companies like IBP will be competed away. An investor that believes that this will not happen will likely find issue with my price target estimate.

The following are the assumptions for my model.

Revenue growth in 2023 is 4.88%, 10% in 2024, and gradually declines to 5% in 2032. Gross margin is 33% in 2023 and 2024, and 32% through 2032. SG&A expenses are equal to 19% of revenue through 2032. Interest expense is equal to 1.5% of revenue through 2032. IBP’s tax rate is 25% in 2023 and 22% after that through 2032. D&A is equal to 4.2% of revenue in 2023 and 4% of revenue after through 2032. Capital expenditures are equal to 1.86% of revenue in 2023 and 2% of revenue after that through 2032. Acquisitions are equal to 3.57% of revenue in 2023 and 3.5% of revenue in the years after through 2032. IBP’s weighted average cost of capital is 10% and its terminal growth rate is 2%.

IBP DCF (Created by Author) IBP DCF Continued (Created by Author)

All of these assumptions lead to my intrinsic value estimate of $107 per share. This represents 26% downside from the stock’s current price and largely assumes another year of a favorable housing market followed by a reversion to a more normal supply/demand environment. This price target is also 8x my estimate of 2024 EBITDA. While this is a low multiple, I believe it is reasonable given the fact that this could be the cyclical top for homebuilders, that IBP has historically had relatively low returns on acquisitions and that there is a poor management incentive structure in place.

Final Thoughts

IBP is currently benefitting from a favorable housing market due to the supply/demand imbalance that is leading to marginal supply being met largely by homebuilders. This is subsequently leading to high demand and more pricing power for companies like IBP that supply insulation and other complementary housing and building products to builders.

I am assigning the stock a sell rating and a price target of $107 per share due to my beliefs that the current supply/demand imbalance in the housing market will work out over time, causing IBP's returns on invested capital to revert to their historic mean. This price target is based on my assumption of IBP's future cash flows, but it is also 8x my estimate of 2024 EBITDA. This multiple seems reasonable given the part of the housing cycle we are in and given IBP’s past returns on acquisitions.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.