Ryde Group Ltd. Files For $17 Million U.S. IPO

Summary

- Ryde Group Ltd. has filed for an IPO to raise $17.25 million in gross proceeds.

- The Singapore-based firm operates a platform for car-pooling and ride-hailing services.

- Ryde is experiencing growth in revenue but is producing increasing operating losses and is thinly capitalized in a capital-intensive industry.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Koh Sze Kiat/E+ via Getty Images

A Quick Take On Ryde Group Ltd

Ryde Group Ltd. (RYDE) has filed to raise $17.25 million in an IPO of its Class A ordinary shares, according to an SEC F-1 registration statement.

The firm operates a platform in Singapore that enables car-pooling and ride-hailing services for consumers.

While Ryde is growing revenue from a small base, it is producing operating losses and is thinly capitalized in an industry that is highly capital-intensive.

I'll provide a final opinion when we learn more details about the IPO.

Ryde Overview

Singapore-based Ryde Group Ltd. was founded to provide a variety of car-sharing capabilities for users in Singapore who wish to earn money or obtain convenient, low-cost transportation-on-demand services.

Management is headed by Founder, Chairman, and CEO Mr. Terence Zou, who has been with the firm since its inception in 2014 and was previously Investment Director at Newfields Capital and Vice President at 3V SourceOne Capital.

The company's primary offerings include the following:

RydePOOL - carpooling

RydeX, XL, LUXE, FLASH, PET, HIRE, and TAXI - ride-hailing

Quick Commerce - package delivery

As of December 31, 2022, Ryde has booked a fair market value investment of $4 million in equity and $3.8 million in convertible debt from investors, including DLG Ventures Pte. Ltd. and Tan Choon Ming.

Ryde Customer/User Acquisition

The firm provides what it calls a 'super mobility app' through major mobile platforms to customers.

The company also provides an in-house payment token (RydeCoin) issued through a rewards program or through user purchases.

Employee Benefit expenses as a percentage of total revenue have fallen slightly as revenues have increased, as the figures below indicate:

Employee Benefits | Expenses vs. Revenue |

Period | Percentage |

Year Ended Dec. 31, 2022 | 23.2% |

Year Ended Dec. 31, 2021 | 23.8% |

(Source - SEC)

The Employee Benefit efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Employee Benefit expense, was 1.3x in the most recent reporting period. (Source - SEC)

Ryde's Market & Competition

According to a 2021 market research report by McKinsey & Company, the market for mobility services in Asia is expected to produce a multi-trillion-dollar opportunity over the decade through 2031.

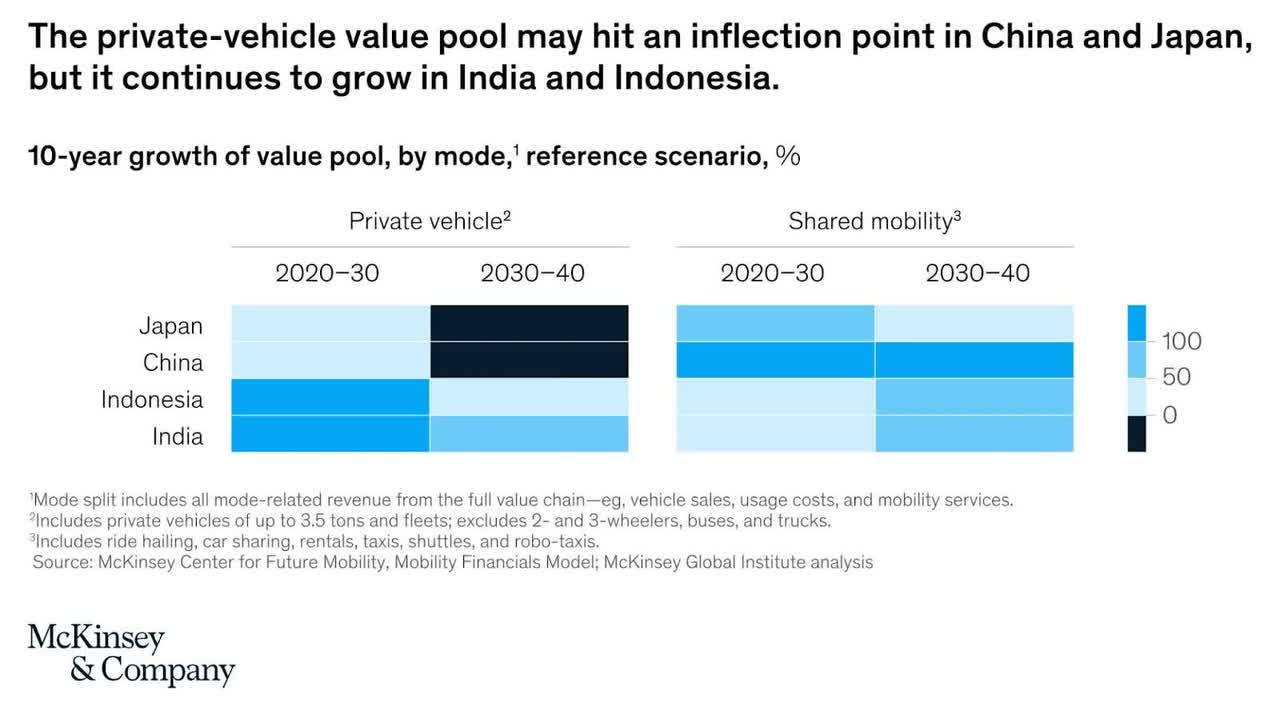

The period ahead will likely feature a significant and durable increase in the use of shared mobility solutions and a drop in sole private vehicle use, as the chart below illustrates:

Mobility In Asia (McKinsey & Company)

The main drivers for this expected growth are new consumer behaviors transforming consumption patterns as well as new forms of vehicle ownership models.

Also, major car manufacturers are launching subscription-based car services, including Toyota and Hyundai.

A survey of Chinese consumers concluded that 55% 'said they were open to using rental options in lieu of purchasing their cars.'

Major competitive or other industry participants include the following:

Gojek

Grab

TADA

ComfortDelGro Taxi

Others, as the barrier to entry for ride and delivery services is low

Ryde Group's Financial Performance

The company's recent financial results can be summarized as follows:

Growing topline revenue from a small base

Declining gross profit and gross margin

A swing to operating loss

Increasing cash used in operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue | ||

Period | Total Revenue | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $6,577,000 | 43.5% |

Year Ended Dec. 31, 2021 | $4,584,300 | |

Gross Profit (Loss) | ||

Period | Gross Profit (Loss) | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | $962,000 | -34.2% |

Year Ended Dec. 31, 2021 | $1,461,500 | |

Gross Margin | ||

Period | Gross Margin | % Variance vs. Prior |

Year Ended Dec. 31, 2022 | 14.63% | -54.1% |

Year Ended Dec. 31, 2021 | 31.88% | |

Operating Profit (Loss) | ||

Period | Operating Profit (Loss) | Operating Margin |

Year Ended Dec. 31, 2022 | $(572,000) | -8.7% |

Year Ended Dec. 31, 2021 | $495,060 | 10.8% |

Net Income (Loss) | ||

Period | Net Income (Loss) | Net Margin |

Year Ended Dec. 31, 2022 | $(3,696,000) | -56.2% |

Year Ended Dec. 31, 2021 | $(917,600) | -20.0% |

Cash Flow From Operations | ||

Period | Cash Flow From Operations | |

Year Ended Dec. 31, 2022 | $(2,862,000) | |

Year Ended Dec. 31, 2021 | $(82,880) | |

(Source - SEC)

As of December 31, 2022, Ryde had $2.2 million in cash and $9.0 million in total liabilities.

Free cash flow during the twelve months ending December 31, 2022, was negative ($2.9 million).

Ryde's IPO Details

Ryde intends to raise $17.25 million in gross proceeds from an IPO of its Class A ordinary shares, although the final figure may differ.

Class A shareholders will be entitled to one vote per share and Class B shareholders will have ten (10) votes per share.

The S&P 500 Index no longer admits firms with multiple classes of stock into its index.

No existing shareholders have indicated an interest in purchasing shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

approximately 15% for market expansion in Southeast Asia and other countries, such as Australia and New Zealand;

approximately 20% for research and development of technology products and services offerings on mobile and web-based platforms;

approximately 20% for marketing and brand building activities; and

the remainder for working capital and other general corporate purposes.

(Source - SEC)

The firm's equity compensation incentive plan currently provides for up to 10% of company stock to be provided to employees and other key personnel upon achievement of performance and tenure milestones.

Management's presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says that there are no legal proceedings that would have a material adverse effect on the company's financial condition or results of operations.

The sole listed bookrunner of the IPO is Maxim Group.

Commentary About Ryde's IPO

RYDE is seeking U.S. public capital market investment for its growth and working capital purposes.

The firm's financials have produced increasing topline revenue from a small base, dropping gross profit and gross margin, a swing to operating loss, and higher cash used in operations.

Free cash flow for the twelve months ending December 31, 2022, was negative ($2.9 million).

Employee Benefit expenses as a percentage of total revenue have fallen as revenue has increased; its Employee Benefit efficiency multiple was 1.3x in the most recent full calendar year.

The firm currently plans to pay no dividends and to retain future earnings, if any, for reinvestment into the company's growth and working capital needs.

RYDE's recent capital spending history indicates it has spent lightly on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing shared mobility services in Asia is large and expected to grow substantially through 2031, although it features intense competition from a number of other participants, including major automobile manufacturers and ride-hailing companies.

Maxim Group is the lead underwriter, and the six IPOs led by the firm over the last 12-month period have generated an average return of negative (38.9%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

Business risks to the company's outlook as a public company include its tiny size compared to major competitors and unproven ability for international expansion.

When we learn more about the IPO from management, I'll provide a final opinion.

Expected IPO Pricing Date: To be announced.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.