Devon Energy: The Path To A 10% Yield And 100% Total Return

Summary

- Devon Energy is a top pick in the oil and gas sector, with strong financials, efficient operations, and deep reserves in the Delaware Basin.

- Oil prices have been resilient, benefiting DVN and driving impressive volume growth and free cash flow.

- DVN prioritizes shareholders, offering generous returns through fixed and variable dividends and substantial share buybacks.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

Evgeniia Medvedeva/iStock via Getty Images

Introduction

It's time to talk about Devon Energy (NYSE:DVN), one of my favorite oil and gas plays. In the past few weeks, I've increased my coverage of upstream energy companies again, giving Strong Buy ratings to players like Cenovus Energy (CVE), a highly efficient Canadian producer with deep inventories.

Another stock I've given a Strong Buy rating is Devon Energy, a company I've had on my radar since I started covering oil and gas in more depth.

Not only is this a company people have kept bringing up in the past few weeks, but it is also one of the best U.S. onshore oil and gas plays.

Since I wrote an article titled Peak Shale: Why I Believe That Devon Energy Could Double, in July, the stock has risen 8.2%, beating the market by 800 basis points.

Even better, the bull case has gotten stronger. Despite ongoing economic weakness, oil has continued its uptrend, reaching highly favorable prices for accelerating dividend payouts.

On top of that, DVN has reported terrific earnings, showing a path to higher production without having to sacrifice shareholder distributions.

In this article, I'll update my bull case using new developments and explain why DVN remains a great spot for income-oriented investors who do not want to sacrifice upside potential in a rising oil environment.

So, let's get to!

Oil Is Rising Again

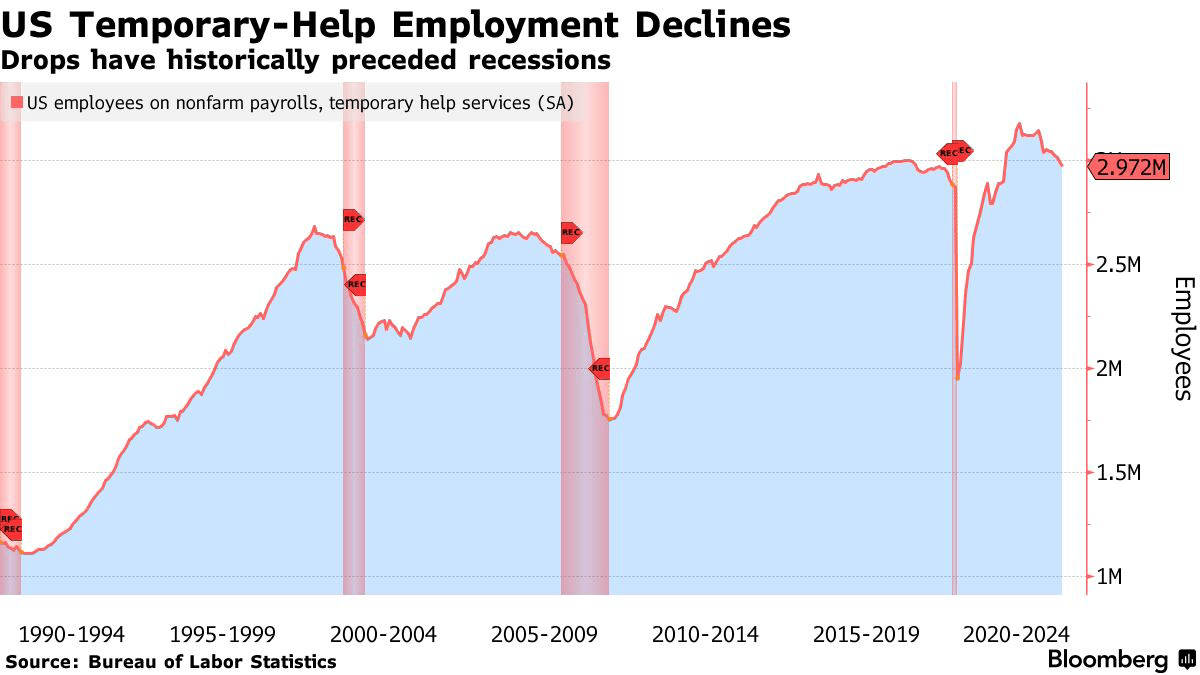

As most readers may be aware, economic growth is not in a great spot. Consumer sentiment is poor, manufacturing and service expectations have taken a hit, and indicators like temporary work are hinting at elevated recession odds.

Bloomberg

Oil, which is a highly cyclical commodity, doesn't seem to care.

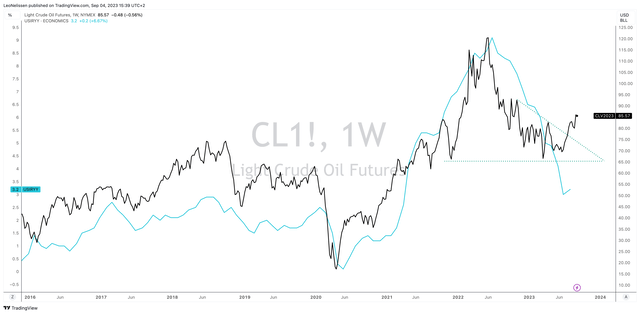

Looking at the chart below, we see that NYMEX WTI crude oil is back at $86.

This is more than 30% above this year's lows and roughly 18% above 2018 peak levels. This is fantastic news for oil companies.

As I've explained in almost every single energy-focused article since 2020, we're dealing with a shift in oil and gas fundamentals.

If this were a normal environment for oil and gas, I believe that oil would be at least $20 lower.

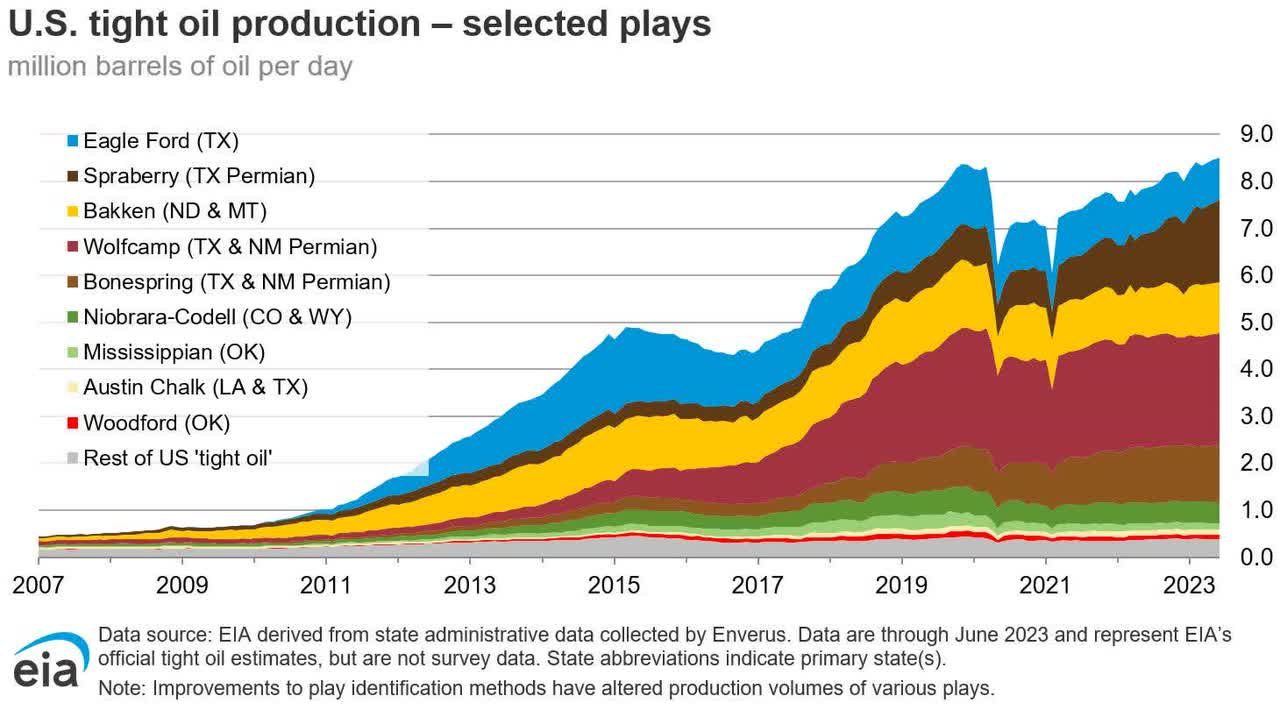

However, it's not a normal situation. Unconventional oil production in the United States used to be the driver of global supply growth. That's over.

Energy Information Administration

The only main driver of onshore supply growth is the Permian, which is expected to see peak production in the fourth quarter of next year.

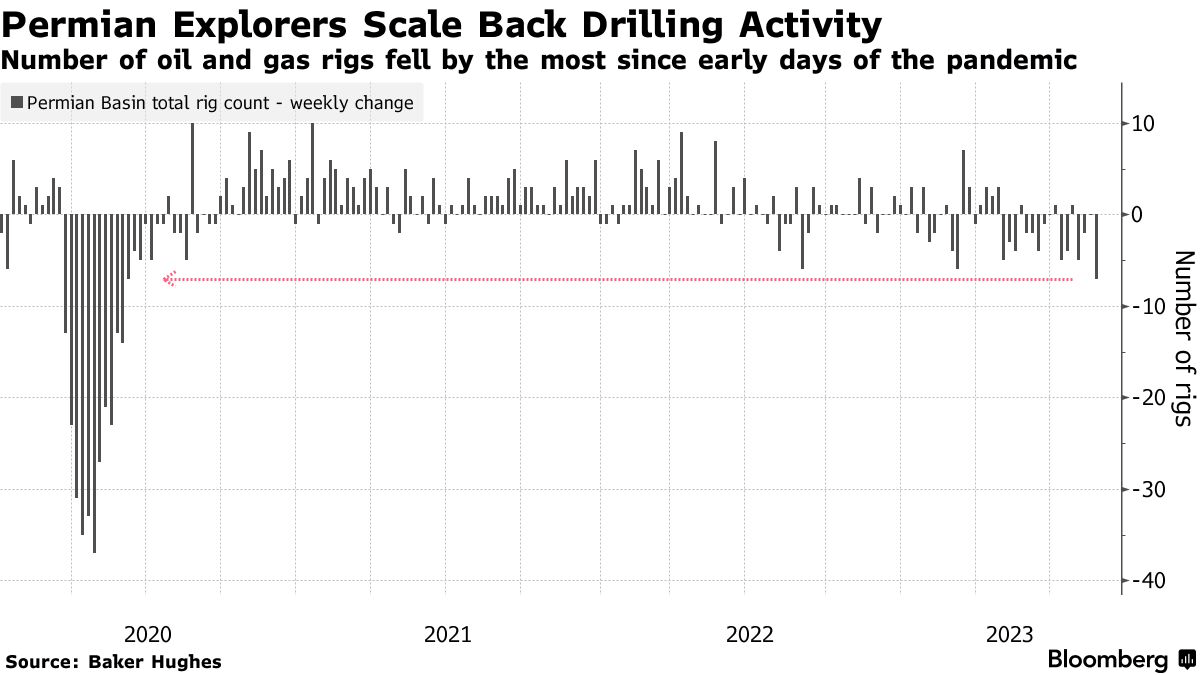

On top of that, Permian drillers have already started to (temporarily) reduce output to deal with market uncertainty.

The number of rigs in the Permian recently fell at the fastest pace in three years.

Bloomberg

As reported by Bloomberg:

Drillers have been dialing back US activity as growth in global oil demand returns slower than executives were expecting. Public producers have also been cutting after buying their closely held rivals in order to keep a lid on spending growth and return profits to shareholders.

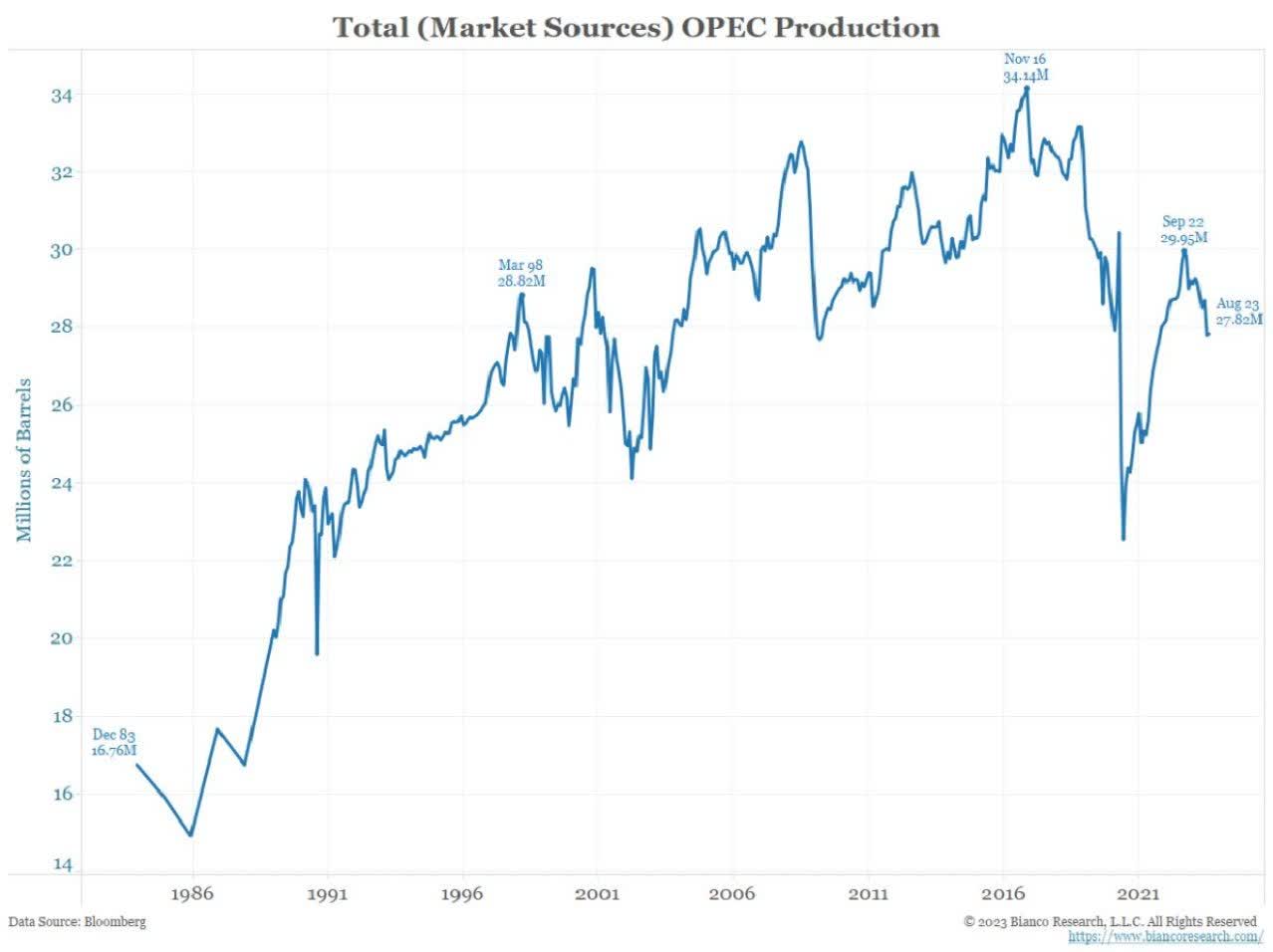

OPEC is doing the same. Saudi Arabia's push to protect $80 Brent (we can assume that this is its target) and related cuts have resulted in very subdued OPEC production.

Bloomberg (Bianco Research)

OPEC knows it has more pricing power because of slower production in the United States. It's not afraid to use its pricing power, as we're currently finding out the hard way - looking at gasoline prices.

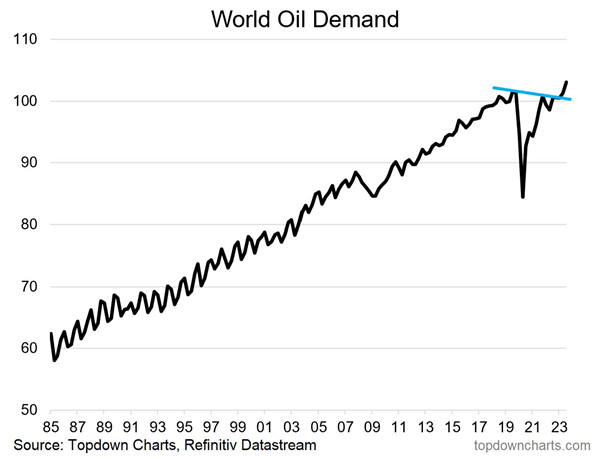

Meanwhile, oil demand is breaking out, hitting new post-pandemic highs.

Topdown Charts

While I do not rule out temporary corrections in oil, given the poor state of the economy, I believe the long-term trend is up.

I also expect triple-digit dollar oil prices the moment economic growth expectations bottom.

If oil is at $86 with subdued demand in most developed nations, imagine what it can do if demand is stronger!

This brings me to Devon.

What Makes DVN So Special

Energy, in general, is a great place to be for income-oriented investors.

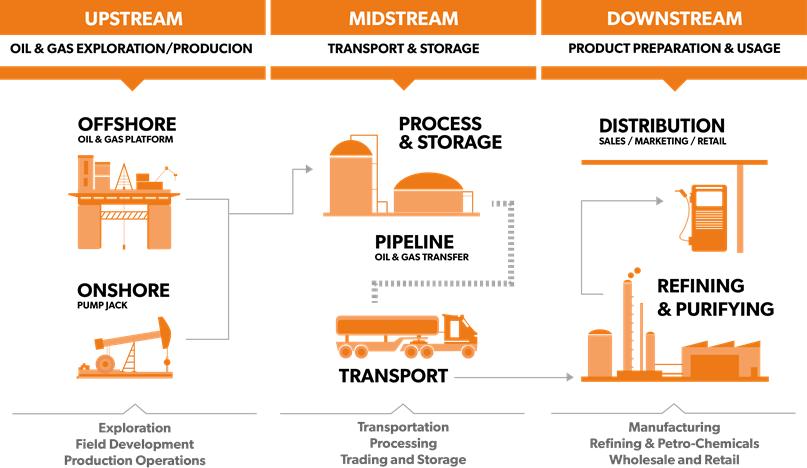

However, there are significant differences between energy industries.

Investors who want income with limited commodity price risks are better off buying midstream companies. The same goes for downstream companies, which turn oil into value-added products. These companies are dependent on the spread between input (oil) and output (gasoline) prices. I'm obviously painting with a broad brush here, but I think you get the idea.

Eland Cables

Upstream companies are the most volatile companies, as they are highly dependent on oil prices.

While this may make some players poor long-term investments, they are the best place to be when betting on higher oil prices.

In this case, I prefer players with deep reserves (given that we're seeing shale players run out of Tier 1 production), low breakeven prices, healthy balance sheets, and the related ability (and willingness!) to distribute most free cash flow to shareholders.

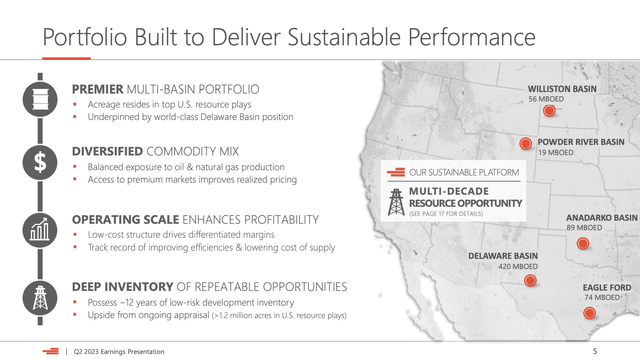

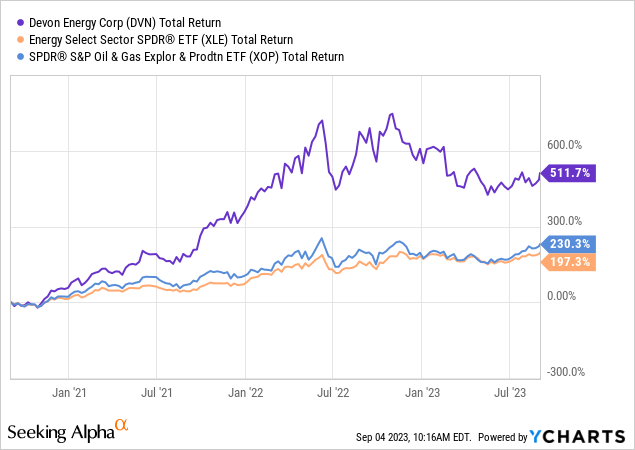

Oklahoma City-based Devon Energy checks all the boxes, which is one of the reasons why DVN shares have outperformed their energy peers over the past three years.

Having said that, although DVN is a well-diversified producer, it gets most of its oil and gas from the Delaware Basin, which is part of the mighty Permian.

In the second quarter, the company produced 662 thousand barrels of oil equivalent ("MBOE"). Roughly half of this (323 thousand BOE) was oil production.

The remaining production consisted of natural gas liquids (164 thousand barrels) and gas.

During its 2Q23 earnings call, the company highlighted some of the strengths that set it apart from its competitors.

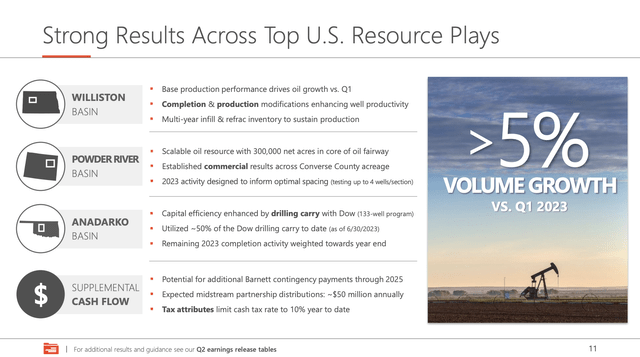

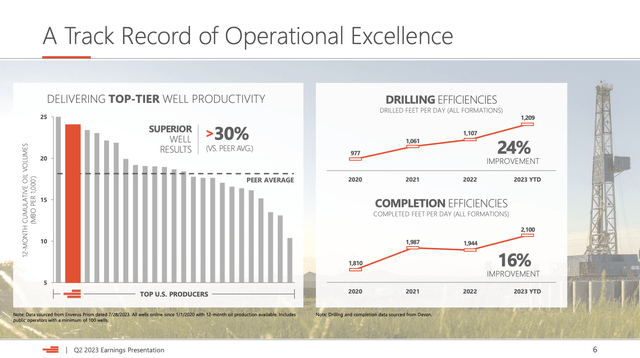

First, production exceeded guidance due to efficiency gains that accelerated cycle times, leading to more days online than planned.

Looking forward, higher completion activity in the Delaware Basin is expected to boost oil volumes in the third quarter, keeping the company on track to meet its annual volume targets. In 2Q23, volume growth exceeded 5%.

The company also noted an 8% year-over-year growth in oil volumes, exceeding midpoint guidance.

This success was attributed to higher completion activity in the Delaware Basin, leveraging a temporary fourth frac crew and improved cycle times.

Notable achievements included a Wolfcamp B appraisal success and redevelopment tests in the Eagle Ford.

The company has set operational records at both the basin and company levels.

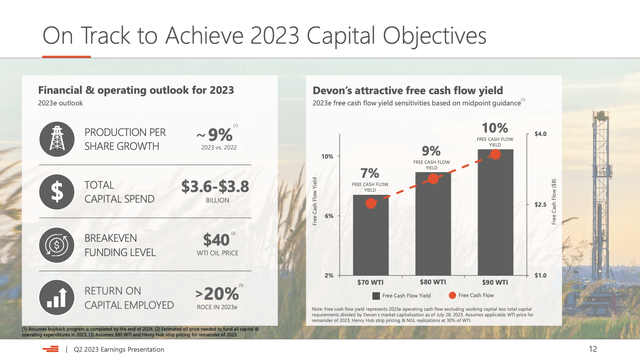

Thanks to current developments, Devon is well on its way to meeting the capital objectives associated with its 2023 plan, with a production per share growth rate of approximately 9% expected for the year.

This growth is self-funded at a $40 WTI price, which shows just how efficient this driller is.

Looking ahead to 2024, Devon plans to sustain productive capacity and benefit from potential improvements in service costs.

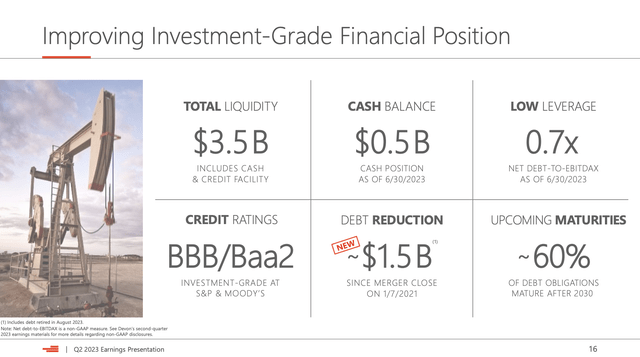

In light of the criteria that I look for in good oil and gas stocks, the company also maintains a strong financial position, exiting the last quarter with $3.5 billion of liquidity and a low net debt-to-EBITDA ratio of 0.7x, well below its mid-cycle leverage target.

The company is taking steps to improve its financial position further by retiring $242 million of debt at maturity, with plans to reduce additional maturities in 2024 and 2025. These actions are supported by the strong cash flow generated by the business.

The company has an investment-grade credit rating of BBB/Baa2, which I expect to be raised to BBB+ over the next 12-24 months.

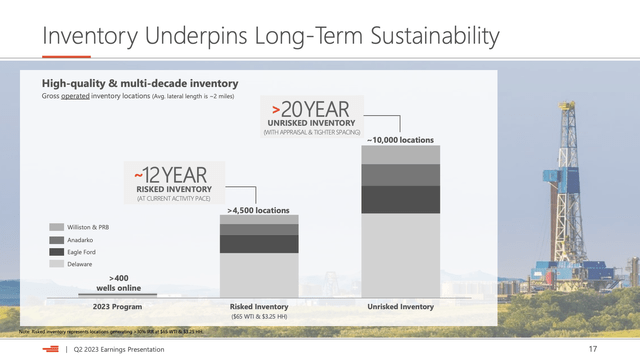

The company also benefits from deep reserves, with more than 20 years' worth of unrisked inventory, most of it in the Delaware basin.

This brings me to the next part.

Devon's Shareholder Distributions

Thanks to low breakeven prices, deep reserves, a healthy balance sheet, and oil price tailwinds, DVN is in a great spot to boost its dividend and buybacks.

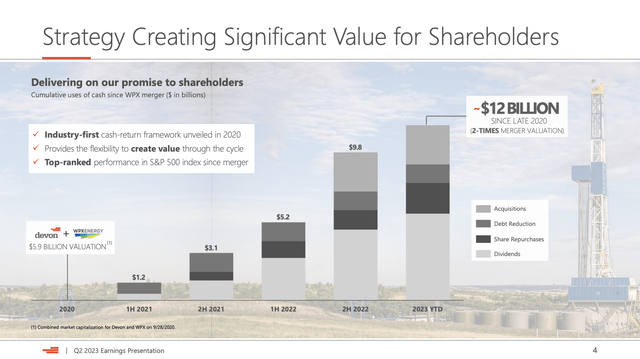

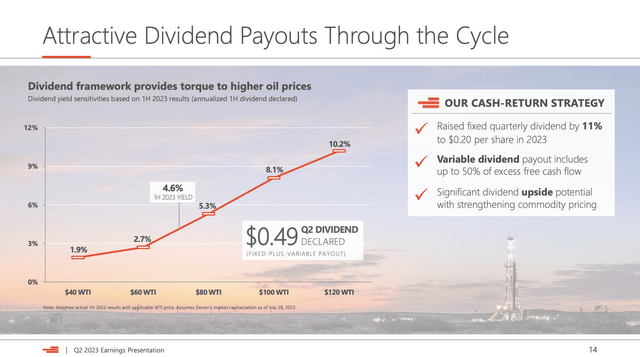

When it comes to capital spending, the company's top priority is returning capital to shareholders, as evidenced by a fixed plus variable dividend of $0.49 per share and stock repurchases totaling $200 million during the second quarter.

DVN is on pace to repurchase approximately 9% of its outstanding shares by the end of the following year. This strategy aims to compound per-share growth for investors.

Since late 2020, Devon has deployed $12 billion towards dividends, share buybacks, debt reduction, and acquisitions, resulting in nearly 2x the value of its pro forma market capitalization.

The goal is to pay a base dividend and a variable dividend of at least 50% of excess free cash flow. This makes DVN a fantastic place to be for dividends. Some oil producers prefer to buy back stock.

As the overview below shows, at $100 WTI, shareholders are in a good spot to receive a dividend exceeding 8%. Bear in mind that when these numbers were published, the stock price was roughly at current levels. So, these numbers are still valid.

At $120 WTI, which I expect to see in the next 24 months, the company could distribute a dividend exceeding 10%, with more room from post-dividend free cash flow.

In other words, 10% isn't the limit of shareholder distributions at $120 WTI.

So far, everything mentioned in this article is why DVN is one of my favorite oil plays on the market - especially because I prefer (special) dividends over buybacks in the energy sector.

Valuation-wise, we're dealing with tremendous upside. As I wrote in my prior article, I expect DVN to double if oil prices reach triple-digit dollar territory.

While current economic conditions are challenging and likely to keep Devon from soaring higher, I believe that energy companies are bottoming. If economic demand improves, I expect a rotation from growth to value, which could push Devon to $100 over the next 2-3 years.

This is mainly based on its free cash flow potential and the rotation from growth to value stocks that is likely to unfold the moment inflation increases again.

Takeaway

Devon Energy stands out as a top pick in the oil and gas sector, and it's not hard to see why. With the resurgence of oil prices and a changing landscape in the industry, DVN is in a great spot to benefit.

Their strong financial position, efficient operations, and deep reserves in the Delaware Basin make them a compelling choice for income-oriented investors.

What sets DVN apart is its commitment to rewarding shareholders. They're on track to repurchase a significant portion of outstanding shares and offer a promising dividend policy that can deliver substantial returns, especially as oil prices continue to climb.

While current economic conditions pose challenges, DVN's potential for growth is undeniable. With the right catalysts, such as increased economic demand and the shift from growth to value stocks, DVN could potentially double in value over the next few years.

So, for those seeking a robust oil play with long-term potential, DVN is a stock to watch closely.

Reasons To Be Bullish

- Oil Price Resilience: DVN thrives in a challenging economic climate, with oil prices surging despite economic concerns.

- Efficient Operations: DVN's operational efficiency exceeds expectations, driving impressive volume growth and free cash flow.

- Financial Stability: With low debt and a strong credit rating, DVN maintains financial stability.

- Generous Returns: DVN prioritizes shareholders, delivering fixed and variable dividends alongside substantial share buybacks.

- High Dividend Potential: DVN's low breakeven prices and deep reserves make it a potential high-yield dividend stock, especially with rising oil prices.

- Upside Potential: DVN's strong fundamentals and the possibility of a value stock rotation can propel its stock price toward $100 in the coming years.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas' FREE book.

This article was written by

Welcome to my Seeking Alpha profile!

I'm a buy-side financial markets analyst specializing in dividend opportunities, with a keen focus on major economic developments related to supply chains, infrastructure, and commodities. My articles provide insightful analysis and actionable investment ideas, with a particular emphasis on dividend growth opportunities. I aim to keep you informed of the latest macroeconomic trends and significant market developments through engaging content. Feel free to reach out to me via DMs or find me on Twitter (@Growth_Value_) for more insights.

Thank you for visiting my profile!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CNQ, PDX, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)

But Tipranks and Yahoo Finance both give a fair price around 60$ (only).