Investigating Commodity Performance Under A Defensive Fed

Summary

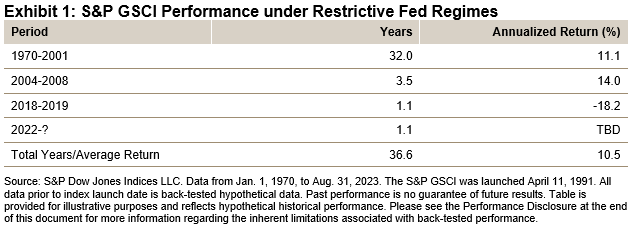

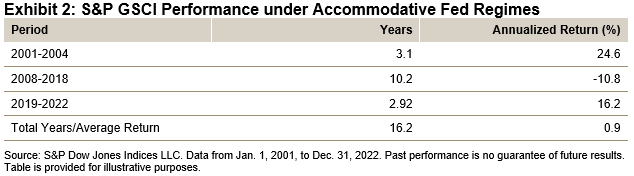

- Since 1970, the S&P GSCI has achieved average annualized returns of 10.5% compared to just under 1% during periods when the Fed maintained a restrictive policy stance.

- Using the primary tool of the Fed, we compare the performance of the S&P GSCI when the Fed funds effective rate remains above target inflation for at least 12 months.

- The S&P GSCI is the leading commodity benchmark, with back-tested history extending for over 50 years.

manassanant pamai

By Brian Luke

I love this time of year. August vacations are over, the kids are back in school and football season kicks off in the U.S. The Fed took its August “vacation” at the Jackson Hole Symposium, where Jerome Powell’s remarks singularly focused on price stability.

Inflation has come down but “remains too high” and the Fed warned it’s “prepared to raise rates further.” As markets prepare for continued restrictive monetary policy, we went back to school to investigate the performance of commodities under a restrictive Fed.

Since 1970, the S&P GSCI has achieved average annualized returns of 10.5% compared to just under 1% during periods when the Fed maintained a restrictive policy stance.

As part of its dual mandate, the Fed sets a target inflation rate of 2%. While that measure remains arbitrary, the Fed seeks to achieve this through accommodative or restrictive monetary policy.

Using the primary tool of the Fed, we compare the performance of the S&P GSCI when the Fed funds effective rate remains above target inflation for at least 12 months.

The S&P GSCI is the leading commodity benchmark, with back-tested history extending for over 50 years. Taking this iconic benchmark, we evaluate index performance throughout this time.

There have each been three periods where sustained monetary policy was either restrictive or accommodative, covering 50 of the 53 years since 1970.[1]

In over two-thirds of the sample, average annualized returns were over 10.5%. This covers the inflationary bouts of the 1970s, the commodity super cycle of the 2000s and one particularly short and abysmal year in 2018/2019.

Investors of commodity ETFs missed these opportunities, with the advent of the commodity ETFs taking place during extremely loose monetary policy regimes. Inflation is now the focus of the Fed and commodity performance has picked up.

Charting the current Fed funds effective rate reminds me of Mr. Powell’s view of the Grand Tetons. These towering peaks pierce the Wyoming sky, with a jagged silhouette stretching for 40 miles.

The highest peak tops 13,775 feet, while the lowest elevation is well over a mile high. Those peaks rest on top of the 3,000-mile-long Rocky Mountains with elevations over one and up to three miles high.

Like the Tetons, inflation has jutted up and fell from its recent peak but remains elevated. This would explain Mr. Powell’s emphasis on inflation, stating “restrictive monetary policy will likely play an increasingly important role.”

Looking at the history of the S&P GSCI, when the Fed gets defensive, commodities have tended to be a good offense. In this current period of restrictive monetary policy, commodities have produced solid but erratic returns.

The S&P GSCI achieved a 22% return in 2022, outpacing all asset classes. Year-to-date, the S&P GSCI has a total return over 5%. Should the Fed remain restrictive, historical commodity returns have proven to be a solid defensive strategy.

[1] The three years include the current period and times the effective rate did not stay above or below for at least twelve consecutive months.

Disclosure: Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures, please visit Terms of Use.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by