Wild Cards For September

Summary

- With a decidedly positive last week of August, many investors are wondering if September would live up to its bad reputation.

- At 0.63%, the 10-year JGBs are deep into negative real rate territory, with the inflation rate in Japan rising to more normal levels it hasn’t seen in years.

- The Chinese central bank has been depreciating the yuan slowly and you may notice that the weaker the yuan, the more pressure there is on U.S. stock prices.

Martin Keiler

With a decidedly positive last week of August, many investors are wondering if September would live up to its bad reputation. It does not have to, if Treasury yields remain behaved and the overall economic and geopolitical news flow remains positive.

But what could push Treasury yields higher in September? The Japanese central bank could – if they keep moving further away from their yield curve control.

At 0.63%, the 10-year JGBs are deep into negative real rate territory, with the inflation rate in Japan rising to more normal levels it hasn’t seen in years.

The Japanese financial system can use a positive yield curve, as interest rate margins are depressed, and their banks have been considered “uninvestable” for decades.

One sign of this change is that Warren Buffett sensed the end of deflation in Japan with a big bet on Japanese trading houses – the conglomerates that source the necessary goods for the Japanese economy globally, whose sales and earnings are positively affected by the end of deflation.

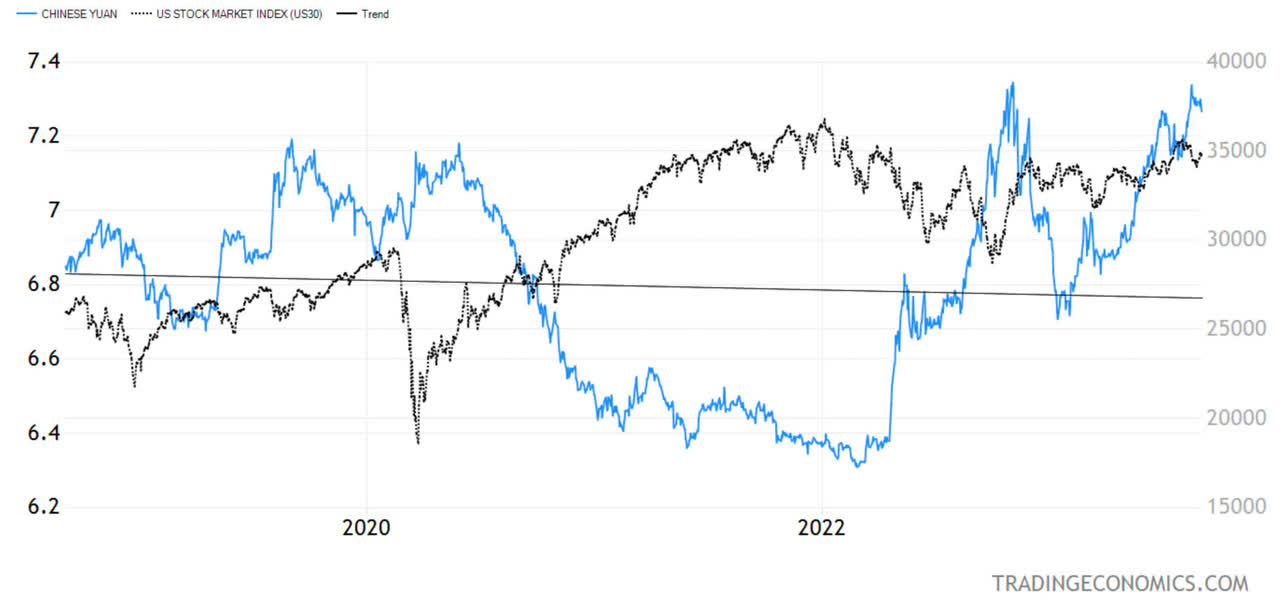

Another factor that could push stock prices lower, is the Chinese yuan. The Chinese central bank has been depreciating the yuan slowly and you may notice that the weaker the yuan (blue line pointing up), the more pressure there is on U.S. stock prices (see below).

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

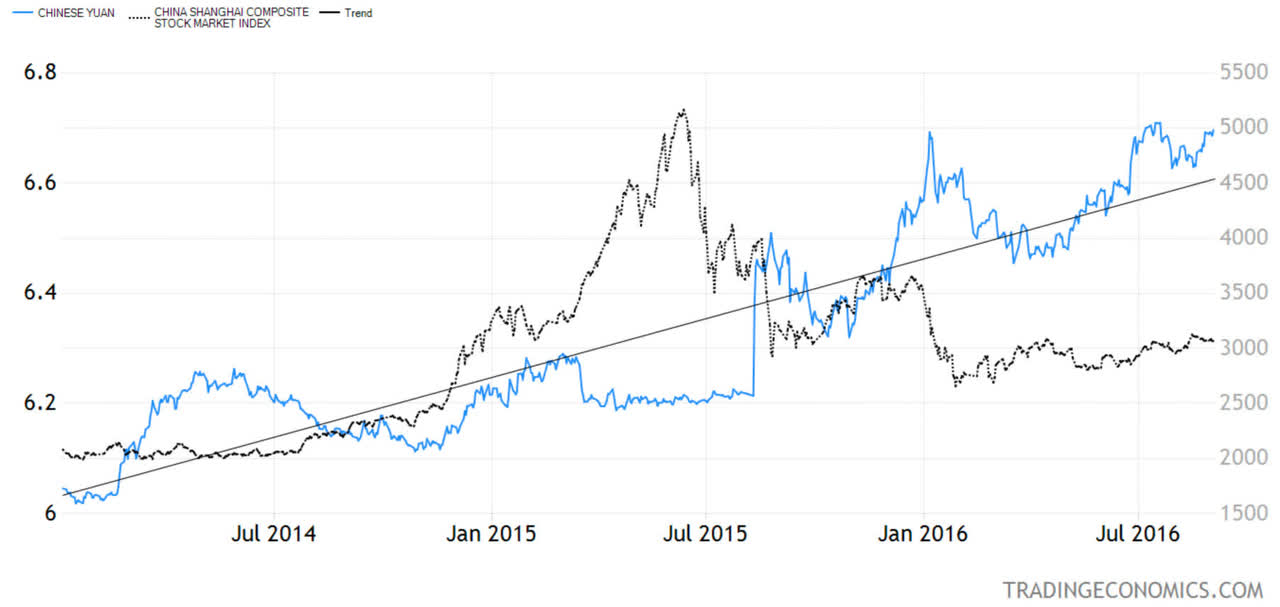

I remember August 2015 (below), when the Chinese central bank let the yen depreciate a bit more quickly in response to their stock market crash in June of that year, which caused the S&P 500 to drop 10% in just four days. Regrettably, the Chinese will move at their own pace and won’t give anyone advance notice.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

This is a possibility, but it is unknowable, if this is on their mind for September. What is more certain, is that the Chinese economy is in deflation at the moment and could surely use some reflationary policy, like a weaker yuan.

The Chinese have been introducing other stimulus measures, but so far it has only resulted in one- or two-day rallies in Chinese markets, but those have failed to produce a sustainable move.

A Big Test is Coming for Bitcoin

In late August, Grayscale Investments scored a big win against the SEC, when an appeals court agreed to force a proper review of the bid to convert the Grayscale Bitcoin Trust (OTC:GBTC) into a Bitcoin exchange-traded fund (ETF).

The U.S. appeals court accepted Grayscale’s argument that the SEC’s rejection of its recent ETF application was unfair, since the SEC had already approved a futures bitcoin ETF, finding the two ETFs similar in nature.

The problem is that it would take 240 days for the SEC to issue its final ruling, which puts bitcoin in “no-man’s land” in the meantime.

Bitcoin had a one-day strong move on the news and then immediately lost all the gains.

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

I have heard, from many sources, that the introduction of a bitcoin spot ETF is the key to restart the rally in bitcoin, as investors would then not have to go through cumbersome crypto exchanges but buy directly from stockbroker accounts. Such stories do not mention that investors would also be able to sell directly.

From a purely technical perspective, it looks like bitcoin rallied into major resistance and has not turned lower, but any decline below the 2022 lows suggests a much deeper downside.

Personally, I do not have a problem with blockchain technology, but my experience with bitcoin holders is that they don’t buy bitcoin in order to transact with it.

They bought bitcoin because it was going up, which is pure speculation, as bitcoin has no cash flows, so they may also decide to sell if it starts going down.

If the approval of a cash bitcoin ETF does not breathe new life into bitcoin, I am afraid the downside here looks much bigger than the upside.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the "About" section of the Navellier & Associates profile that accompany this article.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by