GitLab Earnings Preview: AI A Threat Or Opportunity? Why I'm Bullish

Summary

- GitLab's Q2 2024 results approaching with a cloud of uncertainty regarding AI's impact.

- Investor concerns over AI potentially challenging GitLab's value proposition.

- Current valuation remains reasonably priced at around 14x P/sales with a strong balance sheet.

- Looking for a helping hand in the market? Members of Deep Value Returns get exclusive ideas and guidance to navigate any climate. Learn More »

izusek/E+ via Getty Images

Investment Thesis

GitLab (NASDAQ:GTLB) will report its fiscal Q2 2024 results on Tuesday after hours.

I make the case that GitLab is well-positioned with strong prospects and primed to deliver investors with strong upside over the next twelve months.

Furthermore, here I discuss the top noteworthy bearish consideration that has kept a lid on GitLab's stock, namely the impact of AI on GitLab's intrinsic value.

Separately, GitLab has consistently remarked that next fiscal year it will be operating as a cash flow breakeven enterprise. This means that GitLab can continue to grow at around the mid-20s% CAGR while not incurring significant cash flow losses.

Altogether, I believe that investors will in time reprice this stock higher.

Why GitLab? What to Think About Heading into Q2 Results

GitLab is like a virtual toolbox for software development teams. It's designed to make it easier for these teams to collaborate and build software together. With GitLab, developers can manage their code, keep track of all the changes they make, and even automate the steps needed to turn their code into working software. This means less manual work and more efficient teamwork.

In simple terms, GitLab is not just about writing code; it's about making the whole software-making process smoother and faster. It's like having a one-stop shop for everything from coding to testing, so teams can work together smoothly and deliver better software faster. It's all about simplifying the way software gets made.

Anyone following the GitLab story closely will be acutely aware of the bear case that has surfaced that AI could make writing code easier, therefore democratizing coding for everyone. And by extension, doing away with GitLab's value proposition.

For my part, I suspect that the potential negative impact of AI on GitLab's value proposition is too much in the future. Just too uncertain. Yes, AI can simplify code writing and therefore democratize software development so that more users can write software.

And by extension, with more developers coding, the cost of software development could decrease, which in turn could increase an uptick in the need for software products.

Put another way, I believe that GitLab's Sid Sijbrandij will spend his energy during the earnings call describing how AI will be a net positive for GitLab. For my part, I believe that the ultimate impact of AI on GitLab is for now too uncertain and that investors don't need to overly trouble themselves in answering the unknowable and uncertain future.

Revenue Growth Rates Due to Be Upwards Revised

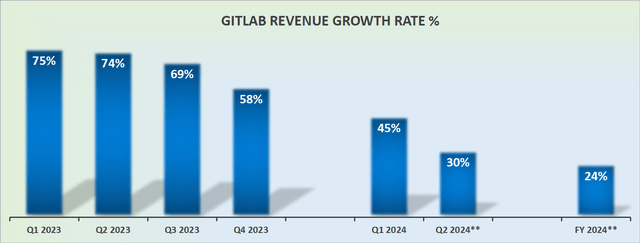

Author's calculations revenue growth rates

The graphic above implies that fiscal 2024 will continue to see GitLab's revenue growth rates continuing to slow down at a steady clip. The implication here is that by fiscal Q4 2024, GitLab's revenue growth rates could be around 20%, which is half the growth rate that GitLab reported in the last quarter, fiscal Q1 2024, at 45%.

I simply don't believe that such a dramatic deceleration will end up being on the cards.

Furthermore, one company's cost line is another company's revenue line. Hence, if the macro environment has become more favorable, as I believe it will, this will translate into GitLab being well-positioned to upward revise its full-year revenues.

As such, I believe GitLab could end up revising its revenue targets to around $565 million for full-year fiscal 2024 (approximately a 4% increase). This would be enough good news to excite investors, but not too much that they'll feel too stretched and priming themselves to underdeliver against heightened expectations.

GTLB Valuation -- Not Expensive

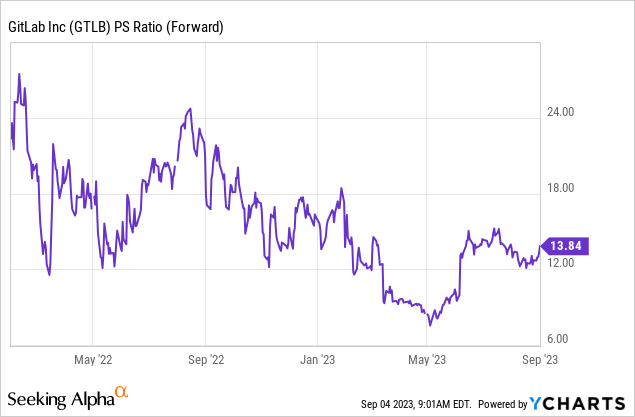

As you can see above, for more than a year GitLab's P/sales multiple has been compressing, even though it did expand since May, overall has compressed down to around 14x, which remains completely reasonably priced.

The one detraction to the bull case is that GitLab is still burning through cash flows. On the other hand, GitLab holds no debt, and more than 13% of its market cap is made up of cash.

The Bottom Line

I'm not entirely certain about the impact of AI on GitLab's business, but its current valuation seems reasonably priced. There are optimistic prospects for the company due to its role as a software development collaboration platform, but there are also concerns that AI could make coding more accessible, potentially diminishing GitLab's value proposition.

However, I'm unsure if this AI threat is imminent or distant. GitLab aims to achieve cash flow breakeven in the next fiscal year, which could lead to stock price appreciation if it sustains growth.

The uncertainty surrounding AI's impact on GitLab's future is significant, but for now, it might not be an immediate concern. Additionally, the company's valuation appears reasonable, with a P/sales multiple of around 14x and a healthy balance sheet with no debt and a significant cash reserve. As we await the Q2 results, I'm cautiously optimistic about GitLab's future.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

Our Investment Group is focused on value investing as part of the Great Energy Transition. For example, did you know that AI uses thousands of megawatt hours for even small computing tasks? Join our Investment Group and invest in stocks that participate in this future growth trend.

I provide regular updates to our stock picks. Plus we hold a weekly webinar and a hand-holding service for new and experienced investors. Further, Deep Value Returns has an active, vibrant, and kind community. Join our lively community!

We are focused on the confluence of the Decarbonization of energy, Digitalization with AI, and Deglobalization.

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

DEEP VALUE RETURNS: The only Investment Group with real performance. I provide a hand-holding service. Plus regular stock updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)