H2 2023: Overweight Tech, AI Highs, Falling Globalization

Summary

- Institutional investors highlight growing concerns over tech stocks' rising valuations while volatility levels continue to stay high.

- Within steady retail investor participation, AI is king in investor choices. However, dividend-driven investing is likely to pull capital away in H2.

- Correlations between global markets are in decline, resulting in higher volatility within markets.

- Rising subsidies continue to chip away at globalization, thus limiting the global growth outlook for leading names.

solarseven

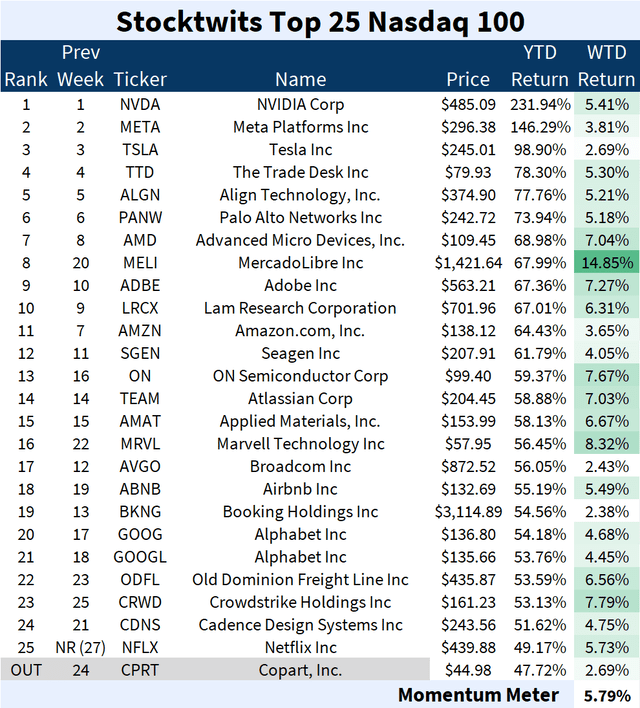

In the 35th week of 2023, the S&P 500's Top 25 stocks by momentum outperformed the S&P 500 index (+4.49% vs +2.50%).

Most of the top gainers were tech stocks, which had a dramatic effect on the Top 25 list of the tech-heavy Nasdaq 100, which outperformed the Nasdaq-100 (+5.79% vs +3.67%).

Given that both tech and broad market valuations have been positive, the overall reaction might be that recessionary fears have passed, and it's a now a return of bull markets. However, much needs to be addressed in terms of overall market health, the assumed balance between Developed Markets (DM) and Emerging Markets (EM) and investor behaviour.

Falling Correlations, Rising Volatilities

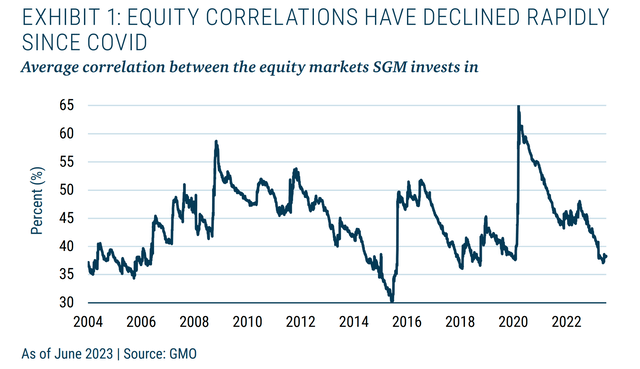

In a study published in the last week of August, Boston-based GMO (also known as Grantham, Mayo, Van Otterloo & Co. LLC), a Boston-based asset manager with a contrarian investing and generally bearish approach and around $60.8 billion in Assets Under Management (AUM), noted that its Systematic Global Macro (SGM) portfolio - which invests in equity markets around the world - has witnessed equity markets dropping in correlation since COVID.

The study goes on to examine market correlation in pairs when both markets were up and when both markets were down (with pairs wherein one market was up and the other was down being excluded on account of their resulting negative correlation). The result: on average, equity markets are 5% more correlated on "down-market" days than on "up-market" days.

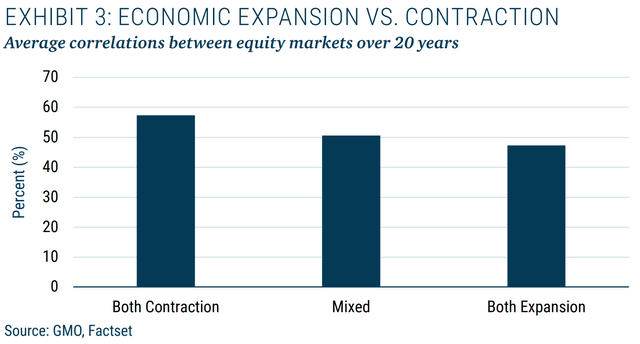

To examine the impact of business cycles on market correlations, the market returns were again paired wherein both markets were either in an upward economic cycle or a downward one using each country's PMI indicator. The results were quite consistent with those from the up- and down-market regime lens: when both economies were expanding, the correlation between markets was substantially lower - a full 10% on average - than when both markets were contracting.

This leads to a general rule of thumb with regard to market correlations:

As either markets or economic cycles shift from negative, to mixed, to positive sentiment, one can generally expect equity market correlations to decline.

However, while market volatility has generally been trending downward toward long-term averages, the VIX index has been drifting into the high teens. Since lower correlations may also mean greater breadth, there are more differentiated return streams to choose from and significant valuation dislocations in equities - with some pricing differences at historic highs.

Investor behaviour has also been contributory factors behind these dislocations.

Retail Flows, Tech Highs, Deglobalization

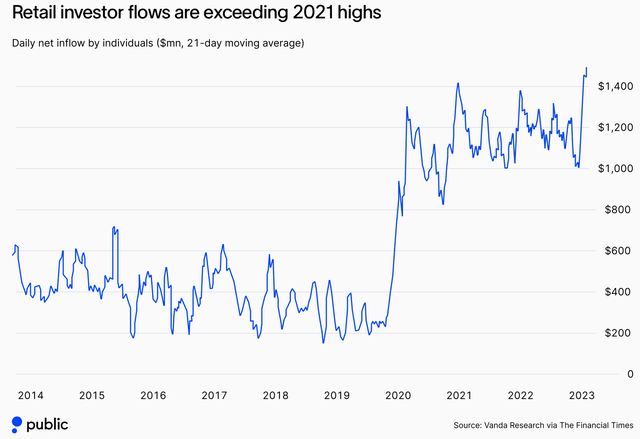

As per trading platform Public, which released its "Retail Investor Report" in the last week of August, U.S. retail investors across platforms set a new all-time high for weekly inflows in February 2023, with $1.5 billion pouring into the market in a single week.

Source: Public (Trading Platform)

The report also included a survey of platform users on a wide range of topics. Salient points of interest were:

- 59.9% of respondents were either positive or neutral about the economy while 40.1% were pessimistic.

- 19% of respondents are already using AI to power investment research.

- 16.4% say that social buzz is an "important buzz" in their decision-making.

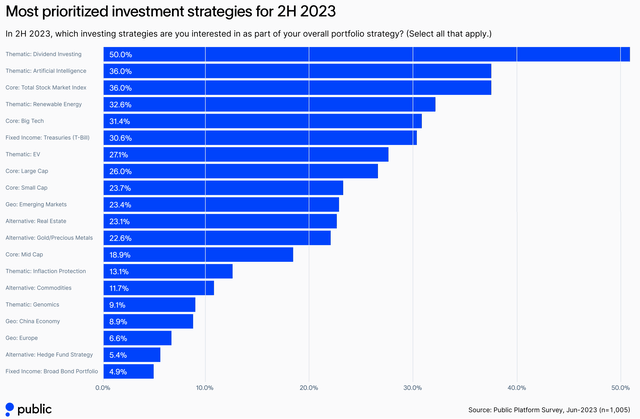

The survey also indicated a surprising return of preference for an equity class that had diminished in the years of headlong rush into growth narratives: dividend-driven investing themes emerged as the most interesting strategy in the second half (H2) of this year.

Source: Public (Trading Platform)

Dividends are generally paid out by companies with stable earnings pass-through capability and enshrined market share status. These typically tend to be classified as "value" stocks and not "growth" stocks. Also, dividend stock investors tend to hold for long periods and in relatively large volumes in order to collect dividend payouts. It will be interesting to see how this affects trading volumes and the resultant high valuations created by said volumes.

A sustained beneficiary of buzz has been AI stocks: AI thematic ETFs saw a 34% YoY increase in new retail investors in H1 2023 and AI stocks comprised 14% of the Top 50 stocks by Page Views on Public's platform. In contrast, buzz doesn't always translate to flows: net investors in top EV ETFs shrunk by 2% from January to August.

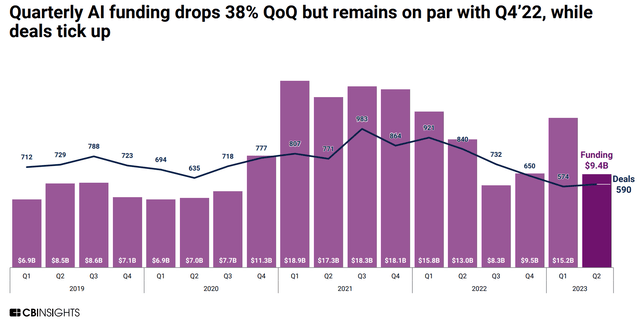

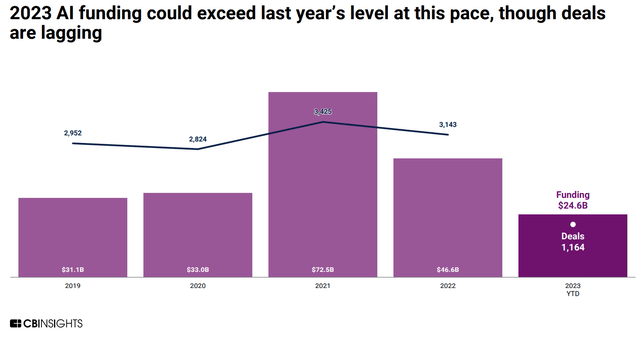

AI has been a favoured theme even in private markets. While Q2 has seen a drop relative to Q1, funding trends are running on par with Q4 with deal volume increasing.

While current trends in deal volume lag behind that of the past year, the net value of deal flow is poised to exceed last year's level.

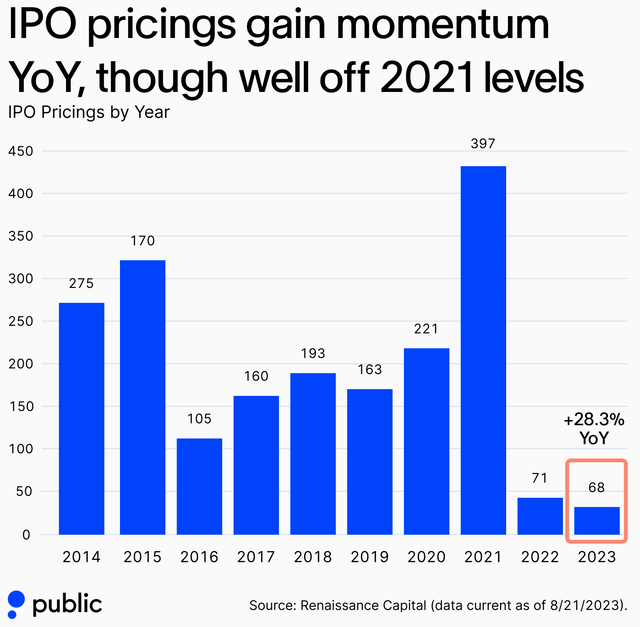

Deal flows typically precede IPOs by a number of quarters or even years. While IPO pricing levels are gaining relative to last year, they're nowhere close to decade-high 2021 levels.

Source: Public (Trading Platform)

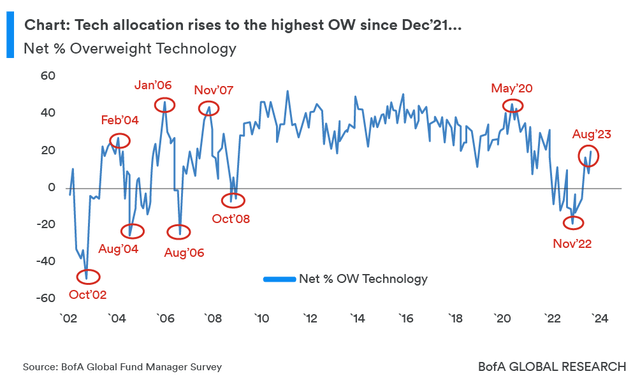

Overall, high-tech valuations have been a matter of concern for institutional investors in the Year-Till-Date (YTD). In Bank of America's Fund Manager Survey for August 2023, the consensus among survey respondents representing 211 fund managers with $545 billion of AUM was that their portfolios' tech allocation is the most overweight, i.e., over-represented in returns relative to their weight, since December 2021.

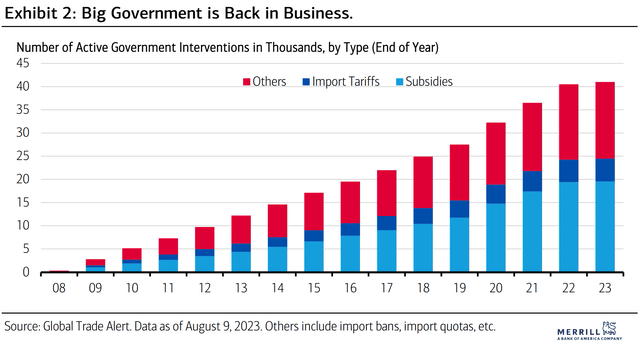

Bank of America-owned Merrill Lynch highlighted a key weakness in valuations in the last week of August: the ongoing subsidies race between the U.S. and China has triggered a global sprint with European Union countries, Japan, Canada, the United Kingdom and others offering their own subsidies and incentives to attract capital investment.

Source: Bank of America Merrill Lynch

The past five years, in particular, could be seen as the first stage of the nearing end of "globalization" wherein a select few companies will be the predominant source of key technologies. The global subsidies race is spurred on by national security concerns as opposed to profits. Thus, the global marketplace will soon be awash in subsidized semiconductors, electric batteries, solar panels and other goods that are produced locally. As a result, supply chain efficiencies, trade flows, global earnings growth and profit margins of numerous firms are poised to be hammered.

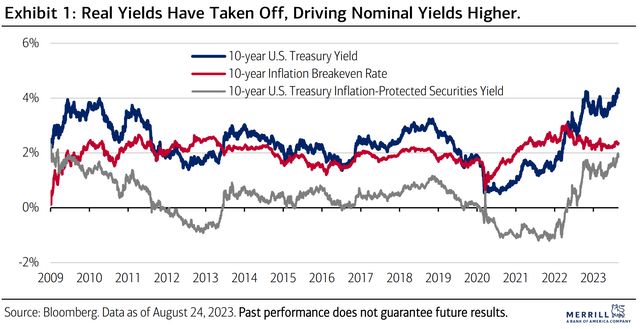

Also affecting market breadth is the fact that U.S. Treasuries - a one-time spoiler for skyward US equity valuations until the tech bubble in the final decade of the past millennium - have been rising in nominal yields under the current rate hike cycle, thus offering another path of risk-adjusted returns.

Source: Bank of America Merrill Lynch

In Conclusion

Overall trends indicate that AI-driven pile-ons into tech will likely be causing volatility in US equity markets while global growth outlook is affected as the world continues to seek fragmentation due to economic security concerns. While it's certainly not true that tech would decline per se, the fact remains that they're far too overvalued in terms of prospective addressable market size.

In terms of market breadth, it's pretty much a buyer's market for the discerning investor with the requisite reach. A wide variety of equities from around the world are increasingly attractive while bond markets offer strong risk-adjusted alternatives to earnings. The estimated return of a classic - dividend-driven investing - proves how valuable periodic coupon payments are proving to be in driving investor choices. The same reasoning applies towards the increasing favourability of bond markets and another disquieting factor for equity valuations.

All in all, it pays to stay well-researched, diversified and be wary of singular growth narratives.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I lead research at an ETP issuer that offers daily-rebalanced products in leveraged/unleveraged/inverse/inverse leveraged factors with various stocks, including some mentioned in this article, underlying them. As an issuer, we don't care how the market moves; our AUM is mostly driven by investor interest in our products.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.